by Calculated Risk on 8/12/2009 10:00:00 AM

Wednesday, August 12, 2009

Distressed Sales and Financing: Sacramento as Example

Just using Sacramento as an example ... I wish the NAR broke out the data like this! Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (normal resales), and distressed sales (Short sales and REO sales). Here is the July data.

They started breaking out REO sales last year, but this is only the second monthly report with short sales. Over two thirds of all resales (single family homes and condos) were distressed sales in July.

Total sales in July were off 7% compared to July 2008; the second month in a row with declining YoY sales.  The second graph breaks out sales by financing type for each July since 2002. (July 2004 was missing, June was used).

The second graph breaks out sales by financing type for each July since 2002. (July 2004 was missing, June was used).

This shows the significant shift to FHA loans and cash buyers (usually investors). Speculators used conventional loans during the bubble, but now cash flow investors are mostly buying with cash.

This suggests most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Investors and first-time home buyers will be buying mostly in the low-to-mid priced areas. Inventories are down in the low priced areas, but with 67% distressed sales, there will be few move-up buyers for the higher priced areas.

Trade Deficit Increases in June

by Calculated Risk on 8/12/2009 08:30:00 AM

The Census Bureau reports:

The ... total June exports of $125.8 billion and imports of $152.8 billion resulted in a goods and services deficit of $27.0 billion, up from $26.0 billion in May, revised. June exports were $2.4 billon more than May exports of $123.4 billion. June imports were $3.5 billion more than May imports of $149.3 billion.

Click on graph for larger image.

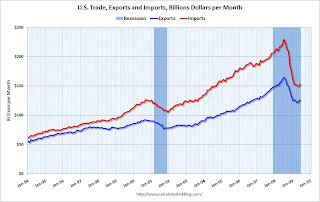

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through June 2009.

Imports were up in June, mostly because of a spike in oil prices. Exports also increased in June. On a year-over-year basis, exports are off 22% and imports are off 31%.

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices increased to $59.17 in June - up about 50% from the prices in February - and the fourth monthly increase in a row. Import oil prices will rise further for July and August.

It appears the cliff diving for U.S. trade might be over - especially for U.S. exports.

Tuesday, August 11, 2009

WSJ: JPMorgan Offering 23 Office Properties For Sale

by Calculated Risk on 8/11/2009 11:48:00 PM

From the WSJ: Feeling Roomy, J.P. Morgan Shops Its Space (ht BR)

J.P. Morgan Chase & Co. is marketing 23 office properties ... with a combined 7.1 million square feet of space, includes four notable towers: One Chase Manhattan Plaza, near Wall Street; Four New York Plaza, also in the Financial District; the former headquarters of Washington Mutual in a downtown Seattle skyscraper that also houses the city's art museum; and a landmarked 1929 Art Deco building in Houston, the former headquarters of Texas Commerce Bank.JPMorgan acquired most of this office space as part of recent acquisitions.

The portfolio is believed to be the largest single portfolio of office properties to hit the market this year and could raise more than $1 billion.

And a great quote:

"Vacant space right now is not ideal," said David Aubuchon, an analyst with Robert W. Baird & Co. ...No kidding! Not in a period with rapidly rising office vacancy rates.

Note: Aubuchon is comparing to a few years ago when vacant space was considered valuable by some CRE investors under the assumption that rents would increase sharply.

More Possible Bidders for Guaranty Bank

by Calculated Risk on 8/11/2009 10:32:00 PM

From Bloomberg: Blackstone, U.S. Bancorp, Ford May Bid for Ailing Guaranty Bank

Blackstone Group LP, Gerald Ford’s Flexpoint and U.S. Bancorp are considering bids for assets of Guaranty Financial Group Inc., the Texas lender that said last month it will probably fail, people familiar with the situation said.Soon.

...

Guaranty, whose backers include billionaire Carl Icahn and Omni Hotels owner Robert Rowling, would be the biggest bank to collapse this year and the largest failure since the seizure last September of Washington Mutual Inc.

And on Colonial Bank from The Birmingham News: Alabama State Banking Board meets; can't say if Colonial Bank a topic

A meeting of the Alabama State Banking Board that was to be held Wednesday regarding the future of Montgomery-based Colonial BancGroup has been canceled.Guaranty, with over $14 billion in assets, will probably not be the largest bank to fail for very long. Colonial had over $26 billion in assets according to their most recent filing.

The board met on Monday, said Elizabeth Bressler, general counsel for the Alabama State Banking Department. Under Alabama law, she said she could not comment on what happened at that meeting or whether it involved Colonial.

Corus only has about $7.6 billion in assets.

Report: Record Number of California Foreclosures Scheduled For Sale

by Calculated Risk on 8/11/2009 07:23:00 PM

From ForeclosureRadar: Record Number of Foreclosures Scheduled For Sale

[F]oreclosure stats were mixed, with Notice of Default filings flat, Notice of Trustee Sale filings rising by 31.6 percent and foreclosure sales dropping 22.7 percent. The number of properties scheduled for foreclosure sale – new Notices of Trustee Sale minus those sales that have cancelled or sold – rose to a record level ...Whether or not there is a flood of foreclosures soon appears to depend on the loan mods. Notice that foreclosures remain pending during the loan mod trial period - so it is possible that the lenders will start cancelling many of these 'Notices of Trustee Sale' soon if the mods are successful.

Foreclosures scheduled for sale rose to 124,874, a 10.4 percent increase from the prior month, and a 93.3 percent increase year-over-year from July 2008. The year-over-year increase is significant given that foreclosure sales in July 2008 set a record that has not again been reached. The increase appears to be primarily due to the fact that lenders are willingly postponing foreclosure sales.

...

Political pressure, financial incentives and the postponement of sales awaiting the completion of loan modification trial periods are likely reasons for the delays. The vast majority of foreclosures, 72 percent, are postponing either due to lenders request, or mutual agreement between the lender and borrower.

The average California foreclosure has a total loan balance of $425,134 on a home that is now worth $236,739.

Taylor Bean BK "Imminent"

by Calculated Risk on 8/11/2009 05:23:00 PM

From the WSJ: Bankruptcy Filing Near for Taylor Bean

A bankruptcy filing is "imminent" for Taylor, Bean & Whitaker Mortgage Corp., lawyers representing the mortgage lender said in a federal court filing last week.No surprise.

...

Meanwhile, an internal email at Taylor Bean dated Monday, Aug. 10, referred to a new computer folder "to assemble all of our bankruptcy detailed spreadsheets and support."

Nothing new on Colonial Bank (or Corus Bank, or Guaranty Bank in Texas).

CIT created a little stir this morning with an NT 10-Q SEC filing. This was just a notice of CIT being unable to file on time - because the executives are busy - and that CIT expects to file by August 17th (just happens to be the date of the cash tender offer).

CIT reiterated in the NT 10-Q that:

If the tender offer is successfully completed, the Company intends to use the proceeds of the Credit Facility to complete the tender offer and make payment for the August 17 notes. Further, the Company and a Steering Committee of the bond holder lending group do not intend for the Company to seek relief under the U.S. Bankruptcy Code, but rather will pursue restructuring efforts as part of the comprehensive restructuring plan to enhance the Company’s liquidity and capital position. If the pending tender offer is not successfully completed, and the Company is unable to obtain alternative financing, an event of default under the provisions of the Credit Facility would result and the Company could seek relief under the U.S. Bankruptcy Code.That isn't new.

emphasis added

CIT also reiterated that there are substantial doubts that the company will continue as a going concern.

In addition, as disclosed in the same Current Report on Form 8-K, the Company’s funding strategy and liquidity position have been materially adversely affected by on-going stress in the credit markets, operating losses, credit ratings downgrades, and regulatory and cash restrictions such that there is substantial doubt about the Company’s ability to continue as a going concern.Also nothing new.

Draft Derivatives Bill Sent to Congress

by Calculated Risk on 8/11/2009 03:23:00 PM

From the Treasury:

... One of the most significant changes in the world of finance in recent decades has been the explosive growth and rapid innovation in the markets for credit default swaps (CDS) and other OTC derivatives. These markets have largely gone unregulated since their inception. Enormous risks built up in these markets – substantially out of the view or control of regulators – and these risks contributed to the collapse of major financial firms in the past year and severe stress throughout the financial system.It appears the proposed bill would require standard derivative products to be traded on exchanges, and that all companies involved in derivative trading would be subject to federal regulation.

Under the Administration's legislation, the OTC derivative markets will be comprehensively regulated for the first time. The legislation will provide for regulation and transparency for all OTC derivative transactions; strong prudential and business conduct regulation of all OTC derivative dealers and other major participants in the OTC derivative markets; and improved regulatory and enforcement tools to prevent manipulation, fraud, and other abuses in these markets.

I haven't found any mention of banning 'naked' CDS (something that was discussed a couple weeks ago), but I haven't read the entire proposal.

CBRE: Retail Cap Rates Increase Sharply in Q2

by Calculated Risk on 8/11/2009 12:41:00 PM

From CB Richard Ellis: U.S. Retail Cap Rates

Average US retail capitalization rates increased 55 basis points in the 2nd quarter of 2009 to 8.12% ...

As some owners were unable to hold on, cap rates continued the upward march in the 2nd quarter. The 55 basis point gain is the largest quarterly increase we have ever measured, even trumping 2008 Q4. ... Our preliminary review of closed sales and escrows in the 3rd quarter indicate cap rates are continuing to rise.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph from CBRE shows the retail cap rate since 2003. Note that 2009 was based on just Q1 and Q2, and Q2 is already at 8.12% - and CBRE sees an additional cap rate increase in the early Q3 data.

From Reuters in July, see: Strip Mall Vacancy Rate Hits 10%, Highest Since 1992

During the second quarter, the vacancy rate at U.S. strip malls reached 10 percent, the highest level since 1992, [Reis] said. ... asking rent fell 1.7 percent from a year ago to $19.28 per square foot. Asking rent fell 0.7 percent from the prior quarter. It was the largest single-quarter decline since Reis began tracking quarterly figures in 1999.Sharply lower rents, higher vacancy rates, reduced leverage and much higher cap rates - Brian calls this the "neutron bomb for RE equity"; destroys CRE investors, but leaves the buildings still standing.

Employment: Men, Women, Positions and People

by Calculated Risk on 8/11/2009 10:30:00 AM

Saturday I posted a description of the differences between the Current Population Survey (CPS: commonly called the household survey), and the Current Employment Statistics (CES: payroll survey).

The CPS gives the total number of people employed (and unemployed), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

So if you wanted to compare the number of men vs. the number of women in the labor force, which survey would you use? Not the CES because that is a measure of positions, and a person working two jobs would be counted twice. Instead you'd want to use the CPS (a count of people, not positions).

However, Professor Casey Mulligan writes in the NY Times Economix: When Will Women Become a Work-Force Majority?

It is possible that, for the first time in American history, women will make up a majority of the labor force late this summer.Uh, no.

emphasis added

First Mulligan means "work force" or "employed", not percent of labor force (the labor force includes unemployed workers too).

But more importantly, Mulligan means women will hold a majority of the positions as measured by the CES. Remember the CES excludes self-employed and farm jobs, and those are probably largely male. And perhaps women are more likely to work two jobs (the CES counts that as two positions).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of men and women in the U.S. labor force. The percentage have been pretty stready for the last 15 years, although the current recession is impacting men more than women.

According to the BLS, there are 10.1 million more men in the labor force than women, but only 7.4 million more men are working.

The unemployment rate for men (20 & over) is 9.8% compared to 7.5% for women. Including teens (16 & over), the unemployment rate for men is 10.5% compared to 8.1% for women.

Catherine Rampell at the NY Times Economix picks up Mulligan's error: The Mancession

Casey B. Mulligan noted, for example, that for the first time in American history women are coming close to representing the majority of the national work force.At least Rampell used "work force" instead of "labor force" but she repeats Mulligan's error. Women are coming close to holding a majority of payroll jobs, but not a majority of the work force or labor force. Back in February, Rampell phrased it better:

With the recession on the brink of becoming the longest in the postwar era, a milestone may be at hand: Women are poised to surpass men on the nation’s payrolls, taking the majority for the first time in American history.To belabor this point: Say there were 50 women and 100 men in the work force, and each women worked two jobs (men only one). The CES would report 200 payroll positions; half for men, and half for women. The CPS would report 150 people had jobs, 50 women and 100 men. Would it be correct to say there were as many women in the work force as men? No.

Both surveys have value, and I'm using this to make a point: The CES is about positions. The CPS is about people.

Congressional Oversight Panel Warns of Threat to Smaller Banks

by Calculated Risk on 8/11/2009 08:38:00 AM

From MarketWatch: Oversight panel: Losses could pose threat to small banks

According to a report from the Congressional Oversight Panel, which is charged with overseeing the $700 billion Troubled Asset Relief program, or TARP, the 18 largest financial institutions with over $600 million in assets would "be able to deal with" whole-loan portfolio losses.Here is the report: August Oversight Report: The Continued Risk of Troubled Assets

However, the report's analysis of troubled whole loans -- based on a model developed by SNL Financial -- suggests they pose a threat to smaller public banks, those with $600 million to $100 billion in assets.

The problem of troubled assets is especially serious for the balance sheets of small banks. Small banks‘ troubled assets are generally whole loans, but Treasury‘s main program for removing troubled assets from banks‘ balance sheets, the PPIP will at present address only troubled mortgage securities and not whole loans. The problem is compounded by the fact that banks smaller than those subjected to stress tests also hold greater concentrations of commercial real estate loans, which pose a potential threat of high defaults. Moreover, small banks have more difficulty accessing the capital markets than larger banks. Despite these difficulties, the adequacy of small banks‘ capital buffers has not been evaluated under the stress tests.The FDIC will stay very busy.

emphasis added