by Calculated Risk on 6/19/2009 07:13:00 PM

Friday, June 19, 2009

Bank Failure #40: First National Bank of Anthony, Anthony, KS

Carry on my wayward bank...

Now, dust in the wind

by Soylent Green is People

From the FDIC: Bank of Kansas, South Hutchinson, Kansas, Assumes All of the Deposits of First National Bank of Anthony, Anthony, Kansas

As of March 31, 2009, First National Bank of Anthony had total assets of $156.9 million and total deposits of approximately $142.5 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $32.2 million. Bank of Kansas' acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. First National Bank of Anthony is the 40th FDIC-insured institution to fail in the nation this year, and the second in Kansas.

Bank Failures 38 & 39: Southern Community Bank, Fayetteville, Georgia and Cooperative Bank, Wilmington, North Carolina

by Calculated Risk on 6/19/2009 06:11:00 PM

Crushing debt broods over banks

Fresh Winter for one.

by Soylent Green is People

From the FDIC: United Community Bank, Blairsville, Georgia Assumes All of the Deposits of Southern Community Bank, Fayetteville, Georgia

As of May 29, 2009, Southern Community Bank had total assets of $377 million and total deposits of approximately $307 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $114 million. United Community Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Southern Community Bank is the 38th FDIC-insured institution to fail in the nation this year, and the seventh in Georgia.

Blair's agents aren't advisors

More like a Capo

by Soylent Green is People

And from the FDIC: First Bank, Troy, North Carolina, Assumes All of the Deposits of Cooperative Bank, Wilmington, North Carolina

As of May 31, 2009, Cooperative Bank had total assets of $970 million and total deposits of approximately $774 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $217 million. First Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Cooperative Bank is the 39th FDIC-insured institution to fail in the nation this year, and the second in North Carolina.

California Mortgage Loan Data by Product and Type

by Calculated Risk on 6/19/2009 05:24:00 PM

NOTE: These graphs were correct, but the data was incorrect. The State added a zero to the HELOC data - I'll post corrected charts tomorrow. (ht Armin)

best to all

California Survey of Loan Servicers Q1

by Calculated Risk on 6/19/2009 02:58:00 PM

The 2009 First Quarter results from the Department of Corporations Survey of Loan Servicers has been released. Historical data is here.

There is a lot of information in this survey: the unpaid balances by loan type, the number of loans by loan type, and modification data.

From Jim Wasserman at the Sacramento Bee: Growing trouble with prime loans (ht Paul)

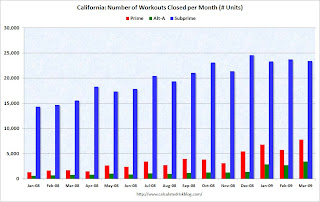

I was going through the state Department of Corporation's newest quarterly report (Q1-2009) for lenders' loan modification activities and this jumped out at me: The number of workouts initiated for prime loans is rising fast, mirroring rising unemployment in California.

The data come from lenders that report to the state as part of Gov. Arnold Schwarzenegger's Nov. 2007 Subprime agreement. These lenders service about 3.3 million loans in California, about half the state's total.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the number of loan modifications initiated by type (Prime, Alt-A, Subprime). This totals almost 1.5 million loan modifications initiated in California since January 2007 (there are 3.3 million loans including HELOCs) - so there is probably some double counting as modification negotiations are started and stopped.

Modifications for prime loans are surging (and Alt-A is increasing rapidly too). It is possible that subprime peaked during the moratorium period.

The second graph shows loan mods completed by category. The data was only broken out by category starting in Jan 2008.

The second graph shows loan mods completed by category. The data was only broken out by category starting in Jan 2008.I expect a surge in prime loan mods completed based on the mods initiated.

Note that completion can mean: account paid current (about 5%), paid-in-full (6%), modified terms (about 60% of completions), short sale (about 11%), deed-in-lieu of foreclosure (few), reductions in principal (few), and other workouts (about 15%).

As an aside, the California website is titled "Subprime". With the surge in prime modifications, I guess we're all subprime now!

FHFA Director: May Expand Loan Refinance to 125 Percent LTV

by Calculated Risk on 6/19/2009 01:11:00 PM

From Bloomberg: Obama Mortgage Refinancing Program May Expand, Lockhart Says

President Barack Obama’s program to help more homeowners refinance may be expanded to include borrowers who owe more than 105 percent of their homes’ values, Federal Housing Finance Agency Director James Lockhart said.This is part of the Home Affordable program, and only applies to homeowners with loans that Fannie and Freddie holds or guarantees.

The Obama administration is considering allowing Fannie Mae and Freddie Mac to refinance loans with current loan-to-value ratios of 125 percent or higher, Lockhart said at a National Association of Real Estate Editors Association conference in Washington yesterday.

As long as this is no cash out, increasing the LTV limit from 105% to 125% just allows Fannie and Freddie to lower the risk on loans they already own or guarantee.

Record Unemployment Rates in Eight States

by Calculated Risk on 6/19/2009 11:04:00 AM

Note: the BLS started keeping state records in 1976, so obviously this doesn't include the Depression.

From the BLS: Regional and State Employment and Unemployment Summary

Michigan again reported the highest jobless rate, 14.1 percent in May. The states with the next highest rates were Oregon, 12.4 percent; Rhode Island and South Carolina, 12.1 percent each; California, 11.5 percent; Nevada, 11.3 percent; and North Carolina, 11.1 percent. Six additional states and the District of Columbia recorded unemployment rates of at least 10.0 percent. The California, Nevada, North Carolina, Oregon, Rhode Island, and South Carolina rates were the highest on record for those states. Florida, at 10.2 percent, and Georgia, at 9.7 percent, also posted series highs. Nebraska and North Dakota registered the lowest unemployment rates, 4.4 percent each. Overall, 12 states and the District of Columbia had significantly higher jobless rates than the U.S. figure of 9.4 percent, 29 states reported measurably lower rates, and 9 states had rates little different from that of the nation.

Office Buildings: 50 Percent Off in London

by Calculated Risk on 6/19/2009 10:30:00 AM

Here are some more CRE price declines ...

From Bloomberg: Simon Halabi’s Companies Default on $1.9 Billion Debt (ht Brian)

Billionaire investor Simon Halabi’s real estate companies defaulted on 1.15 billion pounds ($1.9 billion) of bonds backed by nine London office buildings as the recession cut the value of the properties by about 50 percent.Another 'half off' sale.

...

The buildings were valued at 929 million pounds as of June 8, down from 1.83 billion pounds in October 2006, Hatfield Philips said. Halabi’s companies borrowed against the buildings in 2006. The debt, which was packaged into bonds, expires in October.

FDIC's Bair: 'Too Big to Fail' must end

by Calculated Risk on 6/19/2009 08:58:00 AM

From CNBC: 'Too Big to Fail' Doctrine Must End: FDIC's Bair

“Clearly, there has been moral hazard and lack of market discipline fed by the 'too big to fail' doctrine, and this in turn has been fed by the lack of resolution mechanism that really works for very large financial organizations and this has been a central focus of ours,” [Sheila Bair, chairman of the Federal Deposit Insurance Corp] said in an interview on CNBC."Still analyzing the whitepaper"?

...

“[Obama’s regulation is] a good opening to the process,” said Bair. “I commend the President for getting personally involved in this and taking leadership and putting his own considerable influence behind the efforts…We’re still analyzing the whitepaper and want to work with the administration and Congress constructively on this.”

...

“[The FDIC] is guaranteeing over $6 trillion right now,” she said. “The FDIC has tremendous exposure to the system so we would like a real say on systemic risk issues. [Reform overhaul] is an institutional issue, not a turf issue or a personality issue.”

Thursday, June 18, 2009

Coldwell Banker CEO: "Move-up buyers absent"

by Calculated Risk on 6/18/2009 09:30:00 PM

From Reuters: Housing Sales Lackluster This Spring: Coldwell (ht Annie)

Jim Gillespie, president and chief executive of Coldwell Banker Real Estate, in an interview with Reuters, said sales were only modest during the spring, with demand overwhelmingly dominated by first-time home buyers and investors.With lenders as sellers in a large percentage of sales, it is no surprise there are few move-up buyers. This will impact the mid-to-high end for some time.

"The more important 'move-up' buyers were absent and that is not encouraging," said Gillespie ..."They are key to a U.S. housing market recovery,"

The article also mentions a proposal for a new $15,000 tax credit.

DataQuick: California Bay Area Home Sales Increase

by Calculated Risk on 6/18/2009 07:49:00 PM

From DataQuick: Uptick in Bay Area home sales and median price

The median price paid for a Bay Area home jumped in May as more expensive homes started to sell again. The overall number of homes sold increased for the ninth month in a row, a real estate information service reported.

The median price [increase] ... was due to a small but noticeable increase in sales of homes financed with home loans for more than $417,000, commonly called “jumbo” mortgages. They accounted for 25.5 percent of the Bay Area’s home sales last month, the highest since 25.8 percent last October. Two years ago it was more than 60 percent. The presence of those high-end sales in the statistics pulled the May median up.

Sales of $800,000-plus existing single-family houses rose to 13.2 percent of all house resales last month, up from 9.8 percent in April and the highest since they were 14.8 percent of sales last October. Sales of sub-$400,000 existing houses dropped to 57.5 percent of May sales, down from 62.2 percent in April and the lowest since 56.5 percent in November.

[CR: Be careful with the median price, it is distorted by the change in mix.]

... A total of 7,447 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 4.3 percent from 7,139 in April and up 19.8 percent from 6,216 in May 2008.

The May 2008 sales were the lowest in DataQuick’s statistics, which go back to 1988. May sales have averaged 9,881 and peaked in May 2004 at 13,567 sales.

...

Last month 42.1 percent of all homes resold in the Bay Area had been foreclosed on in the prior 12 months, down from 46.4 percent in April and the lowest since the figure was 41.6 percent last September. A year ago the percentage was 27.7 percent, while the peak was 52.0 percent this February. By county, foreclosure resales ranged last month from 7.7 percent of all resales in San Francisco to 65.1 percent in Solano.

... Foreclosure activity is off its recent peak but remains high by historical standards ...