by Calculated Risk on 8/15/2009 06:50:00 PM

Saturday, August 15, 2009

Unemployed Workers Starting to Exhaust Extended Benefits

From Jack Katzanek at the Press-Enterprise: Time -- and benefits -- running out for Inland jobless (ht Rob Dawg)

... According to the state Employment Development Department, the number of Inland residents whose benefits already have been exhausted is negligible. Only 121 people -- 67 in San Bernardino County and 54 in Riverside County -- were in that situation at the end of July.The Inland Empire could go from 121 workers having exhausted their benefits now to over 21,000 by the end of the year. Ouch.

But the number of people facing that predicament could grow exponentially in the coming weeks.

In Riverside County, it is estimated that 12,000 people risk losing their benefits before the end of the year, and 10,500 more in San Bernardino County.

...

A bill to extend unemployment benefits for 13 weeks was introduced in Congress July 30 by Rep. Jim McDermott, D-Wash. It would apply to about 20 states with unemployment rates higher than 9 percent.

...

[Mike DeCesare, McDermott's spokesman's] research indicates that more than 200,000 people will lose their benefits each month starting in September.

emphasis added

The National Employment Law Project estimates that half a million workers will have exhausted their extended benefits by the end of September, and a total of 1.5 million by the end of the year. These numbers are about to increase sharply.

LA Area Ports: Export Traffic Declines in July

by Calculated Risk on 8/15/2009 01:48:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 22.0% below July 2008.

Outbound traffic was 22.7% below July 2008.

There had been some recovery in U.S. exports earlier this year (the year-over-year comparison was off 30% from December through February). And this showed up in the in the Q1 and Q2 GDP reports as net exports of goods and services added 2.64% and 1.38% to GDP in Q1 and Q2, respectively.

This data suggests exports in Q3 are off to a slow start.

FDIC Bank Failure Update

by Calculated Risk on 8/15/2009 11:12:00 AM

Note: Here is a Problem Bank List (Unofficial) as of Aug 14th (sortable).

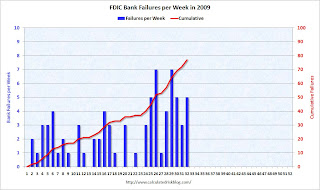

The FDIC closed five more banks on Friday, and that brings the total FDIC bank failures to 77 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

The pace has really picked up recently, with the FDIC seizing almost 5 banks per week in July and August, and with 4 1/2 months to go, it seems 150 bank failures this year is likely.

The current pace suggests there will be more failures in 2009 than in the early years of the S&L crisis. From 1982 thorough 1984 there were about 100 failures per year, and then the number of failures really increased as the 2nd graph shows. There were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

There were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

The 2nd graph covers the entire FDIC period (annually since 1934).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits.

Colonial Bank had almost $25 billion in assets when it was seized yesterday. Guaranty (Texas, with close to $15.4 billion in assets) and Corus ($7.7 billion) are on the ropes, and the dollars could really add up.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

U.K. More Losses for Nationalized Buy-to-Let Lender

by Calculated Risk on 8/15/2009 08:42:00 AM

From The Times: Rising wave of fraud plunges Bradford & Bingley deeper into the red

Bradford & Bingley, the nationalised mortgage lender, has laid bare the dire state of its loan book and said that a rising wave of fraud dragged it to a £160 million loss for the first half of the year."Buy-to-let" is lending to investors for the purpose of renting the property. Some of these investors were really speculators buying for appreciation.

... the Council of Mortgage Lenders ... has forecast that 65,000 people will lose their homes this year, up from 40,000 last year and just under 26,000 in 2007.

B&B, which was the UK’s largest lender to landlords before it was broken up and its mortgage book nationalised last September, said yesterday that 40 per cent of its mortgage book was in negative equity, up from 30 per cent at the end of 2008. ...

B&B has 60 per cent of its book in buy-to-let and 20 per cent in self-certified loans, sometimes called “liars’ loans” because borrowers did not have to provide proof of salary.

...

Customers falling more than three months behind on repayments rose to 5.88 per cent of the book, from 4.6 per cent at the year-end. ...

The number of homeowners falling behind with mortgage repayments continued to climb in the second quarter. About 270,400 borrowers had missed three or more monthly payments between April and June, up from 264,700 in the first three months of the year. ...

The number of possession orders issued by the courts edged down in the second quarter [as] the “pre-action protocol” introduced late last year ... were dampening applications from lenders.

In some areas - like London - investors accounted for a majority of new home purchases in recent years (from a 2007 article):

According to London Development Research, two-thirds of all new homes built in the capital are being bought by investors.Rising delinquency rates, record foreclosures, more borrowers in negative equity ... sounds like the U.S.

Retailers Expect Slow Back-to-School Sales

by Calculated Risk on 8/15/2009 12:29:00 AM

From the NY Times: Retailers See Slowing Sales in Back-to-School Season

Halfway through the back-to-school shopping season, retail professionals are predicting the worst performance for stores in more than a decade ...From the National Retail Federation: NRF's 2009 Back-to-School and Back-to-College Surveys

The National Retail Federation, an industry group, expects the average family with school-age children to spend nearly 8 percent less this year than last. And ShopperTrak, a research company, predicted customer traffic would be down 10 percent from a year ago.

“This is going to be the worst back-to-school season in many, many years,” said Craig F. Johnson, president of Customer Growth Partners, a retailing consultant firm.

According to the National Retail Federation’s 2009 Back to School Consumer Intentions and Actions Survey, conducted by BIGresearch, the average family with students in grades Kindergarten through 12 is expected to spend $548.72 on school merchandise, a decline of 7.7 percent from $594.24 in 2008. ...There are some positive signs for the economy - like new home sales, auto sales increasing, and industrial production/capacity utilization possibly bottoming out - but without the consumer, any recovery will be sluggish at best.

According to the survey, the economy is having a major impact on back-to-school spending as four out of five Americans (85%) have made some changes to back-to-school plans this year as a result. Some of those changes impact spending, with 56.2 percent of back-to-school shoppers hunting for sales more often, 49.6 percent planning to spend less overall, 41.7 percent purchasing more store brand/generic products and 40.0 percent are planning to increase their use of coupons. Others say the economy has impacted lifestyle decisions, with 11.4 percent saying children will cut back on extracurricular activities or sports and 5.7 percent saying that the economy is impacting whether their children will attend a private or public school.

“The economy has clearly changed the spending habits of American families, which will likely create a difficult back-to-school season for retailers,” said Tracy Mullin, President and CEO of NRF.

Friday, August 14, 2009

Bank Failures #75 - #77: Union Bank, National Association, Gilbert, AZ, Community Bank of Nevada, Las Vegas, NV, Community Bank of Arizona, Phoenix, A

by Calculated Risk on 8/14/2009 09:34:00 PM

A "whale" also sleeps on beach

Sharks circle for more

by Soylent Green is People

From the FDIC: MidFirst Bank, Oklahoma City, Oklahoma, Assumes All of the Deposits of Union Bank, National Association, Gilbert, Arizona

Union Bank, National Association, Gilbert, Arizona, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: MidFirst Bank, Oklahoma City, Oklahoma, Assumes All of the Deposits of Community Bank of Arizona, Phoenix, Arizona

As of June 12, 2009, Union Bank, N.A. had total assets of $124 million and total deposits of approximately $112 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $61 million. ... Union Bank, N.A. is the 75th FDIC-insured institution to fail in the nation this year, and the second in Arizona. The last FDIC-insured institution to be closed in the state was Community Bank of Arizona, Phoenix, also today.

Community Bank of Arizona, Phoenix, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of June 30, 2009, Community Bank of Arizona had total assets of $158.5 million and total deposits of approximately $143.8 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $25.5 million. ... Community Bank of Arizona is the 76th FDIC-insured institution to fail in the nation this year, and the first in Arizona. The last FDIC-insured institution to be closed in the state was NextBank, Phoenix, on February 7, 2002.

From the FDIC: FDIC Creates a Deposit Insurance National Bank to Facilitate the Resolution of Community Bank of Nevada, Las Vegas, Nevada

Community Bank of Nevada, Las Vegas, Nevada, was closed today by the State Commissioner, by Order of the Nevada Financial Institutions Division, which then appointed Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of June 30, 2009, Community Bank of Nevada had total assets of $1.52 billion and total deposits of about $1.38 billion. ...

The FDIC as receiver will retain all the assets from Community Bank of Nevada for later disposition. Loan customers should continue to make their payments as usual.

The cost to the FDIC's Deposit Insurance Fund is estimated to be $781.5 million. Community Bank of Nevada is the 77th bank to fail this year and the third in Nevada. The last bank to be closed in the state was Great Basin Bank, Elko, on April 17, 2009

Hotel Owners Walking Away

by Calculated Risk on 8/14/2009 08:47:00 PM

From Kris Hudson at the WSJ: Hotels Deliver Some 'Jingle Mail'

... From San Diego to Dearborn, Mich., an increasing number of hotel owners in the U.S. market are simply walking away ...There is much more in the article.

Distressed noncasino hotel loans now cover more than 1,000 properties with a cumulative loan value of $16.8 billion, according to Real Capital Analytics ....

Delinquencies of loans on casinos that have hotels adds 31 properties and $8.6 billion in distressed loans to the mix.

... According to Trepp LLC, the delinquency rate for CMBS tied to hotels was 4.75% in the second quarter, up from 0.5% a year earlier. Debt-rating provider Fitch Ratings predicts that rate will jump to between 10% and 15% by year end.

A few points on hotels:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The peak occupancy rate for 2009 was probably three weeks ago at 67%.

And that is far below normal ... and it is all downhill for the rest of the year.

Note: Graph doesn't start at zero to better show the change.

Occupancy rates are far below historical levels, room rates are falling, there is more supply coming online - and many properties have too much debt. That spells Jingle Mail!

Bank Failure #74: Down Goes Colonial

by Calculated Risk on 8/14/2009 06:08:00 PM

Colonial colonized

Queen bee Bair in charge.

by Soylent Green is People

From the FDIC: BB&T, Winston-Salem, North Carolina, Assumes All of the Deposits of Colonial Bank, Montgomery, Alabama

Colonial Bank, Montgomery, Alabama, was closed today by the Alabama State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

Colonial Bank's 346 branches in Alabama, Florida, Georgia, Nevada and Texas will reopen under normal business hours beginning tomorrow and operate as branches of BB&T. ...

"The past 18 months have been a very trying period in the financial services arena, but the FDIC and its staff have performed as Congress envisioned when it created the corporation more than 75 years ago," said FDIC Chairman Sheila C. Bair. "Today, after protecting almost $300 billion in deposits since the current financial crisis began, the FDIC's guarantee is as certain as ever. Our industry funded reserves have covered all losses to date. In fact, losses from today's failures are lower than had been projected. I commend our staff for their excellent work in assuring once again a smooth transition for bank customers with these resolutions. The FDIC continues to stand by the nation's insured deposits with the full faith and credit of the U.S. government. No depositor has ever lost a penny of their insured deposits."

...

As of June 30, 2009, Colonial Bank had total assets of $25 billion and total deposits of approximately $20 billion. ... The FDIC and BB&T entered into a loss-share transaction on approximately $15 billion of Colonial Bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $2.8 billion. ... Colonial Bank is the 74th FDIC-insured institution to fail in the nation this year, and the first in Alabama. The last FDIC-insured institution to be closed in the state was Birmingham FSB, Birmingham, on August 21, 1992.

Bank Failure #73: Dwelling House Savings and Loan Association, Pittsburgh, Pennsylvania

by Calculated Risk on 8/14/2009 04:38:00 PM

NOTE: This bank was on the Problem Bank List (Unofficial) released earlier. The bank had received a "PROMPT CORRECTIVE ACTION DIRECTIVE" on May 5th, and that is basically a "Hail Mary pass." - usually means failure.

Bureaucrats to clean up mess

We are new slum lords

by Soylent Green is People

From the FDIC: PNC Bank, National Association, Pittsburgh, Pennsylvania, Assumes All of the Deposits of Dwelling House Savings and Loan Association, Pittsburgh, Pennsylvania

Dwelling House Savings and Loan Association, Pittsburgh, Pennsylvania, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Just a tease ... but look at the losses as a percent of total assets.

As of March 31, 2009, Dwelling House Savings and Loan Association had total assets of $13.4 million and total deposits of approximately $13.8 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.8 million. ... Dwelling House Savings and Loan Association is the 73rd FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania. The last FDIC-insured institution to be closed in the state was Metropolitan Savings Bank, Pittsburgh, on February 2, 2007

Market and Bank Watch

by Calculated Risk on 8/14/2009 03:58:00 PM

There are reports that Colonial will be seized today.

Still waiting on Guaranty (Texas), Corus, and many others: see August 14 Problem Bank List (unofficial) below. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 48.4% from the bottom (328 points), and still off 35.8% from the peak (561 points below the max).

The S&P 500 first hit this level in Feb 1998; over 11 years ago.Note: Doug may be a little slow updating today.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.