by Calculated Risk on 9/17/2009 03:20:00 PM

Thursday, September 17, 2009

DataQuick: California Bay Area Sales Decline

From DataQuick: Bay Area August home sales and median price fall

Bay Area home sales bucked the seasonal norm and fell last month from July, though they remained higher than a year ago for the 12th consecutive month. The region’s overall median sale price also declined as a greater portion of sales occurred in more affordable areas ...This sales decline in August is being reported in many areas.

A total of 7,518 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was down 14.3 percent from 8,771 in July and up 4.0 percent from 7,232 in August 2008, according to MDA DataQuick of San Diego.

...

“Part of the mid-summer pause in the market could have been caused by home shoppers becoming frustrated by market conditions they didn’t anticipate. In many areas there were fewer homes, especially cheap foreclosures, to choose from, and lots of talk about multiple offers and all-cash deals. It might have driven some back to the sidelines,” said John Walsh, MDA DataQuick president.

“At the same time, people are still concerned about job security, and about how many foreclosures might yet hit the market,” he said. “There are ongoing reports of mortgage delinquencies rising, yet the number of homes being foreclosed on has trended down lately. It’s bred a lot of uncertainty among the pundits and the public about how many more foreclosures are coming, when they’ll hit, and what impact they’ll have on prices.”

The 14.3 percent drop in sales between July and August was atypical, given the average change between those two months is a gain of 3.4 percent. ...

The median’s $35,000 drop between July and August was mainly the result of a shift toward a higher percentage of sales occurring in lower-cost inland areas. Although sales fell across the region and home price spectrum, some costlier areas saw the biggest declines. Sales fell the most – 21.1 percent – between July and August in Santa Clara County. Its share of total Bay Area sales fell to 23.1 percent in August, down from 25.1 percent in July.

...

Foreclosure resales made up 32.5 percent of total August resales, up from 31.2 percent in July but down from 36.0 percent a year ago. The August percentage was higher than July’s, despite fewer foreclosed homes selling last month, because of the sharp drop in non-foreclosure resales in August.

...

Foreclosures are off their recent peak but remain high historically ... and non-owner occupied buying is above-average in some markets, MDA DataQuick reported.

And the shift back to more low end homes - even with the lower foreclosure inventory in the low end areas - is a bad sign for the mid-to-high end of the housing market. This suggest prices will fall further in those areas.

It appears the first-time homebuyer frenzy is started to fade, although investors are still buying in the low end areas.

Hotel RevPAR off 25.5%

by Calculated Risk on 9/17/2009 01:38:00 PM

This is a crushing comparison, but the numbers might be distorted by the late Labor Day this year (Sept 7th). That made the comparison easier last week (with more leisure travel), but perhaps business travel hasn't started yet (important for hotels after Labor Day). Next week will be key ...

From HotelNewsNow.com: New Orleans leads declines in STR weekly results

In year-over-year measurements, the U.S. industry’s occupancy fell 14.6 percent [for the week ending 12 September] at 52.8 percent. ADR dropped 12.8 percent to finish the week at US$94.49. RevPAR for the week decreased 25.5 percent to finish at US$49.92.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 9.6% from the same period in 2008.

The average daily rate is down 12.8%, and RevPAR is off 25.5% from the same week last year.

Note that this is a multi-year slump. Although occupancy was off 14.6% compared to the same week in 2008, occupancy is off about 23% from the same week in 2006.

Also, earlier this year business travel was off much more than leisure travel. So it was no suprise that occupancy rates didn't decline as far during the Summer as earlier in the year. However, after Labor Day, business travel becomes far more important for the hotel industry than leisure, and next week will be very important to see if business travel is recovering.

Fed: Household Net Worth Off $12.2 Trillion From Peak

by Calculated Risk on 9/17/2009 11:59:00 AM

The Fed released the Q2 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $12.2 Trillion from the peak in 2007. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

According to the Fed, household net worth increased in Q2 mostly from increases in stock holdings - although the value of household real estate increased slightly too.

Note that this ratio was relatively stable for almost 50 years, and then ... bubbles! This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 43% from the all time low last quarter of 41.9%. The increase was due to a slight increase in the value of household real estate and a decline in mortgage debt - and also a decline in overall GDP (so the ratio increases).

When prices were increasing dramatically, the percent homeowner equity was stable or declining because homeowners were extracting equity from their homes. Now, with prices falling, the percent homeowner equity has been cliff diving.

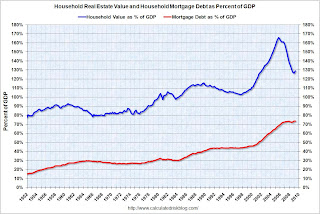

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 43% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased slightly in Q2 - because of a slight increase in real estate values, and a decline in GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased slightly in Q2 - because of a slight increase in real estate values, and a decline in GDP.

Mortgage debt declined, but was flat as a percent of GDP in Q2 - since GDP declined too.

After a bubble, the value of assets decline, but most of the debt remains.

Philly Fed Index Increases in September

by Calculated Risk on 9/17/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region’s manufacturing sector is showing signs of growth, according to firms polled for this month’s Business Outlook Survey. ...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 4.2 in August to 14.1 this month. This is the highest reading since June 2007 and the second consecutive positive reading. The percentage of firms reporting increases in activity (33 percent)exceeded the percentage reporting decreases (19 percent). Other broad indicators

also suggested some growth this month. The current new orders index also remained positive for the second consecutive month, although it edged one point lower, to 3.3. The current shipments index increased eight points and has now increased 18 points over the last two months. Firms reported declines in inventories this month: The current inventory index declined 18 points, from 0.3 in August to ‐18.1. Indicators for unfilled orders and delivery times remained negative, suggesting continued weakness.

Labor market conditions remain weak, despite signs of improvement in overall activity. The current employment index decreased slightly, from ‐12.9 to ‐14.3. Overall declines, however, are still not as widespread as in the first six months of this year. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for two months now, after being negative for 19 of the previous 20 months. Employment is still weak.

Housing Starts in August: Moving Sideways

by Calculated Risk on 9/17/2009 08:31:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 598 thousand (SAAR) in August, up 1.5% from the revised July rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 479 thousand (SAAR) in August, down 3.0% from the revised July rate, but still 34 percent above the record low in January and February (357 thousand).

Permits for single-family units were 462 thousand in August, suggesting single-family starts will be steady in September.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building Permits:Note that single-family completions of 489 thousand are at about the same level as single-family starts (479 thousand). This suggests residential construction employment has stabilized.

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 579,000. This is 2.7 percent (±1.2%) above the revised July rate of 564,000, but is 32.4 percent (±1.3%) below the August 2008 estimate of 857,000.

Single-family authorizations in August were at a rate of 462,000; this is 0.2 percent (±1.1%) below the revised July figure of 463,000.

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 598,000. This is 1.5 percent (±7.9%) above the revised July estimate of 589,000, but is 29.6 percent (±6.0%) below the August 2008 rate of 849,000.

Single-family housing starts in August were at a rate of 479,000; this is 3.0 percent (±5.7%) below the revised July figure of 494,000.

Housing Completions:

Privately-owned housing completions in August were at a seasonally adjusted annual rate of 760,000. This is 5.5 percent (±14.0%) below the revised July estimate of 804,000 and is 25.3 percent (±9.6%) below the August 2008 rate of 1,018,000.

Single-family housing completions in August were at a rate of 489,000; this is 1.6 percent (±12.7%)* below the revised July figure of 497,000.

It now appears that single family starts bottomed in January. However, as expected, it appears starts are moving sideways - and will probably stay near this level until the excess existing home inventory is reduced.

Weekly Unemployment Claims: Stuck at High Level

by Calculated Risk on 9/17/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims decreased to 545,000:

In the week ending Sept. 12, the advance figure for seasonally adjusted initial claims was 545,000, a decrease of 12,000 from the previous week's revised figure of 557,000. The 4-week moving average was 563,000, a decrease of 8,750 from the previous week's revised average of 571,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Sept. 5 was 6,230,000, an increase of 129,000 from the preceding week's revised level of 6,101,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 8,750 to 563,000, and is now 95,750 below the peak in April.

It appears that initial weekly claims have peaked for this cycle. However it seems that weekly claims are stuck at a very high level; weekly claims have been in the high 500 thousands for almost 3 months. This indicates continuing weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

Wednesday, September 16, 2009

More on Housing Tax Credit

by Calculated Risk on 9/16/2009 09:09:00 PM

From Bloomberg: Homebuyer Tax-Credit Extension Gains Lawmaker Support

An extension of the $8,000 U.S. homebuyer tax credit is gaining support in the Senate as bill sponsor John Isakson said he is rallying lawmakers to continue a program that helped boost home sales by more than 1 million.This is terrible policy, and hopefully the bill will be scuttled.

“I’m working the floor now to make everyone aware that the $8,000 credit sunsets on Nov. 30,” Isakson, a Georgia Republican, said in an interview today. The former real estate executive says he is “talking to everybody and anybody.”

Meanwhile the usual suspects are lining up to support the bill:

Realtors, bankers and homebuilders have joined in the push, starting a campaign that encourages Congress to extend the program for one year ...What is wrong with Connecticut?

White House spokesman Robert Gibbs told reporters today that President Barack Obama’s economic team is looking at the tax credit and “evaluating the impact” on new home sales.

“Through that evaluation we’ll come to something to give the president a recommendation,” Gibbs said.

...

The bill has at least 15 co-sponsors including Senate Banking Committee Chairman Christopher Dodd, a Connecticut Democrat, and senators Patty Murray, a Washington Democrat, and Joe Lieberman, a Connecticut independent.

Jobs, Jobs, Jobs

by Calculated Risk on 9/16/2009 05:25:00 PM

From the UCLA News today:

Sluggish overall growth is predicted [in a report titled "The Long Goodbye," by UCLA Anderson Forecast], as the [national] unemployment rate will be above 10 percent well into next year.And in the UK from The Times: Record one in five young people out of work

The number of young people out of work hit a record 947,000 in July as total unemployment in Britain hit 2.47 million.And from the NY Times: High Jobless Rates Could Last Years, O.E.C.D. Warns

Official data today showed that the number of jobless 16 to 24-year-olds jumped by nearly 60,000 in the three months to July to the highest level since 1992, when records began.

That figure translates to a record 19.7 per cent - also the highest since records began - meaning that one in five people in that age bracket is looking for work.

...

Total unemployment hit a 13-year high of 2.47 million as more than 210,000 people lost their jobs, sending the jobless rate back to 1996 levels of 7.9 per cent.

Unless government programs for the unemployed are refined, there is a danger that high jobless rates will persist beyond 2010 in advanced economies, the Organization for Economic Cooperation and Development warned on Wednesday.In the U.S., Rep. Jim McDermott, D-Wash and Sen. Jack Reed, D-R.I. have offered bills in the House and Senate to extend unemployment benefits again. However this proposed extension would only be for any additional 13 weeks for people in high-unemployment states, and many workers will exhaust those claims early in the new year.

“A recovery may be in sight,” the group said in its annual employment outlook, referring to economic output. “But the short-term employment outlook is grim.”

The international organization said that unemployment among its 30 member nations would rise to nearly 10 percent by the end of 2010, above its previous post-1970 peak of 7.5 percent during the second quarter of 1993.

I expect to see a double digit unemployment rate within the next few months, and with below trend GDP growth, I expect double digit unemployment rates through most of 2010.

Report: Fed Reviews Banks CRE Exposure

by Calculated Risk on 9/16/2009 02:41:00 PM

Better late than never ...

From Steve Liesman at CNBC: Fed Reviewing Banks' Commercial Real Estate Exposure (ht Bill)

The Federal Reserve is involved a broad review of commercial real estate exposures at the nation's largest regional banks, which Fed sources say is both the result of concern in that area but part of the "new normal" for how they will be supervising banks.Clearly the Fed has room for improvement. A review of bank failures (see: Federal Reserve Oversight and the Failure of Riverside Bank of the Gulf Coast) shows that the Fed recognized problems of excessive concentration and risk taking as early as 2003 - and the Fed did nothing.

...

People familiar with the examinations say the fed is "getting granular" looking, for example, at the differences in banks' concentration of construction loans vs. multifamily vs. motels and retail.

I think the Fed needs to explain how the new approach would have caught the problems at Riverside (as an example) in 2004 or so. Hopefully that is the point of this "new normal".

NAHB: Builder Confidence increases Slightly in September

by Calculated Risk on 9/16/2009 01:00:00 PM

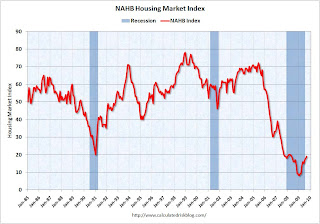

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 19 in September from 18 in August. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the September release for the HMI compared to the July data for starts and sales.

This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the September release for the HMI compared to the July data for starts and sales.

This shows that the HMI, single family starts and new home sales mostly move in the same direction - although there is plenty of noise month-to-month.

NOTE: For purposes of determining if starts are above or below sales, you have to use the quarterly data by intent. You can't compare the monthly total single family starts directly to new home sales, because single family starts include several categories not included in sales (like owner built units and high rise condos).

Press release from the NAHB (added): Builder Confidence Edges Up Again In September

Builder confidence in the market for newly built, single-family homes edged higher for a third consecutive month in September, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI rose one point to 19 this month, its highest level since May of 2008.

“Builders are seeing some improvement in buyer demand as a result of the first-time home buyer tax credit, and low mortgage rates and strong housing affordability have also helped to revive some optimism,” noted Joe Robson, chairman of the National Association of Home Builders (NAHB) and a home builder from Tulsa, Okla. “However, the window is now basically closed for being able to start a new home that can be completed in time for buyers to take advantage of the tax credit before it expires at the end of November, and builders are concerned about what will keep the market moving once the credit is gone. ....”

“Today’s report indicates that builders are starting to see some glimmers of light at the end of the tunnel in terms of improving sales activity,” said NAHB Chief Economist David Crowe. “However, the fact that the HMI component gauging sales expectations for the next six months slipped backward this month is a sign of their awareness that this is a very fragile recovery period and several major hurdles remain that could stifle the positive momentum. Those hurdles include the impending expiration of the $8,000 tax credit as well as the critical lack of credit for housing production loans and continuing problems with low appraisals that are sinking one quarter of all new-home sales. These concerns need to be addressed if we are to embark on a sustained housing recovery that will help bolster economic growth.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

Two out of three of the HMI’s component indexes recorded gains in September. The index gauging current sales conditions rose two points to 18, while the index gauging traffic of prospective buyers rose one point, to 17. Meanwhile, the index gauging sales expectations for the next six months declined one point, to 29.

All four regions posted gains in their HMI readings for September. The biggest improvement was registered in the Midwest, where a three-point gain brought its HMI to 19, the highest level since July of 2007. The Northeast posted a two-point gain to 24, the South posted a two-point gain to 19, and the West posted a one-point gain to 18, respectively.

emphasis added