by Calculated Risk on 8/09/2009 02:03:00 PM

Sunday, August 09, 2009

Research on Homeownership Rate through 2030

Professor Arthur C. Nelson, Director of the Metropolitan Research Center at the University of Utah, has kindly sent me his new paper: "The New Urbanity: The Rise of a New America" (no link). Nelson sees a dramatic shift in American cities based on changes in demographics and in housing peferences. He believes this will lead to a "new era of infill and redevelopment."

Nelson also argues this will lead to a decline in the homeownership rate.

Note: Brief excerpts of Dr. Nelson's paper removed by request. This graph shows the homeownership by age group for three different time periods: 1985, 2000, and 2007. Back in 1985, the homeownership rate declined significantly after people turned 70. However, more recently, the homeownership rate has stayed above 80% for those in the 70 to 75 cohort, and close to 80% for people over 75.

This graph shows the homeownership by age group for three different time periods: 1985, 2000, and 2007. Back in 1985, the homeownership rate declined significantly after people turned 70. However, more recently, the homeownership rate has stayed above 80% for those in the 70 to 75 cohort, and close to 80% for people over 75.

I noted in April:

I expect the homeownership rate to remain high for the boomer generation too. Although there will probably be a geographic shift as the boomer generation retires (towards the sun states) and some downsizing, I don't think the aging of the boomer generation will negatively impact the homeownership rate for 15 years or more.So Dr. Nelson is coming to a different conclusion. He thinks the homeownership rate will fall to 63.5% by 2020, and I think it will stay a little higher as many older couples and singles stay in their homes.

This has significant implications for planning and homebuilders. If Nelson is correct, there will be a dramatic shift towards a "new urbanity" and away from suburbs. And also a shift towards more renting.

Professor Nelson sent me this projection:

| Home Tenure | 2005 | 2020 | Change | Percent Change in Supply | Share of Change in Supply | Tenure 2005 | Tenure 2020 |

|---|---|---|---|---|---|---|---|

| Owner-Homes (occupied and vacant) | 74,164 | 87,135 | 12,971 | 17% | 43% | 68.90% | 63.50% |

| Renter-Homes (occupied and vacant) | 35,903 | 53,254 | 17,351 | 48% | 57% | 31.10% | 36.50% |

| Total | 110,067 | 140,389 | 30,322 | ||||

| Source: Arthur C. Nelson, Director, Metropolitan Research Center | |||||||

Notice the shift to rental units in Nelson's projections. Nelson does note that there were over 2 million excess units in 2005, and that needs to worked off first. Nelson is projecting a need for 30 million new housing units over the next 15 years (I think this is high, but Nelson is expecting many more single person households).

This has huge implications for builders. Using Nelson's figures, home builders will only have to build about 800 thousand (on average) single family units per year through 2020 (after the excess is worked off). This is far below the 1.25 million per year seen in 2004 and 2005. That level of production is not coming back. Here is something I wrote in 2007: Home Builders and Homeownership Rates

[With the rising homeownership rate] the homebuilders was ... had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units ...I think Nelson is correct about the trend, but might be overestimating the shift towards renting. Also I think using age 75 would be better for figure 1, so I think this shift will be delayed by about 10 years.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.33% per year (Goldman's Hatzius estimated 0.5% per year). This would mean the net demand for owner occupied units would be 833K minus about 333K or 500K per year - about 40% of the net demand for owner occupied units for the period 1995 to 2005.

This means the builders have two problems over the next few years: 1) too much inventory, and 2) demand will be significantly lower over the next few years than the 1995-2005 period, and even when the homeownership rate stabilizes and the inventory is reduced, demand (excluding speculation) will only be about 2/3 of the 1995-2005 period.

Krugman: "Great free fall seems to be over"

by Calculated Risk on 8/09/2009 10:57:00 AM

From Bloomberg: U.S. Economy May Have Reached ‘Trough,’ Krugman Says

“It’s quite possible, though not certain, that retrospectively, we’ll say that the recession ended in July or August, maybe September,” Krugman said. “My guess is that we’ve bottomed out now, that August was probably the trough month.”The free fall may be over, but there are few green shoots at the bottom of the cliff.

...

A second stimulus package for the economy is still needed, and should be directed at state and local governments as well as infrastructure spending, he said in an interview in Kuala Lumpur. The world economy may face several years of weak growth without falling into a “double-dip” recession, he said.

...

“What we’re seeing is stabilization,” Krugman said. “We’re seeing that the great freefall and the nosedive seems to be over. It’s leveling out but that is very different from returning to normality.”

Saturday, August 08, 2009

Housing Starts and the Unemployment Rate

by Calculated Risk on 8/08/2009 11:22:00 PM

Reader Mark sent me a link to a talk by Jon Fisher, a professor at the University of San Francisco School of Business. Jon made the point that housing starts and unemployment are inversely correlated.

Of course readers here know that housing lead the economy, and employment lags. So naturally housing and unemployment are inversely correlated with a lag.

Note: Dr. Leamer's Sept 2007 paper: Housing is the Business Cycle is an excellent overview of how housing leads the economy. (Something I covered extensively in 2005) Click on graph for larger image in new window.

Click on graph for larger image in new window.

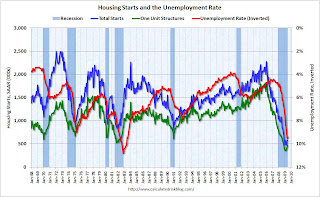

This graph shows housing starts (both total and single unit) and unemployment (inverted).

You can see both the correlaton and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring 2010.

Professor Fisher argued that unemployment will rise to about 10.4% and then fall rapidly. He is basing the rapid decline on a "V shaped" housing recovery similar to previous recessions. I disagree with that point.

In most earlier recessions, the slumps were caused by the Fed raising interest rates to fight inflation. When the Fed cut rates, housing bounced back sharply (V shaped).

Although this recession was led by a housing bust - and that makes it look similar to some previous periods - this recession was not engineered by the Fed raising rates, rather it was the busting of the credit and housing bubbles, and all the related problems that led the economy into recession. Since there is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think Fisher's forecast for a rapid decline in unemployment is also unlikely.

Jobs and the Unemployment Rate

by Calculated Risk on 8/08/2009 07:10:00 PM

FAQ: How can the unemployment rate fall if the economy is losing net jobs, especially since the population is growing?

This data comes from two separate surveys. The unemployment Rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 400,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

A couple of key concepts (from the BLS):

The CES employment series are estimates of nonfarm wage and salary jobs, not an estimate of employed persons; an individual with two jobs is counted twice by the payroll survey. The CES employment series excludes workers in agriculture and private households and the self-employed.And the CPS:

emphasis added

The CPS estimate of employment is for the total number of employed persons. Included are categories of workers that are not covered by the Current Employment Statistics (CES) survey: self-employed persons, private household workers, agriculture workers, unpaid family workers, and workers on leave without pay during the reference period. Multiple jobholders are counted once in the estimate of total employed.So in July, the headline CES number showed a loss of 247,000 non-farm private jobs (by the definitions above). The CPS showed a decline of 155,000 employed people.

Unemployed persons include those who did not have a job during the reference week, had actively looked for work in the prior 4 weeks, and were available for work. Actively looking for work includes activities such as contacting a possible employer, contacting an employment agency or employment center, having a job interview, sending out resumes, filling out job applications, placing or answering job advertisements, and checking union or professional registers.

These two surveys are almost always different, and both are useful.

But the unemployment rate fell, even though the CPS showed a decline in employed people. How can that be?

The CPS also showed a decline in the Civilian Labor Force Level by 422,000. And a decline in the number of unemployed people (U-3) of 267,000.

The unemployment rate is a ratio, with the numerator the number of unemployed, and the denominator the Civilian Labor Force - so these changes in both number lowered the unemployment rate to 9.4%.

If you want more details, see Monthly Employment Situation Report: Quick Guide to Methods and Measurement Issues

Although the CPS showed the labor force declined in July, over time the labor force will continue to grow - probably around 1.5 to 2.0 million people per year on average (once the economy starts to recover), and the CES will probably need to show the addition of around 125,000 jobs per month just to keep the unemployment rate steady (estimates vary of this number).

So remember, the jobs and unemployment rate come from two different surveys and are different measurements (one for positions, the other for people). Some months the numbers may not seem to make sense (lost jobs and falling unemployment rate), but over time the numbers will work out.

Another Apartment-to-Condo Conversion Disaster

by Calculated Risk on 8/08/2009 03:47:00 PM

From the Las Vegas Sun:

The worst investment over the past year was apartment conversions ... [Larry Murphy, president of SalesTraq] said.And the lender for the purchase and conversion of the Meridian? Corus Bank. From 2005:

The worst of the that segment was the Meridian at Hughes Center on Flamingo Road, east of the Strip that was converted from apartments to condominiums between 2005 and 2007, Murphy said.

The property, which had a failed attempt at trying to convert into a condo-hotel because of Clark County regulations, sold for $604 per square foot when it first entered the market. The average price was $539,000, Murphy said.

Through June, the average resale price has fallen to $87,611 or $121 a square foot, Murphy said. With that drop in price has come rising foreclosures. Murphy reports that 201 of the 680 units or 30 percent have been foreclosed upon, and that number is likely to rise. The foreclosures have been running as high as 25 a month so far in 2009, he said.

Murphy said he’s not surprised apartment conversions have fared the worst because in essence some are 20-year-old buildings that have a new granite countertop.

The Meridian consists of five four-story buildings containing 592,680 residential square feet.Not only has the average price fallen 84%, but the current average sales price of $121 per sq ft is significantly below the price of the loan amount from Corus in 2005 (of $188 per sq ft) - before the granite counter top improvements.

Corus ... felt comfortable with the market as this large conversion represents the Bank’s 8th transaction in the Las Vegas area within the last 13 months. “The Meridian appears to be a natural candidate for a condo conversion ...” said John Markowicz, Corus Bank Senior Vice President.

The Meridian appears to be a natural candidate for reconversion back to apartments.

U.K. Record 33 Thousand People Declared Insolvent in Q2

by Calculated Risk on 8/08/2009 11:38:00 AM

From the Independent: Banks take the blame as 33,000 are declared insolvent

More than 33,000 people were declared insolvent during the second quarter of the year, official statistics revealed yesterday, the highest number ever recorded. ...In the U.S., bankruptcy filings are rising sharply too, but are not are record levels because of the change to the bankruptcy law in 2005.

Almost 19,000 people were declared bankrupt during the second quarter of the year ... while a further 12,000 people entered into individual voluntary arrangements, agreements with creditors that fall short of full-scale bankruptcy. ... In addition, 2,000 people signed up to debt relief orders, a new type of insolvency agreement introduced in April for those with relatively small amounts of borrowing.

Insolvency experts warned that the combination of rising unemployment and the lack of stigma attached to options such as IVAs and debt relief orders meant the number of people affected would go on rising.

Mark Sands, director of personal insolvency at Tenon Recovery, predicted 140,000 people would be declared insolvent during 2009, 30 per cent more than in 2006 – the worst year on record so far – when the figure was 107,000.

"The overall record level of personal insolvencies, whilst at first shocking, hides the detail which suggests the worst is yet to come," Mr Sands warned.

For the U.S., see: Personal Bankruptcy Filings up 34.3 Percent compared to July 2008

When it comes to bankruptcy (or insolvency) apparently misery does love company.

NODs Increasing, Foreclosures Decreasing

by Calculated Risk on 8/08/2009 08:10:00 AM

This is a common story in many areas ... the following information is from San Diego.

San Diego real estate broker Edgewood121 attended a presentation this week by San Diego County Assessor / Recorder / County Clerk David Butler on NODs and foreclosures in the county. The following is a handout from the presentation: Click on document for larger image in new window.

Click on document for larger image in new window.

Acording to Edgewood121, Butler said that San Diego county is "expecting a wave of foreclosures in the near future and they are gearing up for it". (quoting Edgewood121 paraphrasing Butler). Butler thinks the banks are holding back, probably because of the various government programs.

Edgewood121 was left with the impression that "it is [only] a matter of time before more properties become available." And that the only reason prices appear to have stabilized "is because of the artificial choking-off of inventory, thereby creating urgency and multiple-offer scenarios."

Clearly the banks are hoping that the modification programs will reduce the number of foreclosures. However most mods just capitalize missed payments and fees (so the banks can pretend they are still whole), and reduce interest rates for a few years (so the homeowner can pretend they still own something of value). Extend and pretend.

Really these underwater "homeowners" are more renters than owners, and many will still have negative equity when the interest rate increases again. Perhaps we should call the modification programs Single Family Public Housing.

Friday, August 07, 2009

Problem Bank List (Unofficial)

by Calculated Risk on 8/07/2009 09:31:00 PM

This is an unofficial list of Problem Banks.

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay - the most recent data is from June 30th. The Fed and OTC data is more timely, and the OCC a little lagged. Credit: surferdude808.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can enter the certificate number in the Institution Directory (ID) system "which will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #72: Community First Bank, Prineville, Oregon

by Calculated Risk on 8/07/2009 09:30:00 PM

Banks cash burn rate a firestorm

Smokey Bair on scene

by Soylent Green is People

From the FDIC: Home Federal Bank, Nampa, Idaho, Assumes All of the Deposits of Community First Bank, Prineville, Oregon

Community First Bank, Prineville, Oregon, was closed today ... As of July 5, 2009, Community First Bank had total assets of $209 million and total deposits of approximately $182 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $45 million. ... Community First Bank is the 72nd FDIC-insured institution to fail in the nation this year, and the third in Oregon. The last FDIC-insured institution to be closed in the state was Silver Falls Bank, Silverton, Oregon, on February 20, 2009.

Bank Failures 70 & 71: First State Bank and Community National Bank of Sarasota County, Florida

by Calculated Risk on 8/07/2009 06:15:00 PM

"A rising tide lifts all boats"

Not these submarines

by Soylent Green is People

From the FDIC: Stearns Bank, National Association, St. Cloud, Minnesota, Assumes All of the Deposits of First State Bank, Sarasota, Florida

First State Bank, Sarasota, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of May 31, 2009, First State Bank had total assets of $463 million and total deposits of approximately $387 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $116 million. ... First State Bank is the 70th FDIC-insured institution to fail in the nation this year, and the fifth in Florida. The last FDIC-insured institution to be closed in the state was Integrity Bank, Jupiter, on July 31, 2009.

From the FDIC: Stearns Bank, National Association, St. Cloud, Minnesota, Assumes All of the Deposits of Community National Bank of Sarasota County, Venice, Florida

Community National Bank of Sarasota County, Venice, Florida, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of June 30, 2009, Community National Bank of Sarasota County had total assets of $97 million and total deposits of approximately $93 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24 million. ... Community National Bank of Sarasota County is the 71st FDIC-insured institution to fail in the nation this year, and the sixth in Florida. The last FDIC-insured institution to be closed in the state was First State Bank, Sarasota, earlier today.