by Calculated Risk on 9/20/2009 04:11:00 PM

Sunday, September 20, 2009

NY Times: Financial Crisis Inquiry Commission

From a NY Times Editorial: Facts and the Financial Crisis

The Financial Crisis Inquiry Commission, created by Congress to examine the causes of the crisis, held its first public meeting last week. ... the meeting was a long time coming, and thin on substance.The NY Times asks some good questions:

In the run-up to the crisis, what did regulators, particularly the Federal Reserve, know and do in response to unconstrained lending? What were their thoughts about the way banks and investors worldwide increasingly disregarded risk?It will be interesting to read the 2004 FOMC transcripts to see if there was any discussion of lending standards, house prices and a credit bubble. It makes no sense that we have to wait 5+ years for the transcripts ...

Publicly, they did not act to curb the excesses. But internally, was there contrary analysis or dissent? Were there chances to take another course that we may learn from now in hindsight?

Answers to these questions are in files that are not public and in the heads of the people in positions of responsibility at the time. The commission must be aggressive in its pursuit of documents and unflinching in taking testimony at even the highest levels of government and business.

I suspect we will find some concerns expressed in 2004 - perhaps something similar to what Fed Economist Michael Prell said at the Dec 21, 1999 FOMC (about the stock market):

To illustrate the speculative character of the market, let me cite an excerpt from a recent IPO prospectus: ... “We do not expect to generate sufficient revenues to achieve profitability and, therefore, we expect to continue to incur net losses for at least the foreseeable future. If we do achieve profitability, we may not be able to sustain it.” Based on these prospects, the VA Linux IPO recorded a first-day price gain of about 700 percent and has a market cap of roughly $9 billion. Not bad for a company that some analysts say has no hold on any significant technology.I wouldn't be surprised to see something similar in the 2004 transcripts, but about housing and the credit markets.

The warning language I’ve just read is at least an improvement in disclosure compared to the classic prospectus of the South Sea Bubble era, in which someone offered shares in “A company for carrying on an undertaking of great advantage, but nobody to know what it is.” But, I wonder whether the spirit of the times isn’t becoming similar to that of the earlier period. ... At this point, those same people are abandoning all efforts at fundamental analysis and talking about momentum as the only thing that matters.

If this speculation were occurring on a scale that wasn’t lifting the overall market, it might be of concern only for the distortions in resource allocation it might be causing. But it has in fact been giving rise to significant gains in household wealth and thereby contributing to the rapid growth of consumer demand--something reflected in the internal and external saving imbalances that are much discussed in some circles.

emphasis added

A couple of Bullish Views

by Calculated Risk on 9/20/2009 01:07:00 PM

From James Grant in the WSJ: From Bear to Bull

Knocked for a loop, we forget a truism. With regard to the recession that precedes the recovery, worse is subsequently better. The deeper the slump, the zippier the recovery. To quote a dissenter from the forecasting consensus, Michael T. Darda, chief economist of MKM Partners, Greenwich, Conn.: "[T]he most important determinant of the strength of an economy recovery is the depth of the downturn that preceded it. There are no exceptions to this rule, including the 1929-1939 period."And from McClatchy Newspapers: Ex-IMF chief economist has rosy recovery view

Growth snapped back following the depressions of 1893-94, 1907-08, 1920-21 and 1929-33. If ugly downturns made for torpid recoveries, as today's economists suggest, the economic history of this country would have to be rewritten.

...

"At the business trough in 1933," Mr. Darda points out, "the unemployment rate stood at 25% (if there had been a 'U6' version of labor underutilization then, it likely would have been about 44% vs. 16.8% today. . . ). At the same time, the consumption share of GDP was above 80% in 1933 and the household savings rate was negative. Yet, in the four years that followed, the economy expanded at a 9.5% annual average rate while the unemployment rate dropped 10.6 percentage points."

...

Our recession, though a mere inconvenience compared to some of the cyclical snows of yesteryear, does bear comparison with the slump of 1981-82. In the worst quarter of that contraction, the first three months of 1982, real GDP shrank at an annual rate of 6.4%, matching the steepest drop of the current recession, which was registered in the first quarter of 2009. Yet the Reagan recovery, starting in the first quarter of 1983, rushed along at quarterly growth rates (expressed as annual rates of change) over the next six quarters of 5.1%, 9.3%, 8.1%, 8.5%, 8.0% and 7.1%. Not until the third quarter of 1984 did real quarterly GDP growth drop below 5%.

[Michael] Mussa, the former chief economist of the International Monetary Fund, presented a decidedly upbeat economic forecast last week that turned heads in the nation's capital. ...I disagree with these views.

"The recession is over and a global recovery is under way," he began, unveiling a pile of data and historical charts to support his view that forecasters regularly underestimate recoveries – and are doing so again.

Where the IMF foresees just 0.6 percent year-over-year growth in 2010 in the U.S. economy and 2.5 percent globally, Mussa sees 3.3 percent growth in the U.S. economy next year and 4.2 percent growth globally. He projects a U.S. growth rate of 4 percent from the middle of this year through the end of 2010.

"All forecasts tend to underpredict the recovery. … I think that's what we are seeing this time," said Mussa, now a senior fellow at the Peterson Institute for International Economics, a leading research organization in Washington.

...

Mussa pointed to forecasts made at the end of the 1981-1982 recession, the closest approximation to today's deep downturn. ...

The Reagan administration projected a growth rate from December 1982 to December 1983 of 3.1 percent, as did the Federal Reserve. In fact, the real growth rate turned out to be 6.3 percent.

...

Mussa concurs with most mainstream forecasters that consumers won't lead this recovery, and that Americans will sharply boost their savings to a 7 percent annual rate by the end of 2010.

What, then, will drive growth? Business investment, Mussa said ...

First, I expect a decent GDP rebound in Q3 and Q4 because of an inventory correction and exports. However this boost will be temporary.

But what will be the engine of growth in 2010? Usually consumer spending and residential investment lead the economy out of recession. Although I started the year expecting a bottom in new home sales and single family housing starts (and it appears that has happened), there is still too much existing home inventory for much of an increase in the short term.

And even Mussa agrees that consumers will remain under pressure as they repair their household balance sheets - yet he expects growth in business investment?

Goldman Sachs put on a research note on Friday: Capital Spending: The Caboose of a Slow Train (no link). Although the analysts noted a possible equipment replacement cycle, they also noted:

Few businesses will step up capital spending sharply unless they see a meaningful improvement in end demand for their products. Since the most important component of end demand for US companies is the domestic consumer, our cautious view of the outlook for personal consumption also implies a cautious view of capital spending, other things being equal. In essence, capital spending is the caboose of recovery, not the locomotive.There is already to much capacity, and until end demand absorbs some of that unused capacity, there won't be a meaningful increase in capital spending.

And on the comparison to the early '80s recession (both Grant and Mussa made this comparison), Krugman had some comments in early 2008: Postmodern recessions

A lot of what we think we know about recession and recovery comes from the experience of the 70s and 80s. But the recessions of that era were very different from the recessions since. Each of the slumps — 1969-70, 1973-75, and the double-dip slump from 1979 to 1982 — were caused, basically, by high interest rates imposed by the Fed to control inflation. In each case housing tanked, then bounced back when interest rates were allowed to fall again.And that means that the Fed can't just cut interest rates and boost housing. This recession is very different than the early '80s.

... Post-moderation recessions haven’t been deliberately engineered by the Fed, they just happen when credit bubbles or other things get out of hand.

This time housing will remain under pressure until the number of excess housing units (both owner occupied and rentals) decline to more normal levels.

So I think an "Immaculate Recovery" is very unlikely.

San Francisco: $30 Billion Option ARM Time Bomb

by Calculated Risk on 9/20/2009 08:49:00 AM

From Carolyn Said at the San Francisco Chronicle: $30 billion home loan time bomb set for 2010

From 2004 to 2008, "one in five people who took out a mortgage loan (for both purchases and refinancing) in the San Francisco metropolitan region ... got an option ARM," said Bob Visini, senior director of marketing in San Francisco at First American CoreLogic, a mortgage research firm. "That's more than twice the national average.The article has much more.

"People think option ARMs (will be) a national crisis," he said. "That's not really true. It's just in higher-cost areas like California where you see their prevalence."

...

First American shows more than 54,000 option ARMs issued here with a value of about $30.9 billion. Fitch shows more than 47,000 option ARMs here with a value of about $28 billion. Both say their data underestimate the totals.

...

Fitch said 94 percent of borrowers elected to make minimum payments only.

...

Unlike subprime loans, which were more commonly used for entry-level homes, option ARMs started out with high balances. In the five-county San Francisco area, option ARMs average about $584,000 and were used to buy homes averaging $823,000, according to an analysis of First American data.

That means they'll spawn foreclosures among upper-end homes.

...

"The average option ARM borrower is significantly underwater, so much that they don't think they'll get out," Sirotic said. On average nationwide, option ARM borrowers ... owe is 126 percent of their home's value, based on depreciation and not including the effects of negative amortization, Sirotic said.

Option ARMs were used as affordability products in mid-to-high priced areas of bubble states like California. Now most of the borrowers are significantly underwater, and this will lead to more foreclosures, and falling prices, in the mid-to-high end areas.

Saturday, September 19, 2009

Senator Dodd Pushing New Bank Regulatory Plan

by Calculated Risk on 9/19/2009 10:47:00 PM

From the NY Times: Leading Senator Pushes New Plan to Oversee Banks

[Sentator Dodd] is planning to propose the merger of four bank agencies into one super-regulator, an idea that is significantly different from what President Obama envisions.There is no question that the regulatory agencies reacted slowly to the obvious increase in risky loans in 2003 and 2004. I think any proposal should explain how a new "superagency" would have caught these problems earlier.

... the bill Mr. Dodd is preparing to make public in the coming weeks would be more ambitious and politically risky than the plan offered by the White House, which considered but then decided against combining the four banking agencies — the Federal Reserve, the Office of Thrift Supervision, the Federal Deposit Insurance Corporation and the Comptroller of the Currency — into one superagency.

...

In the House, Representative Barney Frank of Massachusetts, a Democrat and the chairman of the Financial Services Committee, has been working on legislation that is closer to the Obama plan on consolidation of the agencies.

...

Mr. Dodd has also rejected the administration’s proposal to have the Fed play the leading role as a so-called “systemic risk” regulator that examines the connections between regulated and unregulated companies for trouble spots that could disrupt the markets.

Need a hideout?

by Calculated Risk on 9/19/2009 06:51:00 PM

From the Chicago Sun Times: Capone lodge up for auction

Al Capone's "hideout retreat" in Wisconsin [is up for auction] minimum bid required: $2.5 million.A nice little hideaway ... maybe there is a secret vault ... hey, paging Geraldo!

"Located in the beautiful Northwoods of Wisconsin" near Couderay, the property includes 407 acres with a 37-acre private lake, according to an ad placed on the property announcing the foreclosure sale by Chippewa Valley Bank.

The buyer will get the original 1920s main lodge made of native fieldstone and featuring a massive split fieldstone fireplace. The sale also includes an eight-car garage renovated into a bar and restaurant, a bunkhouse, year-round caretaker's residence, guard tower and other outbuildings ...

Report: Strategic Defaults a "Growing Problem"

by Calculated Risk on 9/19/2009 11:55:00 AM

From Kenneth Harney at the LA Times: Homeowners who 'strategically default' on loans a growing problem

National credit bureau Experian teamed with consulting company Oliver Wyman to identify the characteristics and debt management behavior of the growing numbers of homeowners who bail out of their mortgages with none of the expected warning signs, such as nonpayments on other debts.This fits with recent research from Guiso, Sapienza and Zingales: See New Research on Walking Away and here is their paper: Moral and Social Constraints to Strategic Default on Mortgages

...

[Some results:]

...The number of strategic defaults is far beyond most industry estimates -- 588,000 nationwide during 2008, more than double the total in 2007. ... Strategic defaulters often go straight from perfect payment histories to no mortgage payments at all. ... Strategic defaults are heavily concentrated in negative-equity markets ...

Leonhardt: Wages Grow for Those With Jobs

by Calculated Risk on 9/19/2009 08:36:00 AM

I've been asked many times what people should do financially during a recession. My first answer has always been "Keep your job if you can!"

Earlier this week, David Leonhardt at the NY Times wrote: Wages Grow for Those With Jobs, New Figures Show

Even though unemployment has reached its highest level in 26 years, most workers have received a raise over the last year.From an earlier post, here is a graph of hires and separations from the BLS "Job Openings and Labor Turnover Survey" (JOLTS) survey. The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers.

That contrast highlights what I think is one of the more overlooked features of the Great Recession. In the job market, at least, the recession’s pain has been unusually concentrated.

...

People who have lost their jobs are struggling terribly to find new ones. Since the downturn began in 2007, companies have been extremely reluctant to hire new workers, and few new companies have started. The economy and the job market are churning very slowly.

...

Try thinking of it this way: All of the unemployed people in the country are gathered in a huge gymnasium that’s been turned into a job search center. The fact that this recession is the worst in a generation means that there are many, many people in the gym. The fact that the economy is churning so slowly means that there is not much traffic into and out of the gym.

If you’re inside, you will have a hard time getting out. Yet if you’re lucky enough to be outside the gym, you will probably be able to stay there. The consequences of a job loss are terribly high, but — given that the unemployment rate is almost 10 percent — the odds of job loss are surprisingly low.

Note: Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows hires (Green Line), Quits (blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and blue added together equals total separations. Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (green line) and separations (red and blue together) are pretty close each month. When the green line is above total separations, the economy is adding net jobs, when the green line is below total separations, the economy is losing net jobs.

Total separation and hires have both declined recently - the lower "churn" that Leonhardt discusses, and the reason so many people are stuck in the "gymnasium".

Friday, September 18, 2009

Problem Bank List (Unofficial) Sept 18, 2009

by Calculated Risk on 9/18/2009 09:15:00 PM

This is an unofficial list of Problem Banks.

Note: Bank failures today, Irwin Union Bank, F.S.B., Louisville, KY, and Irwin Union Bank and Trust Company, Columbus, IN, were on this list.

Changes and comments from surferdude808:

There were large changes to Unofficial Problem Bank List as the OCC released some of its newly issued actions for late July and early August.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The list increased by a net of 12 institutions to 436 from 424 last week. Assets increased by $7.4 billion to $294 billion. There were five removals with assets of $8.5 including three failures -- Corus Bank, N.A. ($7 billion), Venture Bank ($991 million), and Brickwell Community Bank ($72.5 million); and two action terminations (First National Bank of Colorado City and Cumberland Valley National Bank).

Interestingly, last week Hometown National Bank, Longview, WA was removed as the OCC terminated a Formal Agreement only for them to be added back to this week’s list as the OCC subsequently placed Hometown under a Cease & Desist Order.

Of the 17 additions this week are several subsidiary banks of the privately controlled bank holding company FBOB Corporation based in Chicago, IL. These include the Park National Bank, Chicago, IL ($4.8 billion), San Diego National Bank, San Diego, CA ($3.4 billion), and Pacific National Bank, San Francisco, CA ($2.1 billion). The Federal Reserve issued a Written Agreement against FBOB Corporation on Sept 14, 2009. FBOB Corporation has assets of $18.3 billion and controls nine institutions supervised by either the OCC or FDIC with five subject to a formal enforcement action.

Other sizable additions to the list this week include the $1.2 billion asset Metrobank, National Association, Houston, TX, and the $1.1 billion asset Atlantic Southern Bank, Macon, GA.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures #93 & 94: Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana

by Calculated Risk on 9/18/2009 05:15:00 PM

Two Irwin Banks burn away

Incandescent heat

by Soylent Green is People

From the FDIC: First Financial Bank, National Association, Hamilton, Ohio, Assumes All of the Deposits of Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana

Federal and state regulators today closed Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana, respectively. The institutions are banking subsidiaries of Irwin Financial Corporation, Columbus, Indiana. The regulators immediately named the Federal Deposit Insurance Corporation (FDIC) as the receiver for the banks. ...A two-fer to start BFF.

Irwin Union Bank and Trust Company, Columbus, Indiana, was closed by the Indiana Department of Financial Institutions. As of August 31, 2009, it had total assets of $2.7 billion and total deposits of approximately $2.1 billion. Irwin Union Bank, F.S.B., Louisville, Kentucky, was closed by the Office of Thrift Supervision. As of August 31, 2009, it had total assets of $493 million and total deposits of approximately $441 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for both institutions will be $850 million. ... The failure of the two institutions brings the nation's total number this year to 94. This was the first failure of the year in Indiana and Kentucky. The last FDIC-insured institutions closed in the respective states were The Rushville National Bank, Rushville, Indiana, on December 18, 1992, and Future Federal Savings Bank, Louisville, Kentucky, on August 30, 1991.

Market, “I.B.G. - Y.B.G.” and Fed MBS and Treasury Purchases

by Calculated Risk on 9/18/2009 04:11:00 PM

While we wait for the FDIC (HomeGnome has a poll each week in the comments!): Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And from Eric Dash at NY Times Economix: What’s Really Wrong With Wall Street Pay?

Note: “I.B.G. - Y.B.G.” stands for what happens - from a trader's perspective - if a huge trade goes South: "I’ll Be Gone and You’ll Be Gone"

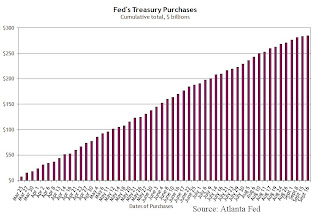

And since we've been discussing the possible impact of Fed purchases on mortgage rates, from the Atlanta Fed weekly Financial Highlights:  From the Atlanta Fed:

From the Atlanta Fed:

On September 15, the Fed purchased $2.05 billion in Treasuries, roughly in the 10-17 year sector; on September 16, it purchased $1.799 billion in the one-to-two year sector. It has purchased a total of $285.2 billion of Treasury securities through September 16. The Fed plans to purchase $300 billion by the end of October, or about six weeks from now, which makes for a pace of about $2.5 billion in purchases per week.

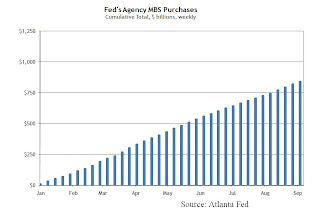

And from the Atlanta Fed:

And from the Atlanta Fed: The Treasury purchases have slowed and will end in six weeks. The MBS purchases are ongoing.The Fed has purchased a net total of $18.8 billion of agency MBS between September 3 and 9. It bought $3.6 billion of Freddie Mac, $12.4 billion of Fannie Mae, and $2.9 billion of Ginnie Mae. The Fed’s cumulative MBS purchases have reached $840.1 billion, and it has announced plans to purchase up to $1.25 trillion by the end of the year.