by Calculated Risk on 5/28/2009 05:56:00 PM

Thursday, May 28, 2009

Report: GM to File Bankruptcy Monday

From Bloomberg: GM Said to Plan June 1 Bankruptcy as Debt Plan Gains

General Motors Corp. ... plans to file for bankruptcy protection on June 1 and sell most of its assets to a new company, people familiar with the matter said.GM SEC Filing:

As provided in the Proposal, the U.S. Treasury has indicated that if holders of Notes of an amount satisfactory to the U.S. Treasury have provided (prior to 5:00 pm EDT on Saturday, May 30, 2009) statements of support satisfactory to the U.S. Treasury indicating that they will not oppose the 363 Sale (if conducted on terms substantially consistent with the Proposal), the U.S. Treasury currently would propose that New GM issue to Old GM as a portion of the consideration offered in connection with the 363 Sale 10% of the common equity of New GM and warrants to purchase an aggregate of 15% of the equity of New GM. The U.S. Treasury has indicated that if these statements of support are not received, the amount of common equity and warrants that it would propose be issued by New GM to Old GM would be substantially reduced or eliminated.Also from the NY Times: New G.M. Plan Gets Support From Key Bondholders

It sounds like they made the bondholders a deal they couldn't refuse.

ATA Truck Tonnage Index Declines 2.2 Percent in April

by Calculated Risk on 5/28/2009 04:00:00 PM

Press Release: ATA Truck Tonnage Index Fell Another 2.2 Percent in April (ht dryfly)

The American Trucking Associations' advance seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 2.2 percent in April, after plunging 4.5 percent in March. April marked the second sequential decrease. In April, the SA tonnage index equaled just 99.2 (2000 = 100), which is its lowest level since November 2001. The not seasonally adjusted (NSA) index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, was down 2.9 percent from March. In April, the NSA index equaled 101.6.

Compared with April 2008, tonnage contracted 13.2 percent, which was the worst year-over-year decrease of the current cycle and the largest drop in thirteen years. In March 2009, tonnage dropped 12.2 percent from a year earlier.

ATA Chief Economist Bob Costello said truck tonnage is getting hit from both the recession and the massive inventory correction that the supply chain is currently undergoing. "While most key economic indictors are decreasing at a slower rate, the year-over-year contractions in truck tonnage accelerated because businesses are right-sizing their inventories, which means fewer truck shipments," Costello said. "The absolute dollar value of inventories has fallen, but sales have decreased as much or more, which means that inventories are still too high for the current level of sales. Until this correction is complete, freight will be tough for motor carriers." Costello added that truck freight has yet to hit bottom and it could be a few more months before this occurs.

emphasis added

| Click on graph for larger image in new window. This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

Berkshire Hathaway's Sokol: "No Green Shoots"

by Calculated Risk on 5/28/2009 02:41:00 PM

From Reuters: MidAmerican's Sokol sees US housing staying weak (ht Alexander, Cord)

David Sokol, chairman of Berkshire Hathaway Inc's MidAmerican Energy Holdings and a contender to succeed Warren Buffett, warned that the U.S. housing market still has a ways to go before bottoming out.

...

"As we look at the economy, I have to be honest: we're not seeing the green shoots," Sokol said ... "We think the official statistics of 10 to 12 months' backlog is actually nearly twice that amount," ...

"There is an enormous shadow backlog of about-to-be foreclosed homes and of individuals who need to sell but have time, and there are already six (for sale) signs on their block," he said.

... "It will be be mid-2011 before we see a balancing of the existing home sales market." He defined "balanced" as a six-month backlog.

New Home Sales: The Distressing Gap

by Calculated Risk on 5/28/2009 12:11:00 PM

For graphs based on the new home sales report this morning, please see: New Home Sales Flat in April

Yesterday, the National Association of Realtors (NAR) reported that "Distressed properties ... accounted for 45 percent of all sales in April". Distressed sales include REO sales (foreclosure resales) and short sales, and based on the 4.68 million existing home sales (SAAR) that puts distressed sales at a 2.1 million annual rate in April.

That fits with the MBA foreclosure and delinquency data released this morning that shows that "3.85% of all mortgages somewhere in the foreclosure process at the end of the first quarter".

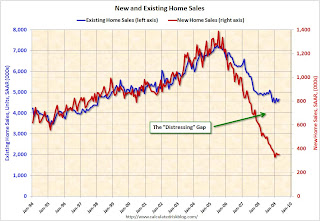

All this distessed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including April new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through March.

As I've noted before, I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Over time, as we slowly work through the distressed inventory of existing homes, I expect existing home sales to fall further - See Existing Home Sales: Turnover Rate - and eventually for the distressing gap to close.

MBA: Mortgage Delinquencies, Foreclosures Hit Records

by Calculated Risk on 5/28/2009 10:21:00 AM

From Bloomberg: Mortgage Delinquencies, Foreclosures Hit Records on Job Cuts

... The U.S. delinquency rate jumped to a seasonally adjusted 9.12 percent and the share of loans entering foreclosure rose to 1.37 percent, the Mortgage Bankers Association said today. Both figures are the highest in records going back to 1972.We're all subprime now!

...

The inventory of new and old defaults rose to 3.85 percent, the MBA in Washington said. Prime fixed-rate mortgages given to the most creditworthy borrowers accounted for the biggest share of new foreclosures at 29 percent, and prime adjustable-rate mortgages were 24 percent, Brinkmann said. It shows the mortgage problem has shifted from a subprime issue to a job-loss problem, he said.

emphasis added

UPDATE: From MarketWatch: Foreclosures break another record in first quarter

Total foreclosure inventory was also up, with 3.85% of all mortgages somewhere in the foreclosure process at the end of the first quarter, compared with 3.3% in the fourth quarter -- also a record jump.Note: I haven't seen a copy of the MBA report yet.

...

While subprime, option ARM and Alt-A loans were a focus of the foreclosure problem initially, the foreclosure rate on prime fixed-rate loans has doubled in the last year.

"For the first time since the rapid growth of subprime lending, prime fixed-rate loans now represent the largest share of new foreclosures," Brinkmann said -- evidence, he added, of the impact that the recession and drops in employment are having on the foreclosure numbers.

New Home Sales Flat in April

by Calculated Risk on 5/28/2009 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 352 thousand. This is essentially the same as the revised rate of 351 thousand in March. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the second lowest sales for April since the Census Bureau started tracking sales in 1963. (NSA, 33 thousand new homes were sold in March 2009; the record low was 32 thousand in April 1982).

As the graph indicates, sales in April 2009 were substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in April 2009 were at a seasonally adjusted annual rate of 352,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And another long term graph - this one for New Home Months of Supply.

This is 0.3 percent (±14.5%)* above the revised March rate of 351,000, but is 34.0 percent (±11.0%) below the April 2008 estimate of 533,000.

There were 10.1 months of supply in April - significantly below the all time record of 12.4 months of supply set in January.

There were 10.1 months of supply in April - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of April was 297,000. This represents a supply of 10.1months at the current sales rate.

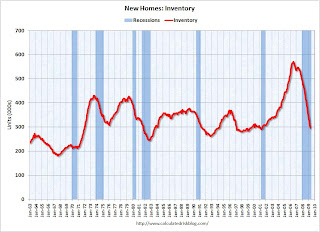

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

It appears the months-of-supply for inventory has peaked, and there is some chance that sales of new homes has bottomed for this cycle - but we won't know for many months. However any recovery in sales will likely be modest because of the huge overhang of existing homes for sale. I'll have more ...

Unemployment Claims: Continued Claims at Record 6.79 Million

by Calculated Risk on 5/28/2009 08:30:00 AM

Another week, another record for continued claims.

The DOL reports on weekly unemployment insurance claims:

In the week ending May 23, the advance figure for seasonally adjusted initial claims was 623,000, a decrease of 13,000 from the previous week's revised figure of 636,000. The 4-week moving average was 626,750, a decrease of 3,000 from the previous week's revised average of 629,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 16 was 6,788,000, an increase of 110,000 from the preceding week's revised level of 6,678,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims are now at 6.79 million - an all time record. This is 5.1% of covered employment.

Note: continued claims peaked at 5.4% of covered employment in 1982 and 7.0% in 1975. So this isn't a record as a percent of covered employment.

The four-week average decreased this week by 3,000, and is now 32,000 below the peak of 7 weeks ago. There is a reasonable chance that claims have peaked for this cycle, but it is still too early to be sure, and if so, continued claims should peak soon.

The level of initial claims (over 623 thousand) is still very high, indicating significant weakness in the job market.

Government Considers Single Banking Regulator

by Calculated Risk on 5/28/2009 12:22:00 AM

From the WaPo: U.S. Weighs Single Agency to Regulate Banking Industry

Senior administration officials are considering the creation of a single agency to regulate the banking industry ...Another potential problem was that many banks and mortgage lenders were regulated by the states. See Conference of State Bank Regulators (CSBS) Update: Many state regulators did an excellent job (I was in contact with several in 2005) - however in making regulatory changes, we need to be aware of the role of the states.

They favor vesting the Federal Reserve with new powers as a systemic risk regulator, with broad responsibility for detecting threats to the financial system. The powers would include oversight of previously unregulated markets, such as the derivatives trade, and of market participants such as hedge funds.

Officials also favor the creation of a new agency to enforce laws protecting consumers of financial products such as mortgages and credit cards.

...

Among these ideas is the creation of a single agency to regulate banks. The new regulator would assume responsibility for the safety and soundness of banks, currently divided among the Fed and three other agencies: the Office of the Comptroller of the Currency, the Office of Thrift Supervision and the Federal Deposit Insurance Corp. The OCC and the OTS would probably disappear, while the Fed and the FDIC would retain other responsibilities.

...

Officials also are considering giving the FDIC the power to seize large financial firms, such as the parent companies of banks, to prevent their collapse.

Wednesday, May 27, 2009

FDIC PPIP LLP DOA?

by Calculated Risk on 5/27/2009 08:39:00 PM

From the WSJ: Plan to Buy Banks' Bad Loans Founders

The Legacy Loans Program [LLP], being crafted by the Federal Deposit Insurance Corp., [as] part of the $1 trillion Public Private Investment Program [PPIP] ... is stalling and may soon be put on hold, according to people familiar with the matter.Also FDIC Chairwoman Sheila Bair said today that banks would not be allowed to use the PPIP to buy their own assets. But she didn't rule out banks buying assets from each other. From Rolfe Winkler writing at Naked Capitalism: FDIC Won't Rule Out Banks as Buyers of Toxic Assets

...

PPIP was to be split between the FDIC program, which would buy whole loans, and one run by the Treasury Department focusing on securities. Treasury is expected to push ahead with its plan -- the larger and more substantial of the two -- and could begin purchases sometime this summer.

Below, I've transcribed Bair's full response to the question she was asked about PPIP....This is probably OK if a healthy bank is a buyer only and doesn't sell any assets using the PPIP. But banks shouldn't be both buyers and sellers.No [banks] will not be able to bid on their own assets. I think there has been some confusion about that....There will be no structure where we would allow banks to bid on their own assets. I think there have been separate issues about whether banks can be buyers on other bank assets and I think that's an issue that we continue to look at.

Record High Yield Curve

by Calculated Risk on 5/27/2009 07:01:00 PM

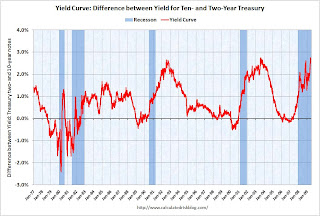

Earlier we discussed the rising ten year yield (treasury sell-off) and the impact on mortgage rates ... and here is some more interest rate news: the yield curve (ten year yield minus two year yield) is at record levels.

From Bloomberg: Yield Curve Steepens to Record as Debt Sales Surge

The difference in yields between Treasury two- and 10-year notes widened to a record on concern surging sales of U.S. debt will overwhelm the Federal Reserve’s efforts to keep borrowing costs low.

The so-called yield curve steepened to 2.75 percentage points, surpassing the previous record of 2.74 percentage points set on Aug. 13, 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the difference between the ten- and two-year yields.

Usually a steep yield curve precedes a period of decent growth, but several analysts suggest the current ten year sell-off is due to concerns about increased Treasury issuance to finance the deficit. Whatever the reason, this is a challenge for the Fed to keep mortgage rates low.

NOTE: For amusement, check out this New Yorker cartoon by David Sipress: "Wasn't that Paul Krugman?"