by Calculated Risk on 6/18/2009 03:41:00 PM

Thursday, June 18, 2009

DOT: U.S. Vehicles Miles increase YoY in April

This is the first same month year-over-year increase in miles driven (April 2009 compared to the April 2008) since November 2007.

Of course gasoline prices have increased sharply since April. The EIA reports that gasoline prices have increased from about $2.10 per gallon in April, to $2.70 per gallon in June - and that will probably impact miles driven.

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +0.6% (1.4 billion vehicle miles) for April 2009 as compared with April 2008. Travel for the month is estimated to be 249.5 billion vehicle miles.

Cumulative Travel for 2009 changed by -1.1% (-10.0 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.1% Year-over-year (YoY); the decline in miles driven was worse than during the early '70s and 1979-1980 oil crisis.

Note that rolling miles driven has a built in lag, and miles driven was larger in April 2009 than April 2008.

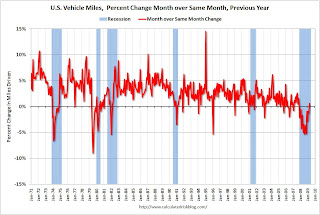

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in April 2009 were 0.6% greater than in April 2008.

This is the first same month year-over-year increase since November 2007.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for April 2009.

Those $134 Billion in Fake Bearer Bonds

by Calculated Risk on 6/18/2009 03:00:00 PM

Some mid-day amusement ...

This was funny ... I never posted on this, because it was pretty clear there wasn't any real story. Maybe the post should be titled: "How some blogs were snookered!"

But a false bottom in a suitcase?

From Dow Jones: US Says Seized 'Treasury Bonds' Are Not The Real Thing

A cache of what appeared to be around $135 billion of U.S. bonds seized at the Italian-Swiss border is, in fact, worthless, a Treasury Department spokesman said.

Two alleged Japanese citizens were stopped by Italian authorities June 4 trying to cross into Switzerland with the supposed bonds, hidden in the false bottom of a suitcase, the authorities said.

Hotel RevPAR off 18.6 Percent

by Calculated Risk on 6/18/2009 01:20:00 PM

Note: some readers might notice the occupancy rate has risen to 61% - but that is just seasonal. The hotel occupancy rate is usually the highest during the peak vacation months of June, July and August.

From HotelNewsNow.com: STR posts US results for 7-13 June 2009

In year-over-year measurements, the industry’s occupancy fell 10.1 percent to end the week at 61.0 percent. Average daily rate dropped 9.4 percent to finish the week at US$96.61. Revenue per available room for the week decreased 18.6 percent to finish at US$58.96.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.6% from the same period in 2008.

The average daily rate is down 9.4%, so RevPAR is off 18.6% from the same week last year.

Owners' Equivalent Rent Correction

by Calculated Risk on 6/18/2009 01:01:00 PM

In a post yesterday, I misread the BLS methodology on calculating Owners' Equivalent Rent.

For a discussion from the BLS of rent measures see: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and Rent of primary residence (Rent)

The survey question referenced in the above post is for weighting, not price changes.

The price relative for OER is calculated by sampling non rent-controlled renters every six months. These average rents are divided by the sample six months earlier - and converted to a monthly change (by taking to the 1/6th power).

From the BLS document above: "The first step is standardizing the collected (market) rents, putting them on a monthly basis, and adjusting them for a number of circumstances that should not affect the CPI."

To be clear - the BLS is using market rents, not the opinion of homeowners to calculated OER.

I apologize for any confusion.

More on State Income Taxes

by Calculated Risk on 6/18/2009 12:20:00 PM

The Nelson A. Rockefeller Institute of Government report on state income taxes is now available on their website: April Is the Cruelest Month

Yesterday I posted a couple of graphs based on the report.

Reader Ann suggested the following graph ... This shows the change in personal income taxes multiplied by the percent personal income tax of total state taxes in 2008.

This shows the change in personal income taxes multiplied by the percent personal income tax of total state taxes in 2008.

This adjusted the decline in personal income taxes by the relative importance of the tax.

As an example, personal income taxes make up 68.5% of the revenue in Oregon and 55.9% in New York. A decline in personal income tax revenue is more important for those states than Arizona (25.3% of the revenue).

Philly Fed: Manufacturing Sector Declines Slow "Dramatically"

by Calculated Risk on 6/18/2009 10:00:00 AM

Still contracting, but the pace of contraction has slowed "dramatically".

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Declines in the region's manufacturing sector were much less in evidence in June, according to results for this month's Business Outlook Survey. Indexes for general activity, new orders, and shipments showed notable improvement, suggesting recent declines have lessened dramatically. Indicative of ongoing weakness, however, firms reported sustained declines in employment and work hours this month.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -22.6 in May to -2.2 this month, its highest reading since September 2008 when the index was positive for one month...

Broad indicators of future activity showed significant improvement this month. The future general activity index remained positive for the sixth consecutive month and increased markedly from 47.5 in May to 60.1, its highest reading since September 2003 (see Chart). The index has now increased 71 points since its trough in December.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 18 of the past 19 months, a span that corresponds to the current recession."

Weekly Unemployment Claims

by Calculated Risk on 6/18/2009 08:29:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 13, the advance figure for seasonally adjusted initial claims was 608,000, an increase of 3,000 from the previous week's revised figure of 605,000. The 4-week moving average was 615,750, a decrease of 7,000 from the previous week's revised average of 622,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 6 was 6,687,000, a decrease of 148,000 from the preceding week's revised level of 6,835,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims decreased to 6.69 million. This is 5.0% of covered employment.

Note: continued claims peaked at 5.4% of covered employment in 1982 and 7.0% in 1975.

The four-week average of weekly unemployment claims decreased this week by 7,000, and is now 43,000 below the peak of 9 weeks ago. There is a reasonable chance that claims have peaked for this cycle, and the decline in continued claims is a positive.

However the level of initial claims (over 608 thousand) is still very high, indicating significant weakness in the job market.

Krugman points out (See: Unemployment claims and employment change)

[T]he level of new claims is basically an indicator of the rate of change of employment. And we are nowhere near the point at which employment looks ready to expand, or for that matter to stop falling at a terrifying rate.

What the figure [see Krugman's graph] suggests is that to stabilize employment, we’d have to see new claims drop below 400,000 or so.

Report: State Personal Income Tax Cliff Diving

by Calculated Risk on 6/18/2009 12:09:00 AM

From the WSJ: State Income-Tax Revenues Sink

State income-tax revenue fell 26% in the first four months of 2009 compared to the same period last year, according to a survey of states by the nonprofit Nelson A. Rockefeller Institute of Government.Here is a Draft of State Revenue Report

The report ... is one of the most up-to-date measures of how deep the recession is digging into Americans' wallets and, consequently, state coffers.

...

The time span notably includes the April 15 deadline for filing taxes, a critical time for states to collect revenues.

And a couple of graphs:

Click on graph for larger image in new window

Click on graph for larger image in new windowThe first graph, from the Nelson A. Rockefeller Institute of Government report, compares the first four months of 2009 to the first four months of 2008, and also compares April 2009 to April 2008 for eight regions. Note that the YoY change for April is worse in all regions than the first four month comparison.

The second graph is the four month comparison of each state (four states had no data).

The second graph is the four month comparison of each state (four states had no data).California isn't the worst, but the state relies heavily on income taxes.

Arizona is just getting crushed - and the pain is widespread.

Wednesday, June 17, 2009

Report: Risk Concentration, Lax Oversight, Brought Down Downey

by Calculated Risk on 6/17/2009 08:21:00 PM

Note: Downey Savings & Loan was seized by regulators on Nov 21, 2008, at an estimated cost to the Deposit Insurance Fund (DIF) of $1.4 billion.

From E. Scott Reckard at the LA Times Money & Co blog: Report: Lax oversight allowed Downey Savings' loan binge

Federal regulators responded inadequately from 2005 on as billions of dollars in high-risk mortgages piled up at weakly managed Downey Savings and Loan, the U.S. Treasury Department inspector general said in a report on last year’s failure of the Newport Beach thrift.Here is a Downey ad from the loose lending period (not in report):

The Office of Thrift Supervision ... began warning Downey management in 2002 about its heavy issuance of pay-option adjustable-rate mortgages but failed to rein in the practice, the report said.

...

Yet despite the warnings, "OTS examiners did not require Downey to limit concentrations in higher-risk loan products," said the 71-page inspector general report, posted Tuesday on the Treasury Department’s website.

Not sure of the exact date of this advertisement, but thanks for the memories! (hat tip Elroy).

From the report:

The primary causes of Downey’s failure were the thrift’s high concentrations in single-family residential loans which included concentrations in option adjustable rate mortgage (ARM) loans, reduced documentation loans, subprime loans, and loans with layered risk; inadequate risk-monitoring systems; the thrift’s unresponsiveness to OTS recommendations; and high turnover in the thrift’s management. These conditions were exacerbated by the drop in real estate values in Downey’s markets.And oversight from the OTS was insufficient:

OTS examiners did not require Downey to limit concentrations in higher-risk loan products. We believe that in light of the OTS’s repeated expressions of concern and management’s unresponsiveness to those concerns, OTS should have been more forceful, at least by 2005, to limit such concentrations. In interviews, OTS examiners commented that this would have been difficult since there was no history of losses in Downey’s option ARM, low documentation, and layered-risk loans from 2002 to 2006. However, both ND Bulletin 02-17 and the successor ND Bulletin 06-14 provide that examiners can direct thrifts to discontinue activities that lead to a specific high-risk concentration when proper oversight and controls are not in place. We believe that if there is one lesson to be learned from Downey’s failure it is that a lack of losses in the short term should not negate the need to address risk exposure such as high concentrations.

This graph from the Inspector General's report (with color added) shows the shift over time to reduced documentation loans. This add risk to already risky products and should have been a huge red flag.

This graph from the Inspector General's report (with color added) shows the shift over time to reduced documentation loans. This add risk to already risky products and should have been a huge red flag."Reduced documentation" is code word for borrower underwritten, as opposed to lender unwritten loans. Not surprisingly, reduced documentation loans perform worse than full documentation loans.

At the same time Downey was shifting to more and more reduced doc loans, they were also increasing the percentage of Option ARMs.

(See the ad above)

This was a toxic combination of risk layering.

BofE's Mervyn King : No Bank should be too big to fail

by Calculated Risk on 6/17/2009 06:01:00 PM

A couple of quotes from The Times: Mervyn King presses his case to limit size of banks

Mervyn King said he wanted a restriction on the size of banks, and that investment banks might have to be split from retail banks. ... he said banks should not be allowed to grow so large that they were deemed too big to fail.That last sentence shows King's frustration - after the crisis is over, it will be business as usual, unless the regulatory reforms have teeth.

...

“It is not sensible to allow large banks to combine high street retail banking with risky investment banking or funding strategies, and then provide an implicit state guarantee against failure,” Mr King said.

The State could limit providing a guarantee for depositors to high street banks that offered straight-forward services. Alternatively, riskier banks should have to hold much more capital. Finally, banks may have to provide their own plan for how they could be wound down in the event of failure. “Making a will should be as much a part of good housekeeping for banks as it is for the rest of us,” Mr King said.

... he was not sure how the Bank [BofE] would use its enhanced authority because its new tools were limited to issuing warnings that were likely to be ignored. “The Bank finds itself in a position rather like that of a church whose congregation attends weddings and burials but ignores the sermons in between,” he said.

Even then it is just a matter of time - and lobbying. The banks are notorious for having no institutional memory.