by Calculated Risk on 5/22/2009 10:40:00 PM

Friday, May 22, 2009

FDIC Bank Failures: By the Numbers

Three banks were closed by the FDIC this week, for a total of 36 banks so far in 2009. The largest was BankUnited in Florida with $12.8 billion in assets.

To put those failures into perspective, here are three graphs: the first shows the number of bank failures by year since the FDIC was founded, and the second graph includes bank failures during the Depression. The third graph shows the size of the assets and deposits (in current dollars). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Back in the '80s, there was some minor multiple counting ... as an example, when First City of Texas failed on Oct 30, 1992 there were 18 different banks closed by the FDIC. This multiple counting was minor, and there were far more bank failures in the late '80s and early '90s than this year.

Note: there are approximately 8,300 FDIC insured banks currently. The second graph includes the 1920s and shows that failures during the S&L crisis were far less than during the '20s and early '30s (before the FDIC was enacted).

The second graph includes the 1920s and shows that failures during the S&L crisis were far less than during the '20s and early '30s (before the FDIC was enacted).

Note how small the S&L crisis appears on this graph! The number of bank failures soared to 4000 (estimated) in 1933.

During the Roaring '20s, 500 bank failures per year was common - even with a booming economy - with depositors typically losing 30% to 40% of their bank deposits in the failed institutions. No wonder even the rumor of a problem caused a run on the bank! The third graph shows the bank failures by total assets and deposits per year in current dollars adjusted with CPI. This data is from the FDIC (1) and starts in 1934.

The third graph shows the bank failures by total assets and deposits per year in current dollars adjusted with CPI. This data is from the FDIC (1) and starts in 1934.

WaMu accounted for a vast majority of the assets and deposits of failed banks in 2008, and it is important to remember that WaMu was closed by the FDIC, and sold to JPMorgan Chase Bank, at no cost to the Deposit Insurance Fund (DIF).

There are many more bank failures to come over the next couple of years, mostly because of losses related to Construction & Development (C&D) and Commercial Real Estate (CRE) loans, but so far, especially excluding WaMu, the total assets and deposits of failed FDIC insured banks is much smaller than in the '80s and early '90s.

Of course this is FDIC insured bank failures only. An investment bank like Lehman isn't included. Nor is the support for AIG, Citigroup and all the other "too big to fail" institutions ...

(1) The FDIC assets and deposit data is here. Click on Failures & Assistance Transactions.

Bank Failure #36: Citizens National Bank, Macomb, Illinois

by Calculated Risk on 5/22/2009 07:43:00 PM

Stronger banks ingest the weak

No morsel remains

by Soylent Green is People

From the FDIC: Morton Community Bank, Morton, Illinois, Assumes All of the Deposits of Citizens National Bank, Macomb, Illinois

Citizens National Bank, Macomb, Illinois, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Morton Community Bank, Morton, Illinois, to assume all of the deposits of Citizens National Bank, excluding those from brokers.

...

As of May 13, 2009, Citizens National Bank had total assets of $437 million and total deposits of approximately $400 million. Morton Community Bank agreed to purchase approximately $240 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $106 million. Morton Community Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Citizens National Bank is the 36th FDIC-insured institution to fail in the nation this year, and the fifth in Illinois. The last FDIC-insured institution to be closed in the state was Strategic Capital Bank, Champaign, earlier today.

Bank Failure #35: Strategic Capital Bank, Champaign , Illinois

by Calculated Risk on 5/22/2009 07:07:00 PM

Addicted to public cash

Only flushed away

by Soylent Green is People

From the FDIC: Midland States Bank, Effingham, Illinois, Assumes All of the Deposits of Strategic Capital Bank, Champaign , Illinois

Strategic Capital Bank, Champaign, Illinois, was closed today by the Illinois Department of Financial and Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Midland States Bank, Effingham, Illinois, to assume all of the deposits of Strategic Capital Bank.

...

As of May 13, 2009, Strategic Capital Bank had total assets of $537 million and total deposits of approximately $471 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $173 million. Midland States Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Strategic Capital Bank is the 35th FDIC-insured institution to fail in the nation this year, and the fourth in Illinois. The last FDIC-insured institution to be closed in the state was Heritage Community Bank, Glenwood, on February 27, 2009.

Bernanke: "What have I done?"

by Calculated Risk on 5/22/2009 04:14:00 PM

The post title needs context ...

We all have moments we will never forget. One of mine occurred when I entered Harvard Yard for the first time, a 17-year-old freshman. It was late on Saturday night, I had had a grueling trip, and as I entered the Yard, I put down my two suitcases with a thump. I looked around at the historic old brick buildings, covered with ivy. Parties were going on, students were calling to each other across the Yard, stereos were blasting out of dorm windows. I took in the scene, so foreign to my experience, and I said to myself, "What have I done?"Excerpts from Fed Chaiman Bernanke's commencement address at Boston College School of Law, Newton, Massachusetts on dealing with the reality of unpredictability:

Ben Bernanke, May 22, 2009

I'd like to offer a few thoughts today about the inherent unpredictability of our individual lives and how one might go about dealing with that reality. As an economist and policymaker, I have plenty of experience in trying to foretell the future, because policy decisions inevitably involve projections of how alternative policy choices will influence the future course of the economy. The Federal Reserve, therefore, devotes substantial resources to economic forecasting. Likewise, individual investors and businesses have strong financial incentives to try to anticipate how the economy will evolve. With so much at stake, you will not be surprised to know that, over the years, many very smart people have applied the most sophisticated statistical and modeling tools available to try to better divine the economic future. But the results, unfortunately, have more often than not been underwhelming. Like weather forecasters, economic forecasters must deal with a system that is extraordinarily complex, that is subject to random shocks, and about which our data and understanding will always be imperfect. In some ways, predicting the economy is even more difficult than forecasting the weather, because an economy is not made up of molecules whose behavior is subject to the laws of physics, but rather of human beings who are themselves thinking about the future and whose behavior may be influenced by the forecasts that they or others make. To be sure, historical relationships and regularities can help economists, as well as weather forecasters, gain some insight into the future, but these must be used with considerable caution and healthy skepticism.And on how he ended up becoming an economist:

After I arrived at college, unpredictable factors continued to shape my future. In college I chose to major in economics as a compromise between math and English, and because a senior economics professor liked a paper I wrote and offered me a summer job. In graduate school at MIT, I became interested in monetary and financial history when a professor gave me several books to read on the subject. I found historical accounts of financial crises particularly fascinating. I determined that I would learn more about the causes of financial crises, their effects on economic performance, and methods of addressing them. Little did I realize then how relevant that subject would become one day. Later I met my wife Anna, to whom I have been married now for 31 years, on a blind date.I'm sure someone has a good blind date joke that would fit here.

The Oil Cushion: Getting Smaller

by Calculated Risk on 5/22/2009 03:09:00 PM

Last year I wrote a post about how falling oil prices would provide some cushion for the U.S. economy: The Oil Cushion. Here is another update ...

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Last quarter I noted:

"The good news is at current oil prices (U.S. spot prices averaged about $39 per barrel in February), oil related PCE will be in the $250 billion seasonally adjusted annual rate (SAAR) range in Q1 - well below the $440 billion SAAR of the first 8 months of 2008.

This is a savings of about $16 billion per month compared to the first 8 months of 2008. That savings will definitely provide a cushion for consumers."

As expected, the BEA reported "PCE, Gasoline, fuel oil, and other energy goods" at $265 billion (SAAR) in Q1.

Now, with spot prices pushing $60 per barrel, oil related PCE will probably come in close to $300 billion (SAAR) in Q2.

That is still provides a sizable cushion compared to the first eight months of 2008 (about $11 billion per month), but this is a drag compared to Q1.

Data sources:

PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117.

Oil prices from EIA U.S. Spot Prices.

Mortgage Pig Wear for Charity is Back!

by Calculated Risk on 5/22/2009 01:16:00 PM

A great Memorial Day gift for the UberNerd in your family! And the proceeds go to fight cancer ...

But first ... Cathy shared this email from Tanta:

Long time the CFO she sought,

And rested she from her own QC

And stood a while in thought.

And as in uffish thought she froze

The S&P with eyes aflame

Came woofling through her CMOs

And burbled as it came.

One two! One two! And through and through!

The rater’s blade went snicker-snack

She started B but with a C

She came galumphing back.

“And hast thou slain the MBS?

My whole loans too? My hedges all?

O frabjous day! Alas! Allay!

My margin got a call!”

‘Twas brillig, and the slivey toves . . .

Doris Tanta Dungey, July 18, 2007

(based on "Jabberwocky" by Lewis Carroll)

Notes from Cathy (Tanta' sister):

These items are produced as they are ordered and we do apologize about the size and color confusion. The best method is to enter this information in the PayPal message box when completing the order.So far the Mortgage Pig Wear raised over $3,500 for charity! From more on other donations, see: Tanta's Bench and Charity Update

We will accept check orders outside of Ebay but that will slow things down. Please EMAIL: rwstick AT yahoo DOT com (Dick) with the item, size and color and we will return the cost with shipping. Once the check is received with shipping instructions we will process the order.

Back in October, after Tanta came home from the hospital and agreed to come to Ohio with me, we had an idea to create Mortgage Pig Wear and donate the proceeds from the sales to the UMMS Greenebaum Cancer Center.

We have friends in Springboro, OH who own a small, local embroidery company called Image Mark-it that is owned and staffed by the type of caring folks who would want to be involved in a project like this. Jumped at the chance, is more like it.

We enlisted her 16 year-old nephew (my son) to handle the shipping and for that he would receive $1.00 per item in his college fund. Tanta would provide the "quality control" or lovingly ride herd on him. She couldn't wait.

Over the past 4 weeks we have "digitized" the pig for the embroidery on sweatshirts and polos and created high quality photo transfers for T-shirts and sweatshirts. Tanta lived long enough to see the samples but not to see the items go into production and be offered for sale. I still can't believe it.

I worried about what to do with this on Saturday so I simply asked Tanta. She wanted us to proceed. My son and my husband both asked her as well - and both got the same answer "Please go ahead with The Mortgage Pig Wear".

In the last day or so as I read the various tributes to her, I saw references to cure vs care. So we've made a small change - we're offering the embroidered pig items with proceeds donated to the Ovarian Cancer Research Fund (www.ocrf.org) and the photo-transfer items split between UMMS Greenebaum and OSUMC James Cancer Centers.

I hope you enjoy wearing these as much as the folks at Image Mark-it and I have enjoyed creating them. We are planning to work very hard to keep up with demand - and for all of us it's a labor of love.

| Holiday |

|

| Click on the Mortgage Pig™ for a larger image in new window. |

| Slap it |

|

| Convexity |

|

Credit Crisis Indicators

by Calculated Risk on 5/22/2009 09:50:00 AM

From the British Bankers' Association reported that the three-month dollar Libor rates were fixed at 0.66%. The LIBOR peaked at 4.81875% on Oct 10, 2008.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

There has been improvement in the A2P2 spread. This has declined to 0.48. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread of around 20 bps.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread has decreased further and is now at 48.45. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.The spread has decreased sharply over the last few months. The spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

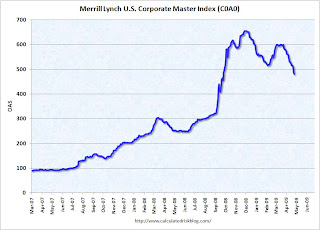

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.Back in early March, Warren Buffett mentioned that credit conditions were tightening again - and this was probably one of the indexes he was looking at. Since March, the index has declined - but is still above normal levels.

Overall it appears the credit crisis has eased significantly.

WSJ: Ghost Malls

by Calculated Risk on 5/22/2009 09:07:00 AM

Not a new topic, but still interesting ...

From the WSJ: Recession Turns Malls Into Ghost Towns

One industry rule of thumb holds that any large, enclosed mall generating sales per square foot of $250 or less -- the U.S. average is $381 -- is in danger of failure. By that measure, Eastland is one of 84 dead malls in a 1,032-mall database compiled by Green Street. (The database focuses heavily on malls owned by publicly traded landlords and doesn't account for several dozen failing malls in private hands.) If retail sales continue to decline at current rates, the dead-mall roster could exceed 100 properties by the end of this year, according to Green Street. That's up from an estimated 40 failing malls in 2006, before the recession began.

"This time around, because of the dramatic changes in consumer spending practices, we're very likely to see more malls in the death spiral than we've ever seen before," says Green Street analyst Jim Sullivan.

...

For towns and cities that are home to dying malls, the fallout can be devastating. Malls hire hundreds of workers and are significant contributors to the local tax base. In suburbs and small towns, malls often are the only major public spaces and the safest venues for teenagers to shop, hang out and seek part-time work.

Thursday, May 21, 2009

WaPo: Auto Bankruptcies Next Week: GM in, Chrysler out

by Calculated Risk on 5/21/2009 10:28:00 PM

From the WaPo: U.S. to Steer GM Toward Bankruptcy

The Obama administration is preparing to send General Motors into bankruptcy next week under a plan that would give the automaker tens of billions of dollars more in public financing ...That is fast!

The move comes as the administration prepares to lift the nation's other faltering car company, Chrysler, from bankruptcy as soon as next week ...

CRE Bust: UK Style

by Calculated Risk on 5/21/2009 08:52:00 PM

From Bloomberg: British Land Has $6.1 Billion Loss on Property Slump (ht Adam)

British Land’s real estate was valued at 5.8 billion pounds on March 31, about 28 percent less than a year earlier, [British Land said in a statement today]. More than half of the properties are retail warehouses and malls, and the rest are office buildings.Rents back to 1991. Property values off 28%. Ouch.

...

Most of British Land’s office buildings are in the City of London, where rents are expected to fall back to 1991 levels by the end of this year ... as job losses and a mistimed building boom depress prices.

...

The City of London now has enough empty space to hold two- thirds of Canary Wharf, its rival financial district 1 1/2 miles to the east. About 9 million square feet (855,000 square meters) are available in the City and that may climb to 12 million by the end of 2009, according to CB Richard Ellis Group Inc. Rents that reached a high of 65 pounds per square foot in mid-2007 are forecast to fall to 40 pounds by the end of this year ...