by Calculated Risk on 4/09/2009 02:18:00 PM

Thursday, April 09, 2009

Hotel Occupancy: RevPAR off 18%

by Calculated Risk on 4/09/2009 01:26:00 PM

Yesterday I summarized the recent data: mall vacancies up, office vacancies up, apartment vacancies up - and rents falling. For lodging, the measure is occupancy and RevPAR (Revenue per available room), and both are off sharply year-over-year.

From HotelNewsNow.com: STR reports U.S. data for week ending 4 April 2009

In year-over-year measurements, the industry’s occupancy fell 9.9 percent to end the week at 56.2 percent (62.3 percent in the comparable week in 2008). Average daily rate dropped 9.0 percent to finish the week at US$98.79 (US$108.59 in the comparable week in 2008). Revenue per available room for the week decreased 18.0 percent to finish at US$55.49 (US$67.68 in the comparable week in 2008).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 9.3% from the same period in 2008.

The average daily rate is down 9.0%, so RevPAR is off 18.0% from the same week last year.

Larry Summers at the Economic Club

by Calculated Risk on 4/09/2009 12:13:00 PM

Larry Summers, Director of the National Economic Council, will speak at to the Economic Club of Washington.

UPDATE: Starting at 12:43 PM ET

Here is the CNBC feed.

Discussion in the comments ...

UPDATE: CSpan Link.

CNBC Interview with Wells Fargo CFO

by Calculated Risk on 4/09/2009 11:09:00 AM

From CNBC: Wells Fargo CFO: Wachovia Merger Behind Record Profits

In December we closed the Wachovia acquisition," said [Howard Atkins, CFO, Wells Fargo]. "This is the first quarter the two companies have been combined and because of the move, we thought it was important to get this news out early."NIMs (Net Interest Margins) are Edit: Higher than expected - and Atkins doesn't say it, but their borrowing costs have to be close to zero.

Atkins said that the losses in the acquistion are behind Wells Fargo. "We did write off most of them [losses]and we are enjoying the benefits of the merged companies," said Atkins.

Atkins said details on Wachovia savings are "going to begin to emerge in the second quarter.

...

Atkins went on to say there was "very little impact" on results from a new rule by the Financial Accounting Standards Board that gives banks more freedom to value assets as they would in normal markets rather than at distressed prices.

U.S. Trade Deficit: Lowest Since 1999

by Calculated Risk on 4/09/2009 08:44:00 AM

The collapse in trade continues to be an important story.

The Census Bureau reports:

[T]otal February exports of $126.8 billion and imports of $152.7 billion resulted in a goods and services deficit of $26.0 billion, down from $36.2 billion in January, revised. February exports were $2.0 billion more than January exports of $124.7 billion. February imports were $8.2 billion less than January imports of $160.9 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through February 2009. The recent rapid decline in foreign trade continued in February. Note that a large portion of the recent decline in imports was related to the fall in oil prices, however the decline in February was mostly non-oil related.

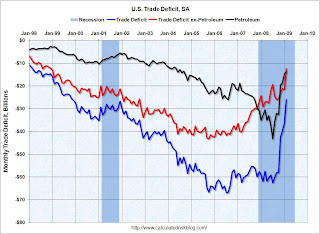

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices fell slightly to $39.22 in February, from $39.81 in January, and import quantities decreased too - so the petroleum deficit declined by $1 billion.

However most of the decline in the trade deficit was non-oil related.

I suppose a collapse in U.S. imports is one way to rebalance the world economy ...

Unemployment Insurance: Continued Claims at Record 5.84 Million

by Calculated Risk on 4/09/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 4, the advance figure for seasonally adjusted initial claims was 654,000, a decrease of 20,000 from the previous week's revised figure of 674,000. The 4-week moving average was 657,250, a decrease of 750 from the previous week's revised average of 658,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 28 was 5,840,000, an increase of 95,000 from the preceding week's revised level of 5,745,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 657,250.

Continued claims are now at 5.84 million - the all time record.

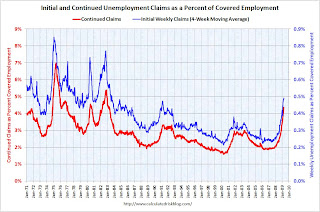

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

This is another very weak report and shows continued weakness for employment.

Housing Bust in Manhattan

by Calculated Risk on 4/09/2009 12:31:00 AM

From Wall Street (1987):

Real Estate Agent Sylvie when Bud Fox goes to buy a condo:From the NY Times: Housing Slump Hits Manhattan...everybody tells ya they hate the Upper East Side and they wanna live on the West Side but honey when it comes to resale time, believe me the East Side's the one that always moves.Agent Sylvie when Bud tries to sell:... well, the market's dead, hon, even the rich are bitching, nothing's moving except termites and cockroaches ...

Apartment prices have once more become the talk of the town in Manhattan, but this time the talk is of uncertainty and falling numbers. ...And I was told New York was immune ...

In this year’s first quarter, sales of co-ops and condominiums in Manhattan plunged nearly 60 percent from the first quarter of 2008. Average co-op prices fell as much as 24 percent in the same period, according to various market reports released last week.

...

[Jonathan J. Miller, an appraiser] said that during the last big real estate downtown, when studio apartments were so cheap that he considered buying one on a credit card, people thought the luxury market would never come back. “Conspicuous consumption was out of vogue in 1991,” he said. “The market was back by 1997 or 1998.”

Wednesday, April 08, 2009

Bailout Bonds

by Calculated Risk on 4/08/2009 09:31:00 PM

From Graham Bowley and Michael de la Merced at the NY Times: U.S. Imagines the Bailout as an Investment Tool

[T]he Obama administration is encouraging several large investment companies to create the financial-crisis equivalent of war bonds: bailout funds.I assume PIMCO, BlackRock and others will charge minimal or no fees for individual investors.

The idea is that these investments ... would give ordinary Americans a chance to profit from the bailouts that are being financed by their tax dollars. ...

But, as with any investment, there are risks. If, as some analysts suspect, the banks’ assets are worth even less than believed, the funds’ investors could suffer significant losses. Nonetheless, the administration and executives in the financial industry are pushing to establish the investment funds, in part to counter swelling hostility against the financial industry.

...

The new funds are still under discussion, and they are unlikely to be established for several months, if indeed the plans go through at all.

You, too, can help bailout Citigroup and BofA! (in addition to your taxes)

The TARP COP: Elizabeth Warren on April Report

by Calculated Risk on 4/08/2009 06:08:00 PM

Here is the Congressional Oversight Panel page: Assessing Treasury’s Strategy: Six Months of TARP

Here is the April Oversight Report.

Vacancies, vacancies, vacancies ... and falling rents

by Calculated Risk on 4/08/2009 04:08:00 PM

Here is a summary of the vacancy reports released over the last few days.

On vacancies:

Malls: From Bloomberg: Vacancies at U.S. Retail Centers Hit 10-Year High, Reis Says

The vacancy rate at neighborhood and community shopping centers rose to 9.5 percent from 8.9 percent the previous quarter and 7.7 percent a year ago ...Offices: Office Vacancy Rate Rises to 15.2% in Q1 and the WSJ: Companies Sold Office Space at a Fast Pace

The office vacancy rate nationwide rose to 15.2% from 14.5% in the previous quarter, and likely will surpass 19.3% over the next year, according to Reis ...Apartments: From Reuters: US apartment market worsens with economy--Reis

The national apartment vacancy rate rose to 7.2 percent in the first quarter, up 0.60 percentage points from the prior quarter and 1.1 percentage points from a year earlier ...Hotels: From HotelNewsNow.com: STR reports U.S. data for week ending 28 March

In year-over-year measurements, the industry’s occupancy fell 12.3 percent to end the week at 56.6 percent...And on rents:

Offices: From the Telegraph: London's empty office space tops 10m sq ft

The slump is placing immense pressure on rents, which have now fallen 27pc in the past year from an average of £65 per sq ft to £47.50.From Bloomberg: San Francisco Office Rents Fall Most Since 2001

San Francisco office rents dropped 24 percent in the first quarter from a year earlier ... The average rent fell citywide to $38.80 a square foot from $50.92 ...From Bloomberg: Manhattan Office Rents Fall Most in Quarter Century

Manhattan office rents ... dropped 6 percent from the fourth quarter to $65.01 a square foot [Note: 24% annual rate] ... The decline is the most in records dating back to 1984 ...Apartments: From the LA Times: Apartment rents fall in Southern California

... The average rent in Los Angeles County fell almost 4% in 2008 ...From Reuters: US apartment market worsens with economy--Reis

Asking rents fell by 0.6 percent to $1,046 per month, the largest single-quarter decline since Reis began reporting quarterly performance data in 1999.Malls: From Bloomberg:

Landlords’ asking rents for regional malls fell 1.2 percent from the prior quarter, the most in five years, said Reis.Hotels: From HotelNewsNow.com:

[D]aily rate dropped 8.8 percent to finish the week at US$99.77 ... Revenue per available room for the week decreased 20.0 percent to finish at US$56.50