by Calculated Risk on 5/07/2009 11:06:00 AM

Thursday, May 07, 2009

Hotel RevPAR in Q1: "Worst year-over-year decline in History"

"OK, so now it’s official. The first quarter of 2009 experienced the worst year-over-year revenue per available room drop in the U.S. lodging industry’s organized history."Note: RevPAR is Revenue per available room - a key measure in the hotel industry.

Jeff Higley: Catching up on hotel topics

From HotelNewsNow.com: STR reports U.S. data for week ending 2 May

In year-over-year measurements, the industry’s occupancy fell 11.6 percent to end the week at 55.7 percent. Average daily rate dropped 8.6 percent to finish the week at US$99.42. Revenue per available room for the week decreased 19.1 percent to finish at US$55.33.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.1% from the same period in 2008.

The average daily rate is down 8.6%, so RevPAR is off 19.1% from the same week last year.

Bernanke on Lessons Learned for Bank Supervision

by Calculated Risk on 5/07/2009 09:36:00 AM

There is no question that the Fed failed to adequately perform their regulatory responsibilities during the housing and credit bubble. However part of the problem was supervisory responsibility were split between various state and Federal regulators. As Fed Chairman Ben Bernanke notes in this speech, under the Gramm-Leach-Bliley Act of 1999, the Fed "serves as consolidated supervisor of all bank holding companies, including financial holding companies." Although the Fed missed significant problems at these holding companies, many of the problems were at mortgage brokers, and commercial banks that were not regulated by the Fed.

The regulators that I spoke with in 2005, at various agencies, were all concerned about the impact of the housing bubble and lax lending standards. But it was difficult to get the various regulators to coordinate. And several people told me confidentially that the Fed and the OTS were blocking efforts to tighten lending standards. So more consolidated supervision is required - but part of the problem during the bubble was that a few key individuals were able to block the efforts of other regulators.

So I think a framework to identify systemic problems would be an important addition.

Fed Chairman Ben Bernanke offers some suggestions: Lessons of the Financial Crisis for Banking Supervision

Looking forward, I believe a more macroprudential approach to supervision--one that supplements the supervision of individual institutions to address risks to the financial system as a whole--could help to enhance overall financial stability. Our regulatory system must include the capacity to monitor, assess, and, if necessary, address potential systemic risks within the financial system. Elements of a macroprudential agenda includePrecisely how best to implement a macroprudential agenda remains open to debate. Some of these critical functions could be incorporated into the practices of existing regulators, or a subset of them might be assigned to a macroprudential supervisory authority. However we proceed, a principal lesson of the crisis is that an approach to supervision that focuses narrowly on individual institutions can miss broader problems that are building up in the system.monitoring large or rapidly increasing exposures--such as to subprime mortgages--across firms and markets, rather than only at the level of individual firms or sectors; assessing the potential systemic risks implied by evolving risk-management practices, broad-based increases in financial leverage, or changes in financial markets or products; analyzing possible spillovers between financial firms or between firms and markets, such as the mutual exposures of highly interconnected firms; ensuring that each systemically important firm receives oversight commensurate with the risks that its failure would pose to the financial system; providing a resolution mechanism to safely wind down failing, systemically important institutions; ensuring that the critical financial infrastructure, including the institutions that support trading, payments, clearing, and settlement, is robust; working to mitigate procyclical features of capital regulation and other rules and standards; and identifying possible regulatory gaps, including gaps in the protection of consumers and investors, that pose risks for the system as a whole.

Weekly Unemployment Claims Decline; Record Continued Claims

by Calculated Risk on 5/07/2009 08:37:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 2, the advance figure for seasonally adjusted initial claims was 601,000, a decrease of 34,000 from the previous week's revised figure of 635,000. The 4-week moving average was 623,500, a decrease of 14,750 from the previous week's revised average of 638,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 25 was 6,351,000, an increase of 56,000 from the preceding week's revised level of 6,295,000. The 4-week moving average was 6,207,250, an increase of 125,250 from the preceding week's revised average of 6,082,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four-week moving average is at 623,500, off 35,250 from the peak 4 weeks ago.

Continued claims are now at 6.35 million - an all time record.

The second shows the four-week average of initial unemployment claims and recessions.

The second shows the four-week average of initial unemployment claims and recessions.Typically the four-week average peaks near the end of a recession.

Also important - in the last two recessions, initial unemployment claims peaked just before the end of the recession, but then stayed elevated for a long period following the recession - a "jobless recovery". There is a good chance this recovery will be very sluggish too, and we will see claims elevated for some time (although below the peak).

The 35,250 decline in the four-week average from the peak appears significant, and there is a good chance that we've seen the peak for weekly unemployment insurance claims. If this is the peak, continued claims should peak soon.

The level of initial claims (over 600 thousand) is still very high, indicating significant weakness in the job market.

Government: Stress Test Results to be released at 5 PM ET

by Calculated Risk on 5/07/2009 12:36:00 AM

Joint statement from Treasury, Fed, FDIC and Comptroller: The Treasury Capital Assistance Program and the Supervisory Capital Assessment Program

During this period of extraordinary economic uncertainty, the U.S. federal banking supervisors believe it to be important for the largest U.S. bank holding companies (BHCs) to have a capital buffer sufficient to withstand losses and sustain lending even in a significantly more adverse economic environment than is currently anticipated. In keeping with this aim, the Federal Reserve and other federal bank supervisors have been engaged in a comprehensive capital assessment exercise--known as the Supervisory Capital Assessment Program (SCAP)--with each of the 19 largest U.S. BHCs.So the Fed will release the losses and loss rates for each of the 12 categories in outlined in the Fed White Paper. And these are the losses for the "more adverse" scenario.

The SCAP will be completed this week and the results released publicly by the Federal Reserve Board on Thursday May 7th, 2009 at 5pm EDT. In this release, supervisors will report--under the SCAP "more adverse" scenario, for each of the 19 institutions individually and in the aggregate--their estimates of: losses and loss rates across select categories of loans; resources available to absorb those losses; and the resulting necessary additions to capital buffers. The estimates reported by the Federal Reserve represent values for a hypothetical 'what-if' scenario and are not forecasts of expected losses or revenues for the firms. Any BHC needing to augment its capital buffer at the conclusion of the SCAP will have until June 8th, 2009 to develop a detailed capital plan, and until November 9th, 2009 to implement that capital plan.

emphasis added

There is much more ...

Wednesday, May 06, 2009

Stress Test Table: Morgan Stanley Needs $1.5 Billion

by Calculated Risk on 5/06/2009 08:01:00 PM

Here are some updates to the table: Morgan Stanley has been changed to needing $1.5 billion, Capital One passed, State Street needs an unspecified amount.

| Name | Total Assets (Billions) | Stress Test Results |

|---|---|---|

| 1. Bank of America | 2,500 | Needs $34 billion |

| 2. JPMorgan Chase | 2,175 | Pass |

| 3. Citigroup | 1,947 | Needs $5 billion |

| 4. Wells Fargo | 1,310 | Needs $15 billion |

| 5. Goldman Sachs | 885 | Pass |

| 6. Morgan Stanley | 659 | Needs $1.5 billion |

| 7. MetLife | 502 | Pass |

| 8. PNC Financial Services | 291 | ??? |

| 9. U.S. Bancorp | 267 | ??? |

| 10. Bank of New York Mellon | 238 | Pass |

| 11. GMAC | 189 | Needs $11.5 billion |

| 12. SunTrust | 189 | ??? |

| 13. State Street | 177 | Needs $$$ |

| 14. Capital One Financial Corp. | 166 | Pass |

| 15. BB&T | 152 | ??? |

| 16. Regions Financial Corp. | 146 | Needs $$$ |

| 17. American Express | 126 | Pass |

| 18. Fifth Third Bancorp | 120 | Needs $3.3 billion (1) |

| 19. KeyCorp | 105 | Needs $3.3 billion (1) |

(1) Citi estimate. (ht Turbo)

Senate Passes Expanded FDIC Credit Line

by Calculated Risk on 5/06/2009 06:05:00 PM

From Reuters: US Senate expands credit lines to FDIC reserves

The U.S. Senate on Wednesday approved a measure to expand a government credit line for the Federal Deposit Insurance Corp ... The FDIC ... has been able to tap the Treasury Department for up to $30 billion since 1991. That credit line would be increased to $100 billion under the new bill.Part of this is for the PPIP, see: Sorkin's ‘No-Risk’ Insurance at F.D.I.C.

The House of Representatives has already passed its version of the legislation ...

Besides raising the cap on FDIC borrowing, the bill gives the federal insurer a $500 billion credit limit that will sunset at the end of next year.

[The F.D.I.C. is] going to be insuring 85 percent of the debt, provided by the Treasury, that private investors will use to subsidize their acquisitions of toxic assets. The program ... is the equivalent of TARP 2.0. Only this time, Congress didn’t get a chance to vote.

...

The F.D.I.C. is insuring the program, called the Public-Private Investment Program, by using a special provision in its charter that allows it to take extraordinary steps when an “emergency determination by secretary of the Treasury” is made to mitigate “systemic risk.”

Foreclosures: The 2nd Wave

by Calculated Risk on 5/06/2009 04:30:00 PM

From Nick Timiraos at the WSJ: Another Sign of Foreclosure Trouble in California

The homeowner association delinquency rate can serve as a leading indicator of sorts because homeowners usually stop paying dues before they stop paying their mortgage. The 90-day delinquency rate on dues for the 260 homeowner associations in California managed by Merit Property Management jumped to 5.3% in March from 2.8% last June. Delinquencies first spiked to 2.6% in December 2007 from 0.8% in March 2007.

... The rising number of HOA delinquencies and the boost in pre-foreclosure notices could be a harbinger of things to come. “There’s reason to believe in California there may be a second wave of foreclosures,” [Andrew Schlegel, Merit communities financial vice president] says.

More Stress Test Leaks: Morgan Stanley, JPMorgan, AmEx all Pass

by Calculated Risk on 5/06/2009 02:32:00 PM

From MarketWatch: Morgan Stanley doesn't need more capital: report

From WSJ: J.P. Morgan, American Express Won't Need New Capital

[F]ederal banking regulators have informed Regions Financial Corp., a regional bank based in Birmingham, Ala., that it needs to raise new capital, according to a person familiar with the matter.From Bloomberg: Bank of America, Citigroup, Wells Fargo, GMAC Need More Capital

A spokesman at Regions declined to comment Wednesday. The size of the cushion that regulators told bank executives they need to protect Regions from potential losses wasn't immediately clear.

Here is a scorecard by asset size (let me know if you hear of any other leaks - we will know it all tomorrow!):

| Name | Total Assets (Billions) | Stress Test Results |

|---|---|---|

| 1. Bank of America | 2,500 | Needs $34 billion |

| 2. JPMorgan Chase | 2,175 | Pass |

| 3. Citigroup | 1,947 | Needs |

| 4. Wells Fargo | 1,310 | Needs $15 billion |

| 5. Goldman Sachs | 885 | Pass |

| 6. Morgan Stanley | 659 | Pass |

| 7. MetLife | 502 | Pass |

| 8. PNC Financial Services | 291 | ??? |

| 9. U.S. Bancorp | 267 | ??? |

| 10. Bank of New York Mellon | 238 | Pass |

| 11. GMAC | 189 | Needs $11.5 billion |

| 12. SunTrust | 189 | ??? |

| 13. State Street | 177 | ??? |

| 14. Capital One Financial Corp. | 166 | ??? |

| 15. BB&T | 152 | ??? |

| 16. Regions Financial Corp. | 146 | Needs $$$ |

| 17. American Express | 126 | Pass |

| 18. Fifth Third Bancorp | 120 | Needs $3.3 billion (1) |

| 19. KeyCorp | 105 | Needs $3.3 billion (1) |

(1) Citi estimate. (ht Turbo)

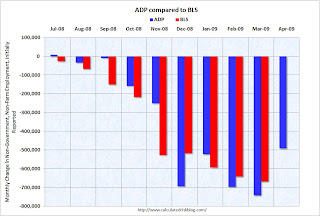

ADP and BLS

by Calculated Risk on 5/06/2009 01:32:00 PM

I added a caution with the ADP employment report this morning: "The ADP employment report hasn't been very useful in predicting the BLS numbers ..."

Several readers have sent me graphs showing that ADP and BLS employment numbers track pretty well over time. That is true - after revisions.

However I think in real time the ADP report isn't that useful for forecasting the BLS numbers (although it might offer a suggestion). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the ADP and BLS employment numbers (note: non-government) as originally released since last Summer.

Here is the original releases for ADP and for the BLS.

Although the two reports generally move together, there have been a number of significant misses; as examples: September, November and December of last year.

The consensus for BLS reported job losses is 630,000 (including government, to be announced Friday), and the ADP report suggests the losses might be a little lower.

However, initial weekly unemployment claims only declined slightly in April, and for the headline number (that includes government - not included in ADP) there have been a number of reports of local government layoffs.

John A. Challenger, chief executive officer of the placement company, said [this morning] ... “state and local governments, as well as school districts, are really feeling the impact of this downturn.”I think the job losses could be less than the average of the last 5 months (averaged 660 thousand per month), but not much less.

Report: Wells Fargo Needs $15 Billion in Capital

by Calculated Risk on 5/06/2009 12:15:00 PM

From Bloomberg: Wells Fargo Said to Need $15 Billion in New Capital

Wells Fargo & Co., the fourth-largest U.S. bank by assets, requires about $15 billion in new capital as a result of regulators’ stress test on the lender ...The leaks just keep coming ...

JPMorgan Chase & Co. doesn’t need to raise its capital, people with knowledge of its results said, while Goldman Sachs Group Inc. and Bank of New York Mellon Corp. have taken actions that suggest they also passed their reviews.