by Calculated Risk on 8/04/2009 10:49:00 AM

Tuesday, August 04, 2009

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 20 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous month.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Stabilizing, But Not Improving, According to NMHC Quarterly Survey

The apartment market continues to struggle, but shows early signs of possibly stabilizing, according to the National Multi Housing Council’s latest Quarterly Survey of Apartment Market Conditions.

All four of the survey's market indexes covering occupancy, sales volume, equity finance and debt finance remained below 50 (indicating conditions were worse than three months ago), but three of the four increased from the last quarter, with only the debt index recording a decline.

“Apartment demand remains tethered to an economy that continues to shed jobs at a fairly rapid pace,” noted NMHC Chief Economist Mark Obrinsky. “Financing is beginning to stabilize, but the market is still a long way from ‘normal’.”

“The survey also suggests that transaction activity is mainly being restrained by uncertainty in apartment property values—whether they have ‘bottomed out’—and not financing constraints. Only when this uncertainty fades are we likely to see a significant upturn in apartment transactions.”

Fears of future property value declines are behind the difficulty apartment firms are having in obtaining equity financing. In a special survey question, 67 percent of respondents said potentially falling property values best explained the lack of equity availability.

...

The Market Tightness Index rose from 16 to 20. This was the eighth straight quarter in which the index has been below 50, but it also the third straight quarter in which the index measure has been rising, as greater shares of respondents are reporting that vacancies are unchanged from the previous quarter rather than even looser.

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

Pending Home Sales Index Increases in June

by Calculated Risk on 8/04/2009 10:01:00 AM

From the NAR: Uptrend Continues in Pending Home Sales

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in June, rose 3.6 percent to 94.6 from an upwardly revised reading of 91.3 in May, and is 6.7 percent above June 2008 when it was 88.7.The increase in pending sales has been mostly from lower priced homes with demand from first time home buyers (taking advantage of the tax credit) and investors. As Yun notes, the demand from first time buyers will probably fade in another month or two.

...

"Activity has been consistently much stronger for lower priced homes,” [Lawrence Yun, NAR chief economist] said. “Because it may take as long as two months to close on a home after signing a contract, first-time buyers must act fairly soon to take advantage of the $8,000 tax credit because they must close on the sale by November 30.”

June PCE and Personal Saving

by Calculated Risk on 8/04/2009 08:31:00 AM

From the BEA: Personal Income and Outlays, June 2009

Personal income decreased $159.8 billion, or 1.3 percent, and disposable personal income (DPI) decreased $143.8 billion, or 1.3percent, in June, according to the Bureau of Economic Analysis.The temporary boost in the May saving numbers due to timing of American Recovery and Reinvestment Act of 2009 stimulus payments was reversed in June.

...

The June change in personal income reflects selected provisions of the American Recovery and Reinvestment Act of 2009, which boosted personal current transfer receipts in May much more than in June. Excluding these receipts ... personal income decreased $7.8 billion, or 0.1 percent, in June, following a decrease of $2.5 billion, or less than 0.1 percent, in May.

...

Real PCE -- PCE adjusted to remove price changes –- decreased 0.1 percent in June, in contrast to an increase of less than 0.1 percent in May.

...

Personal saving -- DPI less personal outlays -- was $504.8 billion in June, compared with $681.0 billion in May. Personal saving as a percentage of disposable personal income was 4.6 percent in June, compared with 6.2 percent in May.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the June Personal Income report. The saving rate was 4.6% in June. (5.4% with three month average)

Households are saving substantially more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.

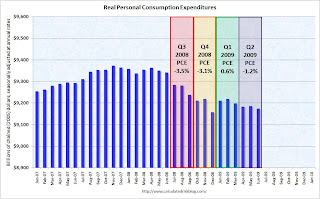

The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and has been relatively flat in Q1 and Q2 2009. Auto sales should gave a boost to PCE in Q3, but in general PCE will probably remain weak over the 2nd half of 2009 and into 2010 as households continue to repair their balance sheets.

Monday, August 03, 2009

Jim the Realtor: Prices falling at the high end

by Calculated Risk on 8/03/2009 10:30:00 PM

Prices are falling at the high end ...

"Poof, another notch down practically overnight ..."

Jim the Realtor: E-Ranch Balloon

Market and Credit Indicators

by Calculated Risk on 8/03/2009 07:42:00 PM

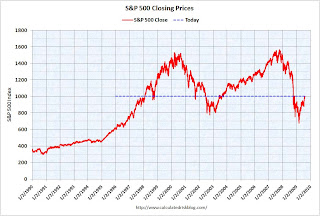

The S&P 500 closed above 1000 for the first time since last November. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 48.2% from the closing bottom (326 points), and off 36% from the peak (563 points below the closing max).

The S&P 500 first hit this level in Feb 1998; over 11 years ago.

The British Bankers' Association reported that the three-month dollar Libor rates were fixed at a new record low of 0.472%. The LIBOR peaked at 4.81875% on Oct 10, 2008.  The A2P2 spread has declined to 0.26. The record (for this cycle) was 5.86 after Thanksgiving, and this is only slightly above the normal spread of around 20 bps.

The A2P2 spread has declined to 0.26. The record (for this cycle) was 5.86 after Thanksgiving, and this is only slightly above the normal spread of around 20 bps.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

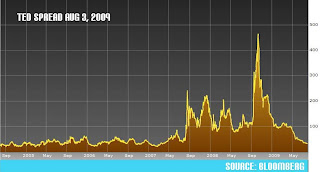

Meanwhile the TED spread has decreased further and is now at 29.4. This is the difference between the interbank rate for three month loans and the three month Treasury.

The peak was 463 on Oct 10th and the spread is now in the normal range. The final graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The final graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The spread has decreased sharply over the last few months. The spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.Some of these indicators will be interesting to follow when the Fed eventually unwinds their current positions.

FDIC Urges Timely Recognition of Home-Equity Loan Losses

by Calculated Risk on 8/03/2009 04:44:00 PM

From Bloomberg: Banks Urged to Consider Higher Home-Equity Reserves (ht Brian)

U.S. banks may need to boost reserves for potential losses on home-equity loans under guidance issued by the Federal Deposit Insurance Corp. as property prices slump from their peak in 2006.From the FDIC: Allowances for Loan and Lease Losses in the Current Economic Environment: Loans Secured by Junior Liens on 1-4 Family Residential Properties

The regulator, in a letter today to banks and examiners, urged lenders to consider issues such as whether borrowers’ total housing debt exceeds the value of their properties and whether homeowners’ first mortgages have been reworked when determining allowances for losses on the debt.

...

“Failing to properly consider the current effect of more senior liens on the collectibility of an institution’s existing junior lien loans is an inappropriate application” of accounting principles, the FDIC said in the letter.

...

In its letter, the FDIC said “the failure to timely recognize estimated credit losses could delay appropriate loss mitigation activity, such as restructuring junior lien loans to more affordable payments or reducing principal on such loans to facilitate refinancings.”

The need to consider all significant factors that affect the collectibility of loans is especially important for loans secured by junior liens on 1-4 family residential properties, both closed-end and open-end, in areas where there have been declines in the value of such properties. ...The FDIC wouldn't release a letter unless they felt many banks were delaying the recognition of home-equity losses.

[D]elaying the recognition of estimated credit losses on junior lien loans secured by 1-4 family residential properties by failing to properly consider the current effect of more senior liens on the collectibility of an institution's existing junior lien loans is an inappropriate application of GAAP. Additional supervisory action may also be warranted based on the magnitude of the deficiencies in this aspect of the institution's [allowance for loan and lease losses] ALLL process. Furthermore, the failure to timely recognize estimated credit losses could delay appropriate loss mitigation activity, such as restructuring junior lien loans to more affordable payments or reducing principal on such loans to facilitate refinancings. Examiners will continue to evaluate the effectiveness of an institution's loss mitigation strategies for loans as part of their assessment of the institution's overall financial condition.

Light Vehicle Sales Over 11 Million (SAAR) in July

by Calculated Risk on 8/03/2009 04:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

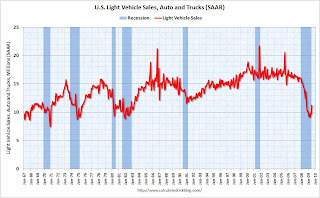

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for July (red, light vehicle sales of 11.24 million SAAR from AutoData Corp).

This is the highest vehicle sales since September 2008 (12.5 million SAAR). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Although sales were boosted by the "Cash-for-clunkers" program, I think sales would have rebounded some anyway. If "Cash-for-clunkers" is extended, then August will probably be over 11 million SAAR too, but I'd expect sales to falter a little later in the year.

U.S. Raids Colonial Bank Office

by Calculated Risk on 8/03/2009 03:03:00 PM

From Reuters: U.S. raids Colonial Bank office in Florida (ht Jim the Realtor)

Federal agents working with the U.S. Treasury's Troubled Asset Relief Program (TARP) executed search warrants at two Florida banks on Monday and Colonial Bank (CNB.N) said one of them was its office in Orlando.Colonial is operating under a Cease & Desist order, and just Friday reported to the SEC: " ... management has concluded that there is substantial doubt about Colonial’s ability to continue as a going concern."

...

A spokeswoman with the office of the Special Inspector General for the Troubled Asset Relief Program, which buys assets from troubled financial institutions to stabilize the banking industry, would only say that its agents executed two search warrants in Florida on Monday.

Colonial has about $25.5 billion in assets and would be the largest bank failure this year. No word on the purpose of the raid.

Barclays Analysts: House Prices Still Falling

by Calculated Risk on 8/03/2009 01:17:00 PM

From Bloomberg: Mortgage-Bond Rally May End on Housing Reality, Barclays Says (ht James)

While an S&P/Case-Shiller index for May showed the first month-over-month price increase since 2006 and a 2 percent seasonally adjusted annualized drop, a more-accurate reading probably would have been an annualized decline of 10 percent to 15 percent, [Barclays' analysts Ajay Rajadhyaksha and Glenn Boyd] wrote.This is similar to the argument Mark Hanson made last week (See: Housing Bottom? No, the Mother of All Head Fakes). I think we will see further price declines in the mid-to-high end bubble areas where the prices have still been sticky.

... seasonally adjusted home-price data has been skewed higher during the spring months of this year and last year by an “amplified” version of typical patterns, according to the analysts. More homeowners sell their properties during those months, cutting the share of foreclosed homes being offloaded at distressed prices, as new buyers focus on “desirable neighborhoods” where values hold up better, they said.

...

Data reflecting a reversal of the seasonal benefit, as well as “a tide of new foreclosure sales” as a moratorium on the seizing of homes put in place by banks subsides, will lead to “renewed weakness” in the fall, they said.

...

They project that U.S. home prices will fall an additional 11 percent on average before bottoming next year, bringing the total decline to 40 percent from their peak.

Ford: July sales increase 2.3 Percent Compared to July 2008

by Calculated Risk on 8/03/2009 11:19:00 AM

From CBS MarketWatch: Ford U.S. July sales rise 2.3%

Ford Motor said Monday that U.S. July sales rose 2.3% to 165,279 vehicles, reversing nearly two years of monthly year-over-year losses.Ford said the "Cash for Clunkers" program helped July sales (no kidding).

This is the first year-over-year increase reported by Ford since November 2007.

Notes: The auto companies compare sales to the same month of the previous year (so this is compared to July 2008). Auto sales will be released all morning, and I'll post a saesonally adjusted graph when a summary is available.