by Calculated Risk on 3/02/2009 06:15:00 PM

Monday, March 02, 2009

Ken (CR Companion fame) on Comments

The Haloscan comment system crash on Friday. Ken has suggested the following:

With this recent haloscan failure, I’ve been investigating JS-Kit and its alternatives (disqus, intensedebate, sezwho). I’ve been frustrated by how ill suited they are to a community like CalculatedRisk, which is really more a real time salon than a blog with semi-static comments.

I’ve also had an evolving interest in enhancing the commenting experience for Calculated Risk users, first through CR Companion, and more recently in building a prototype for a searchable index. Lately I’ve been bubbling with ideas on what could be done to improve things specifically for this blog. But I’ve also been somewhat wary of taking the project on, as this truly is a 24/7 community, and I’ve witnessed how harshly judgment can come over the tubz (the recent Louis CK Everything’s Amazing, Nobody’s Happy bit comes to mind). I may be a CR addict, but I do have a family and personal life, and would like to keep them.

It occurred to me today that there is an alternative. There are clearly a great many talented IT people on this blog, several of whom have already demonstrated both their interest and mojo quite effectively. Perhaps some of you might be interested in joining into the process of building and maintaining an alternative system that is written specifically for us? One that could satisfy the various nits many of you have?

What I’m envisioning is building a site that runs in parallel to JS-Kit for awhile, posting back and forth, much like CRBot’s iRC channel, for safety’s sake.

To get the ball rolling, here are some of the features I’ve been picturing, grouped by Must Haves and Would Be Cool. I imagine you have some of your own ...

Must HavesWould Be CoolFast Simple Generic browser support, including mobile devices Registration (simple, relatively anonymous, with openID support) Multiple moderators (for CR’s sanity) Permalinks per comment Homepage links Threading with a better UI for real time (before you say “yuck!” or “huh?”, let me put together a prototype so you can see what I mean) Choice of a decent editor, with preview and edits within a 5 minute window Keyword searchable archives, with slices by user, CR Post, date, tag (see below) Multiple handles, single user Personal profiles (member since, homepage, deep thoughts, etc.) Visitor count Anyone interested? There’ll be need for client and server developers, sysadmin types, graphic designers, testers, lawyers, nay-sayers, etc. This might take awhile, but it’ll be worth it.Autorefresh (like CR Companion, only more efficient) CRVIX and other stats Tags per comment/thread (e.g. news, well-said, funny, youtube, thread-music, thread-of-the-day) Word clouds per CR post, or per user to give a quick sense of what’s being discussed (or constantly ranted about) Private ratings and filters, ala CR Companion (I’ve taken to heart the desire to avoid a public popularity contest) Top Ten Threads of the Day New post notification (CRBot/The Pig), maybe even from multiple sites like CRBot does (with tags, so people can ignore if desired) A financial dashboard mashup An easy way to paste in references to previous comments

Market: More Cliff Diving

by Calculated Risk on 3/02/2009 03:48:00 PM

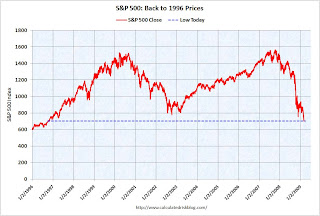

The S&P 500 closed just above 700. We are back to 1996 prices ...

The low in 1997 was 737.01.

The low in 1996 was 598.48. Click on graph for larger image in new window.

Click on graph for larger image in new window.

DOW off about 4.3%

S&P 500 off about 4.7%

NASDAQ off 4.0%

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (If not updated right way, Doug should update in a few minutes)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Vehicle Sales in January

by Calculated Risk on 3/02/2009 02:22:00 PM

The BEA released vehicle sales for January this morning. Total auto and truck sales in the U.S. were below 10 million (SAAR) for the first time since 1982. I've update the sales and turnover graphs below with the January data.

The automakers will release February sales numbers tomorrow, and here is a preview from MarketWatch: No sales bounce in sight for automakers

The total industry decline, according to Edmunds.com, is expected to reach 41.4%. Most forecasts on Wall Street call for a seasonally adjusted annual rate of sales in the low 9-million range, down from 9.6 million last month, which marked a 26-year low.

...

"The crisis in the automotive market continues to worsen, but we believe we are nearing the bottom of this cycle," J.D. Power analyst Jeff Schuster said in a report last week. "Our expectation is for February or March to be the low point, but a high degree of uncertainty and risk remains for the second half of 2009."

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows monthly vehicle sales (autos and trucks) as reported by the BEA at a Seasonally Adjusted Annual Rate (SAAR).

This shows that sales have plunged to just over a 9.75 million annual rate in January - the lowest rate since 1982. If the car analysts are correct, February will be even worse.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).Currently this ratio is at 25.5 years, the highest ever. This is an unsustainable level (I doubt most vehicles will last 25 years!), and the ratio will probably decline over the next few years. This could happen with vehicles being removed from the fleet, but more likely because of a sales increase.

This suggests vehicle sales are much nearer the bottom than the top, and there will probably be some sort of modest rebound later this year or in 2010.

January PCE and Personal Saving Rate

by Calculated Risk on 3/02/2009 11:36:00 AM

Amid all the gloom this morning - the AIG bailout and massive losses, the weak manufacturing ISM index, the cliff diving construction spending numbers - there was this Personal Income and Outlays report for January from the BEA.

This report showed that personal income increased in January, however the increase was mostly because of special factors related to government and military wage increases. But this report also showed that PCE was up slightly from October to January (the period that matters for GDP); about 0.7% in real terms annualized. Not much - and this is just one data point and could be revised, and this might be impacted by gift cards (this data uses the January retail numbers) - but perhaps PCE won't fall completely off a cliff in Q1. I still expect PCE to decline sharply in Q1, but maybe not as rapidly as in Q3 2008 (-3.8% SAAR) and Q4 2008 (-4.3% SAAR)

(SAAR: seasonally adjusted annual rate)

Also interesting:

Personal saving -- DPI less personal outlays -- was $545.5 billion in January, compared with $416.8 billion in December. Personal saving as a percentage of disposable personal income was 5.0 percent in January, compared with 3.9 percent in December.This increase in the percent saved is an important part of the rebalancing process and helps repair household balance sheets.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing).

Although this data may be revised significantly, this does suggest households are saving substantially more than during the last few years (when they saving rate was close to zero). This is a necessary but painful step ... and a rising saving rate will repair balance sheets, but also keep downward pressure on personal consumption.

February 2009 Manufacturing ISM: Employment Index at Record Low

by Calculated Risk on 3/02/2009 10:30:00 AM

From the ISM: February 2009 Manufacturing ISM Report On Business®

"Manufacturing continues to decline at a rapid rate in February. While production has slowed its rate of decline, employment continues to fall precipitously. Prices continue to decline, but price advantages are not sufficient to overcome manufacturers' apparent loss of demand. Survey respondents appear generally pessimistic about recovery in 2009."Manufacturing is still contracting, and employment is especially weak with the employment index at a record low (since the index started in 1948).

...

Manufacturing contracted in February as the PMI registered 35.8 percent, which is 0.2 percentage point higher than the 35.6 percent reported in January. This is the 13th consecutive month of contraction in the manufacturing sector. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

...

ISM's Employment Index registered 26.1 percent in February, which is 3.8 percentage points lower than the 29.9 percent reported in January. This is the seventh consecutive month of decline in employment. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

Construction Spending: Non-Residential Cliff Diving

by Calculated Risk on 3/02/2009 10:01:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is now at the year ago level and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

These are two key stories for 2009: the collapse in private non-residential construction, and the probably bottom for residential construction spending.

From the Census Bureau: January 2009 Construction at $986.2 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $682.6 billion, 3.7 percent (±1.1%) below the revised December estimate of $709.0 billion. Residential construction was at a seasonally adjusted annual rate of $291.5 billion in January, 2.9 percent (±1.3%) below the revised December estimate of $300.3 billion. Nonresidential construction was at a seasonally adjusted annual rate of $391.0 billion in January, 4.3 percent (±1.1%) below the revised December estimate of $408.7 billion.

AIG: $61.7 Billion Loss

by Calculated Risk on 3/02/2009 06:21:00 AM

For the Fed and Treasury AIG restructuring announcement, please see the previous post.

From MarketWatch: AIG reports fourth-quarter loss of over $61 billion

[AIG] said its fourth-quarter loss widened to $61.66 billion, or $22.95 a share, from the $5.29 billion loss in the year-earlier period. Continued severe credit market deterioration, particularly in commercial mortgage-backed securities, and charges related to ongoing restructuring-related activities weighed down results.The numbers just keep getting bigger ...

Treasury and Fed: AIG Restructuring Plan

by Calculated Risk on 3/02/2009 06:15:00 AM

From the Fed: U.S. Treasury and Federal Reserve Board Announce Participation in AIG Restructuring Plan

The U.S. Treasury Department and the Federal Reserve Board today announced a restructuring of the government's assistance to AIG in order to stabilize this systemically important company in a manner that best protects the U.S. taxpayer. ...

The company continues to face significant challenges, driven by the rapid deterioration in certain financial markets in the last two months of the year and continued turbulence in the markets generally. ...

As significantly, the restructuring components of the government's assistance begin to separate the major non-core businesses of AIG, as well as strengthen the company's finances. The long-term solution for the company, its customers, the U.S. taxpayer, and the financial system is the orderly restructuring and refocusing of the firm. This will take time and possibly further government support, if markets do not stabilize and improve.

...

Treasury has stated that public ownership of financial institutions is not a policy goal and, to the extent public ownership is an outcome of Treasury actions, as it has been with AIG, it will work to replace government resources with those from the private sector to create a more focused, restructured, and viable economic entity as rapidly as possible. This restructuring is aimed at accelerating this process. Key steps of the restructuring plan include:

Preferred Equity

The U.S. Treasury will exchange its existing $40 billion cumulative perpetual preferred shares for new preferred shares with revised terms that more closely resemble common equity and thus improve the quality of AIG's equity and its financial leverage. The new terms will provide for non-cumulative dividends and limit AIG's ability to redeem the preferred stock except with the proceeds from the issuance of equity capital.

Equity Capital Commitment

The Treasury Department will create a new equity capital facility, which allows AIG to draw down up to $30 billion as needed over time in exchange for non-cumulative preferred stock to the U.S. Treasury. This facility will further strengthen AIG's capital levels and improve its leverage.

Federal Reserve Revolving Credit Facility

The Federal Reserve will take several actions relating to the $60 billion Revolving Credit Facility for AIG established by the Federal Reserve Bank of New York (New York Fed) in September 2008, to further the goals described above.

[see statement for more details]

Sunday, March 01, 2009

AIG: Earnings at 6 AM ET, Webcast at 8:30 AM

by Calculated Risk on 3/01/2009 10:25:00 PM

American International Group, Inc. (AIG) will report its fourth quarter and full year 2008 results on Monday, March 2, 2009 at approximately 6:00 a.m. EST. AIG’s earnings release and financial supplement will be available in the Investor Information section of www.aigcorporate.com following the filing of AIG’s Form 10-K for the year ended December 31, 2008.From the WSJ: U.S. Revamps Bailout of AIG

AIG Chairman and Chief Executive Officer Edward M. Liddy will host a conference call, broadcast live over the Internet, on Monday, March 2, 2009 at 8:30 a.m. EST to discuss AIG’s fourth quarter results.

The audio webcast of the conference call can be accessed at www.aigwebcast.com.

The new deal, the government's fourth for AIG, represents a nearly complete reversal from the one first laid out in mid-September. Back then, federal officials acted as a demanding lender, forcing the insurer to pay a steep interest rate for what was expected to be a short-term loan. Now the government is relaxing loan terms by wiping out interest in hopes of preserving AIG's value over a longer period.AIG: a black hole.

With the latest move, AIG will have the benefit of up to $70 billion from the TARP program; it got a $40 billion TARP investment in November. The total amounts to 10% of the $700 billion financial-sector rescue fund, money that most lawmakers did not expect would go toward propping up a troubled insurer. Officials believed they had little choice but to use the TARP money, particularly because they lack the authority to unwind a troubled firm such as AIG the way the government can do now with failing banks.

Sunday Evening Futures

by Calculated Risk on 3/01/2009 07:50:00 PM

Just an open thread (I'm working on fixing the comments):

For those interested, here are few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

Right now the futures are off a little for the U.S. markets. It appears DOW 7000 is in jeopardy.

Best to all.