by Calculated Risk on 4/20/2009 11:25:00 AM

Monday, April 20, 2009

Office Space for Rent: One Year Free!

From the LA Times: Southern California office market is hammered by recession

Vacancy in Los Angeles County reached 14.3% in the first quarter, up from 11.2% a year earlier, according to a report released last week by Cushman & Wakefield. In Orange County, where demand has been dwindling for more than a year, vacancy ticked up to nearly 18% from 15%.And the following is ... amusing:

Among the hardest-hit markets are the Inland Empire, Irvine and north Los Angeles County, all of which have been wracked by the losses of tenants in the troubled industries of mortgage and finance. Vacancies in all three areas have surpassed 20%, a sign of a very weak market. In Ontario and the area around Los Angeles International Airport, vacancy tops 30%.

In West Los Angeles, owners are steeply discounting the monthly cost of an office -- cutting rates that, ironically, grew so high during the boom years that many companies were forced to move out and find cheaper digs.I saw this in my community too. Leases expired. Landlords raised the rents sharply. The long term tenants moved out. Real estate related businesses moved in. And now the buildings are vacant!

BofA CEO: "Credit is bad, going to get worse"

by Calculated Risk on 4/20/2009 10:35:00 AM

[L]et me make a couple comments about our given environment. Credit is bad and we believe credit is going to get worse before it will eventually stabilize and improve. Whether that turn is later this year or in the first half of 2010, I'm not going to hazard a guess ... For the rest of the year we look for charge-offs to continue to trend upward. I think it will be at a slower pace than we've experienced. Reserve build will also continue for the next couple quarters though not at the level we experienced this quarter. From an economic standpoint we believe we can see weak but positive GDP growth by the fourth quarter this year. I have to say that even our internal economists are a little at odds as to the timing, with some seeing recovery earlier. However, we think it prudent to run the company under an expectation it will be later in the year or early next year. We believe unemployment levels won't peak until next year at somewhere in the high single digits. At this point we don't see unemployment meeting or exceeding 10% but that will of course be impact by how long the economy stays in recession.

emphasis added

BofA: $13.4 billion in Credit-loss provisions

by Calculated Risk on 4/20/2009 08:55:00 AM

From CNBC: BofA Tops Forecasts with Help from Merrill

While results topped analysts' forecasts, they were bolstered by one-time events, including a $1.9 billion gain from selling shares of China Construction Bank and $2.2 billion of gains tied to widening credit spreads.The confessional is still open.

...

Bank of America set aside $13.38 billion for credit losses in the quarter, up from the fourth quarter's $8.54 billion.

...

Credit quality deteriorated broadly as the economy weakened, housing prices fell and unemployment rose.

Net charge-offs rose to $6.94 billion from $2.72 billion a year earlier. Nonperforming assets more than tripled to $25.74 billion, and rose $7.51 from year-end.

Bank of America's credit card business lost $1.77 billion in the quarter.

"We continue to face extremely difficult challenges, primarily from deteriorating credit quality driven by weakness in the economy and growing unemployment," Lewis said.

Sunday Night Futures

by Calculated Risk on 4/20/2009 01:38:00 AM

I had a great time at the NPR event.

Here is an open thread for discussion. The futures are off slightly ...

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets. The Asian markets are mixed, but mostly up.

And a graph of the Asian markets.

Best to all.

Sunday, April 19, 2009

Planet Money Webcast

by Calculated Risk on 4/19/2009 08:30:00 PM

The Planet Money webcast starts at 6PM PT with This American Life’s Alex Blumberg and NPR’s Adam Davidson. (I'm just in the audience)

Here is the site.

Best to all

Larry Summers: "Substantial risks; issues in the global economy, commercial real estate"

by Calculated Risk on 4/19/2009 06:21:00 PM

Here is the transcript of Larry Summers on NBC’s ‘Meet the Press’

A few excerpts:

GREGORY: Let me ask -- the president has talked about glimmers of hope in the economy. And obviously, what the government has done, through a stimulus package; what the Fed has done through buying up debt is try to create demand in the economy.There is much more ...

My question is, if you’re seeing any easing in the economy or an easing of the recession, is that because the government is propping the economy up?

Or do you see elements of recovery that are self-sustaining?

SUMMERS: Well, I think you’ve got to give the government credit, some credit for what’s happened, but these have the potential to build into something that’s self-sustaining. That’s certainly not something that’s been established to this point, and that’s why we’re going to need to maintain strong policies for quite some time to come.

But I think we can take some satisfaction that, after a period when there was literally no positive indicator to be found, when it seemed like our economy was in a -- a vertical, it’s a more mixed picture today. And you’ve got to give public policies a significant part of the credit for that.

But as the engine turns over, you know, at some point, it will become something that’s much more -- much more self-sustaining. But right now, we’ve got a long way to go in terms of supporting this economy.

GREGORY: Let me have you respond to some criticism. New York Times columnist and economist, and opponent on these matters of the administration, Paul Krugman wrote this week that the administration should be careful not to -- to count a recovery a before it’s hatched.

He wrote this, specifically, about whether a full-blown depression is still possible. This is what he said: “Can a depression happen again? Well, commercial real estate is coming apart at the seams. Credit card losses are surging. And nobody knows just how bad things will get in Japan or Eastern Europe. We probably won’t repeat the disaster of 1931, but it’s far from certain that the worst is over.”

What do you say?

SUMMERS: You know, I disagree with Paul about a lot of things, but he is right to be raising cautions. That’s why, when I just spoke about the economy, I said that, after a period when it -- when everything was negative, there were now some mixture in the indicators. We don’t know what -- we don’t know; we can’t know with certainty what’s going to happen next, and there certainly are real risks ahead.

That’s why the president’s approach to the banking system involves looking at a stress test that contemplates an adverse outcome and thinks about how the financial system will function in an adverse scenario. That’s why we’re very focused on maintaining the pressure.

No one is in any position to declare any kind of victory here. But the fact that no one can declare victory doesn’t mean that we shouldn’t take note of developments as they unfold. And the developments, as I say, are more -- are more mixed now.

But cautions that we’ve got a long way to go; that there are still substantial risks; that there are downside contingencies that we’ve got to prepare for; that there are issues in the global economy; that there are issues in commercial real estate, that’s right.

...

GREGORY: Let me turn to the issue of the banks. You have referenced these stress tests that the administration is administering to banks, and the idea here is to try to find out how much more financial shock the banks would be able to absorb.

The president has made it very clear that he would provide additional money to the banks if it were necessary for them to shore up their financial position. According to the Treasury secretary, you have roughly $100 billion left in the bailout fund. What if the banks need a lot more than that, in terms of capital reserves?

Where would the money come from?

SUMMERS: Well, David, what the president and the Treasury secretary have actually been clear on is that the first choice, the first resort for more capital is going to the private markets, going to the private markets directly to raise equity, going and working with the private markets in a variety of, kind of, so-called asset liability swaps that would have the effect of perhaps diluting some shareholders but also fortifying the level of capital that those banks had.

And so there’s the capacity to turn to the private market. There’s also the -- there’s also the possibility that, over time, some of the banks that are in the strongest position will find themselves in a position where they can repay a portion of those -- a portion of the resources, which would then enable the government to make further -- further contributions, if necessary.

GREGORY: That’s become a controversial point. You have some banks who are saying, “Look, we’re in pretty healthy shape here. We want to give back this bailout money. We don’t want the taxpayers’ money.”

And the administration has appeared to say, “Hey, not so fast.” Wouldn’t that be a good thing?

SUMMERS: Well, the administration’s been, I think, consistent and clear in taking what I would guess almost everybody would agree is the right position. We want -- we want to be out of the financial system. We want people to be paying back the government. But we don’t want people to be paying back the government in ways that will put themselves right back in trouble and leaving themselves with inadequate capital.

And we certainly don’t want people starving automobile loans or starving the mortgage market or starving the small business market in order to pay back the government.

So what Secretary Geithner has made clear is that he’s very open, and regulatory authorities are very open to being paid back, but it has to be done in a way that’s consistent with the stability of the financial institution and has to be consistent with maintaining the -- maintaining the flow of credit.

emphasis added

Housing Activity Forecast

by Calculated Risk on 4/19/2009 02:17:00 PM

Reuters is quoting Freddie Mac chief economist Frank Nothaft as saying that he believes U.S. housing sales are near a bottom. Nothaft also said about one-third of all sales were foreclosure resales.

I disagree with Nothaft's forecast.

My view is:

Since there are far more existing home sales than new home sales, I expect that total sales activity will decline further.

Note: Please do not confuse a bottom in new home sales activity with a bottom in existing home prices. Please see: Housing: Two Bottoms

New Home Sales

With the huge overhang of existing home inventory - especially distressed inventory - it is theoretically possible for new home sales to go to zero. However, it is more likely that some people will always buy a new home, perhaps because of local supply and demand issues, or maybe they just prefer a new home, or perhaps other reasons. Whatever the reason, I think new home sales are near a bottom.

My 2005 call of a top for new home sales was based on objective factors, however calling the bottom is somewhat more subjective.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows new home sales since 1963. The Census Bureau reported that New Home Sales in February were at a seasonally adjusted annual rate of 337 thousand.

This puts February 2009 sales more than 75% below the peak of July 2005, and near the lowest level since the Census Bureau started tracking sales in 1963 (note: only January 2009 sales at 322 thousand SAAR were lower than February).

These sales number are not adjusted for changes in population or number of households - and adjusting for population changes would make current sales look even worse.

As I noted above, it is possible for new home sales to fall further, however since the economy has just come through a period of very tight credit, and extremely low consumer confidence, my guess is this has pushed new home sales to - or near - the bottom for this cycle.

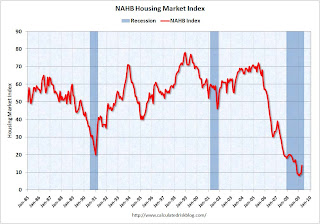

Additional evidence comes from the NAHB builder confidence index. The index increased in April, especially for traffic of prospective buyers. And, anecdotally, the home builders I've spoken with, are all telling me activity has picked up recently.

Additional evidence comes from the NAHB builder confidence index. The index increased in April, especially for traffic of prospective buyers. And, anecdotally, the home builders I've spoken with, are all telling me activity has picked up recently.This graph shows the builder confidence index from the National Association of Home Builders (NAHB). The housing market index (HMI) increased to 14 in April from 9 in March. The record low was 8 set in January.

This is fairly subjective, but I think new home sales are at or near a bottom.

Existing Home Sales

Perhaps we could make the same argument about existing home sales - the economy has just come through a period of very tight credit, and extremely low consumer confidence - depressing sales. But there is another factor to consider for existing home sales; foreclosure resales.

Important note: Foreclosures (the transfer from homeowner to lender) are NOT counted in existing home sales. However when the lender sells the property to a new homeowner, it is counted.

This graph shows existing home sales (left axis) and new home sales (right axis) through February.

This graph shows existing home sales (left axis) and new home sales (right axis) through February. Normally there about 6 times as many existing home sales as new home sales. For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. In recent months this ratio has been close to 14!

In my opinion, the change in the ratio was caused primarily by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Freddie Mac's Frank Nothaft says about one-third of all sales are foreclosure resales. Lawrence Yun, NAR chief economist, recently said "[D]istressed sales accounted for 40 to 45 percent of transactions in February.” Yun is including short sales in addition to foreclosure resales.

These REO resales are real sales and should be included in the NAR statistics, but I suspect these REO buyers might hold these properties longer than recent turnover would suggest. If these are owner occupied buyers, they have probably been waiting to buy, and they have saved a down payment and qualified under the tighter lending standards. They probably won't sell until they can make a reasonable profit to buy a move up home - and it will probably be a number of years before prices recover.

If they are investors, they are likely buying REOs for cash flow - not appreciation, unlike the speculators in recent years - and these investors will probably hold the properties for a number of years too.

And what about all those homeowners with negative equity? If they manage to avoid foreclosure, they will be stuck in their homes for years.

This suggests to me that the turnover rate will slow.

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the February rate of 4.7 million units.

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the February rate of 4.7 million units.I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2009 is for February).

Currently the turnover rate for existing homes is about 6.2% of owner occupied units, still above the median of the last 40 years (6.1%).

Although there may be some increase in existing home sales over the next few months (as foreclosure resales stay elevated), I expect the turnover rate to fall further - perhaps much further - and for existing home sales to decline over the next couple of years.

Summers: For New Capital, Banks Must Try Private Markets First

by Calculated Risk on 4/19/2009 12:55:00 PM

From Bloomberg: Summers Says Banks Must Tap Markets for New Capital (ht jb)

Banks in the U.S. that have received billions of dollars from the government will first have to rely on private markets if they need more money, National Economic Council Director Lawrence Summers said.This is one of the concerns about releasing the stress test results - since the government will require that the weaker banks try to raise private capital first, there might be a loss of investor confidence and even a run on the banks.

“The first resort for more capital is going to the private markets directly to raise equity,” Summers told NBC’s “Meet the Press” program ...

His comments signal that banks deemed in need of capital at the conclusion of government-run “stress tests” may not get additional funds automatically ...

David Axelrod, a senior White House adviser, said some banks “are going to have very serious problems, but we feel that there are tools available to address those problems.” The banks want the “market to know” the health of their balance sheets, he said today on CBS’s “Face the Nation.”

Appraisal Changes: Home Valuation Code of Conduct

by Calculated Risk on 4/19/2009 09:52:00 AM

Starting on May 1st, Fannie Mae and Freddie Mac will not purchase mortgages from Sellers that do not adopt the The Home Valuation Code of Conduct (HVCC). The intention of the code is to insure the independence of the appraiser.

From Kenneth Harney at the LA Times: Mortgage industry changes throw new hurdles in borrowers' way

[B]eginning May 1, Fannie and Freddie are refusing to fund loans with appraisals that do not follow a set of new rules known as the Home Valuation Code of Conduct. Among the procedural changes: Mortgage brokers no longer can order appraisals directly, but instead must allow lenders or investors to use third-party "appraisal management companies" to assign the job to appraisers in their networks.The Center for Public Integrity has a good dicussion of the appraisal process and the HVCC: The Appraisal Bubble

...

Starting April 15, all good faith estimates provided to applicants must indicate a flat $455 charge for appraisals arranged through the appraisal management company. The broker previously charged $325. Consumers will now have to pay the appraisal fee upfront -- before any inspection or valuation is completed -- using a credit card, debit card or electronic fund transfer.

What happens if the appraisal comes in low and the applicants can't qualify for the refi or purchase program they sought? Tough luck: They'll have just two choices: Pay another $455 for a second appraisal -- with no assurance that it will solve the problem -- or cancel the application.

Richard Frank, an appraiser in Vero Beach, Florida, started appraising homes in 1998, when values were climbing. From the beginning, Frank said he stepped into a business arrangement in which lenders forced appraisers to abandon their standards if they wanted work.For more, here is some info from Freddie Mac:

Frank said lenders commonly gave appraisers an estimated value for a home on each appraisal order. Appraisers, who usually determine values by comparing homes to recent sales of comparable properties, often worked backwards from that estimated price to find recent real estate sales that would “make the value,” he said. Working backwards from the estimate was faster. Everyone made money. And since appraising homes is subjective — both an art and a science — it was easy to fudge numbers.

“The [supposedly comparable] houses might be bigger and better, but who’s going to know?” Franks said. “In an increasing market, your sins are buried.”

If an appraisal came in lower than the purchase price, the loan likely would be denied. Since loan origination staff is typically paid by commission, a failed deal meant no paycheck for them. If that happened too many times, Frank says, lenders stopped sending the appraiser work. “Put out, and you will get more dates. It’s just that simple,” he said.

The Home Valuation Code of Conduct fact sheet [PDF 88K]

The Home Valuation Code of Conduct [PDF 25K]

Frequently Asked Questions

Saturday, April 18, 2009

NPR's 'Planet Money'

by Calculated Risk on 4/18/2009 09:10:00 PM

Note: I will be at this event tomorrow night.

From Tom Petruno at the LA Times: NPR's 'Planet Money,' live from Santa Monica

Fans of NPR's Alex Blumberg and Adam Davidson, who produced the award-winning housing-crisis explainer "The Giant Pool of Money," will want to tune in to KCRW on Sunday from 6 to 7 p.m. PDT: The two will be broadcasting their "Planet Money" show live from the Broad Stage in Santa Monica.

Following on the success of "The Giant Pool of Money" in May 2008, Blumberg and Davidson launched Planet Money in early September to blog on the nation’s economic crisis. Their timing was perfect: Planet Money began on Sept. 7 -- the day the government seized Fannie Mae and Freddie Mac, the first dominoes to fall in the financial-system collapse.