by Calculated Risk on 9/22/2009 01:14:00 PM

Tuesday, September 22, 2009

Q2 2009: Mortgage Equity Extraction Strongly Negative

Note: This is not data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other contributors for the pervious MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q2 2009, the Net Equity Extraction was minus $48 billion, or negative 1.8% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report shows the amount of mortgage debt outstanding is declining, and this is partially because of debt cancellation per foreclosure sales (and a little from modifications), and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

Clearly the Home ATM has now been closed for a few quarters.

Philly Fed State Coincident Indicators

by Calculated Risk on 9/22/2009 10:46:00 AM

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty states are showing declining three month activity. The index increased in 6 states, and was unchanged in 4.

Here is the Philadelphia Fed state coincident index release for August.

In the past month, the indexes increased in 11 states (Arkansas, Indiana, Montana, North Dakota, Nebraska, Rhode Island, South Carolina, South Dakota, Virginia, Vermont, and Wisconsin), decreased in 36, and remained unchanged in three (New Hampshire, Ohio, and Tennessee) for a one-month diffusion index of -50. Over the past three months, the indexes increased in six states (Arkansas, North Dakota, South Carolina, South Dakota, Vermont, and Wisconsin), decreased in 40, and remained unchanged in four (Mississippi, Montana, Nebraska, and Virginia) for a three-month diffusion index of -68.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

A large percentage of states still showed declining activity in August.

Bank Report: Asia Rebounding

by Calculated Risk on 9/22/2009 08:57:00 AM

From the NY Times: Asia Rebounding Rapidly, Bank Reports

The [Asian Development Bank] declared that economic growth in China would be 8.2 percent this year, 1.2 percentage points higher than the bank’s forecast in March, and 8.9 percent next year.This should help U.S. exporters.

The bank raised its 2009 growth forecast for India to 6 percent, from 5 percent predicted in March, and for developing Asian countries as a group to 3.9 percent, from 3.4 percent.

“Developing Asia is proving to be more resilient to the global downturn than was initially thought,” the bank said in a statement accompanying its semiyearly assessment.

A common factor among countries doing better than expected is that they have been able to offset weak exports by stimulating domestic demand more than anyone expected. ...

Note: The August west coast port traffic shows a clear pickup in exports.

Monday, September 21, 2009

Inspector General: FDIC saw risks at IndyMac in 2002

by Calculated Risk on 9/21/2009 11:59:00 PM

From the Inspector General Report:

Between 2001 and 2003, [Division of Insurance and Research] DIR risk assessments and quarterly banking profiles identified concerns about a number of issues, including:Matt Padilla at the O.C. Register has the story: FDIC saw risks at IndyMac in 2002 but failed to act• consumers’ ever-increasing debt load, the expansion of adjustable rate mortgages, and a potential housing bubble;In January 2002, DIR noted that non-recession-tested lending programs such as subprime lending and HLTV lending may pose the biggest threat to consumer loan portfolio credit quality in a slowing economy. In May 2003, DIR reported that there was a concern about the extent to which lenders’ scoring models under-predicted losses during the 2001 recession. DIR noted that many subprime lenders experienced loss rates higher than their models predicted and that some consumer lending business models had been found to be inadequate, including those that relied on the securitization market for funding and were, therefore, sensitive to market pricing changes.

• subprime and high loan-to-value (HLTV) lending as a risk in the event that the United States economy suffered a significant recession; and

• pricing and modeling charge-off risk with respect to the originate-to-sell model of the mortgage business.

The FDIC noted issues at IndyMac as early as 2002, but did not stop the bank’s risk taking, the report says.Clearly the FDIC DIR was on the right track in 2001 to 2003. Just like with the Federal Reserve failure of oversight, we need a clear explanation why no significant action was taken.

“It was not until August 2007 that the FDIC began to understand the implications that the historic collapse of the credit market and housing slowdown could have on IMB and took additional actions to evaluate IMB’s viability,” the report says.

...

Despite these risks, the FDIC switched to relying on examinations from the OTS from 2004 to mid 2007, a period in which Indymac “continued to rely heavily on volatile funding sources such as brokered deposits and (Federal Home Loan Bank) advances to fund its growth.”

...

IndyMac’s failure is expected to cost the FDIC’s insurance fund $10.7 billion.

Banks to Make Loans to FDIC?

by Calculated Risk on 9/21/2009 10:24:00 PM

From the NY Times: F.D.I.C. May Borrow Funds From Banks (ht RJ)

Senior regulators say they are seriously considering a plan to have the nation’s healthy banks lend billions of dollars to rescue the insurance fund that protects bank depositors. ...Of course healthy banks would be happy to lend money to the FDIC; it is completely risk free and backed by the Treasury (and taxpayers).

Bankers and their lobbyists like the idea ... The Federal Deposit Insurance Corporation, which oversees the fund, is said to be reluctant to use its authority to borrow from the Treasury.

...

Bankers worry that a special assessment of $5 billion to $10 billion over the next six months would crimp their profits and could push a handful of banks into deeper financial trouble or even receivership. And any new borrowing from the Treasury would be construed as a taxpayer bailout ...

Officials say that the F.D.I.C. will issue a proposed plan next week to begin to restore the financial health of the ailing fund.

Fed Funds and Unemployment Rate

by Calculated Risk on 9/21/2009 07:04:00 PM

The Real Time Economics blog at the WSJ discusses expectations for the Fed two day meeting that starts tomorrow: Expect Patience From the Fed (note: the statement will be released on Wednesday).

No one expects a rate hike, and the main focus will be on the economic outlook and whether MBS purchases will slow. Last month, the FOMC statement noted "economic activity is leveling out", and the statement this month might be slightly more positive.

The Fed also announced last month: "To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions ..."

And this month the committee might announce a "smooth transition" for the purchases of agency mortgage-backed securities - and extend the deadline a few months into 2010.

As far as "patience", the Fed's mission is to conduct "monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates". So unless inflation picks up significantly (unlikely in the near term with so much slack in the system), it is unlikely that the Fed will increase the Fed's Fund rate until sometime after the unemployment rate peaks. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

Moody’s: CRE Prices Off 39 Percent from Peak, Off 5% in July

by Calculated Risk on 9/21/2009 04:16:00 PM

From Bloomberg: Moody’s Property Index Resumes ‘Steep’ Fall in July (ht James)

The Moody’s/REAL Commercial Property Price Indices fell 5.1 percent in July from the month before, Moody’s said today in a statement. The index is down almost 39 percent from its October 2007 peak.Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

Commercial property sales this year may fall to an 18-year low. This latest set of numbers suggests no letup in that trend, said Neal Elkin, president of Real Estate Analytics LLC, a New York firm that partners with Moody’s in producing the report.

“We are still vulnerable to moves on the downside,” Elkin said in a telephone interview. “As time passes, the distress and the stress among those who need to sell is growing.”

...

Florida apartment values tumbled 40 percent in a year, the report said.

“That’s eye-popping,” Elkin said. The decline is being caused in part by “a ripple effect” from the overbuilding of condominiums in those markets, many of which are now competing as rentals, he said.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

Also note the comment from Neal Elkin about condos being converted to rental units. There has been a surge in rental units, and rents are falling in most areas - and this is also impacting Apartment building prices.

GAO Report: AIG Stabilized, Repayment "Unclear"

by Calculated Risk on 9/21/2009 03:00:00 PM

| First a repeat of Eric's great AIG cartoon! Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

A report on AIG from the General Accounting Office (GAO):

While federal assistance has helped stabilize AIG’s financial condition, GAO-developed indicators suggest that AIG’s ability to restructure its business and repay the government is unclear at this time. Indicators of AIG’s financial risk suggest that since AIG reported significant losses in late 2008, AIG’s operations, with federal assistance, have begun to show signs of stabilizing in mid 2009. Similarly, after a declining trend through 2008 and early 2009, indicators of AIG insurance companies’ financial risk suggest improved financial conditions that were largely results of federal assistance. Indicators of AIG’s repayment of federal assistance show some progress in AIG’s ability to repay the federal assistance; however, improvement in the stability of AIG’s business depends on the long-term health of the company, market conditions, and continued government support. Therefore, the ultimate success of AIG’s restructuring and repayment efforts remains uncertain. GAO plans to continue to review the Federal Reserve’s and Treasury’s monitoring efforts and report on these indicators to determine the likelihood of AIG repaying the government’s assistance in full and the government recouping its investment.

emphasis added

AIA: Architectural Billings Index Declines in August

by Calculated Risk on 9/21/2009 12:14:00 PM

From Baltimore Business Journal: Architects report drop in future projects in August

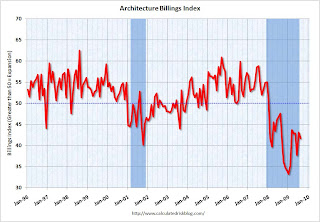

... The American Institute of Architects said August’s Architectural Billings Index, an economic indicator of future construction activity, fell to 41.7 during the month, which is down from 43.1 in July.

...

“While there have been occasional signs of optimism over the last few months, the overwhelming majority of architects are reporting that banks are extremely reluctant to provide financing for projects and that new equity requirements and conservative appraisals are making it even more difficult for developers to get loans,” said Kermit Baker, AIA chief economist. “Until the anxiety within the financial community eases, these conditions are likely to continue.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment through most of next year - at least.

Report: Mortgage Delinquencies increase in August

by Calculated Risk on 9/21/2009 11:09:00 AM

From Reuters: Mortgage Delinquencies Rise Alongside Unemployment (ht Ron Wallstreetpit)

Reuters reports that a record 7.58% of U.S. homeowners with mortgages were 30+ days delinquent in August, up from 7.32% in July ... and up from 4.89% in August 2008.

Reuters also notes that delinquencies are rising at "an accelerating pace".

This is one part of the coming "triple whammy" at the end of this year that Tom Lawler mentioned this morning: rising foreclosures, end of the Fed buying MBS, and the end of the housing tax credit.

We have to be a little careful with the delinquency numbers because they include homeowners in the trial period for modifications.

Note: This uses a different approach than the MBA. The MBA reported 9.24% of all loans outstanding were delinquent at the end of the 2nd quarter. Another 4.3% of loans were in the foreclosure process.