by Calculated Risk on 8/28/2009 01:50:00 PM

Friday, August 28, 2009

Problem Bank List (Unofficial) Aug 28, 2009

This is an unofficial list of Problem Banks.

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay (the FDIC July Enforcement Actions were released today). The Fed and OTC data is more timely, and the OCC a little lagged. Credit: surferdude808.

Changes and comments from surferdude808:

The “unofficial Problem Bank list” underwent substantial changes since last week because of failures; new additions, especially from the OCC and FDIC as they released a number of actions for July; and an identification of unassisted mergers during Q2.See description below table for Class and Cert (and a link to FDIC ID system).

This week there are 412 institutions on the “unofficial Problem Bank list” with assets of $252.2 billion compared with 391 institutions with assets of $256.5 billion last week. The failure of Guaranty Bank with assets of $14.4 billion was responsible for the great majority of the asset decline. Another 10 institutions with assets of $2.5 billion were removed because of failure or unassisted merger and there was one action that was terminated.

Additions during the week are 32 institutions with assets of $15.7 billion. Most notable of these additions are the ShoreBank, Chicago, IL with assets of $2.7 billion and three subsidiaries of First National of Nebraska, Inc. (ticker symbol FINN) with assets of $4.5 billion.

Since the FDIC released the latest quarterly data, we were able to update assets for all institutions as of Q2. For the 381 institutions that were on the “unofficial Problem Bank list” at Q1 and Q2, assets declined by $3.3 billion.

With the FDIC Q2 release, we can see how well the “unofficial Problem Bank list” compares with the FDIC’s official Problem Bank list. The FDIC list includes 416 institutions with assets of $299.8 billion at Q2 while for a comparable period the “unofficial Problem Bank list” had 392 institutions with assets of $280 billion; thus, the unofficial list is a reasonable approximation with an acceptable tracking error.

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Unemployment and Net Jobs

by Calculated Risk on 8/28/2009 10:23:00 AM

Next Friday the BLS employment report for August will be released.

Last month, when the unemployment rate dipped slightly to 9.4% from 9.5% in June, there were several articles like this one from the LA Times: Unemployment rate decline may indicate the recession has hit bottom.

Earlier I pointed out that the dip in unemployment was just monthly noise: Jobs and the Unemployment Rate

FAQ: How can the unemployment rate fall if the economy is losing net jobs, especially since the population is growing?Here are a couple of scatter graphs to illustrate this point ...

This data comes from two separate surveys. The unemployment Rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 400,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

...

[T]he jobs and unemployment rate come from two different surveys and are different measurements (one for positions, the other for people). Some months the numbers may not seem to make sense (lost jobs and falling unemployment rate), but over time the numbers will work out.

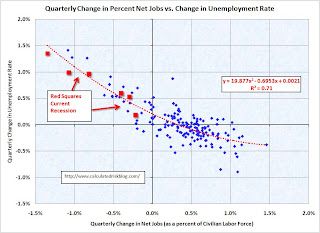

The first graph shows the monthly change in net jobs (on the x-axis) as a percentage of the civilian workforce, and the change in the unemployment rate on the y-axis.

The data is for the last 40 years: 1969 through July 2009.

Click on graph for large image.

Click on graph for large image.Obviously there is a correlation - the more jobs added (further right on the x-axis), the more the unemployment rate declines (y-axis). And generally the more jobs lost, the more the unemployment rate increases.

But the graph sure is noisy on a monthly basis.

If the economy added 0.2% net jobs in one month (as a percent of the civilian workforce, or about 300 thousand net jobs currently), the unemployment rate could increase 0.2% or decrease 0.4% - and still be within the normal scatter.

The second graph covers the same period but on a quarterly basis:

Now we see a much sharper correlation.

Now we see a much sharper correlation.The Red squares are the for 2008, and the first two quarters of 2009. This recession fits the normal pattern.

If the economy loses about 200 thousand jobs per month in August and September, this relationship suggests the unemployment rate will probably be close to 10% by the end of September.

This also suggests the economy needs to be adding about 0.33 percent of the civilian workforce per quarter to keep the unemployment rate from rising. That is about 170 thousand net jobs per month.

Note that the trend line is a 2nd order polynomial (equation on graph). When the economy starts to add jobs, more people start looking for work - and the relationship between net jobs and unemployment rate is not linear.

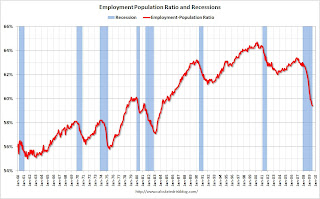

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

This measure fell slightly in July to 59.4%, the lowest level since the early '80s. However once the economy starts adding jobs, more people will be looking for work, and the employment-population ratio will start to increase. This means the stronger the economy, the more net jobs required each quarter to lower the unemployment rate by the same amount (as shown on the 2nd graph above).

The bottom line is the unemployment rate will still increase, and we will probably see 10% later this year.

July PCE and Saving Rate

by Calculated Risk on 8/28/2009 08:30:00 AM

From the BEA: Personal Income and Outlays, July 2009

Personal income increased $3.8 billion, or less than 0.1 percent, and disposable personal income (DPI) decreased $4.6 billion, or less than 0.1 percent, in July, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $25.0 billion, or 0.2 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in July, compared with an increase of 0.1 percent in June.

...

Personal saving -- DPI less personal outlays – was $458.5 billion in July, compared with $486.8 billion in June. Personal saving as a percentage of disposable personal income was 4.2 percent in July, compared with 4.5 percent in June.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the July Personal Income report. The saving rate was 4.2% in July.

Households are saving substantially more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise.

The following graph shows real Personal Consumption Expenditures (PCE) through July (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The July numbers suggest PCE will grow at a 1.3% (annualized rate) in Q3.

Note that PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and was been relatively flat in Q1 and Q2 2009. Auto sales should gave a boost to PCE in Q3, but in general PCE will probably remain weak over the 2nd half of 2009 and into 2010 as households continue to repair their balance sheets.

Japan: Record Unemployment Rate

by Calculated Risk on 8/28/2009 12:16:00 AM

From MarketWatch: Japan reports record unemployment rate for July

Japan [reported] a record unemployment rate and the biggest decline in consumer prices in roughly 38 years.Japan's recession may be over, but I bet it doesn't feel like it to many workers.

Japan's Ministry of Internal Affairs and Communications said the country's unemployment rate rose to 5.7% in July from 5.4% in the previous month.

The unemployment rate was higher than the 5.5% expected by economists, according to Dow Jones Newswires, and is the highest on record since World War II.

...

Meanwhile Japan's average monthly income per household fell 2.4% in nominal terms in July, while consumption expenditures fell 4.5% nominally ...

Thursday, August 27, 2009

Recession hitting Farms

by Calculated Risk on 8/27/2009 10:26:00 PM

From the WSJ: Recession Finally Hits Down on the Farm (ht Bob_in_MA)

The Agriculture Department forecast Thursday that U.S. farm profits will fall 38% this year, indicating that the slump is taking hold in rural America. ... The Agriculture Department said it expects net farm income -- a widely followed measure of profitability -- to drop to $54 billion in 2009, down $33.2 billion from last year's estimated net farm income of $87.2 billion, which was nearly a record high.And from the Chicago Fed August AgLetter:

Farmland values for the second quarter of 2009 were 3 percent lower than a year ago in the Seventh Federal Reserve District. ... Almost 30 percent of the responding bankers expected farmland values to fall in the third quarter of 2009, whereas 71 percent expected stable farmland values.This will probably mean lower food prices, from the WSJ:

For most Americans, the chill in the farm belt is related to one of the few positives they see in this economy: slowing inflation. Prices farmers are receiving for everything from corn and wheat to hogs are down sharply from last year.

Kasriel: "The Rhyming of History – Bloomberg and the RFC?"

by Calculated Risk on 8/27/2009 06:01:00 PM

A little history from Paul Kasriel, Chief Economist at Northern Trust: The Rhyming of History – Bloomberg and the RFC?

On November 7, 2008, Bloomberg LP sued the Federal Reserve Board under terms of the Freedom of Information Act to obtain the names of borrowers of funds from the Federal Reserve as well as lists of the collateral posted by the borrowers. On August 25, 2009, a U.S. District judge ruled in favor of Bloomberg, ordering the Federal Reserve Board to turn over to Bloomberg the requested information within five days. At this writing, the Fed has yet to comply and has yet made a decision to appeal the ruling.CR Notes, from Bloomberg: The Fed has asked the Judge to stay the order until the U.S. Court of Appeals in New York can hear the case.

The Fed has been reluctant to reveal the names of its borrowers allegedly out of a concern that such a revelation could have an adverse competitive impact on the borrowers.Would we see another liquidity crisis because of concerns about the level of borrowing by certain banks from the Fed? I don't think so - but this is the concern. Doesn't everyone already suspect that Citi and BofA will be near the top of the list?

The reason I bring this up is that it is similar to a situation that arose in 1932 with the Reconstruction Finance Corporation (RFC). The RFC was established by an act of Congress on January 22, 1932, for the purpose of making loans to financial institutions, railroads and to extend credit for crop loans. The Treasury provided some capital to the RFC and the RFC was permitted to borrow from the Treasury. Initially, the RFC granted credit primarily to banks. These loans coincided with a reduction in bank failures and currency held outside the banks declined.

On July 21, 1932, the RFC was authorized to make loans for self-liquidating public works projects, and to states to provide relief and work relief to needy and unemployed people. This legislation also required that the RFC report to Congress, on a monthly basis, the identity of all new borrowers of RFC funds. On orders from the Speaker of the House of Representatives, commencing in August 1932, the names of banks borrowing from the RFC became public information. This publication of the names of banks borrowing from the RFC discouraged current borrowers from continuing their borrowing and prospective borrowers from commencing borrowings out of a fear that depositors would judge this borrowing as a sign of financial weakness. By November 1932, the outstanding amount of RFC loans to banks had decreased.

In mid February of 1933, a Detroit bank began having difficulties. The RFC was willing to lend to this bank, but because of a dispute between one of the Michigan senators and Henry Ford, a large depositor in the bank, the RFC loan was not allowed to be made. A bank panic started in Michigan as a result. This Michigan bank panic served as a catalyst for a nationwide bank panic.

The failure of the Detroit bank was not because the bank was reluctant to borrow from the RFC. But one can only speculate as to whether other banks in Michigan and nationwide were reluctant to borrow from the RFC because their names would have been published. And one can only speculate that if these other banks had willing to borrow from the RFC if a nationwide bank could have been averted.

Today, we have federal deposit insurance. Therefore, the probabilities and magnitude of depositor runs on banks are much reduced compared with 1933. Yet, we can see “runs” by stockholders and other creditors of banks if there is a suspicion of financial problems. If the Fed is required to publish the names of financial institutions to which it has extended credit and this publication induces financial institutions to refrain from borrowing from the Fed, one can only speculate if this would be the tinder for another liquidity conflagration in the coming months.

I suppose some second tier bank might have a problem if the data is disclosed.

Hotel RevPAR off 16.7 Percent

by Calculated Risk on 8/27/2009 02:13:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 22 August 2009

In year-over-year measurements, the industry’s occupancy fell 7.2 percent to end the week at 60.4 percent. Average daily rate dropped 10.2 percent to finish the week at US$95.70. Revenue per available room for the week decreased 16.7 percent to finish at US$57.84.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 7.3% from the same period in 2008.

The average daily rate is down 10.2%, and RevPAR is off 16.7% from the same week last year.

Comments: This is a multi-year slump. Although the occupancy rate was off 7.3 percent compared to last year, the occupancy rate is off over 11 percent compared to the same week in 2007.

The end of July through the beginning of August is usually the peak leisure travel period. So the peak occupancy rate for 2009 was probably a month ago at 67%. And that is far below normal.

Earlier this year business travel was off much more than leisure travel. So it was expected that the summer months would not be as weak as earlier in the year. September - after Labor Day (Sept 7th) - will be the real test for business travel, and for the hotel industry.

Report: Car Sales Slump 11% Below June Levels

by Calculated Risk on 8/27/2009 11:57:00 AM

From the Financial Times: ‘Cash-for-clunkers’ sales disappoint Detroit (ht James)

[S]igns are already emerging that overall sales will fall back sharply now that the incentives have expired.It now appears that sales in August were at about a 16 million SAAR (auto sales for August will be released next week).

...

[Edmunds.com] estimates that, based on visits to its websites, “purchase intent” is down 11 per cent from the average in June ...

excerpted with permission

This follows an 11.22 million SAAR in July. The Cash-for-clunkers program started on July 24th.

If sales in September are 11% below June - that would put sales at under 9 million SAAR - the lowest sales for this cycle, and perhaps at the lowest rate since the early '70s. Of course the program just ended, but it will be interesting to see how much Cash-for-Clunkers cannibalized future sales.

FDIC Q2 Banking Profile: 416 Problem Banks, $3.7 Billion Net Loss

by Calculated Risk on 8/27/2009 10:00:00 AM

The FDIC released the Q2 Quarterly Banking Profile today. The FDIC listed 416 banks with $299.8 billion in assets as “problem” banks in Q2, up from 305 banks with $220.0 billion in assets in Q1, and 252 and $159.4 billion in assets in Q4 2008.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 391 problem banks - and will probably increase this week. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

The 416 problem banks reported at the end of Q2 is the highest since 1993.

There has been some concern that the FDIC has been slow to add banks to the problem list - and a number of failed banks were apparently never on the official list. The second graph shows the assets of "problem" banks since 1990.

The second graph shows the assets of "problem" banks since 1990.

The assets of problem banks are the highest since 1993.

And the banking industry posted a net loss for the quarter:

Burdened by costs associated with rising levels of troubled loans and falling asset values, FDIC-insured commercial banks and savings institutions reported an aggregate net loss of $3.7 billion in the second quarter of 2009. Increased expenses for bad loans were chiefly responsible for the industry’s loss. Insured institutions added $66.9 billion in loan-loss provisions to their reserves during the quarter, an increase of $16.5 billion (32.8 percent) compared to the second quarter of 2008. Quarterly earnings were also adversely affected by writedowns of asset-backed commercial paper, and by higher assessments for deposit insurance.On the Deposit Insurance Fund:

On June 30, 2009, a special assessment was imposed on all insured banks and thrifts. For 8,106 institutions, with assets of $9.3 trillion, the special assessment was 5 basis points of each institution’s assets minus Tier 1 capital; 89 other institutions, with assets of $4.0 trillion, had their special assessment capped at 10 basis points of their second quarter assessment base.

The Deposit Insurance Fund (DIF) decreased by $2.6 billion (20.3 percent) during the second quarter to $10.4 billion (unaudited). Accrued assessment income from the regular and the special assessment increased the fund by $9.1 billion. Interest earned, combined with realized gains on securities and debt guarantee surcharges from the Temporary Liquidity Guarantee Program added $1.1 billion to the fund. Unrealized losses on available-for-sale securities combined with operating expenses reduced the fund by $1.3 billion.

The reduction in the DIF was primarily due to an $11.6 billion increase in loss provisions for bank failures. Twenty-four insured institutions with combined assets of $26.4 billion failed during the second quarter of 2009, the largest number of quarterly failures since the fourth quarter of 1992, when 42 insured institutions failed. For 2009 through the end of the second quarter, 45 insured institutions with combined assets of $35.9 billion failed at an estimated current cost to the DIF of $10.5 billion.

The DIF’s reserve ratio was 0.22 percent on June 30, 2009, down from 0.27 percent at March 31, 2009, and 1.01 percent one year ago. The June figure is the lowest reserve ratio for the combined bank and thrift insurance fund since March 31, 1993, when the reserve ratio was 0.06 percent.

Weekly Unemployment Claims: Still Very High

by Calculated Risk on 8/27/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims decreased to 570,000:

In the week ending Aug. 22, the advance figure for seasonally adjusted initial claims was 570,000, a decrease of 10,000 from the previous week's revised figure of 580,000. The 4-week moving average was 566,250, a decrease of 4,750 from the previous week's revised average of 571,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Aug. 15 was 6,133,000, a decrease of 119,000 from the preceding week's revised level of 6,252,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,750 to 566,250, and is now 92,500 below the peak in April. It appears that initial weekly claims have peaked for this cycle.

The number of initial weekly claims is still very high (at 570,000), indicating significant weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.