by Calculated Risk on 8/16/2009 10:40:00 PM

Sunday, August 16, 2009

Report: Guaranty Bank Bids Due Monday

The Financial Times is reporting that regulators have ask prospective buyers to submit bids for Guaranty Bank on Monday.

Guaranty Bank had $14.4 billion in assets at the end of Q1.

From Reuters: Regulators want Guaranty bids by Monday: report

Regulators are hoping that three banks that had bid for Colonial Bank -- Canada's Toronto Dominion, JPMorgan and Spain's BBVA -- will step in to bid for Guaranty ... private equity consortium, which includes Blackstone Group LP, Carlyle, Oak Hill Capital, TPG and the Texas banker Gerald Ford, is also considering a bid for GuarantySounds like another fairly large bank failure this week.

WSJ: Loss Rates for FDIC higher than during S&L Crisis

by Calculated Risk on 8/16/2009 09:25:00 PM

From the WSJ: Failed Banks Weighing on FDIC

For the 102 banks that have collapsed in the past two years, the FDIC's estimated cost averaged 34%. That is sharply higher than the 24% rate between 1989 and 1995, when 747 financial institutions were closed by regulators ... At three of the five banks that failed Friday, increasing the total to 77 so far this year, the financial hit to the agency's deposit-insurance fund is expected by the FDIC to be about 50% of their assets.The numbers for the Community Bank of Nevada, Las Vegas, Nevada are amazing. From the FDIC on Friday:

As of June 30, 2009, Community Bank of Nevada had total assets of $1.52 billion ... The cost to the FDIC's Deposit Insurance Fund is estimated to be $781.5 million.The question is: Why is the FDIC waiting so long on banks like Community Bank of Nevada?

Judge: WaMu's actions in Pushing for Foreclosure suggest "Bad Faith"

by Calculated Risk on 8/16/2009 03:54:00 PM

Jim Dwyer at the NY Times brings us the tale of WaMu pushing for foreclosure, even though the owner of the small multi-tenant building kept trying to pay in full after missing two payments in May and June 2008: Banks Help Small Debt Become a Big One (ht Edward)

Here is the order vacating the default from Judge Emily Jane Goodman:

"The facts in this case, in their simplicity, illustrate the state or property foreclosures in New York and the economic relationship and their borrowers, as well as the surrounding ironies."An interesting read.

WaMu actually had a strong incentive to push for foreclosure or payment in full (the entire amount of the note) or even to delay the proceedings. In the July 2008 Summons and Complaint, WaMu's attorney wrote:

As of the date hereof, (unless a different date is indicated) there is due the plaintiff upon said Note and Mortgage the following:So the note required 11.6% interest once the loan went into default (5% above the original rate). Since the building was worth more than the amount owed, by pushing for foreclosure, WaMu could collect this higher interest rate, legal fees, and other fees.

Principal balance : $460,283.26

Interest rate : 6.60%

Interest due from : April 1, 2008

Default interest : 11.60%

Default Interest due from : May 16, 2008

Late charges due as of : $150.09

May 1, 2008

Obligor shall also pay any prepayment, recapture and other fees as

set forth in the Note.

Since the default is vacated, the interest rate on late payments goes back to 6.6%, and I hope the Judge rules for WaMu's successor to pay the borrower's legal fees (usually a separate motion) - especially since she suggested WaMu had acted in bad faith.

A couple of excerpts from the Order:

"Even if the bank had no duty to alert defendant to the possible litigation, and even if their service methods are permissible, they clearly elected not to affect the most reliable available service - personal service - suggesting bad faith by Washington Mutual, especially when taken with their refusal to accept payment after only two months of lateness, as well as their decision to accelerate the entire loan."And from the footnotes:

The Court admonishes the Bank's counsel for submitting papers, referring to the oppositions papers of Owner's principal, a lawyer, as containing "fraud and deceit" and that his seeking to vacate the default and protect his property as "frivolous". These charges are not only disrespectful to another member of the bar, it is not supported by his or her papers.

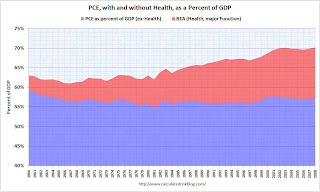

Health Care Spending and PCE

by Calculated Risk on 8/16/2009 01:28:00 PM

By request ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows health care spending as a percent of GDP using three measures.

The first BEA measure, by major type of product, is of health care services as percent of GDP.

The larger BEA measure, by major function, includes health goods and services as a percent of GDP.

The Department of Health and Human Services includes investment in equipment and structures and is the broadest measure of health care spending. See here for a description of the HHS estimates:

These statistics, termed National Health Expenditure Accounts (NHEA), are compiled with the goal of measuring the total amount spent in the United States to purchase health care goods and services during the year. The amount invested in medical sector structures and equipment and in non-commercial research in the United States, to procure health services in the future, is also included.Here are the HHS estimates. (Note: 2008 in graph is based on HHS forecast).

The NHEA are generally compatible with the National Income and Product Accounts (NIPA), but bring a more complete picture of the health care sector of the nation’s economy together in one set of statistics.

The second graph shows the broader BEA measure and Personal Consumption Expenditures (PCE) as a percent of GDP. (Note: we can't use the HHS measure because that includes investment, and investment is not included in PCE).

Important: y-axis doesn't start at zero to better show the change in PCE from health spending - Please do not use to compare health spending to overall PCE (starting from zero percent would be better).

Important: y-axis doesn't start at zero to better show the change in PCE from health spending - Please do not use to compare health spending to overall PCE (starting from zero percent would be better).This graph was inspired by an article in Business Week by Michael Mandel: Consumer Spending is *Not* 70% of GDP (ht jb).

Note that PCE ex-health has actually declined slightly over the last 50 years, but health care related spending has increased sharply (not exactly news!).

Mandel writes:

First, the category of “personal consumption expenditures” includes pretty much all of the $2.5 trillion healthcare spending, including the roughly half which comes via government.This isn't quite correct. Healthcare spending will be around $2.5 trillion this year (according to the HHS), but that includes investment (see first graph). The portion included in PCE is about $1.9 trillion (the blue line in the first graph and red shaded area in second graph).

But the more important point is what will happen in the future. From a demographic perspective, these are the best of times for healthcare expenses. The original baby busters (from 1925 to the early 1940s) are now at the peak medical expense years, but their medical care is being heavily supported by the baby boomers (now in their peak earning years).

Here is an animation I made several years ago to show this point. The shows the U.S. population distribution by age from 1920 to 2000 (plus 2005).

Watch for the original baby bust (shows up in 1930). Those are the people currently in retirement.

Animation updates every 2 seconds.

Just some food for thought ...

The Rentership Society

by Calculated Risk on 8/16/2009 10:11:00 AM

From the Boston Globe: President shifts focus to renting, not owning

The Obama administration, in a major shift on housing policy, is abandoning George W. Bush’s vision of creating an “ownership society’’ and instead plans to pump $4.25 billion of economic stimulus money into creating tens of thousands of federally subsidized rental units in American cities.This conversion of housing stock from ownership to rental units is already happening. Based on data from the Census Bureau, there have been over 4.3 million units added to the rental inventory since Q4 2004, far more than the 1.1 million new units completed as 'built for rent' since 2004. (see The Surge in Rental Units)

The idea is to pay for the construction of low-rise rental apartment buildings and town houses, as well as the purchase of foreclosed homes that can be refurbished and rented to low- and moderate-income families at affordable rates.

...

“People who were owners are going to be renting for a while,’’ said Margery Turner, vice president for research for The Urban Institute, a Washington think tank that studies social and economic policy.

“There is a housing stock that is sitting vacant. There is a real opportunity here’’ to use those homes as rental property and solve both problems, she said.

And this conversion is ongoing. According to the Campbell Survey, 29 percent of all existing home properties in Q2 were purchased by investors - probably mostly for use as rentals.

In addition, many of the modification programs are really turning homeowners into renters (or "debtowners"). Most mods just capitalize missed payments and fees, and reduce interest rates for a few years. Many of these "homeowners" will still have negative equity when the interest rate increases again, and this could be viewed as Single Family Public Housing.

The Rentership Society.

Saturday, August 15, 2009

Jim the Realtor: The $4 Million Gate

by Calculated Risk on 8/15/2009 10:59:00 PM

For a Saturday night - two stories from Jim - the 2nd one is a small high end development that was just foreclosed on by Wells Fargo.

Unemployed Workers Starting to Exhaust Extended Benefits

by Calculated Risk on 8/15/2009 06:50:00 PM

From Jack Katzanek at the Press-Enterprise: Time -- and benefits -- running out for Inland jobless (ht Rob Dawg)

... According to the state Employment Development Department, the number of Inland residents whose benefits already have been exhausted is negligible. Only 121 people -- 67 in San Bernardino County and 54 in Riverside County -- were in that situation at the end of July.The Inland Empire could go from 121 workers having exhausted their benefits now to over 21,000 by the end of the year. Ouch.

But the number of people facing that predicament could grow exponentially in the coming weeks.

In Riverside County, it is estimated that 12,000 people risk losing their benefits before the end of the year, and 10,500 more in San Bernardino County.

...

A bill to extend unemployment benefits for 13 weeks was introduced in Congress July 30 by Rep. Jim McDermott, D-Wash. It would apply to about 20 states with unemployment rates higher than 9 percent.

...

[Mike DeCesare, McDermott's spokesman's] research indicates that more than 200,000 people will lose their benefits each month starting in September.

emphasis added

The National Employment Law Project estimates that half a million workers will have exhausted their extended benefits by the end of September, and a total of 1.5 million by the end of the year. These numbers are about to increase sharply.

LA Area Ports: Export Traffic Declines in July

by Calculated Risk on 8/15/2009 01:48:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 22.0% below July 2008.

Outbound traffic was 22.7% below July 2008.

There had been some recovery in U.S. exports earlier this year (the year-over-year comparison was off 30% from December through February). And this showed up in the in the Q1 and Q2 GDP reports as net exports of goods and services added 2.64% and 1.38% to GDP in Q1 and Q2, respectively.

This data suggests exports in Q3 are off to a slow start.

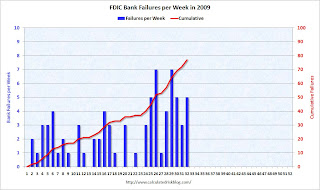

FDIC Bank Failure Update

by Calculated Risk on 8/15/2009 11:12:00 AM

Note: Here is a Problem Bank List (Unofficial) as of Aug 14th (sortable).

The FDIC closed five more banks on Friday, and that brings the total FDIC bank failures to 77 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

The pace has really picked up recently, with the FDIC seizing almost 5 banks per week in July and August, and with 4 1/2 months to go, it seems 150 bank failures this year is likely.

The current pace suggests there will be more failures in 2009 than in the early years of the S&L crisis. From 1982 thorough 1984 there were about 100 failures per year, and then the number of failures really increased as the 2nd graph shows. There were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

There were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

The 2nd graph covers the entire FDIC period (annually since 1934).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits.

Colonial Bank had almost $25 billion in assets when it was seized yesterday. Guaranty (Texas, with close to $15.4 billion in assets) and Corus ($7.7 billion) are on the ropes, and the dollars could really add up.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

U.K. More Losses for Nationalized Buy-to-Let Lender

by Calculated Risk on 8/15/2009 08:42:00 AM

From The Times: Rising wave of fraud plunges Bradford & Bingley deeper into the red

Bradford & Bingley, the nationalised mortgage lender, has laid bare the dire state of its loan book and said that a rising wave of fraud dragged it to a £160 million loss for the first half of the year."Buy-to-let" is lending to investors for the purpose of renting the property. Some of these investors were really speculators buying for appreciation.

... the Council of Mortgage Lenders ... has forecast that 65,000 people will lose their homes this year, up from 40,000 last year and just under 26,000 in 2007.

B&B, which was the UK’s largest lender to landlords before it was broken up and its mortgage book nationalised last September, said yesterday that 40 per cent of its mortgage book was in negative equity, up from 30 per cent at the end of 2008. ...

B&B has 60 per cent of its book in buy-to-let and 20 per cent in self-certified loans, sometimes called “liars’ loans” because borrowers did not have to provide proof of salary.

...

Customers falling more than three months behind on repayments rose to 5.88 per cent of the book, from 4.6 per cent at the year-end. ...

The number of homeowners falling behind with mortgage repayments continued to climb in the second quarter. About 270,400 borrowers had missed three or more monthly payments between April and June, up from 264,700 in the first three months of the year. ...

The number of possession orders issued by the courts edged down in the second quarter [as] the “pre-action protocol” introduced late last year ... were dampening applications from lenders.

In some areas - like London - investors accounted for a majority of new home purchases in recent years (from a 2007 article):

According to London Development Research, two-thirds of all new homes built in the capital are being bought by investors.Rising delinquency rates, record foreclosures, more borrowers in negative equity ... sounds like the U.S.