by Calculated Risk on 5/06/2009 08:01:00 PM

Wednesday, May 06, 2009

Stress Test Table: Morgan Stanley Needs $1.5 Billion

Here are some updates to the table: Morgan Stanley has been changed to needing $1.5 billion, Capital One passed, State Street needs an unspecified amount.

| Name | Total Assets (Billions) | Stress Test Results |

|---|---|---|

| 1. Bank of America | 2,500 | Needs $34 billion |

| 2. JPMorgan Chase | 2,175 | Pass |

| 3. Citigroup | 1,947 | Needs $5 billion |

| 4. Wells Fargo | 1,310 | Needs $15 billion |

| 5. Goldman Sachs | 885 | Pass |

| 6. Morgan Stanley | 659 | Needs $1.5 billion |

| 7. MetLife | 502 | Pass |

| 8. PNC Financial Services | 291 | ??? |

| 9. U.S. Bancorp | 267 | ??? |

| 10. Bank of New York Mellon | 238 | Pass |

| 11. GMAC | 189 | Needs $11.5 billion |

| 12. SunTrust | 189 | ??? |

| 13. State Street | 177 | Needs $$$ |

| 14. Capital One Financial Corp. | 166 | Pass |

| 15. BB&T | 152 | ??? |

| 16. Regions Financial Corp. | 146 | Needs $$$ |

| 17. American Express | 126 | Pass |

| 18. Fifth Third Bancorp | 120 | Needs $3.3 billion (1) |

| 19. KeyCorp | 105 | Needs $3.3 billion (1) |

(1) Citi estimate. (ht Turbo)

Senate Passes Expanded FDIC Credit Line

by Calculated Risk on 5/06/2009 06:05:00 PM

From Reuters: US Senate expands credit lines to FDIC reserves

The U.S. Senate on Wednesday approved a measure to expand a government credit line for the Federal Deposit Insurance Corp ... The FDIC ... has been able to tap the Treasury Department for up to $30 billion since 1991. That credit line would be increased to $100 billion under the new bill.Part of this is for the PPIP, see: Sorkin's ‘No-Risk’ Insurance at F.D.I.C.

The House of Representatives has already passed its version of the legislation ...

Besides raising the cap on FDIC borrowing, the bill gives the federal insurer a $500 billion credit limit that will sunset at the end of next year.

[The F.D.I.C. is] going to be insuring 85 percent of the debt, provided by the Treasury, that private investors will use to subsidize their acquisitions of toxic assets. The program ... is the equivalent of TARP 2.0. Only this time, Congress didn’t get a chance to vote.

...

The F.D.I.C. is insuring the program, called the Public-Private Investment Program, by using a special provision in its charter that allows it to take extraordinary steps when an “emergency determination by secretary of the Treasury” is made to mitigate “systemic risk.”

Foreclosures: The 2nd Wave

by Calculated Risk on 5/06/2009 04:30:00 PM

From Nick Timiraos at the WSJ: Another Sign of Foreclosure Trouble in California

The homeowner association delinquency rate can serve as a leading indicator of sorts because homeowners usually stop paying dues before they stop paying their mortgage. The 90-day delinquency rate on dues for the 260 homeowner associations in California managed by Merit Property Management jumped to 5.3% in March from 2.8% last June. Delinquencies first spiked to 2.6% in December 2007 from 0.8% in March 2007.

... The rising number of HOA delinquencies and the boost in pre-foreclosure notices could be a harbinger of things to come. “There’s reason to believe in California there may be a second wave of foreclosures,” [Andrew Schlegel, Merit communities financial vice president] says.

More Stress Test Leaks: Morgan Stanley, JPMorgan, AmEx all Pass

by Calculated Risk on 5/06/2009 02:32:00 PM

From MarketWatch: Morgan Stanley doesn't need more capital: report

From WSJ: J.P. Morgan, American Express Won't Need New Capital

[F]ederal banking regulators have informed Regions Financial Corp., a regional bank based in Birmingham, Ala., that it needs to raise new capital, according to a person familiar with the matter.From Bloomberg: Bank of America, Citigroup, Wells Fargo, GMAC Need More Capital

A spokesman at Regions declined to comment Wednesday. The size of the cushion that regulators told bank executives they need to protect Regions from potential losses wasn't immediately clear.

Here is a scorecard by asset size (let me know if you hear of any other leaks - we will know it all tomorrow!):

| Name | Total Assets (Billions) | Stress Test Results |

|---|---|---|

| 1. Bank of America | 2,500 | Needs $34 billion |

| 2. JPMorgan Chase | 2,175 | Pass |

| 3. Citigroup | 1,947 | Needs |

| 4. Wells Fargo | 1,310 | Needs $15 billion |

| 5. Goldman Sachs | 885 | Pass |

| 6. Morgan Stanley | 659 | Pass |

| 7. MetLife | 502 | Pass |

| 8. PNC Financial Services | 291 | ??? |

| 9. U.S. Bancorp | 267 | ??? |

| 10. Bank of New York Mellon | 238 | Pass |

| 11. GMAC | 189 | Needs $11.5 billion |

| 12. SunTrust | 189 | ??? |

| 13. State Street | 177 | ??? |

| 14. Capital One Financial Corp. | 166 | ??? |

| 15. BB&T | 152 | ??? |

| 16. Regions Financial Corp. | 146 | Needs $$$ |

| 17. American Express | 126 | Pass |

| 18. Fifth Third Bancorp | 120 | Needs $3.3 billion (1) |

| 19. KeyCorp | 105 | Needs $3.3 billion (1) |

(1) Citi estimate. (ht Turbo)

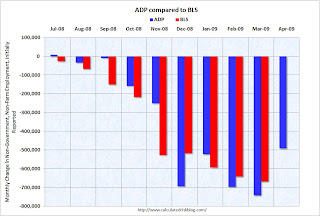

ADP and BLS

by Calculated Risk on 5/06/2009 01:32:00 PM

I added a caution with the ADP employment report this morning: "The ADP employment report hasn't been very useful in predicting the BLS numbers ..."

Several readers have sent me graphs showing that ADP and BLS employment numbers track pretty well over time. That is true - after revisions.

However I think in real time the ADP report isn't that useful for forecasting the BLS numbers (although it might offer a suggestion). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the ADP and BLS employment numbers (note: non-government) as originally released since last Summer.

Here is the original releases for ADP and for the BLS.

Although the two reports generally move together, there have been a number of significant misses; as examples: September, November and December of last year.

The consensus for BLS reported job losses is 630,000 (including government, to be announced Friday), and the ADP report suggests the losses might be a little lower.

However, initial weekly unemployment claims only declined slightly in April, and for the headline number (that includes government - not included in ADP) there have been a number of reports of local government layoffs.

John A. Challenger, chief executive officer of the placement company, said [this morning] ... “state and local governments, as well as school districts, are really feeling the impact of this downturn.”I think the job losses could be less than the average of the last 5 months (averaged 660 thousand per month), but not much less.

Report: Wells Fargo Needs $15 Billion in Capital

by Calculated Risk on 5/06/2009 12:15:00 PM

From Bloomberg: Wells Fargo Said to Need $15 Billion in New Capital

Wells Fargo & Co., the fourth-largest U.S. bank by assets, requires about $15 billion in new capital as a result of regulators’ stress test on the lender ...The leaks just keep coming ...

JPMorgan Chase & Co. doesn’t need to raise its capital, people with knowledge of its results said, while Goldman Sachs Group Inc. and Bank of New York Mellon Corp. have taken actions that suggest they also passed their reviews.

Foreclosures: More movin' on up!

by Calculated Risk on 5/06/2009 10:10:00 AM

From Bloomberg: Rich Americans Default on Luxury Homes Like Subprime Victims (ht Lance)

Chuck Dayton put down a quarter of the $950,000 purchase price when he bought his house in Newport Beach, California, in 2004. ... Dayton, 43, went into default four months ago because he couldn’t afford payments on the three-bedroom home, located within a block of the Pacific Ocean.The next wave of defaults is building ... this time in the mid-to-high range.

...

Dayton said he financed the purchase of his home, 40 miles south of Los Angeles in Orange County, with a payment-option adjustable-rate mortgage now serviced by JPMorgan’s Washington Mutual.

...

Dayton refinanced in February 2007 with a $1 million loan from Washington Mutual ... He also took out two private mortgages and now has a balance of $106,000 on those loans ... Dayton went into default on Jan. 29 and owes $46,584 in delinquent payments and penalties, according to First American CoreLogic ...

The number of U.S. homes valued at more than $729,750, the jumbo-loan limit in the most affluent areas, entering the foreclosure process jumped 127 percent during the first 10 weeks of this year from the same period of 2008, data compiled by RealtyTrac Inc. of Irvine, California, show. The rate rose 72 percent for homes valued at less than $417,000 and 78 percent for all homes

Other Employment Reports

by Calculated Risk on 5/06/2009 08:50:00 AM

The ADP employment report hasn't been very useful in predicting the BLS numbers, but here it is anyway: April ADP Report:

Nonfarm private employment decreased 491,000 from March to April 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from February to March was revised by 34,000, from a decline of 742,000 to a decline of 708,000.And from Bloomberg: U.S. April Job Cuts Rise 47% From a Year Ago, Challenger Says

Job cuts announced by U.S. employers in April increased 47 percent from a year earlier, led by government agencies and companies in the automotive industry, while the total was the lowest since October.The BLS report for April will be released Friday. Hopefully the pace of job losses has slowed - over the last 5 months the BLS has reported 3.3 million net jobs lost!

...

“Job cuts are still at recession levels, but the fact that they are falling is certainly promising and may suggest that employers are starting to feel a little more confident about future business conditions,” John A. Challenger, chief executive officer of the placement company, said in a statement. Still, he said, “state and local governments, as well as school districts, are really feeling the impact of this downturn.”

Tuesday, May 05, 2009

Report: BofA Needs $34 Billion in Capital

by Calculated Risk on 5/05/2009 11:58:00 PM

From Reuters: Bank of America to need $34 billion in capital: source

Bank of America (BAC.N) has been deemed to need an additional $34 billion in capital, according to the results of a government stress test, a source familiar with the results said on Tuesday.From the WSJ: BofA Needs $35 Billion Jolt

And Bloomberg: Tests Said to Show Bank of America Has Biggest Need

Regulators have determined that Bank of America Corp. has the largest need for new capital among the 19 biggest U.S. banks subjected to stress tests, according to people familiar with the matter.

Citigroup Inc.’s shortfall is more limited because the company already plans to convert government preferred shares to common stock, the people said.

Homeowners Underwater

by Calculated Risk on 5/05/2009 09:47:00 PM

There is substantial disagreement on the number of homeowners underwater (they owe more than their homes are worth). At the end of 2008, American CoreLogic estimated there were 8.2 million homeowners underwater.

Zillow.com is now estimating 26.9 million homeowners with negative equity.

From the WSJ: House-Price Drops Leave More Underwater

Real-estate Web site Zillow.com said that overall, the number of borrowers who are underwater climbed to 26.9 million at the end of the first quarter from 16.3 million at the end of the fourth quarter.This is a substantial difference. Apparently Zillow assumes that borrowers with HELOCs have drawn down the maximum amount, and I suppose they use their house price software. My guess is Economy.com's estimate is closer.

...

Moody's Economy.com estimates that of 78.2 million owner-occupied single-family homes, 14.8 million borrowers, or 19%, owed more than their homes were worth at the end of the first quarter, up from 13.6 million at the end of last year.

No matter - the number is huge. And many of these borrowers are in danger of default if they experience a negative event (death, disease, divorce, unemployment, etc.)