by Calculated Risk on 5/02/2009 01:59:00 PM

Saturday, May 02, 2009

Buffett on Housing and Consumer Spending

From MarketWatch: Buffett sees some housing market stabilization

"In the last few months you've seen a real pickup in activity although at much lower prices," Buffett said, citing data from Berkshire's real estate brokerage business, which is one of the largest in the U.S.Also from MarketWatch: Buffett: Consumer spending slump not over

...

"We see something close to stability at these much-reduced prices in the medium to lower part of the market," Buffett said.

The recent drop in consumer spending and the resulting pressure on retailing, manufacturing and services industries could last "quite a long time," Berkshire Hathaway Chairman Warren Buffett said Saturday.

"I think our retail businesses will not do well for some time" as U.S. consumers save more, Buffett told investors at the company's annual shareholders meeting. "I would not look for any quick rebound in retail, manufacturing and services businesses."

Click on graph for large image.

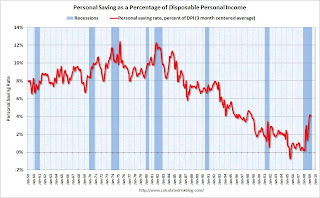

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the March Personal Income report released yesterday. The saving rate was 4.1% in March.

This suggest households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but, as Buffett notes, this will also keep pressure on personal consumption.

Foreclosures: Banks Setting Opening Auction Bid Below Amount Owed

by Calculated Risk on 5/02/2009 09:02:00 AM

From Jillayne Schlicke at Rain City Guide: Why are Banks Setting the Opening Auction Bid Below The Principal Balance?

I attended a foreclosure auction in Bellevue, WA last week to discover if the rumor was true that banks are opening their bids below the amount owed. I received confirmation from three professional investors that yes, the banks have been doing that, it’s no secret, and there seems to be no discernable pattern. It’s not one particular bank or lender, it’s not particular types of property or in any specific area. It appears to be random.Jillayne offers some possible explanations why the banks are bidding below the amount they are owed. I've been hearing similar stories in California.

... Only a few of the trustee sales attracted bidders, and the rest were deeded back to the bank. Out of the 92 active sales, 25 had opening bids below the amount owed to the bank.

Also, here is the monthly post: April Economic Summary in Graphs.

Friday, May 01, 2009

Summary Post

by Calculated Risk on 5/01/2009 10:27:00 PM

[Silverton Bank's failure] will ripple through the banking industry, which some industry experts said will have catastrophic consequences for banks across the Sun Belt as it impacts potentially hundreds of bank balance sheets.Many small banks invested in Silverton, or Silverton sold them loan participation in mostly Construction & Development loans. The losses could lead to other bank failures.

Bank Failure 32: America West Bank, Layton, Utah

by Calculated Risk on 5/01/2009 08:13:00 PM

Whom do they remind you of?

Moe, Curly, Larry.

by Soylent Green is People

From the FDIC: Cache Valley Bank, Logan, Utah, Assumes All of the Deposits of America West Bank, Layton, Utah

America West Bank, Layton, Utah, was closed today by the Utah Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Cache Valley Bank, Logan, Utah, to assume all of the deposits of America West.

...

As of December 31, 2008, America West Bank had total assets of approximately $299.4 million and total deposits of $284.1 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $119.4 million. Cache Valley Bank's acquisition of all of the deposits of America West Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives.

America West Bank is the 32nd bank to fail in the nation this year and the second in Utah. The last FDIC-insured institution to fail in the state was MagnetBank, Salt Lake City, on January 30, 2009.

WSJ: Citi Needs "Up to $10 Billion" in Capital

by Calculated Risk on 5/01/2009 07:54:00 PM

From the WSJ: Citi Said to Need Up to $10 Billion

Citigroup Inc. may need to raise as much as $10 billion in new capital, according to people familiar with the matter ...If Citi isn't required to raise capital, I doubt there will be much confidence in the stress test results. I was expecting a much higher number than $10 billion.

The bank ... is negotiating with the Federal Reserve and may need less if regulators accept the bank's arguments about its financial health ... In a best-case scenario, Citigroup could wind up having a roughly $500 million cushion above what the government is requiring.

Also, from the NY Times: Citigroup to Sell Japanese Units for $5.56 Billion

Citigroup said Friday that it would sell its Japanese brokerage and investment banking units for $5.56 billion, securing much-needed capital before results due this coming week from a U.S. government “stress test” of its financial health.

...

Citigroup said it would realize a loss of $200 million on the transaction, which would generate $2.5 billion in tangible common equity, a measure of financial health.

Bank Failure 31: Citizens Community Bank, Ridgewood, New Jersey

by Calculated Risk on 5/01/2009 05:05:00 PM

Mixing money aroma...

Two Jersey banks merge.

by Soylent Green is People

From the FDIC: North Jersey Community Bank, Englewood Cliffs, New Jersey, Assumes All of the Deposits of Citizens Community Bank, Ridgewood, New Jersey

Citizens Community Bank, Ridgewood, New Jersey, was closed today by the New Jersey Department of Banking and Insurance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with North Jersey Community Bank, Englewood Cliffs, New Jersey, to assume all of the deposits of Citizens Community Bank.

...

As of December 31, 2008, Citizens Community Bank had total assets of approximately $45.1 million and total deposits of $43.7 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $18.1 million. North Jersey Community Bank's acquisition of the deposits of Citizens Community Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives.

Citizens Community Bank is the 31st bank to fail in the nation this year and the first in New Jersey. The last FDIC-insured institution to fail in the state was Dollar Savings Bank, Newark, on February 14, 2004.

Bank Failure 30: Silverton Bank, National Association, Atlanta, Georgia

by Calculated Risk on 5/01/2009 04:14:00 PM

Silverton Bank, crash and burn.

May might be hectic

by Soylent Green is People

From the FDIC: FDIC Creates Bridge Bank to Take Over Operations of Silverton Bank, National Association, Atlanta, Georgia

The Federal Deposit Insurance Corporation (FDIC) created a bridge bank to take over the operations of Silverton Bank, National Association, Atlanta, Georgia, after the bank was closed today by the Office of the Comptroller of the Currency (OCC). ...

Silverton Bank did not take deposits directly from the general public nor did it make loans to consumers. It was a commercial bank that provided correspondent banking services to its client banks.

Silverton Bank had approximately 1,400 client banks in 44 states, and operated six regional offices. It provided a variety of services for its clients, including credit card operations, clearing accounts, investments, consulting, purchasing loans, and selling loan participations. Since the FDIC created a new bank to take over the operations of Silverton Bank, there is not expected to be any meaningful impact on the bank's clients.

...

At the time of its closing, Silverton Bank had approximately $4.1 billion in assets and $3.3 billion in deposits, all of which are expected to be within the FDIC's insurance limits.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $1.3 billion. Silverton Bank is the 30th bank to fail in the nation this year and the sixth in Georgia. The last FDIC-insured institution to fail in the state was American Southern Bank, Kennesaw, on April 24

Auto Sales: Very weak in April

by Calculated Risk on 5/01/2009 03:24:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

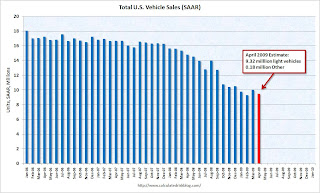

This graph shows the historical vehicle sales from the BEA (blue) and an estimate for April (light vehicle sales of 9.32 million SAAR from AutoData Corp).

Note: this graph includes a small number of heavy vehicle sales to compare to the BEA.

On a seasonally adjusted basis, total sales were still above the February level, but not much.

A few quotes:

"Industrywide, April felt more like a dust bowl than a spring garden for new car sales."

Jim O'Donnell, president of BMW in North America, May 1, 2009.

"It's kind of like the anchor bouncing a long on the bottom of the lake. It has found bottom and it's tripping along a little bit. I think we have found the bottom in aggregate."

Mark LeNeve, GM vice president for sales and marketing, sales conference call, May 1, 2009.

"The industry appears to have stabilized, as it's been fairly level for the past four months. We know where the bottom is, and as the economy struggles to recover, vehicle sales should follow."

Chrysler President Jim Press, May 1, 2009.

Comparing Quarterly and Monthly PCE

by Calculated Risk on 5/01/2009 03:00:00 PM

Here is a common question:

Q: I was looking at the Q1 Advance GDP report, and it showed that PCE was up 2.2%. However the March Personal Income and Outlay report showed that real March PCE was off -0.2%, after increasing 0.1% in February, and 0.9% in January. How did they get 2.2% for Q1 PCE growth? How does that compare to the monthly numbers?

A: First, the reported change in the Personal Income report is from the previous month (not annualized). The quarterly GDP report is the annualized change from Q4 to Q1.

Second, the quarterly change is from the average PCE in Q4 to the average PCE in Q1. Look at the following chart ...

Click on graph for larger image in new window.

Note: graph doesn't start at zero to show the change. All numbers are in billions.

This shows both the quarterly (red) and monthly (blue) PCE data (2000 dollars).

If you average October, November and December PCE, you get the Q4 PCE. And Q1 PCE is the average of January, February and March.

The math is simple: $8,214.2 (Q1 2009) divided by $8170.5 (Q4 2008) equals 1.00535. Take that to the 4th power (to annualize), subtract 1, and that gives the annualized rate of change in real PCE from Q4 to Q1: 2.2%.

Notice that the month-to-month change isn't useful in comparing to the quarterly change. Also notice that I didn't even report the March PCE numbers - that was mostly captured in the Q1 GDP report - and the monthly series is noisy.

The first two Personal Income reports each quarter are much more useful than the final month. When the April Personal Income report is released, the media will focus on the month-to-month change. However I will compare April PCE to January PCE - and then May PCE to February. This is the "two month" estimate for Q2 PCE (notice the calculation compares to the same month of the previous quarter, not the previous month).

For some time I had been forecasting a slump in consumer spending, and then using the two month method, I was able to declare the slump had arrived, see: Personal Income for August Indicates Consumer Recession and Estimating PCE Growth for Q3 2008

[T]his will be the first decline in PCE since Q4 1991. This is strong evidence that the indefatigable U.S. consumer is finally throwing in the towel.I was also among the first to point out PCE would probably be positive in Q1: February PCE and Personal Saving Rate

This suggests that PCE will make a positive contribution to GDP in Q1.The monthly data is extremely useful for forecasting - especially the first two months of each quarter.

Corus Posts Loss, Warns of Possible Receivership

by Calculated Risk on 5/01/2009 01:45:00 PM

Just a preview for Bank Failure Friday ...

From the Corus 8-K SEC Filing this morning (ht Kevin):

Both the [Federal Reserve Bank of Chicago and the Office of the Comptroller of the Currency] will continue to monitor the results of our operations, including liquidity and capital and based on their assessment of our ability to continue to operate in a safe and sound manner, may take further actions including placing the Bank into conservatorship or receivership. Additional actions taken by our regulators may negatively impact our ability to continue as a going concern.From the South Florida Business Journal: Fla. condo lender Corus Bank warns of receivership

Corus Bank said it had $2 billion in nonperforming loans and $499 million in foreclosed property as of March 31. That covered 32 percent of the bank’s $7.7 billion in assets.On Feb 18th Corus announced a consent order with regulators.

It might not have been a great business model to focus on Florida condos.