by Calculated Risk on 7/18/2009 03:19:00 PM

Saturday, July 18, 2009

Ritholtz: "Why are people calling a bottom for Real Estate?"

I'm working on a housing start post, but first ...

Barry Ritholtz presents the following graph and asks:

"I cannot figure out why people continue to call for a bottom in Real Estate — as if there is going to be this snap back any day now."

Well I'm one of the people who wrote yesterday that a bottom for single family housing starts might have happened:

It now appears that single family starts might have bottomed in January.A few quick points:

First, there will probably be two bottoms for Residential Real Estate. The first will be for new home sales, housing starts and residential investment. The second bottom will be for prices. For more on this, see: More on Housing Bottoms

Most people think prices when they hear the word "bottom", and the bottom for prices usually trails the bottom for housing starts - sometimes the two bottoms can happen years apart!

Second, looking for a bottom in housing starts doesn't imply "a snap back" in activity. As I noted yesterday, "I expect starts to remain at fairly low levels for some time as the excess inventory is worked off."

I'll have more on why the housing start report is somewhat good news soon.

Slip Sliding Sideways

by Calculated Risk on 7/18/2009 10:53:00 AM

Here is a graph from Jan Hatzius at Goldman Sachs (no link):  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows the end of cliff diving for retail sales, auto sales, home sales, and capital goods orders - but so far no recovery.

But GDP can still turn slightly positive.

Here is a speech from San Francisco Fed President Janet Yellen in March: The Uncertain Economic Outlook and the Policy Responses.

[I]t takes less than many people think for real GDP growth rates to turn positive. Just the elimination of drags on growth can do it. For example, residential construction has been declining for several years, subtracting about 1 percentage point from real GDP growth. Even if this spending were only to stabilize at today’s very low levels—not a robust performance at all—a 1 percentage point subtraction from growth would convert into a zero, boosting overall growth by 1 percentage point. A decline in the pace of inventory liquidation is another factor that could contribute to a pickup in growth. Inventory liquidation over the last few months has been unusually severe, especially in motor vehicles—a typical recession pattern. All it would take is a reduction in the pace of liquidation—not outright inventory building—to raise the GDP growth rate.This is a very important point for forecasters - to distinguish between growth rates and levels. Even if the economy has bottomed, it is at a very low level compared to the last few years, and the recovery will probably be very sluggish.

emphasis added

Jim the Realtor on High Rise Condo Project

by Calculated Risk on 7/18/2009 08:38:00 AM

Jim the Realtor takes us on a tour of the 679-unit Vantage Point complex in downtown San Diego. "They had been taking $25,000 deposits since 2004, but could only generate around 200 sales - not enough to qualify for Fannie/Freddie financing (need 70% pre-sold)."

Jim says the developer has returned the deposits, converted a part of the building to apartments - and is now to trying to sell again at a lower price - that Jim thinks is still too high.

Note: these new high rise condos aren't included as inventory by either the Census Bureau (new homes) or the NAR (existng homes).

Here is some info on the condo lending rules from the WSJ on June 22nd: Changes Urged to Rules on Condo Loans

In March, Fannie Mae said it would no longer guarantee mortgages on condos in buildings where fewer than 70% of the units have been sold, up from 51%. Fannie Mae also won't purchase mortgages in buildings where 15% of owners are delinquent on condo association dues or where one owner has more than 10% of units, which the firm sees as signals that a building could run into financial trouble. Freddie Mac will implement similar policies next month.

...

Fannie Mae officials say the new rules haven't been as taxing as some claim. The mortgage company said the 70% rule doesn't apply to loan applications submitted through an underwriting program used by major lenders, and that hundreds of projects submitted through that program since March 1 have been approved even though their sales levels are below 70%. Developers are also able to apply for exemptions to the new policies for loans that are manually underwritten.

...

Fannie and Freddie have also boosted fees on mortgages for condos. Buyers without a minimum 25% down payment have to pay closing-cost fees equal to 0.75% of their loan, regardless of their credit score, under new rules that took effect in April. Fannie has said it will drop that fee in August for cooperative apartments and detached condos.

"The Money Game"

by Calculated Risk on 7/18/2009 12:07:00 AM

Click on painting for larger image in new window.

Click on painting for larger image in new window.

"The Money Game"

Image posted with permission from Laguna Beach artist Scott Moore.

This images is of a five foot by seven and a half foot oil painting.

Scott posted a step-by-step outline here of how he designed and painted the image (with much more detail). In the detail you can see Fannie and Freddie, Madoff, Countrywide, and much more. Enjoy.

Friday, July 17, 2009

Bank Failures #56 & #57: Temecula Valley Bank, Temecula, CA and Vineyard Bank, Rancho Cucamonga, CA

by Calculated Risk on 7/17/2009 09:23:00 PM

This makes four today. We've discussed these two before ...

Failure swings.... to deep center

A double this time.

by Soylent Green is People

From the FDIC: California Bank & Trust, San Diego, California, Assumes All of the Deposits of Vineyard Bank, National Association, Rancho Cucamonga, California

Vineyard Bank, National Association, Rancho Cucamonga, California, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.From the FDIC: First-Citizens Bank and Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Temecula Valley Bank, Temecula, California

...

As of March 31, 2009, Vineyard Bank, N.A. had total assets of $1.9 billion and total deposits of approximately $1.6 billion.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $579 million. ... Vineyard Bank, N.A. is the 56th FDIC-insured institution to fail in the nation this year, and the seventh in California. The last FDIC-insured institution to be closed in the state was Mirae Bank, Los Angeles, on June 26, 2009.

Temecula Valley Bank, Temecula, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.

...

As of May 31, 2009, Temecula Valley Bank had total assets of $1.5 billion and total deposits of approximately $1.3 billion.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $391 million. ... Temecula Valley Bank is the 57thth FDIC-insured institution to fail in the nation this year, and the eighth in California. The last FDIC-insured institution to be closed in the state was Vineyard Bank, National Association, Rancho Cucamonga, also today.

Report: Record Drop in State Tax Revenues

by Calculated Risk on 7/17/2009 08:08:00 PM

No surprise ...

From the NY Times: State Tax Revenues at Record Low, Rockefeller Institute Finds (ht Ann)

The anemic economy decimated state tax collections during the first three months of the year ... The drop in revenues was the steepest in the 46 years that quarterly data has been available.Here is the report: State Tax Decline in Early 2009 Was the Sharpest on Record

Over all, the report found that state tax collections dropped 11.7 percent in the first three months of 2009, compared with the same period last year.

...

All the major sources of state tax revenue — sales taxes, personal income taxes and corporate income taxes — took serious blows ...

And it looks much worse in Q2:

Early figures for April and May of 2009 show an overall decline of nearly 20 percent for total taxes, a further dramatic worsening of fiscal conditions nationwide.Note: an earlier report was on state pesonal income taxes - this is all state taxes.

Bank Failure #55: BankFirst, Sioux Falls, South Dakota

by Calculated Risk on 7/17/2009 06:14:00 PM

Two down, many to follow

Quaff to banks gone bye.

by Soylent Green is People

From the FDIC:

BankFirst, Sioux Falls, South Dakota, was closed today by the South Dakota Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Alerus Financial, National Association, Grand Forks, North Dakota, to assume all of the deposits of BankFirst.That makes two today ...

...

As of April 30, 2009, BankFirst had total assets of $275 million and total deposits of approximately $254 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $91 million. ... BankFirst is the 55th FDIC-insured institution to fail in the nation this year, and the first in South Dakota. The last FDIC-insured institution to be closed in the state was First Federal Savings Bank of South Dakota, Rapid City, on April 24, 1992.

Bank Failure #54: First Piedmont Bank, Winder, Georgia

by Calculated Risk on 7/17/2009 05:47:00 PM

Does Taxpayers cool cash quench?

Not so for Piedmont.

by Soylent Green is People

From the FDIC:

First Piedmont Bank, Winder, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with First American Bank and Trust Company, Athens, Georgia, to assume all of the deposits of First Piedmont Bank.

...

As of July 6, 2009, First Piedmont Bank had total assets of $115 million and total deposits of approximately $109 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $29 million. ... First Piedmont Bank is the 54th FDIC-insured institution to fail in the nation this year, and the tenth in Georgia. The last FDIC-insured institution to be closed in the state was Neighborhood Community Bank, Newnan, on June 26, 2009.

Market, State Unemployment, Fed Balance Sheet

by Calculated Risk on 7/17/2009 04:00:00 PM

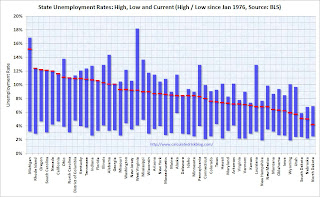

A few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states now have double digit unemployment rates.

Missouri, Washington, New Jersey and West Virginia are getting close.

Eight states are at record unemployment rates: Rhode Island, Oregon, South Carolina, Nevada, California, Florida, Georgia, and Delaware. The Atlanta Fed is now posting Economic Highlights and Financial Highlights weekly.

The Atlanta Fed is now posting Economic Highlights and Financial Highlights weekly.

I cover most of the economic data as it is released, but these are good summaries.

This graph shows the composition of the Fed's assets. From the Atlanta Fed:

While the overall size of the Fed’s balance sheet has been shrinking slightly over the last two months, the composition of the balance sheet has changed. There have been sizeable declines in short-term lending to financials and lending to nonbank credit markets. For example, combined, TAF credit, currency swaps, and the CPFF have fallen by about one-half from over $1 trillion on April 8 to just under $500 billion on July 8. Offsetting these declines have been increases in holdings of agency debt, agency mortgage backed securities (MBS), and U.S. Treasury securities. Combined, these three categories have increased by about $430 billion since April 8.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Report: CIT in Talks for DIP Financing

by Calculated Risk on 7/17/2009 03:02:00 PM

From CNBC: CIT Talks Now Include Possible Financing in Bankruptcy

CIT Group's talks with many lenders have transitioned primarily to how the company would receive financing once it files for bankruptcy, CNBC has learned.A bad sign ...

Although talks are continuing on financing outside of bankruptcy, sources said that discussions are also focused on a so-called debtor-in-possession loan, in which CIT would receive money after a bankruptcy filing.

For that reason, a bankruptcy filing is unlikely on Friday, although the situation remains fluid.