by Calculated Risk on 5/14/2009 08:31:00 AM

Thursday, May 14, 2009

Unemployment Claims: Continued Claims Surge Past 6.5 Million

The DOL reports on weekly unemployment insurance claims:

In the week ending May 9, the advance figure for seasonally adjusted initial claims was 637,000, an increase of 32,000 from the previous week's revised figure of 605,000. The 4-week moving average was 630,500, an increase of 6,000 from the previous week's revised average of 624,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 2 was 6,560,000, an increase of 202,000 from the preceding week's revised level of 6,358,000. The 4-week moving average was 6,337,250, an increase of 128,750 from the preceding week's revised average of 6,208,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four-week moving average is at 630,500, off 28,250 from the peak 5 weeks ago.

Continued claims are now at 6.56 million - an all time record.

The second graph shows the four-week average of initial unemployment claims and recessions.

The second graph shows the four-week average of initial unemployment claims and recessions.Typically the four-week average peaks near the end of a recession.

The four-week average increased this week by 6,000, and is now 28,250 below the peak. There is a reasonable chance that claims have peaked for this cycle, but it is still too early to be sure, and if so, continued claims should peak soon.

The level of initial claims (over 630 thousand) is still very high, indicating significant weakness in the job market.

Summary, Futures and the Tan Man

by Calculated Risk on 5/14/2009 12:11:00 AM

Here is a summary for Wednesday:

The administration asked Congress to move quickly on legislation that would allow federal oversight of many kinds of exotic instruments, including credit-default swaps ... The Treasury secretary, Timothy F. Geithner, said the measure should require swaps and other types of derivatives to be traded on exchanges or clearinghouses and backed by capital reserves, much like the capital cushions that banks must set aside in case a borrower defaults on a loan. ...

The proposal will probably force many types of derivatives into the open, reducing the role of the so-called shadow banking system that has arisen around them.

[T]he SEC sent a "Wells" notice to Mozilo weeks ago alerting him of the planned charges, which included alleged violations of insider-trading laws, as well as failing to disclose material information to shareholders.The U.S. futures are off slightly tonight:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the Asian markets are mostly off 1% to 3%.

Best to all.

Wednesday, May 13, 2009

MEW, Consumption and Personal Saving Rate

by Calculated Risk on 5/13/2009 09:29:00 PM

Here is a new paper on Mortgage Equity Withdrawal (MEW): House Prices, Home Equity-Based Borrowing, and the U.S. Household Leverage Crisis by Atif Mian and Amir Sufi (both University of Chicago Booth School of Business and NBER) (ht Jan Hatzius)

From the authors abstract (the entire paper is available at the link):

Using individual-level data on homeowner debt and defaults from 1997 to 2008, we show that borrowing against the increase in home equity by existing homeowners is responsible for a significant fraction of both the sharp rise in U.S. household leverage from 2002 to 2006 and the increase in defaults from 2006 to 2008. Employing land topology-based housing supply elasticity as an instrument for house price growth, we estimate that the average homeowner extracts 25 to 30 cents for every dollar increase in home equity. Money extracted from increased home equity is not used to purchase new real estate or pay down high credit card debt, which suggests that consumption is a likely use of borrowed funds. Home equity-based borrowing is stronger for younger households, households with low credit scores, and households with high initial credit card utilization rates. Homeowners in high house price appreciation areas experience a relative decline in default rates from 2002 to 2006 as they borrow heavily against their home equity, but experience very high default rates from 2006 to 2008. Our estimates suggest that home equity based borrowing is equal to 2.3% of GDP every year from 2002 to 2006, and accounts for over 20% of new defaults in the last two years.A couple of key points:

emphasis added

And this brings us to the personal saving rate.

In an earlier post I argued that the saving rate declined into the early '90s because of demographic changes, however I expected the saving rate to start to rise as the boomers reached their mid-40s (in the late 1990s). Obviously this didn't happen.

I posited that the wealth effect from the twin bubbles - stock market and housing - had led the boomers into believing they had saved more than they actually had.

This research suggests that MEW played a significant role in suppressing the saving rate too. And since the Home ATM is now closed, this is more evidence that the saving rate will increase (probably back to 8% or so) - and keep pressure on the growth of personal consumption expenditures (PCE).

For background, here are couple of graphs:

Click on graph for large image.

Click on graph for large image.The first graph shows the annual saving rate back to 1929.

Notice that the saving rate went negative during the Depression as household used savings to supplement income. And the saving rate rose to over 25% during WWII.

There is a long period of a rising saving rate (from after WWII to about 1974) and a long period of a declining saving rate (from the early '80s to 2008). (corrected text)

Some of the change in saving rate was related to demographics. As the large baby boom cohort entered the work force in the mid '70s, the saving rate declined (younger families usually save less). But, as I noted above, I expected the saving rate to start to increase in the last '90s.

And here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction through Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

NOTE: Anyone who wants the Equity Extraction data, please see this post for a spreadsheet and how to credit Dr. Kennedy's work.

This graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".This measure is near zero ($7.2 billion for the quarter) and is an estimate of the impact of MEW on consumption. When people refinance with cash out or draw down HELOCs, they usually spend the money.

William Seidman

by Calculated Risk on 5/13/2009 07:02:00 PM

From Bloomberg: William Seidman, Who Led Cleanup of S&L Crisis, Dies

In his memoir [published in 1993], Seidman offered a set of lessons learned. They included, “Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid.”Those two sentences should be emblazoned above every desk of every financial regulator.

My condolences to Mr. Seidman's family and friends.

Regulatory Reform for Derivatives

by Calculated Risk on 5/13/2009 05:38:00 PM

From the U.S. Treasury: Regulatory Reform Over-The-Counter (OTC) Derivatives

As the AIG situation has made clear, massive risks in derivatives markets have gone undetected by both regulators and market participants. But even if those risks had been better known, regulators lacked the proper authorities to mount an effective policy response.The press release has the details, but basically the Obama Administration is proposing all derivatives must be centrally cleared and subject to oversight and regulation.

Today, to address these concerns, the Obama Administration proposes a comprehensive regulatory framework for all Over-The-Counter derivatives.

From Reuters: U.S. regulators propose OTC derivatives crackdown

Authorities proposed subjecting all over-the-counter derivatives dealers to "a robust regime of prudential supervision and regulation," including conservative capital, reporting and margin requirements.About time.

Treasury Secretary Timothy Geithner, Securities and Exchange Commission Chairman Mary Schapiro, and Mike Dunn, acting chairman of the Commodity Futures Trading Commission, announced the proposal at a news conference.

Under current law, over-the-counter (OTC) derivatives are largely excluded or exempted from regulation.

"We're going to require for the first time all standardized over-the-counter derivative products be centrally cleared," said Geithner.

Market Update

by Calculated Risk on 5/13/2009 04:00:00 PM

Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The market is only off 43.5% from the peak.

Note: I'm still looking for Derivatives announcement (previous thread)

Geithner to Announce Tougher Derivatives Rules at 4 PM ET

by Calculated Risk on 5/13/2009 03:50:00 PM

From Dow Jones: Treasury, SEC, CFTC To Unveil OTC Derivatives Regulatory Plan

The Treasury Department will unveil its plan for regulatory reform of over-the-counter derivatives late Wednesday afternoon, Michael Dunn, the acting chairman of the Commodity Futures Trading Commission, said Wednesday.Here is the CNBC feed. (hopefully)

Speaking at an advisory committee meeting at the CFTC's offices, Dunn said he will appear alongside Treasury Secretary Timothy Geithner and Securities and Exchange Commission Chairman Mary Schapiro at 4 p.m. EDT to discuss the details.

"Green Shoots Wilting"

by Calculated Risk on 5/13/2009 01:32:00 PM

A few excerpts from Economists React: ‘Green Shoots Withering’ in Retail

We now have to expect flat consumption in April, which means there has been no net increase since January ... the freefall is over but shredded balance sheets and declining incomes mean a broadly flat trend is about the best we can expect. Greens shoots withering ...Some people mistook the end of "cliff diving" for "green shoots" and started predicting a "V-shaped" recovery. Although the worst of the declines is probably over, an immaculate recovery seems very unlikely. (See Immaculate Recovery? )

Ian Shepherdson, High Frequency Economics

Overall, these data suggest consumers could not sustain the modest first quarter gains in spending and at least one “green shoot” appears to be wilting.

Nomura Global Economics

Update on Inventory Correction

by Calculated Risk on 5/13/2009 11:05:00 AM

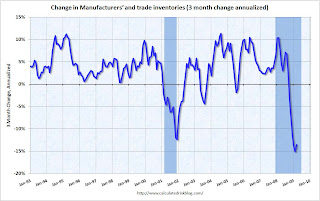

The Q1 GDP report showed a strong inventory correction is under way, with the BEA reporting inventories declined -136.8 billion (SAAR) in Q1. The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed more evidence of declining inventories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Census Bureau reported:

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,404.1 billion, down 1.0 percent (±0.1%) from February 2009 and down 4.8 percent (±0.3%) from March 2008.The above graph shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in this recession, but inventories are now declining sharply.

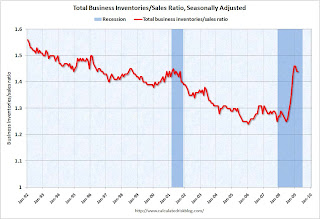

However, even with the sharp decline in inventories, the inventory to sales ratio was flat in March at 1.44.

However, even with the sharp decline in inventories, the inventory to sales ratio was flat in March at 1.44.There has been a race between declining sales and declining inventory. And even if sales start to stabilize, inventory levels are still too high, and further inventory reductions are coming.

LA Times: Sour CRE Loans

by Calculated Risk on 5/13/2009 10:13:00 AM

This is a story we've discussed for a few years, but it is probably worth repeating: Small and regional banks couldn't compete in the residential mortgage market during the housing bubble (with some exceptions), so they focused on Construction & Development (C&D) and other Commercial Real Estate (CRE) loans. The C&D loans are defaulting in large numbers now and this is impacting a number of regional banks (like BankUnited and Corus).

And defaults are just starting to increase on other CRE loans. Most of the coming bank failures will be due to C&D and CRE loans.

From the LA Times: Sour commercial real estate loans threaten to hurt regional banks

The slumping market for commercial real estate -- viewed by many as the next big shoe to drop on the economy -- now threatens to drag down regional banks as they struggle to collect on loans made against shopping centers and office buildings.For a few graphs on C&D loan concentrations and noncurrent rates (from the FDIC Q4 Quarterly Banking Profile), see: Bank Failures and C&D Loans . The Q1 FDIC report should be released in a few weeks.

Seriously overdue loans against commercial developments have shot up dramatically in recent months, as delinquencies snowball on construction loans and mortgages for office buildings, malls and apartments.

...

"Commercial lending is our bread and butter, the lion's share of our business," said Dominic Ng, chairman of East West Bancorp, which with $12 billion in assets is the second-largest bank based in Los Angeles County.

The Pasadena bank ... set aside $226 million to cover loan losses last year, up from $12 million in 2007. The bank lost $49 million in 2008, compared with a profit of $161 million in 2007.

Land development and construction loans, the main problem so far for East West, total about 20% of the bank's loan portfolio. Now Ng says he is nervously watching delinquencies on commercial mortgages -- about 40% of East West's loans.