by Calculated Risk on 9/23/2009 07:09:00 PM

Wednesday, September 23, 2009

Jim the Realtor: New Homes in San Diego

Just so you know, builders are still building in parts of San Diego (Carmel Valley). Pretty amazing ...

"Completely sold out. Sold out of all available properties. They're still building more. ... how about this, 250 people on the waiting list."

Falling Rents, Credit Card Defaults, and Market

by Calculated Risk on 9/23/2009 04:00:00 PM

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From Bloomberg: Manhattan Apartment Rents Drop as Employers Cut Jobs (ht Mike In Long Island)

Manhattan apartment rents dropped an average of at least 8 percent ...From Reuters: U.S. credit card defaults rise to record: Moody's (ht Ron Wallstreetpit)

Rents for studio apartments fell 11 percent to an average of $1,763, according to the broker’s data on deals in May through August compared with the same period a year earlier. The cost of a one-bedroom declined 8 percent to an average of $2,425. Two-bedrooms declined 11 percent to $3,421 and three- bedroom units fell 8 percent to $4,633.

The U.S. credit card charge-off rate rose to a record high in August ...And just a note: The consensus estimate for existing home sales tomorrow is 5.35 million SAAR. I'll take the under.

The Moody's credit card charge-off index -- which measures credit card loans that banks do not expect to be repaid -- rose to 11.49 percent in August from 10.52 percent in July.

...

"We continue to call for a recovery of the credit card sector to begin once industry average charge-offs peak in mid-2010 between 12 percent and 13 percent," Moody's said in a report.

FOMC Statement: Slow MBS Purchases

by Calculated Risk on 9/23/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in August suggests that economic activity has picked up following its severe downturn. Conditions in financial markets have improved further, and activity in the housing sector has increased. Household spending seems to be stabilizing, but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment and staffing, though at a slower pace; they continue to make progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee anticipates that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will support a strengthening of economic growth and a gradual return to higher levels of resource utilization in a context of price stability.

With substantial resource slack likely to continue to dampen cost pressures and with longer-term inflation expectations stable, the Committee expects that inflation will remain subdued for some time.

In these circumstances, the Federal Reserve will continue to employ a wide range of tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt. The Committee will gradually slow the pace of these purchases in order to promote a smooth transition in markets and anticipates that they will be executed by the end of the first quarter of 2010. As previously announced, the Federal Reserve’s purchases of $300 billion of Treasury securities will be completed by the end of October 2009. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is monitoring the size and composition of its balance sheet and will make adjustments to its credit and liquidity programs as warranted.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

emphasis added

Retail Hiring Outlook "Jobs Scarce"

by Calculated Risk on 9/23/2009 12:30:00 PM

From the WSJ: Holiday Jobs Look Scarce as Pessimism Grips Retail

... About 40% of stores surveyed across a broad swath of retailing ... told the Hay Group, a human resources consulting firm, that they expect to hire between 5% and 25% fewer temporary workers this year than last ...Seasonal retail hiring will be watch closely. Here is a repeat of a graph from a post a couple weeks ago: Seasonal Retail Hiring

That's a grimmer outlook than the Hay survey found a year ago, when 29% of retailers said they would be slashing their holiday workforce.

...

A third of retailers in the survey said they expect sales during Christmas to decline 5% to 25% this year. Another third expect sales to remain the same as last year. Researcher Retail Forward estimates last year was the worst selling season in 42 years with sales declining 4.5% in the fourth quarter. It also issued a forecast predicting sales will be flat with last year's weak numbers."

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. This graph shows the historical net retail jobs added for October, November and December by year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This really shows the collapse in retail hiring in 2008. This also shows how the season has changed over time - back in the '80s, retailers hired mostly in December. Now the peak month is November, and many retailers start hiring seasonal workers in October.

The WSJ article is a little confusing. First they are comparing to last year (with 40% of retailers saying they will hire fewer workers than in 2008). But there is this paragraph:

In a typical Christmas season, the retail sector contributes about 700,000 temporary jobs to the economy. If retailers decrease those numbers by 10% to 20%, that would translate to a potential loss of more than 100,000 jobs this year just when they are most in demand.The 700,000 number is about right (as shown on the graph), but if retailers hire at the pace of last year, employment will be off 300,000 or so from normal.

DOT: Vehicle Miles increase in July

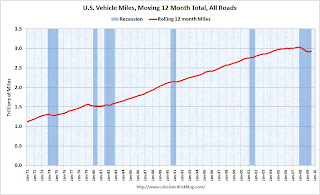

by Calculated Risk on 9/23/2009 10:49:00 AM

Although vehicle miles increased in July 2009 compared to July 2008, miles driven are still 1.3% below the peak for the month of July in 2007.

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +2.3% (5.8 billion vehicle miles) for July 2009 as compared with July 2008. Travel for the month is estimated to be 263.4 billion vehicle miles.

Cumulative Travel for 2009 changed by 0.0% (-0.6 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the rolling 12 month of U.S. vehicles miles driven.

By this measure (used to remove seasonality) vehicle miles declined sharply, and are set to slowly increase.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in July 2009 were 2.3% greater than in July 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for July 2009.

MBA: 30 Year Mortgage Rates Fall Below 5 Percent

by Calculated Risk on 9/23/2009 08:58:00 AM

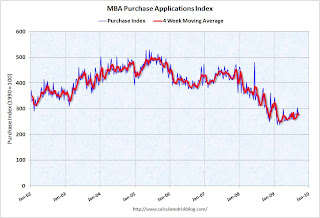

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, increased 12.8 percent on a seasonally adjusted basis from one week earlier, which was a holiday shortened week. ...

The Refinance Index increased 17.4 percent from the previous week as, for the first time since mid-May, the 30-year fixed rate dipped below 5 percent. The seasonally adjusted Purchase Index increased 5.6 percent from one week earlier, driven by applications for government-insured loans.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.97 percent from 5.08 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Tuesday, September 22, 2009

WSJ: Delayed Foreclosures and "Shadow" Inventory

by Calculated Risk on 9/22/2009 09:43:00 PM

From Ruth Simon and James Hagerty at the WSJ: Delayed Foreclosures Stalk Market

... Legal snarls, bureaucracy and well-meaning efforts to keep families in their homes are slowing the flow of properties headed toward foreclosure sales, even when borrowers are in deep distress. ... some analysts believe the delays are ... creating a growing "shadow" inventory of pent-up supply that will eventually hit the market.The foreclosures are coming. How many and when is the question. But based on the comments from the BofA spokeswoman, it sounds like foreclosures will "spike" in Q4.

...

Ivy Zelman ... believes three million to four million foreclosed homes will be put up for sale in the next few years. The question is whether the flow of these homes onto the market will resemble "a fire hose or a garden hose or a drip," she says.

... "We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" for a loan modification or other alternatives, says a Bank of America Corp. spokeswoman. Foreclosure sales had dropped to "abnormally low" levels in response to government efforts to stem foreclosures, she adds.

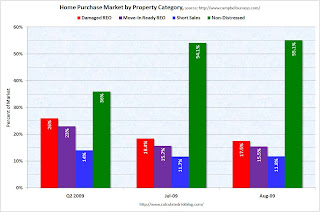

Home Purchase Market by Property Category

by Calculated Risk on 9/22/2009 06:28:00 PM

This is from a monthly survey by Campbell Communications (posted with permission).

Source: Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions, Campbell Communications, June 2009 Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Campbell survey broke REOs down into damaged and move-in ready. Distressed sales also include short sales.

Mark Hanson has pointed out that "organic" sales (non-distressed) have a seasonal pattern, and that distressed sales are basically steady all year. This new monthly data from Campbell Surveys should show that change in mix over the next few months.

A comment on Option ARMs

by Calculated Risk on 9/22/2009 04:11:00 PM

The impact of Option ARM recasts is a huge question mark.

Diana Olick at CNBC writes: ARM Payment Shock a Myth?

We've been talking a lot recently about the "next wave" of foreclosures that would be driven by adjustable rate mortgage resets. In a research note today, FBR's Paul miller is taking an interesting tack: "While we remain very concerned about the impact of continued job losses on default rates, our analysis suggests that payment shock from ARM resets should not be a problem, as long as the Federal Reserve can keep short-term rates at record lows."Stop right there. Resets are not a problem with low interest rates. The potential problems are from loan recasts.

From Tanta on resets and recasts:

"Reset" refers to a rate change. "Recast" refers to a payment change. ... "Recast" is really just a shorter word for "reamortize": you take the new interest rate, the current balance, and the remaining term of the loan, and recalculate a new payment that will fully amortize the loan over the remaining term.Since a large percentage of ARM borrowers chose the negatively amortizing option, their payments will jump when the loan is reamortized or recast. Of course the interest rate will still be low, and the recast will be at the low rate.

So it is really hard to tell what will happen.

We see cautionary articles all the time:

But I think the exact impact is uncertain. Many Option ARM borrowers are defaulting before the loan recasts, see: $134B of U.S. Option ARM RMBS To Recast by 2011 (note: Fitch is just looking at securitized Option ARMs, not loans in bank portfolios):

Of the $189 billion securitized Option ARM loans outstanding, 88% have yet to experience a recast event ... Of these loans that have not yet recast, 94% have utilized the minimum monthly payment to allow their loans to negatively amortize.For more on defaulting before recast, see: Option ARM Defaults Shrink Recast Wave, Barclays Says .

...

Further evidence of option ARM underperformance in the last year lies in the number of outstanding securitized Option ARMs either 90 days or more delinquent, in foreclosure or real estate-owned proceedings, which has increased from 16% to 37%. Total 30+ day delinquencies are now 46%, despite the fact that only 12% have recast and experienced an associated payment shock. Instead, negative and declining equity has presented a larger problem: due to high concentrations in California, Florida, and other states with rapidly declining home prices, average loan-to-value ratios have increased from 79% at origination to 126% today. 'Negative equity and payment shocks will continue as Option ARM loans recast in large numbers in the coming years,' said Somerville.

emphasis added

And it is important to remember that most of the Option ARM loans in the Wells Fargo portfolio (via Wachovia) recast in ten years, as noted by the Healdsburg Housing Bubble: Reset Chart from Credit Suisse has a Major Error From the Wells Fargo Q2 Conference Call:

[W]hile many other option ARM loans have recast periods as short as five years, our Pick-a-Pay loans generally have ten-year contractual recasts. As a result, we have virtually no loans where the terms recast over the next three years, allowing us more time to work with borrowers as they weather the current economic downturn.It is a little confusing. You can't just look at a chart of coming recasts and know when borrowers will default. The real problem for Option ARMs is negative equity, and the surge in defaults is happening before the loans recast.

But the recasts will matter too, since many of these borrowers used these mortgages as "affordability products", and bought the most expensive homes they could "afford" (based on monthly payments only). When the recasts arrive, these borrowers will have few options.

The Housing Tax Credit Debate is Heating Up

by Calculated Risk on 9/22/2009 02:36:00 PM

Really not much of a debate - most economists, left and right - oppose it.

Patrick Coolican has a great overview: Economists say extending tax credit for first-time homebuyers is bad policy

[I]t’s not surprising that Nevada’s congressional delegation has signed on to a plan to extend the credit and even make it more generous.And from economists:

“It’s working,” says Rep. Dina Titus, the 3rd District Democrat. “You can see the positive impact of it. It really is stimulating the economy, helping Realtors and developers and homebuilders and individual homebuyers.”

“It’s terrible policy,” says Mark Calabria of the libertarian Cato Institute.There is much much more in the article.

“It’s awful policy,” says Andrew Jakabovics, associate director for housing and economics at the liberal Center for American Progress. “It’s incredibly expensive. It’s not well targeted.”

...

“We paid $8,000 to at least 1.5 million people to do something they were going to do anyway,” Jakabovics says.

...

“A heck of a lot of people would have bought the house anyway,” says Ted Gayer, an economist at the Brookings Institution.

...

The tax break, due to expire at the end of November, is on track to cost $15 billion, twice what Congress had planned. In other words, it will cost $43,000 for every new homebuyer who would not have bought a house without the tax break.

Gayer also questions whether moving people from renting to owning is really all that useful ...

The tax credit is one, albeit very expensive, way to create more households, but rental vouchers to get people out of their parents’ basements should also be considered, economists say.

Here is a post estimating the cost of an additional housing unit sold.

Also, it seems the goal of any stimulus should be to create more households, not just move people from renting to owning.

Here is a quote from an economist who called the housing bubble (no link):

The housing tax credit is an enormously inefficient use of government resources, and it does not really focus on what the economy needs: more job creation, and a return to “normal” growth of households.

While I believe it is highly unlikely that it will be expanded – that’s just REALLY TOO DUMB, even for Congress – I do think that the current credit will be extended for a bit.

Thomas Lawler former Fannie Mae and Wall Street economist, Sept 18, 2009