by Calculated Risk on 9/12/2009 05:59:00 PM

Saturday, September 12, 2009

Failed Banks and the Deposit Insurance Fund

As a companion to the September 11 Problem Bank List (unofficial), below is a list of failed banks since Jan 2007.

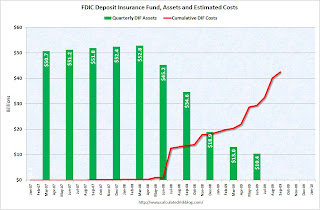

The recently released FDIC Q2 Quarterly Banking Profile showed that the Deposit Insurance Fund (DIF) balance had fallen to $10.4 billion or 0.22% of insured deposits as of June 30th. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The cumulative estimated losses for the DIF, since early 2007, are now over $42.5 billion.

Regulators closed three more banks on Friday, and that brings the total FDIC insured bank failures to 92 in 2009. At the recent pace, regulators will probably close around 150 banks this year - the most since 1992.

Failed Bank List

Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

Click here for a full screen version.

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

OECD: Global Recession Over

by Calculated Risk on 9/12/2009 03:48:00 PM

Just thought everyone would want to know ...

From The Independent: OECD calls an end to the global recession

The global downturn was effectively declared over yesterday, with the Organisation for Economic Co-operation and Development (OECD) revealing that "clear signs of recovery are now visible" in all seven of the leading Western economies, as well as in each of the key "Bric" nations.From the OECD: Composite Leading Indicators point to broad economic recovery

The OECD's composite leading indicators suggest that activity is now improving in all of the world's most significant 11 economies – the leading seven, consisting of the US, UK, Germany, Italy, France, Canada and Japan, and the Bric nations of Brazil, Russia, India and China – and in almost every case at a faster pace than previously.

OECD composite leading indicators (CLIs) for July 2009 show stronger signs of recovery in most of the OECD economies. Clear signals of recovery are now visible in all major seven economies, in particular in France and Italy, as well as in China, India and Russia. The signs from Brazil, where a trough is emerging, are also more encouraging than in last month’s assessment.Although there is clear improvement in many countries, the recovery will probably be very choppy and sluggish. And the OECD agrees that unemployment will continue to rise into 2010:

Despite early signs that an economic recovery may be in sight, unemployment is likely to continue rising into 2010.

Jim the Realtor: On the REO Trail

by Calculated Risk on 9/12/2009 11:49:00 AM

REO activity is starting to pickup again, and Jim breaks the news to a tenant:

Distressed Sales: Sacramento as Example

by Calculated Risk on 9/12/2009 08:38:00 AM

Just using Sacramento as an example ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (normal resales), and distressed sales (Short sales and REO sales). Here is the August data.

They started breaking out REO sales last year, but this is only the third monthly report with short sales. Almost two thirds of all resales (single family homes and condos) were distressed sales in August.

Total sales in August were off 10% compared to August 2008; the third month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.7%) or FHA loans (26.9%), suggesting most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Friday, September 11, 2009

Problem Bank List (Unofficial) Sept 11, 2009

by Calculated Risk on 9/11/2009 09:43:00 PM

This is an unofficial list of Problem Banks.

Note: Bank failures today, Corus Bank, N.A., Chicago IL, Brickwell Community Bank, Woodbury, MN, and Venture Bank, Lacey, WA, were on this list.

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by 3 institutions to 424; however, assets jumped by $18.8 billion to $286.6 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

We added seven institutions and removed four institutions from last week’s list. Most prominent among the additions are United Commercial Bank (ticker UCBH), San Francisco, CA with assets of $12.8 billion, La Jolla Bank, FSB, La Jolla, CA with assets of $3.9 billion, and Bank of Granite (ticker GRAN), Granite Falls, NC, with assets of $1.1 billion, which has the dubious distinction of being once praised by Warren Buffet as one of the best run banks in the country (http://www.charlotteobserver.com/breaking/story/927809.html).

The removals include three failures on September 4th and one action termination by the OCC. The other change to the list is a Prompt Corrective Action being issued by the FDIC against Rainier Pacific Bank, Tacoma, WA, which is reportedly already operating under a Cease & Desist Order.

Starting with its release of actions during July 2009, the FDIC is disclosing its notice of charges against institutions that are contesting enforcement actions. In an American Banker article some industry observers thought this new disclosure is very harsh as it includes specific details on why the agency is seeking an enforcement order. One banker quoted in the article thought the FDIC started disclosing the charges to limit dissent -- "This is just another way of putting additional pressure on community banks to consent to these orders, even if they think it is not in the best interest of the bank," said Jeffrey C.. Gerrish, a partner at the law firm Gerrish McCreary Smith PC in Memphis. "The inflammatory nature of these charges could certainly do damage to a community bank." The FDIC said it is only trying to make the “information accessible” and that most information becomes public if there is a hearing. While we applaud the FDIC in providing increased transparency around its actions, we would like the FDIC to improve the timeliness of their disclosures regarding new enforcement actions. Generally, the other agencies will release their actions as they occur while the FDIC only discloses its actions once a month on a lagged basis. For example, the FDIC will disclose its actions for August at the end of September.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #92: Venture Bank, Lacy, Washington

by Calculated Risk on 9/11/2009 09:11:00 PM

Rest easy now Venture Bank

Feds have made you safe.

by Soylent Green is People

Note: Mostly Haiku will be by SGIP, but here is an extra ...

But very little gained, now

the whole bank transfered

by seajane

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Venture Bank, Lacy, Washington

Venture Bank, Lacy, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....

As of July 28, 2009, Venture Bank had total assets of $970 million and total deposits of approximately $903 million. ...

The FDIC and First-Citizens Bank & Trust Company entered into a loss-share transaction on approximately $715 million of Venture Bank's assets....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $298 million. .... Venture Bank is the 92nd FDIC-insured institution to fail in the nation this year, and the third in Washington. The last FDIC-insured institution closed in the state was Westsound Bank, Bremerton, on May 8, 2009.

Bank Failure #91: Brickwell Community Bank, Woodbury, Minnesota

by Calculated Risk on 9/11/2009 07:27:00 PM

Failed bank numbers soar like crane

May top Mount Fuji

by Soylent Green is People

From the FDIC:

Brickwell Community Bank, Woodbury, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with CorTrust Bank, N.A., Mitchell, South Dakota, to assume all of the deposits of Brickwell Community Bank.

...

As of July, 24, 2009, Brickwell Community Bank had total assets of $72 million and total deposits of approximately $63 million. CorTrust Bank will pay the FDIC a premium of 0.10 percent to assume all of the deposits of Brickwell Community Bank. In addition to assuming all of the deposits of the failed bank, CorTrust Bank agreed to purchase essentially all of the assets.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22 million. ... Brickwell Community Bank is the 91st FDIC-insured institution to fail in the nation this year, and the third in Minnesota. The last FDIC-insured institution closed in the state was Mainstreet Bank, Forest Lake, on August 28, 2009.

Bank Failure #90: Corus Bank, National Association, Chicago, Illinois

by Calculated Risk on 9/11/2009 07:19:00 PM

Finally, the King is dead

Long live Corus Bank!

by Soylent Green is People

Pigs get fat, hogs get slaughtered

Corus is sausage

by Anon (two since we've waited so long)

From the FDIC:

Corus Bank, National Association, Chicago, Illinois, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with MB Financial Bank, National Association, Chicago, Illinois, to assume all of the deposits of Corus Bank, N.A.

...

As of June 30, 2009, Corus Bank had total assets of $7 billion and total deposits of approximately $7 billion. MB Financial Bank will pay the FDIC a premium of 0.2 percent to assume all of the deposits of Corus Bank. In addition to assuming all of the deposits of the failed bank, MB Financial Bank agreed to purchase approximately $3 billion of the assets, comprised mainly of cash and marketable securities. The FDIC will retain the remaining assets for later disposition. The FDIC plans to sell substantially all of the remaining assets of Corus Bank in the next 30 days in a private placement transaction.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.7 billion. MB Financial Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Corus Bank is the 90th FDIC-insured institution to fail in the nation this year, and the sixteenth in Illinois. The last FDIC-insured institution closed in the state was Platinum Community Bank, Rolling Meadows, on September 4, 2009.

Report: Down Goes Corus!

by Calculated Risk on 9/11/2009 05:14:00 PM

Click on photo for larger image in new window.

Click on photo for larger image in new window.

Reader Eric wearing the proper attire at Corus Bank today ...

From Crain's ChicagoBusiness: MB Financial to take over Corus Bank branches

MB Financial Inc. will assume the branches and deposits of Corus Bank ... will be seized at the end of business Friday by federal regulators, according to a person familiar with the matter.No word from the FDIC yet ...

Most of the assets of Corus, made up primarily of delinquent condo loans spread throughout the U.S., will be sold by the Federal Deposit Insurance Corp. in the next few weeks, according to this person. Several private-equity firms and real estate outfits are lined up to bid for those assets, according to numerous published reports.

Market and AIG Probe

by Calculated Risk on 9/11/2009 04:09:00 PM

While we wait for the FDIC ...

From Grant McCool at Reuters: U.S. probes AIG executives-law enforcement source

U.S. investigators are probing the former head of American International Group Inc's Financial Products unit, Joseph Cassano, and other executives for securities fraud, a law enforcement source familiar with the case said on Friday.And, coincidentally, the S&P 500 is at about the same level as on 9/11 - eight years ago.

The source said that a grand jury may be impaneled this month in New York to consider potential charges that executives failed to disclose the value of toxic assets to the bailed-out insurance company's outside accountants and shareholders.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 54% from the bottom (366 points), and still off 33% from the peak (522 points below the max).

The S&P 500 first hit this level in February 1998; over 11 years ago.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.