by Calculated Risk on 4/29/2009 10:39:00 PM

Wednesday, April 29, 2009

Milken Conference: Credit Markets and the Role of Finance

A couple of videos from the Milken conference. The first one includes Lewis Ranieri, who is generally given significant credit for creating the private MBS market, and has been warning about the MBS market for several years.

Ranieri makes a number of comments on housing starting at 11:50. I disagree with his assertion about prices being near the bottom - although it is probably true in some areas.

The second video is on the Credit Markets (ht Bob_in_MA). He suggests the discussion is interesting near the end when Milken draws parallels to the 1970s:

More Chrysler: Treasury Increases Offer to Debtholders

by Calculated Risk on 4/29/2009 07:15:00 PM

From the WSJ: Treasury Sweetens Offer to Lenders In Chrysler Bankruptcy Talks

The U.S. Treasury, in a last-ditch effort to avoid a bankruptcy filing by Chrysler LLC, has sweetened its most recent offer to lenders by $250 million ... Lenders, who had until 6 p.m. to vote on the offer ... were notified at 4:30 via conference call and were sent to a Web site to vote for the deal.Down to the last few hours ...

Such a deal can't be approved outside bankruptcy court without 100% consent from lenders....

One reason Chrysler may need to file for bankruptcy is so that Fiat can clear out hundreds of auto dealers from its sales network, which is easier to do in bankruptcy where dealer franchisee agreements can quickly be rejected or amended. The automaker also has asbestos and environmental liabilities which Fiat does not want and are more easily shed in bankruptcy court.

...

Plans were under way for President Barack Obama to deliver a speech about Chrysler on Thursday morning. People who have been briefed on the matter said two versions of the speech were being drafted ...

WaPo: Chrysler BK Would Install Fiat Management

by Calculated Risk on 4/29/2009 05:37:00 PM

From the WaPo: Sources: Chrysler Bankruptcy Plan Would Oust CEO, Install Fiat Management

Chrysler chief executive Robert Nardelli would be replaced by the management of Italian automaker Fiat under a bankruptcy plan that the United States is preparing for the storied automaker...The deadline is tomorrow.

If the bankruptcy proceeds as expected ... The ownership of the new company would be divided between the union's retiree health fund, which would get a 55 percent stake, Fiat, which would get at least a 35 percent stake, and the United States, which would take an 8 percent stake. The Canadian government would receive two percent.

Chrysler's creditors would get $2 billion in cash and no equity stake. The automaker's current owner Cerberus Capital Management would be wiped out.

Ranieri: Housing Is ‘Shouting Distance’ From Bottom

by Calculated Risk on 4/29/2009 03:55:00 PM

From Bloomberg: Lewis Ranieri Says Housing Is ‘Shouting Distance’ From Bottom

“I’m actually very enthusiastic about housing, and I haven’t said that in five years,’’ Ranieri said, speaking on a panel at the Milken Institute Global Conference in Beverly Hills, California. “We’re within shouting distance of a bottom.”The article says Ranieri was talking about prices, but that isn't clear from the quote. He might be talking about residential investment. Prices will fall further ...

And a look at the markets ...

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

See Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries".

FOMC Statement: As Previous Announced, Will Buy $1.75 Trillion in MBS, Agency Debt and Treasuries

by Calculated Risk on 4/29/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in March indicates that the economy has continued to contract, though the pace of contraction appears to be somewhat slower. Household spending has shown signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit. Weak sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories, fixed investment, and staffing. Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time. Nonetheless, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve will buy up to $300 billion of Treasury securities by autumn. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is facilitating the extension of credit to households and businesses and supporting the functioning of financial markets through a range of liquidity programs. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of financial and economic developments.

GDP Report: The Good News

by Calculated Risk on 4/29/2009 11:41:00 AM

Although Q1 GDP was very negative due to the sharp investment slump (this was expected, see: Q1 GDP will be Ugly), the decline in Q1 was weighted towards lagging sectors. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This table shows the contribution to GDP for several sectors in Q1 2009 compared to Q4 2008.

The leading sectors are on the left, the lagging sectors towards the right.

There has been a shift from leading sectors to lagging sectors, although the negative contribution from residential investment was larger in Q1 than in Q4 2008.

However it appears that the slump in residential investment (mostly new home construction and home improvement) is slowing, and I expect the contribution to Q2 2009 to be close to zero - after declining for 13 consecutive quarters.

This doesn't mean the downturn is over, but this does suggest that the worst of the GDP declines is probably over.

For more, see Business Cycle: Temporal Order. Here is a repeat of the table showing a simplified typical temporal order for emerging from a recession:

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Note: Any recovery will probably be sluggish, because household balance sheets still need repair (more savings), and any rebound in residential investment will probably be small because of the huge overhang of existing inventory. As I noted in Temporal Order, at least we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

The Investment Slump

by Calculated Risk on 4/29/2009 09:13:00 AM

The huge investment slump was the key story in Q1. Click on graph for larger image in new window.

Click on graph for larger image in new window.

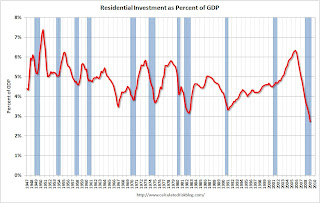

Residential investment (RI) has been declining for 13 consecutive quarters, and Q1 2009 was the worst quarter (in percentage terms) of the entire bust. Residential investment declined at a 38% annual rate in Q1.

This puts RI as a percent of GDP at 2.7%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

Business investment in equipment and software was off 33.8% (annualized), and investment in non-residential structures was off 44.2% (annualized).

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - fell off a cliff. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - it is the best predictor of future economic activity.

GDP Declines 6.1% in Q1

by Calculated Risk on 4/29/2009 08:32:00 AM

From the BEA: Gross Domestic Product: First Quarter 2009 (Advance)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 6.1 percent in the first quarter of 2009 ...So PCE increased (as expected), but investment slumped sharply in all categories.

Real personal consumption expenditures increased 2.2 percent in the first quarter, in contrast to a decrease of 4.3 percent in the fourth. ...

Real nonresidential fixed investment decreased 37.9 percent in the first quarter ...

Nonresidential structures decreased 44.2 percent ...

Equipment and software decreased 33.8 percent ...

Real residential fixed investment decreased 38.0 percent ...

From Rex Nutting at MarketWatch: GDP falls 6.1% on record drop in investment

The two-quarter contraction is the worst in more than 60 years. The big story for the first quarter was in the business sector, where firms halted new investments, and shed workers and inventories at a dizzying pace ...For the stress tests, the baseline scenario for Q1 was minus 5.0%, and the more adverse scenario was minus 6.9%, so, before revisions, Q1 is between the two scenarios. More to come ...

Tuesday, April 28, 2009

Late Night Open Thread

by Calculated Risk on 4/28/2009 11:49:00 PM

By popular request ... the futures are up slightly ahead of the GDP report. Asian markets are mostly up (Nikkei is off over 2%).

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

Best to all.

Commercial Real Estate: "World of hurt"

by Calculated Risk on 4/28/2009 09:23:00 PM

From the Financial Times: Commercial mortgages at risk

“Commercial real estate is in a world of hurt and will be for at least the next two years,” said Ross Smotrich, analyst at Barclays Capital. “This is a capital intensive business in which lending capacity has diminished because of the absence of securitisation, while the fundamentals are driven by the overall economy so both occupancy and rents are declining.”Rising vacancy rates and falling rents ... not the best fundamentals. The story is the same for retail, multi-family, industrial, and hotels. CRE: A world of hurt.

... At the end of the first quarter, defaults and payments more than 60 days late were at 1.53 per cent of outstanding mortgages. Fitch said they could reach 4 per cent by the end of 2010.