by Calculated Risk on 3/04/2009 05:00:00 PM

Wednesday, March 04, 2009

LA Times: Housing Development Sites Become "Wasteland"

From the LA Times: As projects grind to a halt, home sites turn to wasteland

By day, it's far too quiet at the site of a planned housing and retail development on a former Navy base in Oakland.Some of these units have been mothballed (with fences and guards), others essentially abandoned. This is just more supply waiting for the market to improve.

At night, neighbors can hear the thieves come out.

They rip out copper wire, haul away pipes and take anything else they can steal from dozens of buildings on the site, abandoned after Irvine developer SunCal Cos. fell victim to the economy.

It's a scene not uncommon throughout California...

"I hear hacking and see scary bonfires in the middle of the night," said Don Johnson, a retired Coast Guard employee who lives near the defunct Oak Knoll Naval Medical Center in Oakland.

Nearly 250 residential developments with a combined total of 9,389 houses and condominiums have been halted in California, according to research firm Hanley Wood Market Intelligence. The units, worth close to $3.5 billion, were in various stages of development.

Market Rebound

by Calculated Risk on 3/04/2009 03:59:00 PM

The Fed may say the economy has weakened (see Beige Book), but the markets rebounded today ...

Dow up 2.2%

S&P 500 up 2.4%

NASDAQ up 2.5%

Back to full posting later today ...

Fed's Beige Book

by Calculated Risk on 3/04/2009 03:00:00 PM

Reports from the twelve Federal Reserve Districts suggest that national economic conditions deteriorated further during the reporting period of January through late February. Ten of the twelve reports indicated weaker conditions or declines in economic activity; the exceptions were Philadelphia and Chicago, which reported that their regional economies "remained weak." The deterioration was broad based, with only a few sectors such as basic food production and pharmaceuticals appearing to be exceptions. Looking ahead, contacts from various Districts rate the prospects for near-term improvement in economic conditions as poor, with a significant pickup not expected before late 2009 or early 2010.And on real estate:

Residential real estate markets remained in the doldrums in most areas, with only scattered, very tentative signs of stabilization reported. The pace of sales remained very low in most areas and declined further in some; most Districts reported small declines, but New York cited a sales drop of 60 to 65 percent in Manhattan compared with twelve months earlier. By contrast, Cleveland, Richmond, Dallas, and San Francisco each reported a rising or better-than-expected sales pace for existing or new homes in some areas, attributed largely to falling prices and improved financing terms for some types of home mortgages. House prices continued to decline, reportedly at double-digit paces in some areas, with little or no signs of a deceleration evident. Builders in various Districts generally remain pessimistic regarding recovery prospects this year, and consequently the pace of new home construction declined further in most areas.Grim outlook, especially for CRE. (sorry for slow post, I'm on jury duty!)

Demand for commercial, industrial, and retail space fell further during the reporting period, with some evidence of more rapid deterioration than in preceding periods. Vacancy rates rose and lease rates declined on a widespread basis; New York noted that commercial real estate markets "weakened noticeably," while Atlanta described reports on commercial real estate that were "decidedly more negative" than in previous periods. Construction activity has declined commensurately, and assorted reports suggest that market participants expect this weakness to continue at least through the end of 2009. Cleveland noted that public works projects have shown stability of late, although they declined in the San Francisco District as a result of the budgetary struggles of some state and local governments there. Credit constraints and uncertainty were reported to be a drag on commercial construction and leasing activity in the Philadelphia, Chicago, Dallas, and San Francisco Districts.

emphasis added

Employment Data

by Calculated Risk on 3/04/2009 11:49:00 AM

I don't have much confidence in the ADP numbers, but here they are anyway ...

From CNBC: ADP Shows Record Job Losses; Planned Layoffs Down

ADP said on Wednesday that private employers cut 697,000 jobs in February versus a revised 614,000 jobs lost in January.And on the Challenger layoff report:

The January job cuts were originally reported at 522,000.

It was the biggest job loss since the report's launch in 2001 ...

[P]lanned layoffs at U.S. firms fell 23 percent in February from January's seven-year peak, but remained well above long term averages as the protracted U.S. recession took a heavy toll on employment, ...The consensus for the BLS report on Friday is about 650,000 fewer jobs, but I've seen some forecast much higher (in the 850,000 range). We can be pretty sure the number will be very ugly.

"The decline in job cuts last month offers some hope that January was the peak and we will now see layoffs begin to fall or at least stabilize," said John A. Challenger, chief executive officer of Challenger, Gray & Christmas, in a statement.

But he said monthly job cuts may remain above 100,000 in the first half of the year and possibly for the rest of 2009.

February ISM Non-Manufacturing Index Shows Faster Contraction

by Calculated Risk on 3/04/2009 10:00:00 AM

From the Institute for Supply Management: February 2009 Non-Manufacturing ISM Report On Business®

"The NMI (Non-Manufacturing Index) registered 41.6 percent in February, 1.3 percentage points lower than the 42.9 percent registered in January, indicating contraction in the non-manufacturing sector for the fifth consecutive month at a slightly faster rate. The Non-Manufacturing Business Activity Index decreased 4 percentage points to 40.2 percent. The New Orders Index decreased 0.9 percentage point to 40.7 percent, and the Employment Index increased 2.9 percentage points to 37.3 percent. The Prices Index increased 5.6 percentage points to 48.1 percent in February, indicating a slower decrease in prices from January. According to the NMI, one non-manufacturing industry reported growth in February. Respondents are concerned about the soft market conditions, the negative outlook for employment and the overall state of the economy."This is another weak report.

Treasury Releases Detailed Guidelines on Mortgage Modification Plan

by Calculated Risk on 3/04/2009 09:24:00 AM

From MarketWatch: Treasury says mortgage plan to help up to 9 mln homeowners

The Treasury Department released guidelines to its mortgage modification plan on Wednesday and said that the program will help up to 9 million homeowners avoid foreclosure. The guidelines will enable servicers to begin modifying mortgages right away ... The Treasury program also includes incentives for removing second liens on loans.From financialstability.gov (Treasury site):

Summary of Guidelines

Modification Program Guidelines

Counselor Q&A

Fact Sheet

Report: 8.3 Million U.S. Homeowners with Negative Equity

by Calculated Risk on 3/04/2009 09:08:00 AM

From Bloomberg: More Than 8.3 Million U.S. Mortgages Are Underwater

More than 8.3 million U.S. mortgage holders owed more on their loans in the fourth quarter than their property was worth as the recession cut home values by $2.4 trillion last year, First American CoreLogic said.Late last year Mark Zandi at Moody's Economy.com estimated that there were "roughly 12 million households, or 16%, owe more than their homes are worth". The difference between the estimates is probably because a large number of homeowners have little equity - and small changes in home price assumptions change the number underwater significantly. The differences in percentages is because CoreLogic is using only households with mortgages; Zandi used all households (about 31% of households have no mortgages).

An additional 2.2 million borrowers will be underwater if home prices decline another 5 percent, First American, a Santa Ana, California-based seller of mortgage and economic data, said in a report today. Households with negative equity or near it account for a quarter of all mortgage holders.

Toll Brothers: More Losses, No Pick-up in Activity

by Calculated Risk on 3/04/2009 06:48:00 AM

"We have not yet seen a pick-up in activity at our communities other than ordinary seasonal increases for this time of year."Press Release: Toll Brothers Reports 1st Qtr 2009 Results

Robert I. Toll, chairman and chief executive officer, March 4, 2009

Toll Brothers ... today reported a FY 2009 first quarter net loss of $88.9 million ... which included pre-tax write-downs totaling $156.6 million.Toll's normal cancellation rate is about 7%.

...

Joel H. Rassman, chief financial officer, stated: "Given the numerous uncertainties related to sales paces, sales prices, mortgage markets, cancellations, market direction and the potential for and size of future impairments, it is particularly difficult in the current climate to provide guidance for the rest of FY 2009. As a result, we will not provide earnings guidance at this time."

...

FY 2009's first-quarter cancellation rate (current-quarter cancellations divided by current-quarter signed contracts) was 37.1% ...

In summary: More losses. More write-downs. More cancellations. No guidance. No pick-up in activity.

Tuesday, March 03, 2009

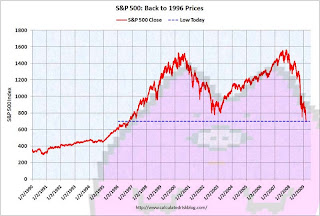

Interesting Technical Pattern Developing*

by Calculated Risk on 3/03/2009 09:30:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Reader Nate suggests the S&P 500 is just tracing out the Mortgage Pig™. (ht Nate and IF)

* IF suggested the post title.

Mortgage Pig™ says: "In UR Poolz Killin your convexity."

For those interested, here are few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

Office Furniture: Cliff Diving

by Calculated Risk on 3/03/2009 08:32:00 PM

From Reuters: U.S. office furniture orders, shipments plunge in January

U.S. office furniture orders and shipments fell about 25 percent in January, reflecting the biggest year-over-year percentage declines since the 2001-02 recession, a trade group said.

The Business and Institutional Furniture Manufacturers Association said January orders fell 25 percent to $565 million and shipments fell 26 percent to $630 million.

BIFMA also lowered its 2009 forecast for orders to a decline of 26.5 percent, compared with its prior estimate of a drop of 11.6 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual consumption of office furniture in the U.S. (including imports) and the Business and Institutional Furniture Manufacturers Association forecast for 2009.

The slump in the office market - with rapidly rising office vacancies - is having a secondary impact on office suppliers. This is similar to what happened to the home furnishing bust over the last few years because of the bursting of the housing bubble. Based on this forecast, the U.S. office furniture market will probably be back to the 1994 to 1995 level.