by Calculated Risk on 9/17/2009 10:25:00 PM

Thursday, September 17, 2009

Iowa Attorney General: "Option ARMs are about to explode"

From Reuters: "Option" mortgages to explode, officials warn

"Payment option ARMs are about to explode," Iowa Attorney General Tom Miller said after a Thursday meeting with members of President Barack Obama's administration to discuss ways to combat mortgage scams.This was a meeting of state AGs discussing mortgage scams with the Obama Administration, and based on the comments, there was an emphasis on Option ARMs.

...

In Arizona, 128,000 of those mortgages will reset over the the next year and many have started to adjust this month, the state's attorney general, Terry Goddard, told Reuters after the meeting.

"It's the other shoe," he said. "I can't say it's waiting to drop. It's dropping now."

I guess that deserves a Hoocoodanode?

FTC Considering Ban on Upfront Loan Mod Fees

by Calculated Risk on 9/17/2009 07:41:00 PM

About time ... (and a BFF preview below)

From Jillayne Schlicke at RainCityGuide: FTC Considers Total Ban on Upfront Loan Modification Fees. FTC Chairman Jon Leibowitz made the suggestion today. Jillayne adds:

Third party loan mod salesmen should only be allowed to collect a fee once the loan modification is not only performed but also after the homeowner has made a specific number of on time payments. This will rid the system of the Devil’s Rejects subprime LOs who act like they just walked off the set of a Rob Zombie movie and can only smell money.Exactly! Jillayne has been arguing for this ban for some time.

And to get ready for Bank Failure Friday (BFF), from an SEC 8-K filing today: (ht Michael)

On September 15, 2009, Irwin Financial Corporation (the “Corporation”) and its principal depository institution subsidiary, Irwin Union Bank and Trust Company (“IUBT”), entered into a Cease and Desist Order (the “Order”) with the Board of Governors of the Federal Reserve System (the “Federal Reserve”) and the Indiana Department of Financial Institutions (the “DFI”). The Order includes requirements that the Corporation and IUBT achieve certain designated capital levels and reduce reliance on certain types of deposits by September 30, 2009. The Corporation and IUBT believe that there is no realistic prospect of achieving the required capital levels by the date required in the Order and, in the absence of certain loan sales, which the Corporation and IUBT believe would not be approved by appropriate regulatory bodies, they cannot achieve the requisite reduction in reliance on the designated deposits by the required date."No realistic prospect" is pretty clear.

emphasis added

The Impact on Mortgage Rates of the Fed buying MBS

by Calculated Risk on 9/17/2009 06:20:00 PM

The Federal Reserve released the Factors Affecting Reserve Balances today. Total assets were basically flat at $2.14 trillion. This graph from the Atlanta Fed shows the breakdown in the assets (from earlier this month): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This raises an interesting question: What is the impact from Fed MBS buying on mortgage rates?

Earlier this year, Political Calculations introduced a tool to estimate mortgage rates based on the Ten Year Treasury yield (based on an earlier post of mine): Predicting Mortgage Rates and Treasury Yields. Using their tool, with the Ten Year yield at 3.39%, this suggests a 30 year mortgage rates of 5.36% based on the historical relationship between the Ten Year yield and mortgage rates.

Freddie Mac released their weekly survey today:

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.04 percent with an average 0.7 point for the week ending September 17, 2009, down from last week when it averaged 5.07 percent.This made me wonder if mortgage rates have been running below projections while the Fed has buying MBS ...

So I updated the previous graph. Sure enough mortgage rates have been below expectations for a number of months (the last 5 months in blue triangles).

So I updated the previous graph. Sure enough mortgage rates have been below expectations for a number of months (the last 5 months in blue triangles).Although this is a limited amount of data - and the blue triangles are within the normal spread - this suggests the Fed's buying of MBS is reducing mortgage rates by about 35 bps.

Of course the Fed is also buying Treasuries - reducing the yield on the Ten Year Treasury - and that is another factor reducing mortgage rates (although Treasury buying is a much smaller amount and for different durations).

The third graph shows a breakdown of Fed Treasury purchases by maturity. From the Atlanta Fed:

The third graph shows a breakdown of Fed Treasury purchases by maturity. From the Atlanta Fed: Decomposing the Fed’s purchases of Treasury securities by maturity shows a heavy focus in the four-to-seven-year and seven-to-10-year sectors, together making up half of all purchases so far.I think the impact on mortgage rates from the Treasury purchases is minor. This suggests to me that mortgage rates will rise by about 35 bps, relative to the Ten Year yield, when the Fed stops buying MBS.

But the last four Treasury purchases have been focused elsewhere, with the biggest purchases in the shorter end of the yield curve.

DataQuick: California Bay Area Sales Decline

by Calculated Risk on 9/17/2009 03:20:00 PM

From DataQuick: Bay Area August home sales and median price fall

Bay Area home sales bucked the seasonal norm and fell last month from July, though they remained higher than a year ago for the 12th consecutive month. The region’s overall median sale price also declined as a greater portion of sales occurred in more affordable areas ...This sales decline in August is being reported in many areas.

A total of 7,518 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was down 14.3 percent from 8,771 in July and up 4.0 percent from 7,232 in August 2008, according to MDA DataQuick of San Diego.

...

“Part of the mid-summer pause in the market could have been caused by home shoppers becoming frustrated by market conditions they didn’t anticipate. In many areas there were fewer homes, especially cheap foreclosures, to choose from, and lots of talk about multiple offers and all-cash deals. It might have driven some back to the sidelines,” said John Walsh, MDA DataQuick president.

“At the same time, people are still concerned about job security, and about how many foreclosures might yet hit the market,” he said. “There are ongoing reports of mortgage delinquencies rising, yet the number of homes being foreclosed on has trended down lately. It’s bred a lot of uncertainty among the pundits and the public about how many more foreclosures are coming, when they’ll hit, and what impact they’ll have on prices.”

The 14.3 percent drop in sales between July and August was atypical, given the average change between those two months is a gain of 3.4 percent. ...

The median’s $35,000 drop between July and August was mainly the result of a shift toward a higher percentage of sales occurring in lower-cost inland areas. Although sales fell across the region and home price spectrum, some costlier areas saw the biggest declines. Sales fell the most – 21.1 percent – between July and August in Santa Clara County. Its share of total Bay Area sales fell to 23.1 percent in August, down from 25.1 percent in July.

...

Foreclosure resales made up 32.5 percent of total August resales, up from 31.2 percent in July but down from 36.0 percent a year ago. The August percentage was higher than July’s, despite fewer foreclosed homes selling last month, because of the sharp drop in non-foreclosure resales in August.

...

Foreclosures are off their recent peak but remain high historically ... and non-owner occupied buying is above-average in some markets, MDA DataQuick reported.

And the shift back to more low end homes - even with the lower foreclosure inventory in the low end areas - is a bad sign for the mid-to-high end of the housing market. This suggest prices will fall further in those areas.

It appears the first-time homebuyer frenzy is started to fade, although investors are still buying in the low end areas.

Hotel RevPAR off 25.5%

by Calculated Risk on 9/17/2009 01:38:00 PM

This is a crushing comparison, but the numbers might be distorted by the late Labor Day this year (Sept 7th). That made the comparison easier last week (with more leisure travel), but perhaps business travel hasn't started yet (important for hotels after Labor Day). Next week will be key ...

From HotelNewsNow.com: New Orleans leads declines in STR weekly results

In year-over-year measurements, the U.S. industry’s occupancy fell 14.6 percent [for the week ending 12 September] at 52.8 percent. ADR dropped 12.8 percent to finish the week at US$94.49. RevPAR for the week decreased 25.5 percent to finish at US$49.92.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 9.6% from the same period in 2008.

The average daily rate is down 12.8%, and RevPAR is off 25.5% from the same week last year.

Note that this is a multi-year slump. Although occupancy was off 14.6% compared to the same week in 2008, occupancy is off about 23% from the same week in 2006.

Also, earlier this year business travel was off much more than leisure travel. So it was no suprise that occupancy rates didn't decline as far during the Summer as earlier in the year. However, after Labor Day, business travel becomes far more important for the hotel industry than leisure, and next week will be very important to see if business travel is recovering.

Fed: Household Net Worth Off $12.2 Trillion From Peak

by Calculated Risk on 9/17/2009 11:59:00 AM

The Fed released the Q2 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $12.2 Trillion from the peak in 2007. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

According to the Fed, household net worth increased in Q2 mostly from increases in stock holdings - although the value of household real estate increased slightly too.

Note that this ratio was relatively stable for almost 50 years, and then ... bubbles! This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 43% from the all time low last quarter of 41.9%. The increase was due to a slight increase in the value of household real estate and a decline in mortgage debt - and also a decline in overall GDP (so the ratio increases).

When prices were increasing dramatically, the percent homeowner equity was stable or declining because homeowners were extracting equity from their homes. Now, with prices falling, the percent homeowner equity has been cliff diving.

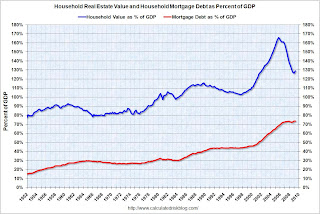

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 43% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased slightly in Q2 - because of a slight increase in real estate values, and a decline in GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased slightly in Q2 - because of a slight increase in real estate values, and a decline in GDP.

Mortgage debt declined, but was flat as a percent of GDP in Q2 - since GDP declined too.

After a bubble, the value of assets decline, but most of the debt remains.

Philly Fed Index Increases in September

by Calculated Risk on 9/17/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region’s manufacturing sector is showing signs of growth, according to firms polled for this month’s Business Outlook Survey. ...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 4.2 in August to 14.1 this month. This is the highest reading since June 2007 and the second consecutive positive reading. The percentage of firms reporting increases in activity (33 percent)exceeded the percentage reporting decreases (19 percent). Other broad indicators

also suggested some growth this month. The current new orders index also remained positive for the second consecutive month, although it edged one point lower, to 3.3. The current shipments index increased eight points and has now increased 18 points over the last two months. Firms reported declines in inventories this month: The current inventory index declined 18 points, from 0.3 in August to ‐18.1. Indicators for unfilled orders and delivery times remained negative, suggesting continued weakness.

Labor market conditions remain weak, despite signs of improvement in overall activity. The current employment index decreased slightly, from ‐12.9 to ‐14.3. Overall declines, however, are still not as widespread as in the first six months of this year. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for two months now, after being negative for 19 of the previous 20 months. Employment is still weak.

Housing Starts in August: Moving Sideways

by Calculated Risk on 9/17/2009 08:31:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 598 thousand (SAAR) in August, up 1.5% from the revised July rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 479 thousand (SAAR) in August, down 3.0% from the revised July rate, but still 34 percent above the record low in January and February (357 thousand).

Permits for single-family units were 462 thousand in August, suggesting single-family starts will be steady in September.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building Permits:Note that single-family completions of 489 thousand are at about the same level as single-family starts (479 thousand). This suggests residential construction employment has stabilized.

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 579,000. This is 2.7 percent (±1.2%) above the revised July rate of 564,000, but is 32.4 percent (±1.3%) below the August 2008 estimate of 857,000.

Single-family authorizations in August were at a rate of 462,000; this is 0.2 percent (±1.1%) below the revised July figure of 463,000.

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 598,000. This is 1.5 percent (±7.9%) above the revised July estimate of 589,000, but is 29.6 percent (±6.0%) below the August 2008 rate of 849,000.

Single-family housing starts in August were at a rate of 479,000; this is 3.0 percent (±5.7%) below the revised July figure of 494,000.

Housing Completions:

Privately-owned housing completions in August were at a seasonally adjusted annual rate of 760,000. This is 5.5 percent (±14.0%) below the revised July estimate of 804,000 and is 25.3 percent (±9.6%) below the August 2008 rate of 1,018,000.

Single-family housing completions in August were at a rate of 489,000; this is 1.6 percent (±12.7%)* below the revised July figure of 497,000.

It now appears that single family starts bottomed in January. However, as expected, it appears starts are moving sideways - and will probably stay near this level until the excess existing home inventory is reduced.

Weekly Unemployment Claims: Stuck at High Level

by Calculated Risk on 9/17/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims decreased to 545,000:

In the week ending Sept. 12, the advance figure for seasonally adjusted initial claims was 545,000, a decrease of 12,000 from the previous week's revised figure of 557,000. The 4-week moving average was 563,000, a decrease of 8,750 from the previous week's revised average of 571,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Sept. 5 was 6,230,000, an increase of 129,000 from the preceding week's revised level of 6,101,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 8,750 to 563,000, and is now 95,750 below the peak in April.

It appears that initial weekly claims have peaked for this cycle. However it seems that weekly claims are stuck at a very high level; weekly claims have been in the high 500 thousands for almost 3 months. This indicates continuing weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

Wednesday, September 16, 2009

More on Housing Tax Credit

by Calculated Risk on 9/16/2009 09:09:00 PM

From Bloomberg: Homebuyer Tax-Credit Extension Gains Lawmaker Support

An extension of the $8,000 U.S. homebuyer tax credit is gaining support in the Senate as bill sponsor John Isakson said he is rallying lawmakers to continue a program that helped boost home sales by more than 1 million.This is terrible policy, and hopefully the bill will be scuttled.

“I’m working the floor now to make everyone aware that the $8,000 credit sunsets on Nov. 30,” Isakson, a Georgia Republican, said in an interview today. The former real estate executive says he is “talking to everybody and anybody.”

Meanwhile the usual suspects are lining up to support the bill:

Realtors, bankers and homebuilders have joined in the push, starting a campaign that encourages Congress to extend the program for one year ...What is wrong with Connecticut?

White House spokesman Robert Gibbs told reporters today that President Barack Obama’s economic team is looking at the tax credit and “evaluating the impact” on new home sales.

“Through that evaluation we’ll come to something to give the president a recommendation,” Gibbs said.

...

The bill has at least 15 co-sponsors including Senate Banking Committee Chairman Christopher Dodd, a Connecticut Democrat, and senators Patty Murray, a Washington Democrat, and Joe Lieberman, a Connecticut independent.