by Calculated Risk on 3/14/2009 03:22:00 PM

Saturday, March 14, 2009

G20: Key is Value of Assets on Banks’ Balance Sheets

Here is the G20 statement. Excerpt:

Our key priority now is to restore lending by tackling, where needed, problems in the financial system head on, through continued liquidity support, bank recapitalisation and dealing with impaired assets, through a common framework (attached). We reaffirm our commitment to take all necessary actions to ensure the soundness of systemically important institutions.And from the "common framework":

We, the G20 Finance Ministers and Central Bank Governors, agreed the need to continue working together to maintain and support lending in our financial systems. We are committed to taking decisive action, where needed, and to use all available tools to restore the full functioning of financial markets, and in particular to underpin the flow of credit, both domestically and globally.The rest is general, but it keeps coming back to how to value the toxic assets on the banks' balance sheets.

Actions to achieve this may include where necessary:providing liquidity support, including through government guarantees to financial institutions’ liabilities; injecting capital into financial institutions; protecting savings and deposits; and, strengthening banks’ balance sheets, including through dealing with impaired assets.

Our key priority now is to address the uncertainties around the value of assets held on banks’ balance sheets, which are significantly constraining banks’ lending. This uncertainty, and the extent to which banks are holding capital to protect themselves from further potential extreme losses, is preventing them from restoring lending to business and households, with damaging consequences to our economies.

emphasis added

G-20: No Call for Stimulus

by Calculated Risk on 3/14/2009 09:15:00 AM

From the WSJ: G-20 Won't Call for More Stimulus

Finance ministers and central bank heads from the group of 20 leading economies won't make a joint call for further fiscal stimulus at the end of their two-day meeting here ...The G-20 Finance Ministers are meeting today in preparation for the April 2nd summit of national leaders in London. Geithner is expected to hold a briefing around mid-day ET after the G-20 talks.

Separately, officials will lay out a set of principles on how to address the toxic assets weighing on banks' balance sheets ... The person said the principles will likely be included in an annex to the communique officials will release after today's meeting.

The U.S. plans to release details of its plan to use public and private money to ease the burden of toxic assets in the coming weeks, but European governments are likely to want more detail even sooner ...

It doesn't sound like there will be a coordinated fiscal stimulus policy as some had hoped for.

Friday, March 13, 2009

Friday is Cancelled

by Calculated Risk on 3/13/2009 09:19:00 PM

I guess the FDIC needed a break!

David Letterman: Andy Kindler visits with Maria Bartiromo and Paul Krugman

Enjoy the evening ...

LA Port Import Traffic Collapses in February

by Calculated Risk on 3/13/2009 06:03:00 PM

Earlier today the Census Bureau reported that both imports and exports continued to decline in January. But February is looking even worse. Last week China reported exports had collapsed in February. And from the Journal of Commerce Online today: St. Petersburg TEU Traffic Plunges

The First Container Terminal in St. Petersburg, Russia’s biggest box terminal, reported traffic in February plunged 27.3 percent from a year ago as imports collapsed.Now we have data from the Port of Los Angeles for February (usually I wait until Long Beach reports too and combine the two ports, but this collapse is stunning).

The terminal handled 61,301 TEUs in February, taking volume for the first two months of the year to 124,608 TEUs, a drop of 24.7 percent on the same period in 2008.

The decline “is a direct result of the unfolding economic downturn which is affecting Russian importers in every possible way,” said Egor Govorukhin, vice president sales and marketing at National Container Co., the terminal’s owner.

Click on graph for larger image in new window.

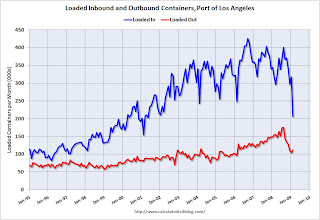

Click on graph for larger image in new window.This graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 35% below last February and 35% below last month.

The Port of Los Angeles put up a special message explaining the collapse:

Contributing factors:We have to be careful because of the impact of the Chinese New Year on trade, but it does appear trade collapsed in February.Continued worldwide economic crisis contributing to a decline in trade volumes.

Consumer sales are down due to high unemployment rates. 15 less vessel calls this February due to this decline and the consolidation of services in order to fill up the existing services. Chinese factories closed for an extended periods of time (beyond the normal time period) for Chinese New Year. Due to the lack of volume and Chinese New Year, Maersk 6700 TEU/week vessel did not make any calls in LA during the month of February (which is traditionally a low volume month). Anticipate this year’s volumes will continue to be below last year’s volumes because sales are still slow with most economists predicting there will not be any recovery before the second half of the year.

Stock Market: Another Up Day

by Calculated Risk on 3/13/2009 04:21:00 PM

While we wait for the FDIC on Friday the 13th ... the S&P 500 is now up 11.8% from the lows. Here are a couple of graphs: Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P is just above the closing low of last November.

Report: BankUnited Halts Attempts to Raise Capital

by Calculated Risk on 3/13/2009 02:27:00 PM

Another Bank Failure Friday tease ...

BankUnited has apparently halted efforts to find a buyer or raise capital according to TheDeal.com (ht Brian) citing unnamed sources. According to the story, the move suggests the FDIC is preparing to seize BKUNA.

Report: 200 FDIC Agents Arrive in Puerto Rico

by Calculated Risk on 3/13/2009 12:33:00 PM

Since it is Bank Failure Friday, this is just an early tease ...

From the Caribbean Business: FDIC agents here checking several banks (ht David)

Financial Commissioner Alfredo Padilla admitted Friday that some 200 Federal Deposit Insurance Corp. (FDIC) agents were in Puerto Rico but said it was not to close a bank but to check several of them.Maybe the FDIC agents just need a vacation.

Padilla said a decision was made to investigate several banks at the same time, which is why so many more agents than usual were in town.

Philly Fed State Coincident Indexes: Widespread Recession

by Calculated Risk on 3/13/2009 11:06:00 AM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Almost all states are showing declining activity over the last three months.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 49 states in January (Louisiana was the one exception). Here is the Philadelphia Fed state coincident index release for January.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for January 2009. The indexes decreased in 49 states and increased in one, Louisiana, for the month (a one-month diffusion index of -96). For the past three months, the indexes have increased in one state, Wyoming; stayed flat in one state, Louisiana; and decreased in the other 48 states (a three-month diffusion index of -94).

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Last month (December) the number of states with increasing activity was reported as zero, but that has been revised to two. So the current month - with only one state showing increasing activity - is the record for fewest states with increasing activity.

Stewart vs. Cramer

by Calculated Risk on 3/13/2009 10:37:00 AM

Note: The Daily Show website is a little slow today (for some reason!)

Here is the full episode.

Here are three short uncensored excerpts (warning: explicit language).

Part II.

Part III.

FICO President: 'Worst to come' for Mortgage Crisis

by Calculated Risk on 3/13/2009 10:14:00 AM

"Before we do the credit cards, we are actually not done with the mortgage [crisis] - the worst of that is yet to come in fact. The thing about mortgages is you can predict when they are going to reset and you can sort of see what is coming. We easily have another 12 to 18 months of pretty ugly times in terms of mortgage resetting. ... Credit cards are next."

FICO (formerly Fair Isaac) CEO and Michael Porter, CNBC

Porter also defends FICO scores as useful (no surprise), and I think he is mostly correct. Unfortunately during the housing bubble, many lenders used creditworthiness (and FICO scores) as the only measure to allow a loan. Historically lenders used the "Three C's": creditworthiness, capacity, and collateral.

On capacity, during the bubble, lenders qualified borrowers at teaser rates - or the Neg Am rate for Option ARMs. They didn't consider if the borrower could meet the fully amortized rate. On collateral, lenders just assumed housing prices would increase and 100%+ LTV loans were common. All three C's still matter.