by Calculated Risk on 8/10/2009 11:58:00 PM

Monday, August 10, 2009

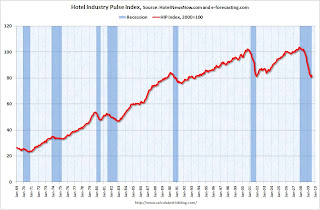

Hotel Industry Pulse Index Shows Slight Improvement in July

From HotelNewsNow.com: HIP increases by 1.6 in July; first sign of turning point

This morning, economic research firm e-forecasting.com, in conjunction with Smith Travel Research, announced that after 19 months of consecutive decline, HIP climbed 1.6 percent in July. HIP, the Hotel Industry’s Pulse index, is a composite indicator that gauges business activity in the US hotel industry in real-time. The latest increase brought the index to a reading of 82.2. The index was set to equal 100 in 2000.

...

“With HIP finally showing a slight improvement after 19 months of decline, it appears we may be seeing the light at the end of the tunnel” said Chad Church, Industry Research Manager at STR. “It will be important to monitor the pace of growth in the HIP over the second half of the year to see if July was an anomaly or a true turning point in this recession.”

...

The composite indicator is made with the following components: revenues from consumers staying at hotels and motels adjusted for inflation, room occupancy rate and hotel employment, along with other key economic factors that influence hotel business activity.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This index suggests that the cliff diving for the hotel industry might be over, although this is just one data point.

Over the last couple of years the hotel industry has been crushed. RevPAR (Revenue per available room) is off over 15% compared to the same period in 2008. And at the current occupancy and room rate levels, many hotels are losing money.

The end to cliff diving is not the same as new growth, but it is better than more cliff diving!

HIP historical data provided by HotelNewsNow.com and e-forecasting.com.

WaPo: Ailing States Face Bleak Outlook

by Calculated Risk on 8/10/2009 09:35:00 PM

From the WaPo: Stimulus Funds Bring Relief to States, but What About 2010?

As states across the country grapple with the worst economy in decades, most have cut services, forced workers to take unpaid days off, shut offices several days a month and scrambled to find new sources of revenue.The article discusses the budget situations for a number of states. But here is a little positive news from California State Controller John Chiang today:

The good news is that much of the pain this year has been cushioned by billions of dollars of federal stimulus money, which has allowed states and localities to avoid laying off teachers, prison guards, police officers and firefighters.

The bad news is that for the next fiscal year, beginning in July, the picture looks even bleaker. Revenue is expected to remain depressed, even if the national economy improves. There will be only half as much federal stimulus aid available, and many states have already used up their emergency reserves.

... When adjusting for Registered Warrants issued on personal income and corporate tax refunds, General Fund Revenue was 8% below July 2008. However, the pace of deterioration has slowed considerably relative to the 39.4%, 39%, and 17.7% deterioration in March, April, and May, respectively.

This slowing decline can be attributed to several factors ... First, the Governor signed a bill in October that imposes a 20% understatement penalty on corporate tax. Companies were given the option to avoid the penalty by filing an amended return and paying their actual tax liability by May 31, 2009. As a result, corporate taxes saw sharp increases as firms took action to avoid the penalty.

Second, the sales tax rate was increased on April 1 from 7.25% to 8.25%. This has helped to bolster the sales tax revenues collected by the State, which were up 20.8% from last July. Another policy change that has had a positive impact on California’s sales tax collections is the Federal Government’s “Cash for Clunkers” program. ... This program has been successful in boosting demand for new automobiles, and thus, generating additional tax revenues for California. Although this positive indicator is driven by economic incentives created by policy changes in Washington D.C. more than a genuine rebound in consumer activity, any encouraging signs in the economy were virtually nonexistent six months ago.

Auto Sales and the Unemployment Rate

by Calculated Risk on 8/10/2009 06:11:00 PM

On Saturday I posted a graph and some analysis of Housing Starts and the Unemployment Rate

Today I received a request for a similar graph of auto sales and the unemployment rate.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows light vehicles sales including SUVs and small trucks, and the unemployment rate (inverted - see right scale).

Light vehicle sales usually bottom sometime before the unemployment rate peaks - just like for housing starts. This makes sense since the usual two engines of recovery are housing and personal consumption. See Business Cycle: Temporal Order

New Market Graph

by Calculated Risk on 8/10/2009 04:20:00 PM

Click on graph for larger image in new window.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short sent me this new graph matching up the market bottoms (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Doug has probably jinxed the market!

New York Condo Shadow Inventory

by Calculated Risk on 8/10/2009 03:10:00 PM

From Crain's New York: Shadow units cast pall (ht Nick)

... In Manhattan in the first quarter, [condo] sales were halved from year-earlier levels even as more apartments flooded onto the market, leaving it choking on an 18.6-month supply of units. ...There are plenty of details in the article. This shadow inventory is a significant issue, especially in areas with high rise condos.

As bad as those figures look, they may actually overstate the health of the market. Industry experts point to a growing mountain of so-called shadow inventory that is not reflected in the data. This includes units that are held by developers in soon-to-be completed buildings, as well as those kept off the market by banks and by individual owners who are waiting for conditions to improve before they tack up “For Sale” signs.

“We are undercounting the housing stock,” says Jonathan Miller, chief executive of appraisal firm Miller Samuel Inc. ... In a report on Manhattan residential real estate this spring, Mr. Miller estimated that in addition to the 10,445 condominiums that showed up in unsold inventory, there were as many as 7,000 shadow units.

Just a reminder - the Census Bureau new home inventory report does not include high rise condos, so if these units are not listed, they are not counted anywhere.

Freddie Mac: Taylor Bean Losses could be "Significant"

by Calculated Risk on 8/10/2009 12:49:00 PM

From Bloomberg: Freddie Mac Says Its Loss From Taylor Bean May Be 'Significant'

Freddie Mac ... said the collapse of lender Taylor, Bean & Whitaker Mortgage Corp. may cause it “significant” losses.From the SEC filing:

...

The Ocala, Florida-based lender accounted for about 5.2 percent of Freddie Mac’s single-family mortgage purchases last year ... Freddie Mac can force lenders to repurchase defaulted loans that weren’t of the credit quality they represented, a use of its contracts already made harder by the collapses of IndyMac Bancorp., Washington Mutual Inc. and Lehman Brothers Holdings Inc., the company said.

...

Brian Faith, a spokesman for Fannie Mae, Freddie Mac’s Washington-based rival, said last week his company hasn’t done business with Taylor Bean “for some time.”

On August 4, 2009, we notified Taylor, Bean & Whitaker Mortgage Corp., or TBW, that we had terminated its eligibility, for cause, as a seller and servicer for us effective immediately. TBW accounted for approximately 5.2% and 2.7% of our single-family mortgage purchase volume activity for full-year 2008 and the six months ended June 30, 2009, respectively. We are in the process of determining our total exposure to TBW in the event it cannot perform its contractual obligations to us. The amount of our losses in such event could be significant.

Fed Poised to Halt Treasury Purchases Soon

by Calculated Risk on 8/10/2009 10:56:00 AM

The Fed has been a steady buyer of Treasury securities. It appears this program will end in September.

From the last FOMC statement:

[T]he Federal Reserve will buy up to $300 billion of Treasury securities by autumn.From Bloomberg last week: Fed Set to End Purchases, Two Former Governors Say

The Federal Reserve is set to halt its purchases of up to $300 billion in U.S. Treasuries in mid- September as scheduled, and will probably announce the decision next week, two former central bank governors said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.According to the Cleveland Fed:

The New York Fed reports additional purchases of $7.0 billion on August 6 (mostly 7 year maturity), and $6.594 billion on August 10 (mostly 3 to 4 year).The Fed purchased $6.496 billion in Treasury securities on July 30, focused in the three–to-four year sector, and another $7.248 billion on August 5 with maturities between four and seven years. To date, the Fed has purchased $236 billion of Treasuries and will purchase up to $300 billion by autumn.

That puts the total Fed purchases at $250 billion of Treasuries, and the Fed will probably purchase $50 billion more - and then stop in September.

This will be an interesting sentence in the FOMC statement on Wednesday - and it will be interesting to see the reaction in the Treasury markets. The yield on the 10 year note is already creeping back up toward 4% (3.82% this morning), and that will push up mortgage rates.

Also from Bloomberg, on CRE and the Fed: Fed Focusing on Real-Estate Recession as Bernanke Convenes FOMC

The [CRE] industry is likely to be high on the agenda when Bernanke and his colleagues sit down in Washington tomorrow for the Federal Open Market Committee meeting on monetary policy. ... If nonresidential real estate remains in the doldrums, the Fed may be forced to leave emergency-lending programs in place and keep its benchmark interest rate close to zero for longer than some investors expect ...There is no question private nonresidential real estate will be under pressure from some time - this is no surprise.

More on Corus Bank

by Calculated Risk on 8/10/2009 09:01:00 AM

The following article is similar to the Chicago Tribune article last week, Corus Bankshares Inc. on cusp of crisis, but adds a little local color in Florida.

From the Miami Herald: Soured loans on South Florida condos sinking Corus Bankshares

Heavy with $182 million in construction loans, the long-awaited Trump International Hotel and Tower, a luxury hotel condominium in Fort Lauderdale beach, stands furnished, but empty, with not a single tenant inside.Also on potential bank failures, check out the Problem Bank Link (unofficial) I posted late Friday (Credit: surferdude808).

...

Close to foreclosure, the structure is part of Corus Bank's deeply troubled loan portfolio, which as of May 31 includes 14 outstanding condo loans in South Florida, of which 12 are over 90 days past due. At almost $1 billion, these South Florida construction loans form half of the $2 billion nonperforming loans across the United States that led Corus to warn last month that it may fail.

Corus is long past the June 18 deadline imposed by regulators to raise $390 million in capital, and many believe the Federal Deposit Insurance Corp. will seize the bank within a month -- once it finds a buyer.

...

According to Corus' financial statements, a key reason it lent so much money in Florida was ``the existence and strength of pre-sale contracts.'' Unlike most other states, Florida allows developers to sell condominium units before construction begins. Buyers generally put down a 20 percent deposit, of which half is used on construction costs. Essentially, these act as interest-free loans for the developers, who typically take out short-term loans from banks (like Corus) to build the condos. If the depositors walk away, however, developers are left with an empty building.

Sunday, August 09, 2009

CRE: Large SoCal Office Building Owner to Walk Away

by Calculated Risk on 8/09/2009 08:55:00 PM

From the WSJ: Maguire Properties Warns of Loan Defaults

Maguire Properties Inc., one of the largest office-building owners in Southern California, is planning to hand over control of seven buildings with some $1.06 billion in debt to creditors ...All of these buildings have negative cash flow with rising vacancies and falling rents. This is more losses for the lenders (or CMBS investors for six of these buildings).

Maguire ... notified the buildings' mortgage holders Friday that it expected "imminent default" on the loans.

The seven buildings, with 4.2 million square feet, make up about 20% of Maguire's portfolio. ... The company still has $3.5 billion in debt, and some analysts say that amount exceeds the value of its remaining properties. "Almost every building in [Maguire's] portfolio is under water," says Michael Knott, an analyst with Green Street Advisors.Maquire also owned the building recently built for subprime mortgage broker New Century in Irvine, and sold that building a couple of months ago for a substantial discount to construction costs.

Krugman: Reappoint Bernanke

by Calculated Risk on 8/09/2009 05:53:00 PM

From Bloomberg: Bernanke Should Be Appointed to a Second Term, Krugman Says

“He’s earned the right to a second term,” [Princeton University Economist Paul Krugman] ... said yesterday in an interview in Kuala Lumpur. “He turned the Fed into the financial intermediary of last resort. When the banking system failed to deliver capital where it was needed, he put the Fed into the markets.”Stiglitz is unsure: Stiglitz Says U.S. Facing a ‘Very Slow’ Recovery From Recession

...

“I think Bernanke has done a really good job,” Krugman said. “He failed to see this coming and he was behind the curve in early phases. But he’s been really very good in the sense that it’s really very hard to see how anyone could have done more to stem this crisis.”

When asked whether Bernanke should be reappointed so he can remain Fed chief after his current term expires Jan. 31, Stiglitz replied: “That’s a hard question.” A replacement is “something we ought to consider,” he said.And more from a couple of weeks ago: The Bernanke Reappointment Tour (Roubini says yes, Thoma says yes, and I'm uncertain).