by Calculated Risk on 9/06/2009 11:00:00 AM

Sunday, September 06, 2009

A Surge in Homeless Children

In the comments yesterday we were comparing the "feel" of the current recession compared to the early '80s. Back then it seemed there were many more homeless people, and camps of "Reaganvilles" (an echo of the Hoovervilles during Depression) were sprouting up around the country. I commented that it seems there are far fewer homeless people now, so this story caught my eye ...

From the NY Times: Surge in Homeless Children Strains School Districts

While current national data are not available, the number of schoolchildren in homeless families appears to have risen by 75 percent to 100 percent in many districts over the last two years, according to Barbara Duffield, policy director of the National Association for the Education of Homeless Children and Youth, an advocacy group.

There were 679,000 homeless students reported in 2006-7, a total that surpassed one million by last spring, Ms. Duffield said.

With schools just returning to session, initial reports point to further rises. In San Antonio, for example, the district has enrolled 1,000 homeless students in the first two weeks of school, twice as many as at the same point last year.

G-20 Agrees on Increasing Capital Requirements

by Calculated Risk on 9/06/2009 08:00:00 AM

From the WSJ: G-20 Agree to Boost Banks' Capital Requirements, Set Rules on Bonuses

The agreement on bankers' pay calls for a large portion of bonuses to be clawed back if bank performance subsequently deteriorates. It also calls for the deferral of a share of bonuses. ... More detailed proposals will be worked on in coming weeks by the Financial Stability Board ... Officials want the new rules in place before bonuses are paid out at year-end.And on capital requirements:

... the officials [agreed] that more needs to be done to boost banks' capital cushions "once recovery is assured." ...Here is the Communiqué - UK, 5 September 2009 (PDF 13KB)

In a victory for Mr. Geithner ... there was also agreement that the leverage of international banks – the ratio of their total equity to their total assets -- should be capped. ... Officials fear that if the capital is not raised, undercapitalized 'zombie banks' would be unable to lend and would block economic recovery.

And Declaration on further steps to strengthen the financial system, 5 September 2009 (PDF 15.5KB)

Saturday, September 05, 2009

Massachusetts: Workers Exhausting Unemployment Benefits

by Calculated Risk on 9/05/2009 10:38:00 PM

This is a story that will keep building as workers exhaust their extended unemployment benefits ...

From the Boston Globe: State jobless pay to end for many

Massachusetts is experiencing its first wave of jobless workers to exhaust unemployment benefits after nearly two years of rising unemployment, state labor officials said.And on extending the unemployment benefits for another 13 weeks, from the SF Chronicle: 4 stimulus breaks due to run out at year end

The state this week sent out letters notifying about 2,500 jobless workers that they had or would soon receive their last unemployment checks, having used up state and federal extensions that provided up to 79 weeks, or about 18 months, of benefits. The state expects about 21,000 jobless workers to run out of unemployment benefits by Thanksgiving.

The stimulus act increased the weekly unemployment benefit by $25 per week, allowed people to deduct up to $2,400 in benefits on their federal tax return and extended the federal government's extended benefits program, which provides additional compensation to people who have used up their regular state benefits.It is very likely that this bill will pass soon (the Senate bill is S. 1647).

In California, a person who exhausted 26 weeks of state benefits could get up to 20 more weeks under the first federal extension, then up to 13 weeks under a second extension and up to 20 weeks more under a third extension. The first and second extensions were supposed to expire in the spring but the stimulus extended them until Dec. 31. The stimulus also provided 100 percent federal funding for the third extension.

All these federal benefits sunset after Dec. 31. A person who was already receiving extended benefits on Jan. 1 could finish that round of benefits, but not start the next extension. A person who was still receiving their regular state benefits on Jan. 1 would get no extended benefits.

HR3404, sponsored by Rep. Jim McDermott, D-Wash., would extend all of the expiring provisions through next year. It also would create a fourth extension of up to 13 weeks for people in high-unemployment states.

When Will the Unemployment Rate hit 10%?

by Calculated Risk on 9/05/2009 07:25:00 PM

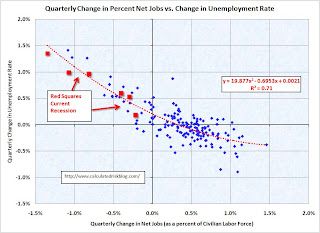

Although the unemployment rate is noisy month-to-month, we can use the graph and formula from Unemployment and Net Jobs to guess when the unemployment rate will reach 10%.

This graph from that previous posts shows the quarterly change in net jobs (on the x-axis) as a percentage of the civilian workforce, and the change in the unemployment rate on the y-axis.

The data is for the last 40 years: 1969 through Q2 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Red squares are for 2008, and for the first two quarters of 2009.

The U-3 headline unemployment rate for August was reported at 9.7% (this is actually rounded up from 9.66%).

If net job losses average over 200 thousand per month, the unemployment rate will probably hit 10% in October.

If net job losses average 100 to 200 thousand per month, the unemployment rate will probably reach 10% in November.

With 50 thousand net job losses per month, it will probably take until December.

And if the economy averages zero net job losses per month, the unemployment rate will probably hit 10% in January or so.

These are just estimates - the series is noisy month-to-month - and it is possible the unemployment rate could hit 10% this month.

As I noted previously, this graph also suggests the economy needs to be adding about 0.33 percent of the civilian workforce per quarter to keep the unemployment rate from rising. That is about 170 thousand net jobs per month. Note: The civilian workforce in August was 154.6 million. 0.33% of 154.6 million is 510 thousand jobs per quarter or 170 thousand per month.

Note that the trend line is a 2nd order polynomial (equation on graph). When the economy starts to add jobs, more people start looking for work - and the relationship between net jobs and unemployment rate is not linear.

Housing Starts and the Unemployment Rate

by Calculated Risk on 9/05/2009 01:49:00 PM

Here is an update. See the post last month for much more discussion ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows housing starts (both total and single unit) and unemployment (inverted).

You can see both the correlaton and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring 2010.

Platinum and Taylor, Bean & Whitaker

by Calculated Risk on 9/05/2009 10:45:00 AM

From the WSJ: Failed Illinois Bank Has Ties to Fallen Mortgage Executive

The Illinois connection to Mr. Farkas' now-bankrupt mortgage banking empire of Taylor, Bean & Whitaker Mortgage Corp. was Rolling Meadows, Ill.-based Platinum Community Bank, which went down Friday with assets of $345.6 million and deposits of $305 million.Nice.

...

After acquiring Platinum, located in Chicago's northwest suburbs, Mr. Farkas sent an email to his staff in October 2008 saying the purchase was "without a doubt the MOST IMPORTANT acquisition we have ever made and offers opportunity for (Taylor Bean) to grow and prosper." Eventually, he said, Platinum would help "fund new production thereby eliminating funding challenges in the future. And it will lessen our reliance on other banks that have hampered our operations in the past." He also wrote that it was "imperative" for employees to set up personal bank accounts at Platinum.

NY Times: One-sixth of Construction Loans in Trouble

by Calculated Risk on 9/05/2009 07:59:00 AM

From Floyd Norris at the NY Times: Construction Loans Falter, a Bad Omen for Banks

Reports filed by banks with the Federal Deposit Insurance Corporation indicate that at the end of June about one-sixth of all construction loans were in trouble. With more than half a trillion dollars in such loans outstanding, that represents a source of major losses for banks.See the great charts in the article.

...

It is in commercial real estate construction — be it stores or office buildings — that the pain seems likely to rise. At the end of June, $291 billion in such loans was outstanding, down only a few billion from the peak reached earlier this year.

“On the commercial side,” said Matthew Anderson, a partner in Foresight Analytics, a research firm based in Oakland, Calif., “I think we are fairly early in the down cycle.”

The article makes the point that the local and regional banks were unable to compete with the larger banks for credit card loans (and residential mortgages too). So the smaller banks ended up overweighted in Construction & Development (C&D) and CRE loans. That isn't look good now, and most of the bank failures during the next couple of years will probably be because of CRE and C&D defaults.

I was looking back at some old posts, and I started writing about how CRE typically follows residential real estate back in 2006, and also about the excessive C&D and CRE loans concentrations of local and regional banks. Here is an excerpt from a post in March 2007:

The housing crisis is now front page news, but there is little discussion about U.S. bank exposure to CRE loans. If a CRE slump follows the residential real estate bust (the typical historical pattern), then the U.S. commercial banks might have a serious problem.The pattern is always the same: residential leads, CRE follows. And some lenders (and developers) never learn.

Friday, September 04, 2009

SEC Chairman Madoff? Corus and More

by Calculated Risk on 9/04/2009 09:55:00 PM

A few posts earlier today:

From the SEC: Investigation of Failure of the SEC to Uncover Bernard Madoff’s Ponzi Scheme - Public Version - :

The other NERO examiner noted that “[a]ll throughout the examination, Bernard Madoff would drop the names of high-up people in the SEC.” Madoff told them that Christopher Cox was going to be the next Chairman of the SEC a few weeks prior to Cox being officially named. He also told them that Madoff himself “was on the short list” to be the next Chairman of the SEC.Note: first posted at the WSJ Washington Wire.

emphasis added

The Corus auditor resigned. From a SEC 8-K filing today (ht jb):

On August 31, 2009, Corus Bankshares, Inc. (the “Company”), received notification from Ernst & Young, LLP (“E&Y”) of their resignation as the Company’s independent registered public accounting firm.There was no disagreement with the auditor, but I guess E&Y isn't sticking around for the FDIC party.

And a Cease & Desist for Granite Bank in North Carolina, from The Charlotte Observer: Bank of Granite under “cease and desist” order (ht Surferdude808)

Regulators have placed Bank of Granite Corp. under a so-called “cease and desist” order, the bank announced this afternoon.But what makes this one a little unusual:

Known for being conservative and thrifty, it was once praised by Warren Buffett as one of the best-run banks in the country.And here is a puzzle for you all (via Surferdude808). On the FDIC cert site, Platinum Community Bank is listed as having $148 million in assets. However, when the bank was seized today, the FDIC noted:

Platinum Community Bank, as of August 29, 2009, had total assets of $345.6 million and total deposits of $305.0 million.Did this bank really more than double their assets in 60 days? (Update: probably is related to the bank holding company)

Bank Failure #89: First State Bank, Flagstaff, AZ

by Calculated Risk on 9/04/2009 09:13:00 PM

First State Bank falls forcefully

Feds funds are famished.

by Soylent Green is People

From the FDIC: Sunwest Bank, Tustin, California, Assumes All of the Deposits of First State Bank, Flagstaff, Arizona

First State Bank, Flagstaff, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Sunwest Bank, Tustin, California, to assume all of the deposits of First State Bank.Five more today ... so far.

...

As of July 24, 2009, First State Bank had total assets of $105 million and total deposits of approximately $95 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $47 million. .... First State Bank is the 89th FDIC-insured institution to fail in the nation this year, and the third in Arizona. The last FDIC-insured institution closed in the state was Union Bank, National Association, Gilbert, on August 14, 2009.

Bank Failure #88: Community Bank, Rolling Meadows, Illinois

by Calculated Risk on 9/04/2009 08:08:00 PM

Platinum Bank now fools gold

Shut by tin star Fed

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of Insured Deposits of Platinum Community Bank, Rolling Meadows, Illinois

The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of Platinum Community Bank, Rolling Meadows, Illinois. The bank was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver.No one wanted this one. That makes four today.

The FDIC will mail customers checks for their insured funds on Tuesday, September 8. Platinum Community Bank, as of August 29, 2009, had total assets of $345.6 million and total deposits of $305.0 million.

...

Platinum Community Bank is the 88th FDIC-insured institution to fail this year and the 15th in Illinois. The last bank to be closed in the state was Inbank, Oak Forest, earlier today. The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $114.3 million.