by Calculated Risk on 4/29/2009 03:55:00 PM

Wednesday, April 29, 2009

Ranieri: Housing Is ‘Shouting Distance’ From Bottom

From Bloomberg: Lewis Ranieri Says Housing Is ‘Shouting Distance’ From Bottom

“I’m actually very enthusiastic about housing, and I haven’t said that in five years,’’ Ranieri said, speaking on a panel at the Milken Institute Global Conference in Beverly Hills, California. “We’re within shouting distance of a bottom.”The article says Ranieri was talking about prices, but that isn't clear from the quote. He might be talking about residential investment. Prices will fall further ...

And a look at the markets ...

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

See Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries".

FOMC Statement: As Previous Announced, Will Buy $1.75 Trillion in MBS, Agency Debt and Treasuries

by Calculated Risk on 4/29/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in March indicates that the economy has continued to contract, though the pace of contraction appears to be somewhat slower. Household spending has shown signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit. Weak sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories, fixed investment, and staffing. Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time. Nonetheless, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve will buy up to $300 billion of Treasury securities by autumn. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is facilitating the extension of credit to households and businesses and supporting the functioning of financial markets through a range of liquidity programs. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of financial and economic developments.

GDP Report: The Good News

by Calculated Risk on 4/29/2009 11:41:00 AM

Although Q1 GDP was very negative due to the sharp investment slump (this was expected, see: Q1 GDP will be Ugly), the decline in Q1 was weighted towards lagging sectors. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This table shows the contribution to GDP for several sectors in Q1 2009 compared to Q4 2008.

The leading sectors are on the left, the lagging sectors towards the right.

There has been a shift from leading sectors to lagging sectors, although the negative contribution from residential investment was larger in Q1 than in Q4 2008.

However it appears that the slump in residential investment (mostly new home construction and home improvement) is slowing, and I expect the contribution to Q2 2009 to be close to zero - after declining for 13 consecutive quarters.

This doesn't mean the downturn is over, but this does suggest that the worst of the GDP declines is probably over.

For more, see Business Cycle: Temporal Order. Here is a repeat of the table showing a simplified typical temporal order for emerging from a recession:

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Note: Any recovery will probably be sluggish, because household balance sheets still need repair (more savings), and any rebound in residential investment will probably be small because of the huge overhang of existing inventory. As I noted in Temporal Order, at least we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

The Investment Slump

by Calculated Risk on 4/29/2009 09:13:00 AM

The huge investment slump was the key story in Q1. Click on graph for larger image in new window.

Click on graph for larger image in new window.

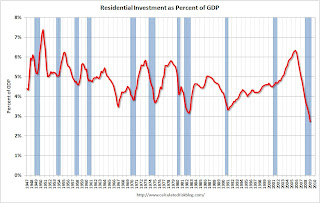

Residential investment (RI) has been declining for 13 consecutive quarters, and Q1 2009 was the worst quarter (in percentage terms) of the entire bust. Residential investment declined at a 38% annual rate in Q1.

This puts RI as a percent of GDP at 2.7%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

Business investment in equipment and software was off 33.8% (annualized), and investment in non-residential structures was off 44.2% (annualized).

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - fell off a cliff. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - it is the best predictor of future economic activity.

GDP Declines 6.1% in Q1

by Calculated Risk on 4/29/2009 08:32:00 AM

From the BEA: Gross Domestic Product: First Quarter 2009 (Advance)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 6.1 percent in the first quarter of 2009 ...So PCE increased (as expected), but investment slumped sharply in all categories.

Real personal consumption expenditures increased 2.2 percent in the first quarter, in contrast to a decrease of 4.3 percent in the fourth. ...

Real nonresidential fixed investment decreased 37.9 percent in the first quarter ...

Nonresidential structures decreased 44.2 percent ...

Equipment and software decreased 33.8 percent ...

Real residential fixed investment decreased 38.0 percent ...

From Rex Nutting at MarketWatch: GDP falls 6.1% on record drop in investment

The two-quarter contraction is the worst in more than 60 years. The big story for the first quarter was in the business sector, where firms halted new investments, and shed workers and inventories at a dizzying pace ...For the stress tests, the baseline scenario for Q1 was minus 5.0%, and the more adverse scenario was minus 6.9%, so, before revisions, Q1 is between the two scenarios. More to come ...

Tuesday, April 28, 2009

Late Night Open Thread

by Calculated Risk on 4/28/2009 11:49:00 PM

By popular request ... the futures are up slightly ahead of the GDP report. Asian markets are mostly up (Nikkei is off over 2%).

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

Best to all.

Commercial Real Estate: "World of hurt"

by Calculated Risk on 4/28/2009 09:23:00 PM

From the Financial Times: Commercial mortgages at risk

“Commercial real estate is in a world of hurt and will be for at least the next two years,” said Ross Smotrich, analyst at Barclays Capital. “This is a capital intensive business in which lending capacity has diminished because of the absence of securitisation, while the fundamentals are driven by the overall economy so both occupancy and rents are declining.”Rising vacancy rates and falling rents ... not the best fundamentals. The story is the same for retail, multi-family, industrial, and hotels. CRE: A world of hurt.

... At the end of the first quarter, defaults and payments more than 60 days late were at 1.53 per cent of outstanding mortgages. Fitch said they could reach 4 per cent by the end of 2010.

Jim the Realtor: Still Flippin'

by Calculated Risk on 4/28/2009 06:45:00 PM

This REO was bought for $163,000 in January, repaired, and then listed for $265,000. It went pending the first week.

Jim says this house was in similar condition as this REO disaster.

Tiered House Price Indices

by Calculated Risk on 4/28/2009 05:03:00 PM

On more Case-Shiller graph ...

The following graph is based on the Case-Shiller Tiered Price Indices for San Francisco. Case-Shiller has tiered pricing data for all 20 cities in the Composite 20 index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that prices increased faster for lower priced homes than higher priced homes. And prices have also fallen faster too.

It now appears mid-to-high priced homes are overpriced compared to lower priced homes - although prices will probably continue to fall for all three tiers. Because of foreclosure activity, I expect the lower priced areas to bottom (especially in real terms) before the higher priced areas.

For those interested, Case-Shiller also has condo price indices for five cities: Los Angeles, San Francisco, Chicago, Boston and New York.

Liberty Property Trust on Leasing and Cap Rates

by Calculated Risk on 4/28/2009 03:46:00 PM

Here are a few interesting comment from the Liberty Property Trust conference call (ht Brian). Note LRY is a REIT specializing in industrial and office properties.

Let me turn to our operating performance and real estate fundamentals. Normally the first quarter is our slowest quarter for the year. But in addition, we clearly felt the full impact of the economic downturn in our markets. We leased 2.8 million square feet in the quarter, down 50% from our leasing productivity in the fourth quarter. This decline is totally consistent with what we are seeing in the markets, a 40% decline in deal activity from 2008 levels. Occupancy declined to 90.1% driven by a decline in our renewal percentage to 54.1%. This renewal decline was driven by our industrial portfolio, since our office and flex renewal rates were 72 and 63% respectively. What happened were three large industrial expirations that simply shut down their operations. A pattern that I think we are going the see more of throughout the rest of 2009. Consistent with the competitive nature of the markets, rents were flat.New tenants are making sure their landlords will stay in business! And from the Q&A on cap rates:

...

We are seeing the manifestation of the [soft economy] as more tenants downsize at the end of their lease. On last quarters call we discussed a recent trend where tenants were asking for rent relief and for the most part we were saying no, but more recently we were seeing an additional trend where good tenants with strong credit come to us before the end of their lease looking for rate reduction in current rent in exchange for additional lease term. In these instances we conduct a thorough economic analysis considering the credit of the tenant, the length of the proposed term, the health of the market and the extent to which we do business or could do business with that customer in multiple markets to. To date we are only completed a few of these “blend and extend” transactions, but we believe in a tenant driven market tenants will continue to ask their landlord to participate. While our portfolio has higher occupancy than the market in most of our cities, aggressive competitive behavior is rapidly affecting rental rates and concessions. On new leases and to a lesser degree on renewal leases, market rents are generally lower, varying by product type availability of competitive space, size, credit and term. The range is wide from slightly up to down as much as 20%. Concessions on new leases primarily in the form of free rent have increased during the first quarter and also vary by market and by lease term. Some leases have none. Some leases a few months and some as much as one month per year to as much as six months in the lease…A new phenomenon that is beginning to have a positive impact on our ability to get deals done is the fact that tenants and brokers that represent them are now underwriting landlords [for credit quality].

Analyst: With $100 million of asset sales that you guys are looking to do, are you looking for a range of cap rates or what kind of timing you are looking at there?These are probably industrial buildings with higher cap rates than offices or retail, but cap rates have clearly risen significantly. Rents are falling, cap rates are rising - and that means prices are cliff diving.

LRY: We’re staying with our original guidance on the range which I believe was eight to 11% ...

Analyst: Maybe I missed it but for the 35 million that you sold in the quarter did you guys provide a cap rate on that.

LRY: It was about mid nines.