by Calculated Risk on 9/18/2009 09:15:00 PM

Friday, September 18, 2009

Problem Bank List (Unofficial) Sept 18, 2009

This is an unofficial list of Problem Banks.

Note: Bank failures today, Irwin Union Bank, F.S.B., Louisville, KY, and Irwin Union Bank and Trust Company, Columbus, IN, were on this list.

Changes and comments from surferdude808:

There were large changes to Unofficial Problem Bank List as the OCC released some of its newly issued actions for late July and early August.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The list increased by a net of 12 institutions to 436 from 424 last week. Assets increased by $7.4 billion to $294 billion. There were five removals with assets of $8.5 including three failures -- Corus Bank, N.A. ($7 billion), Venture Bank ($991 million), and Brickwell Community Bank ($72.5 million); and two action terminations (First National Bank of Colorado City and Cumberland Valley National Bank).

Interestingly, last week Hometown National Bank, Longview, WA was removed as the OCC terminated a Formal Agreement only for them to be added back to this week’s list as the OCC subsequently placed Hometown under a Cease & Desist Order.

Of the 17 additions this week are several subsidiary banks of the privately controlled bank holding company FBOB Corporation based in Chicago, IL. These include the Park National Bank, Chicago, IL ($4.8 billion), San Diego National Bank, San Diego, CA ($3.4 billion), and Pacific National Bank, San Francisco, CA ($2.1 billion). The Federal Reserve issued a Written Agreement against FBOB Corporation on Sept 14, 2009. FBOB Corporation has assets of $18.3 billion and controls nine institutions supervised by either the OCC or FDIC with five subject to a formal enforcement action.

Other sizable additions to the list this week include the $1.2 billion asset Metrobank, National Association, Houston, TX, and the $1.1 billion asset Atlantic Southern Bank, Macon, GA.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures #93 & 94: Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana

by Calculated Risk on 9/18/2009 05:15:00 PM

Two Irwin Banks burn away

Incandescent heat

by Soylent Green is People

From the FDIC: First Financial Bank, National Association, Hamilton, Ohio, Assumes All of the Deposits of Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana

Federal and state regulators today closed Irwin Union Bank, F.S.B., Louisville, Kentucky, and Irwin Union Bank and Trust Company, Columbus, Indiana, respectively. The institutions are banking subsidiaries of Irwin Financial Corporation, Columbus, Indiana. The regulators immediately named the Federal Deposit Insurance Corporation (FDIC) as the receiver for the banks. ...A two-fer to start BFF.

Irwin Union Bank and Trust Company, Columbus, Indiana, was closed by the Indiana Department of Financial Institutions. As of August 31, 2009, it had total assets of $2.7 billion and total deposits of approximately $2.1 billion. Irwin Union Bank, F.S.B., Louisville, Kentucky, was closed by the Office of Thrift Supervision. As of August 31, 2009, it had total assets of $493 million and total deposits of approximately $441 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for both institutions will be $850 million. ... The failure of the two institutions brings the nation's total number this year to 94. This was the first failure of the year in Indiana and Kentucky. The last FDIC-insured institutions closed in the respective states were The Rushville National Bank, Rushville, Indiana, on December 18, 1992, and Future Federal Savings Bank, Louisville, Kentucky, on August 30, 1991.

Market, “I.B.G. - Y.B.G.” and Fed MBS and Treasury Purchases

by Calculated Risk on 9/18/2009 04:11:00 PM

While we wait for the FDIC (HomeGnome has a poll each week in the comments!): Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And from Eric Dash at NY Times Economix: What’s Really Wrong With Wall Street Pay?

Note: “I.B.G. - Y.B.G.” stands for what happens - from a trader's perspective - if a huge trade goes South: "I’ll Be Gone and You’ll Be Gone"

And since we've been discussing the possible impact of Fed purchases on mortgage rates, from the Atlanta Fed weekly Financial Highlights:  From the Atlanta Fed:

From the Atlanta Fed:

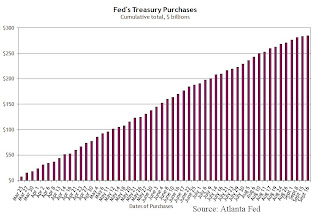

On September 15, the Fed purchased $2.05 billion in Treasuries, roughly in the 10-17 year sector; on September 16, it purchased $1.799 billion in the one-to-two year sector. It has purchased a total of $285.2 billion of Treasury securities through September 16. The Fed plans to purchase $300 billion by the end of October, or about six weeks from now, which makes for a pace of about $2.5 billion in purchases per week.

And from the Atlanta Fed:

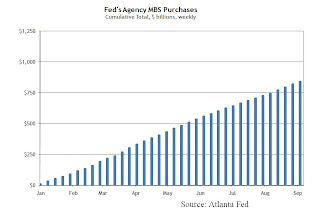

And from the Atlanta Fed: The Treasury purchases have slowed and will end in six weeks. The MBS purchases are ongoing.The Fed has purchased a net total of $18.8 billion of agency MBS between September 3 and 9. It bought $3.6 billion of Freddie Mac, $12.4 billion of Fannie Mae, and $2.9 billion of Ginnie Mae. The Fed’s cumulative MBS purchases have reached $840.1 billion, and it has announced plans to purchase up to $1.25 trillion by the end of the year.

Hamilton on Regulating Banking Sector Compensation

by Calculated Risk on 9/18/2009 02:09:00 PM

Professor Hamilton, at Econbrowser, excerpts from the WSJ on curbing bankers' pay, and adds some important comments: Regulating compensation in the banking sector

One of the key questions for understanding the causes of our current problems is the following. Suppose that in 2005, the individuals who were putting together securities derived from subprime and alt-A mortgage loans could have known, with perfect foresight, events that were going to unfold in 2008. Would they have still done the same things they did in 2005? My concern is that, for many individuals, the answer might be "yes", insofar as they were richly rewarded personally in 2005 for making exactly the decisions they did. It was other parties (namely you and me) who later down the road were forced to absorb the downside of their gambles. Capitalism functions well when individuals are rewarded for making socially productive decisions. It is a disaster when individuals are rewarded for making socially destructive decisions. For this reason, I am quite supportive of the broad idea of the above proposal.For some people I don't think there is any question the answer would have been "yes". For many others, they would have ignored the "perfect foresight", and rationalized away the risks. The result is the same, but the second group can feel better about themselves while living large.

Hamilton also adds some comments on regulatory capture - another important issue.

Unemployment Rates: California, Nevada, and Rhode Island set new series highs

by Calculated Risk on 9/18/2009 11:26:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Twenty-seven states and the District of Columbia reported over-the-month unemployment rate increases, 16 states registered rate decreases, and 7 states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia.

...

Fourteen states and the District of Columbia reported jobless rates of at least 10.0 percent in August. Michigan continued to have the highest unemployment rate among the states, 15.2 percent. Nevada recorded the next highest rate, 13.2 percent, followed by Rhode Island, 12.8 percent, and California and Oregon, 12.2 percent each. The rates in California, Nevada, and Rhode Island set new series highs.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Fourteen states and D.C. now have double digit unemployment rates.

Illinois, Indiana, and Georgia are all close.

Four states are at record unemployment rates: Rhode Island, Oregon, Nevada, and California. Several others - like Florida and Georgia - are close.

FDIC's Bair: DIF May Borrow from Treasury

by Calculated Risk on 9/18/2009 10:26:00 AM

From the WSJ: FDIC Considers Borrowing From Treasury to Shore Up Deposit Insurance

Federal Deposit Insurance Corp. Chairman Sheila Bair said her agency is considering borrowing from the U.S. Treasury to replenish its deposit insurance fund.UPDATE: Bair is responding to comments by Barney Frank (see this speech at 25 mins, ht Kevin)

"We are carefully considering all options" including borrowing from the Treasury, Ms. Bair said Friday after a speech in Washington.

Here is a reference to a recent letter from Sen Levin, via Dow Jones: FDIC Should Borrow From Tsy, Not Charge Banks Fee

Sen. Carl Levin, D-Mich. ... said in a letter to FDIC Chair Sheila Bair that he was concerned about the possibility of the agency charging banks a second special assessment this year. ... Such fees could hurt smaller banks, Levin wrote.The Deposit Insurance Fund (DIF) had $10.4 billion in assets at the end of Q2, but the total reserves were $42 billion. Note that accounting for the DIF includes reserves against estimate future losses, so that is the difference between the total reserves and the reported assets. Total reserves of the Deposit Insurance Fund (DIF) stood at $42 billion. From the FDIC:

"Adding yet another major financial obligation during this crisis could further deplete the capital of these small financial institutions, making it difficult for them to extend the credit needed to turn our economy around," Levin said in the letter.

Just as insured institutions reserve for loan losses, the FDIC has to provide for a contingent loss reserve for future failures. To the extent that the FDIC has already reserved for an anticipated closing, the failure of an institution does not reduce the DIF balance. The contingent loss reserve, which totaled $28.5 billion on March 31, rose to $32.0 billion as of June 30, reflecting higher actual and anticipated losses from failed institutions. Additions to the contingent loss reserve during the second quarter caused the fund balance to decline from $13.0 billion to $10.4 billion. Combined, the total reserves of the DIF equaled $42.4 billion at the end of the quarter.Of course the FDIC cut a check to MB Financial Bank last week for approximately $4 billion as part of the Corus Bank seizure. For the Corus deal, MB Financial Bank assumed all of the deposits of Corus Bank (approximately $7 billion) and agreed to purchase approximately $3 billion of the assets (mostly cash and marketable securities). The FDIC wrote a check for the difference. The FDIC retained the remaining $4 billion in assets for later disposal, and estimated the losses would be $1.7 billion. But writing a $4 billion check was a significant hit to the cash reserves of the DIF.

WaPo: FHA Cash Reserves Will Drop Below Requirement

by Calculated Risk on 9/18/2009 08:38:00 AM

From the WaPo: Housing Agency's Cash Reserves Will Drop Below Requirement

The Federal Housing Administration has been hit so hard by the mortgage crisis that for the first time, the agency's cash reserves will drop below the minimum level set by Congress, FHA officials said.Here is a table of FHA lenders with 2 year default rates of 15% or more (only lenders with 100+ originations included). There are ten lenders with "perfect" records (100% default), but they only have one or two originations each. Many of these lenders will probably go away with the new rules.

The FHA guaranteed about a quarter of all U.S. home loans made this year, and the reserves are meant as a financial cushion to ensure that the agency can cover unexpected losses.

"It's very serious," FHA Commissioner David H. Stevens said in an interview. "There's nothing more serious that we're addressing right now, outside the housing crisis in general, than this issue."

...

[Stevens] said he is planning to announce Friday several measures that should help the reserves rebound quickly.

...

An independent audit due out this fall will show that the agency's reserves will drop below the 2 percent level as of Oct. 1, the start of the new fiscal year, Stevens said.

...

For one, he will propose that banks and other lenders that do business with the FHA have at least $1 million in capital they can use to repay the agency for losses if they were involved in fraud. Now, they are required only to hold $250,000. Second, he will propose that lenders also take responsibility for any losses due to fraud committed by the mortgage brokers with whom they work.

emphasis added

The FHA is banking on a "recovery in the housing market":

The new audit shows that even without any new measures, the reserves will rebound to the required level within two or three years largely as the result of the recovery in the housing market, Stevens said. This calculation is based on projections of future home prices, interest rates and the volume and credit quality of FHA's business.Yeah, if house prices increase, everything will be OK!

Note: here is a post from a couple of weeks ago: FHA: The Next Bailout?

Thursday, September 17, 2009

Iowa Attorney General: "Option ARMs are about to explode"

by Calculated Risk on 9/17/2009 10:25:00 PM

From Reuters: "Option" mortgages to explode, officials warn

"Payment option ARMs are about to explode," Iowa Attorney General Tom Miller said after a Thursday meeting with members of President Barack Obama's administration to discuss ways to combat mortgage scams.This was a meeting of state AGs discussing mortgage scams with the Obama Administration, and based on the comments, there was an emphasis on Option ARMs.

...

In Arizona, 128,000 of those mortgages will reset over the the next year and many have started to adjust this month, the state's attorney general, Terry Goddard, told Reuters after the meeting.

"It's the other shoe," he said. "I can't say it's waiting to drop. It's dropping now."

I guess that deserves a Hoocoodanode?

FTC Considering Ban on Upfront Loan Mod Fees

by Calculated Risk on 9/17/2009 07:41:00 PM

About time ... (and a BFF preview below)

From Jillayne Schlicke at RainCityGuide: FTC Considers Total Ban on Upfront Loan Modification Fees. FTC Chairman Jon Leibowitz made the suggestion today. Jillayne adds:

Third party loan mod salesmen should only be allowed to collect a fee once the loan modification is not only performed but also after the homeowner has made a specific number of on time payments. This will rid the system of the Devil’s Rejects subprime LOs who act like they just walked off the set of a Rob Zombie movie and can only smell money.Exactly! Jillayne has been arguing for this ban for some time.

And to get ready for Bank Failure Friday (BFF), from an SEC 8-K filing today: (ht Michael)

On September 15, 2009, Irwin Financial Corporation (the “Corporation”) and its principal depository institution subsidiary, Irwin Union Bank and Trust Company (“IUBT”), entered into a Cease and Desist Order (the “Order”) with the Board of Governors of the Federal Reserve System (the “Federal Reserve”) and the Indiana Department of Financial Institutions (the “DFI”). The Order includes requirements that the Corporation and IUBT achieve certain designated capital levels and reduce reliance on certain types of deposits by September 30, 2009. The Corporation and IUBT believe that there is no realistic prospect of achieving the required capital levels by the date required in the Order and, in the absence of certain loan sales, which the Corporation and IUBT believe would not be approved by appropriate regulatory bodies, they cannot achieve the requisite reduction in reliance on the designated deposits by the required date."No realistic prospect" is pretty clear.

emphasis added

The Impact on Mortgage Rates of the Fed buying MBS

by Calculated Risk on 9/17/2009 06:20:00 PM

The Federal Reserve released the Factors Affecting Reserve Balances today. Total assets were basically flat at $2.14 trillion. This graph from the Atlanta Fed shows the breakdown in the assets (from earlier this month): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This raises an interesting question: What is the impact from Fed MBS buying on mortgage rates?

Earlier this year, Political Calculations introduced a tool to estimate mortgage rates based on the Ten Year Treasury yield (based on an earlier post of mine): Predicting Mortgage Rates and Treasury Yields. Using their tool, with the Ten Year yield at 3.39%, this suggests a 30 year mortgage rates of 5.36% based on the historical relationship between the Ten Year yield and mortgage rates.

Freddie Mac released their weekly survey today:

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.04 percent with an average 0.7 point for the week ending September 17, 2009, down from last week when it averaged 5.07 percent.This made me wonder if mortgage rates have been running below projections while the Fed has buying MBS ...

So I updated the previous graph. Sure enough mortgage rates have been below expectations for a number of months (the last 5 months in blue triangles).

So I updated the previous graph. Sure enough mortgage rates have been below expectations for a number of months (the last 5 months in blue triangles).Although this is a limited amount of data - and the blue triangles are within the normal spread - this suggests the Fed's buying of MBS is reducing mortgage rates by about 35 bps.

Of course the Fed is also buying Treasuries - reducing the yield on the Ten Year Treasury - and that is another factor reducing mortgage rates (although Treasury buying is a much smaller amount and for different durations).

The third graph shows a breakdown of Fed Treasury purchases by maturity. From the Atlanta Fed:

The third graph shows a breakdown of Fed Treasury purchases by maturity. From the Atlanta Fed: Decomposing the Fed’s purchases of Treasury securities by maturity shows a heavy focus in the four-to-seven-year and seven-to-10-year sectors, together making up half of all purchases so far.I think the impact on mortgage rates from the Treasury purchases is minor. This suggests to me that mortgage rates will rise by about 35 bps, relative to the Ten Year yield, when the Fed stops buying MBS.

But the last four Treasury purchases have been focused elsewhere, with the biggest purchases in the shorter end of the yield curve.