by Calculated Risk on 4/09/2009 07:55:00 PM

Thursday, April 09, 2009

Using Corporate Bonds as an Economic Predictor

UPDATE: Here is the paper: Credit Market Shocks and Economic Fluctuations: Evidence from Corporate Bond and Stock Markets (ht MrM who writes: "Please note that the authors construct their own bond indices, so one should not draw conclusions about their paper by looking at Moody's charts")

Justin Lahart reports in the WSJ on a new research paper: Giving Corporate Credit Its Due (ht James)

In a forthcoming paper in the Journal of Monetary Economics [economists Simon Gilchrist and Vladimir Yankov at Boston University, and Egon Zakrajsek at the Federal Reserve] show that spreads on low- to medium-risk corporate bonds, particularly those with 15 or more years until maturity, predicted changes in the economy phenomenally well, forecasting the ups and downs in both hiring and production a year before they occurred. Since writing the paper, they extended their analysis back to 1973 and found bonds' predictive ability still held.I haven't seen the paper yet, but here are the spreads I've been following based on 30 year corporate bonds.

With the massive widening in corporate-bond spreads last fall, the economists' model predicts industrial production will fall another 17% by the end of the year, and the economy will lose another 7.8 million jobs on top of the 5.1 million it has shed since the recession began. Ouch.emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

It looks like this spread has predicted a few extra recessions! I'm looking forward to the paper.

China: Record Auto Sales, Now Number 1 Auto Market

by Calculated Risk on 4/09/2009 05:51:00 PM

From The Times: China bucks trend with new record in car sales

... Chinese people ... bought 1.10 million vehicles in March, up some five per cent from the previous record of 1.06 million in March last year, data from the China Association of Automobile Manufacturers showed.Interesting.

The number cemented China in its position as the world’s largest car market, outstripping even the US.

...

Growth in sales had slowed in 2008 to its lowest annual rate in more than a decade as the global financial crisis took its toll towards the end of the year, prompting many Chinese to keep their wallets shut tight in case of more problems ahead. However, the government support measures introduced in February have spurred the market.

For more on China, from Roubini: China’s Economy in 2009 and Beyond

[T]here are greater signs of economic recovery in March from the depths of Q4 2008 and most forward looking indicators suggest that Q2 2009 through Q4 2009 growth will accelerate relative to the dismal Q4 of 2008 and weak Q1 of 2009. In particular, economic data for China (including loan growth, the PMI, recovery in residential sales volume – if not prices, and public investment) do point to a stabilization or even slight improvement but we at RGE Monitor still see risks that Chinese growth will be well below the government target of 8% and even below the 6.5% level that the IMF and World Bank are predicting – a figure of 5-6% seems more likely.Bob_in_MA also recommends: China Financial Markets by Michael Pettis, a professor at Peking University’s Guanghua School of Management.

Market: More Volatility

by Calculated Risk on 4/09/2009 03:45:00 PM

Another day, another big swing ...

Dow up 3.1% (back above 8,000)

S&P 500 up 3.8%

NASDAQ up 3.9% Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

This puts the recent rally into perspective - the S&P is still off about 45% from the 2007 high.

Hotel Occupancy: RevPAR off 18%

by Calculated Risk on 4/09/2009 01:26:00 PM

Yesterday I summarized the recent data: mall vacancies up, office vacancies up, apartment vacancies up - and rents falling. For lodging, the measure is occupancy and RevPAR (Revenue per available room), and both are off sharply year-over-year.

From HotelNewsNow.com: STR reports U.S. data for week ending 4 April 2009

In year-over-year measurements, the industry’s occupancy fell 9.9 percent to end the week at 56.2 percent (62.3 percent in the comparable week in 2008). Average daily rate dropped 9.0 percent to finish the week at US$98.79 (US$108.59 in the comparable week in 2008). Revenue per available room for the week decreased 18.0 percent to finish at US$55.49 (US$67.68 in the comparable week in 2008).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 9.3% from the same period in 2008.

The average daily rate is down 9.0%, so RevPAR is off 18.0% from the same week last year.

Larry Summers at the Economic Club

by Calculated Risk on 4/09/2009 12:13:00 PM

Larry Summers, Director of the National Economic Council, will speak at to the Economic Club of Washington.

UPDATE: Starting at 12:43 PM ET

Here is the CNBC feed.

Discussion in the comments ...

UPDATE: CSpan Link.

CNBC Interview with Wells Fargo CFO

by Calculated Risk on 4/09/2009 11:09:00 AM

From CNBC: Wells Fargo CFO: Wachovia Merger Behind Record Profits

In December we closed the Wachovia acquisition," said [Howard Atkins, CFO, Wells Fargo]. "This is the first quarter the two companies have been combined and because of the move, we thought it was important to get this news out early."NIMs (Net Interest Margins) are Edit: Higher than expected - and Atkins doesn't say it, but their borrowing costs have to be close to zero.

Atkins said that the losses in the acquistion are behind Wells Fargo. "We did write off most of them [losses]and we are enjoying the benefits of the merged companies," said Atkins.

Atkins said details on Wachovia savings are "going to begin to emerge in the second quarter.

...

Atkins went on to say there was "very little impact" on results from a new rule by the Financial Accounting Standards Board that gives banks more freedom to value assets as they would in normal markets rather than at distressed prices.

U.S. Trade Deficit: Lowest Since 1999

by Calculated Risk on 4/09/2009 08:44:00 AM

The collapse in trade continues to be an important story.

The Census Bureau reports:

[T]otal February exports of $126.8 billion and imports of $152.7 billion resulted in a goods and services deficit of $26.0 billion, down from $36.2 billion in January, revised. February exports were $2.0 billion more than January exports of $124.7 billion. February imports were $8.2 billion less than January imports of $160.9 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through February 2009. The recent rapid decline in foreign trade continued in February. Note that a large portion of the recent decline in imports was related to the fall in oil prices, however the decline in February was mostly non-oil related.

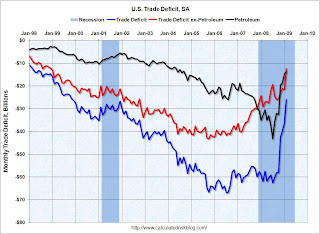

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices fell slightly to $39.22 in February, from $39.81 in January, and import quantities decreased too - so the petroleum deficit declined by $1 billion.

However most of the decline in the trade deficit was non-oil related.

I suppose a collapse in U.S. imports is one way to rebalance the world economy ...

Unemployment Insurance: Continued Claims at Record 5.84 Million

by Calculated Risk on 4/09/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 4, the advance figure for seasonally adjusted initial claims was 654,000, a decrease of 20,000 from the previous week's revised figure of 674,000. The 4-week moving average was 657,250, a decrease of 750 from the previous week's revised average of 658,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 28 was 5,840,000, an increase of 95,000 from the preceding week's revised level of 5,745,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 657,250.

Continued claims are now at 5.84 million - the all time record.

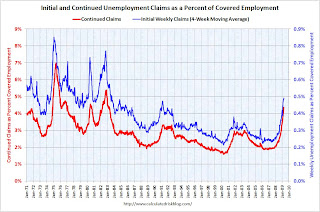

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

This is another very weak report and shows continued weakness for employment.

Housing Bust in Manhattan

by Calculated Risk on 4/09/2009 12:31:00 AM

From Wall Street (1987):

Real Estate Agent Sylvie when Bud Fox goes to buy a condo:From the NY Times: Housing Slump Hits Manhattan...everybody tells ya they hate the Upper East Side and they wanna live on the West Side but honey when it comes to resale time, believe me the East Side's the one that always moves.Agent Sylvie when Bud tries to sell:... well, the market's dead, hon, even the rich are bitching, nothing's moving except termites and cockroaches ...

Apartment prices have once more become the talk of the town in Manhattan, but this time the talk is of uncertainty and falling numbers. ...And I was told New York was immune ...

In this year’s first quarter, sales of co-ops and condominiums in Manhattan plunged nearly 60 percent from the first quarter of 2008. Average co-op prices fell as much as 24 percent in the same period, according to various market reports released last week.

...

[Jonathan J. Miller, an appraiser] said that during the last big real estate downtown, when studio apartments were so cheap that he considered buying one on a credit card, people thought the luxury market would never come back. “Conspicuous consumption was out of vogue in 1991,” he said. “The market was back by 1997 or 1998.”