by Calculated Risk on 3/04/2009 06:48:00 AM

Wednesday, March 04, 2009

Toll Brothers: More Losses, No Pick-up in Activity

"We have not yet seen a pick-up in activity at our communities other than ordinary seasonal increases for this time of year."Press Release: Toll Brothers Reports 1st Qtr 2009 Results

Robert I. Toll, chairman and chief executive officer, March 4, 2009

Toll Brothers ... today reported a FY 2009 first quarter net loss of $88.9 million ... which included pre-tax write-downs totaling $156.6 million.Toll's normal cancellation rate is about 7%.

...

Joel H. Rassman, chief financial officer, stated: "Given the numerous uncertainties related to sales paces, sales prices, mortgage markets, cancellations, market direction and the potential for and size of future impairments, it is particularly difficult in the current climate to provide guidance for the rest of FY 2009. As a result, we will not provide earnings guidance at this time."

...

FY 2009's first-quarter cancellation rate (current-quarter cancellations divided by current-quarter signed contracts) was 37.1% ...

In summary: More losses. More write-downs. More cancellations. No guidance. No pick-up in activity.

Tuesday, March 03, 2009

Interesting Technical Pattern Developing*

by Calculated Risk on 3/03/2009 09:30:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Reader Nate suggests the S&P 500 is just tracing out the Mortgage Pig™. (ht Nate and IF)

* IF suggested the post title.

Mortgage Pig™ says: "In UR Poolz Killin your convexity."

For those interested, here are few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

Office Furniture: Cliff Diving

by Calculated Risk on 3/03/2009 08:32:00 PM

From Reuters: U.S. office furniture orders, shipments plunge in January

U.S. office furniture orders and shipments fell about 25 percent in January, reflecting the biggest year-over-year percentage declines since the 2001-02 recession, a trade group said.

The Business and Institutional Furniture Manufacturers Association said January orders fell 25 percent to $565 million and shipments fell 26 percent to $630 million.

BIFMA also lowered its 2009 forecast for orders to a decline of 26.5 percent, compared with its prior estimate of a drop of 11.6 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual consumption of office furniture in the U.S. (including imports) and the Business and Institutional Furniture Manufacturers Association forecast for 2009.

The slump in the office market - with rapidly rising office vacancies - is having a secondary impact on office suppliers. This is similar to what happened to the home furnishing bust over the last few years because of the bursting of the housing bubble. Based on this forecast, the U.S. office furniture market will probably be back to the 1994 to 1995 level.

Pensions: Another Trillion Dollar Bailout?

by Calculated Risk on 3/03/2009 05:25:00 PM

From David Evans at Bloomberg: Hidden Pension Fiasco May Foment Another $1 Trillion Bailout (ht James & Bob)

Public pension funds across the U.S. are hiding the size of a crisis that’s been looming for years. Retirement plans play accounting games with numbers, giving the illusion that the funds are healthy.Evans points out that many pension plans have been funded based on optimistic projections of future investment returns. He gives several examples including:

...

The misleading numbers posted by retirement fund administrators help mask this reality: Public pensions in the U.S. had total liabilities of $2.9 trillion as of Dec. 16, according to the Center for Retirement Research at Boston College. Their total assets are about 30 percent less than that, at $2 trillion.

With stock market losses this year, public pensions in the U.S. are now underfunded by more than $1 trillion.

The nation’s largest public pension fund, California Public Employees’ Retirement System, has been reporting an expected rate of return of 7.75 percent for the past eight years, and 8 percent before that, according to Calpers spokesman Clark McKinley.There is much more in the article.

Its annual return during the decade from Dec. 31, 1998, to Dec. 31, 2008, has been 3.32 percent, and last year, when markets tanked, it lost 27 percent.

Note: Back in 2007 Evans wrote a great article on a Florida state run investment pool investing in SIVs.

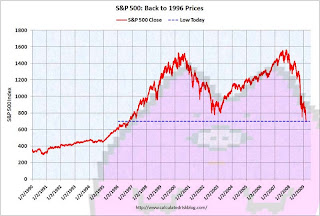

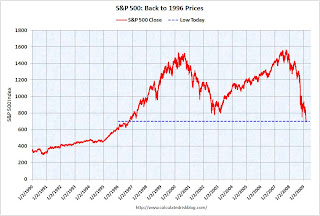

Stock Market: S&P 100 points from 1995

by Calculated Risk on 3/03/2009 03:49:00 PM

The S&P 500 closed below 700 today at 696 and change. We are back to 1996 prices ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.By popular demand I've extend this graph back to 1990.

The low in 1996 was 598.48.

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (If not updated right way, Doug should update in a few minutes)

The 2nd worst bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

GM Sales off 53%, Toyota Off 40%

by Calculated Risk on 3/03/2009 01:52:00 PM

Headline from MarketWatch: GM U.S. February sales down 53% to 126,170 units

Also from MarketWatch: Toyota U.S. sales down 39.8% to 109,583 units in February

Last month GM reported U.S. sales fell 48.9% compared to January 2008, so the numbers are still getting worse.

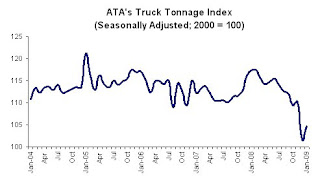

Transportation: Record Idle Ships, Trucking Tonnage Increases Slightly

by Calculated Risk on 3/03/2009 01:05:00 PM

From the Journal of Commerce: Idle Box Fleet Reaches 1.35M TEUs (hat tip Vincent)

Idled ocean container capacity on March 2 reached a record 1.35 million TEUs with 453 ships without work as carriers continue to axe services in the face of collapsing cargo volumes and tumbling freight rates across all trade routes.From the American Trucking Association: ATA Truck Tonnage Index Rose 3 Percent in January

The jobless figure, up from 392 vessels of 1.1 million TEUs two weeks ago, is equivalent to 10.7 percent of the world cellular container ship fleet in capacity terms, according to AXS-Alphaliner, the Paris-based consultant.

This is the highest unemployment rate in the history of container shipping and is three times the 3.5 percent jobless figure in the depth of the 2002 bear market.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index climbed 3 percent in January 2009, marking only the second month-to-month increase in the last seven months. Still, the gain did little to erase the revised 7.8 percent contraction in December 2008. In January, the seasonally adjusted tonnage index equaled just 104.7 (2000 = 100), its second-lowest level since October 2002. ...

Compared with January 2008, the index declined 10.8 percent, which was slightly better than December’s 12.5 percent year-over-year drop.

ATA Chief Economist Bob Costello said that there was no reason to get excited about January’s 3 percent month-to-month improvement. “Tonnage will not fall every month, and just because it rises every now and then doesn’t mean the economy is on the mend,” Costello said. “Furthermore, tonnage is contracting significantly on a year-over-year basis, which is highlighting the current weakness in the freight environment.”

Ford U.S. Sales Down 46.3% in February

by Calculated Risk on 3/03/2009 12:10:00 PM

Update: From CNBC: Ford Sales Fall Sharply but Match Forecasts

Sales at [Ford] fell 46.3 percent on an adjusted basis ... Ford sold 99,060 vehicles last month, compared with 192,248 the same month in 2008.The decline of 46.3% is a comparison to a year ago February.

In January, Ford reported a 42.1% decline in total U.S. sales compared to January 2008. In December 2008, Ford reported a 32.4% YoY decline. And in November, Ford reported a 31.5% YoY decline (compared to November 2007).

The comparisons just keep getting worse.

Pending Home Sales Index Down 7.7%

by Calculated Risk on 3/03/2009 10:00:00 AM

From the NAR: Pending Home Sales Down but Housing Affordability at Record

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in January, fell 7.7 percent to 80.4 from a downwardly revised reading of 87.1 in December, and is 6.4 percent below January 2008 when it was 85.9. The index is at the lowest level since tracking began in 2001, when the index value was set at 100.This suggests a further decline in existing home sales for the March report (January was the most recent report). Note: there still might be a slight increase in existing home sales in February based on the December Pending Home Sales report.

Lawrence Yun, NAR chief economist, said ... “We expect similarly soft home sales in the near term ... "

emphasis added

Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the January report suggests existing home sales will decrease from February to March.

Finally, ignore the "affordability index". That really just tells us that interest rates are low - something we already know.

Fed: TALF to Begin Disbursing Funds March 25th

by Calculated Risk on 3/03/2009 09:25:00 AM

In carrying out the Financial Stability Plan, the Department of the Treasury and the Federal Reserve Board are announcing the launch of the Term Asset-Backed Securities Loan Facility (TALF), a component of the Consumer and Business Lending Initiative (CBLI). The TALF has the potential to generate up to $1 trillion of lending for businesses and households.TALF Terms and Conditions (88 KB PDF)

The TALF is designed to catalyze the securitization markets by providing financing to investors to support their purchases of certain AAA-rated asset-backed securities (ABS). These markets have historically been a critical component of lending in our financial system, but they have been virtually shuttered since the worsening of the financial crisis in October. By reopening these markets, the TALF will assist lenders in meeting the borrowing needs of consumers and small businesses, helping to stimulate the broader economy.

Under today’s announcement, the Federal Reserve Bank of New York will lend up to $200 billion to eligible owners of certain AAA-rated ABS backed by newly and recently originated auto loans, credit card loans, student loans, and SBA-guaranteed small business loans. Issuers and investors in the private sector are expected to begin arranging and marketing new securitizations of recently generated loans, and subscriptions for funding in March will be accepted on March 17, 2009. On March 25, 2009, those new securitizations will be funded by the program, creating new lending capacity for additional future loans.

...

Today the Board also released revised terms and conditions for the facility and a revised set of frequently asked questions. ...

The Treasury Department also released a new white paper outlining efforts to unlock credit markets. On February 10, 2009, the Board and Treasury announced an expansion of TALF to include new asset categories that could generate up to $1 trillion in new lending. Teams from the Treasury Department and Federal Reserve are analyzing the appropriate terms and conditions for accepting commercial mortgage-backed securities (CMBS) and are evaluating a number of other types of AAA-rated newly issued ABS for possible acceptance under the expanded program. The expanded program will remain focused on securities that will have the greatest macroeconomic impact and can most efficiently be added to the TALF at a low and manageable risk to the government.

...

Increased TALF lending and other actions to stabilize the financial system have the potential to greatly expand the Federal Reserve’s balance sheet. In order for the Federal Reserve to conduct monetary policy over time in a way consistent with maximum sustainable employment and price stability, it must be able to manage its balance sheet, and in particular, to control the amount of reserves that the Federal Reserve provides to the banking system. The amount of reserves is the key determinant of the interest rate that the Federal Reserve uses to pursue its monetary policy objectives. Treasury and the Federal Reserve will seek legislation to give the Federal Reserve the additional tools it will need to enable it to manage the level of reserves while providing the funding necessary for the TALF and for other key credit-easing programs.

TALF Frequently Asked Questions (102 KB PDF)

TALF White Paper

Fun reading for all. Here comes another significant expansion of the Fed's balance sheet.