by Calculated Risk on 2/27/2009 09:31:00 PM

Friday, February 27, 2009

High on the Hill

Tomorrow morning at 8AM ET, the Buffett letter to investors will be released, and later I'll post a February Economic Summary in Graphs.

The AIG deal might be announced Sunday evening or Monday morning.

Today real GDP growth was revised down to minus 6.2% (annualized), the Citi deal was announced, two banks failed (Heritage Community Bank, Glenwood, Illinois and Security Savings Bank, Henderson, Nevada), and the S&P 500 is back to 1996 prices.

Also, the Restaurant Performance Index for January was released, and here is a look at Investment Contributions to GDP.

If you need a laugh after reading that news, Jim the Realtor showcases an investment opportunity in San Diego - enjoy!

Bank Failure #16 in 2009: Security Savings Bank, Henderson, Nevada

by Calculated Risk on 2/27/2009 07:45:00 PM

From the FDIC: Bank of Nevada, Las Vegas, Nevada Assumes All of the Deposits of Security Savings Bank, Henderson, Nevada

Security Savings Bank, Henderson, Nevada was closed today by the Nevada Financial Institutions Division, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes two today! Update ... by Soylent Green Is People

As of December 31, 2008, Security Savings Bank had total assets of approximately $238.3 million and total deposits of $175.2 million. Bank of Nevada did not pay a premium to acquire the deposits of Security Savings Bank.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $59.1 million. The Bank of Nevada's acquisition of all the deposits of Security Saving Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Security Savings Bank is the sixteenth bank to fail in the nation this year.

Security is toast as well

Yes, Friday is here.

Bank Failure #15 in 2009: Heritage Community Bank, Glenwood, Illinois

by Calculated Risk on 2/27/2009 07:27:00 PM

From the FDIC: MB Financial Bank, N.A., Chicago, Illinois, Assumes All of the Deposits of Heritage Community Bank, Glenwood, Illinois

Heritage Community Bank, Glenwood, Illinois, was closed today by the Illinois Department of Financial Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday ... oh wait, there is another one too!

As of December 5, 2008, Heritage Community Bank had total assets of $232.9 million and total deposits of $218.6 million. ...

The FDIC and MB Financial Bank entered into a loss-share transaction. MB Financial Bank will share in the losses on approximately $181 million in assets covered under the agreement. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $41.6 million. MB Financial Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Heritage Community Bank is the fifteenth FDIC-insured institution to fail in the nation this year and the third in the state.

A comment on comments ...

by Calculated Risk on 2/27/2009 06:09:00 PM

The old comment system went down today. I switched over to the JS-Kit system and this is probably a permanent switch. The Haloscan system was no longer being improved, and JS-Kit has a number of new features in development.

There is a control feature at the bottom for threaded or flat comments. I'm still trying to figure everything out! Suggestions welcome ...

Now back to waiting for the FDIC.

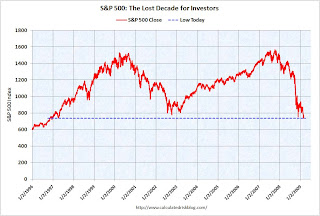

Party Like It's ... 1996

by Calculated Risk on 2/27/2009 03:59:00 PM

The S&P 500 closed at 735 or so. The low in 1997 was 737.01.

Note: the S&P 500 was at 744 when Greenspan spoke of "irrational exuberance"! Click on graph for larger image in new window.

Click on graph for larger image in new window.

DOW off 1.6%

S&P 500 off 2.3%

NASDAQ off 1.0%

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (Doug should update soon)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

California Unemployment Rate Hits Double Digits

by Calculated Risk on 2/27/2009 03:17:00 PM

From the LA Times: California unemployment rate reaches 10.1%

More than 1 in 10 California workers were unemployed in January ...Ouch.

The 10.1% jobless rate is the highest since June 1983 and not far below the 11% record set in November 1982 at the worst point of a severe recession ... Job losses escalated in January, with the state's unemployment rate jumping by 1.4 percentage points from a revised 8.7% for December.

Investment Contributions to GDP

by Calculated Risk on 2/27/2009 02:00:00 PM

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag is getting smaller, and the drag on GDP will be significantly less in 2009, than in 2007 and 2008.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

The REALLY bad news is nonresidential investment (blue) is about to fall off a cliff. Nonresidential investment subtracted -0.24% (SAAR) from GDP in Q4, and will decline sharply in 2009 based on the Fed's Senior Loan Officer Survey, the Architecture Billings Index, and many many other reports and stories. In previous downturns the economy recovered long before nonresidential investment - and that will probably be true again this time.

As always, residential investment is the investment area to follow - it is the best predictor of future economic activity.

GE Cuts Dividend

by Calculated Risk on 2/27/2009 01:49:00 PM

This is a big story because it shows how quickly the economy has changed. Just last November, GE once again promised not to cut the dividend through the end of 2009.

From MarketWatch: GE to cut dividend to 10 cents from 31 cents: WSJ

General Electric will cut its quarterly dividend to 10 cents from 31 cents, the Wall Street Journal reported on its Web site Friday.And from GE last November: An update on the GE dividend

On Sept. 25, GE stated that its Board of Directors had approved management’s plan to maintain GE’s quarterly dividend of $0.31 per share, totaling $1.24 per share annually, through the end of 2009. That plan is unchanged.This dividend cut was inevitable. But hoocoodanode? Apparently not GE management.

The Stress Test Schedule

by Calculated Risk on 2/27/2009 12:05:00 PM

It has been widely reported that the stress tests will be completed "no later than the end of April", based on this FAQ:

Q10: When will the process be completed?Just to let everyone know, I've heard the banks have been told to submit their stress test results by Wednesday March 11th. Too bad the results will not be made public.

A: The Federal supervisory agencies will conclude their work as soon as possible, but no later than the end of April.

UPDATE: Questions from a reader:

Just to repeat the first question: With all that is happening in Asia and Europe (especially the exposure to Eastern Europe and other emerging markets), what are the macro assumptions for these markets? I'm sure other readers have excellent questions too.The Fed published macroeconomic assumptions for the US. What about international markets? Should the banks assume mark-to-market accounting will stay or will be repealed? Should the banks still assume that in 2010 they will have to bring off-balance sheet exposures back on their books?

Restaurant Performance Index Rebounds Slightly

by Calculated Risk on 2/27/2009 10:57:00 AM

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved Somewhat in January as Restaurant Performance Index Rebounded From December’s Record Low

The outlook for the restaurant industry improved somewhat in January, as the National Restaurant Association’s comprehensive index of restaurant activity bounced back from December’s record low. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.4 in January, up 1.0 percent from December’s record low level of 96.4.

“Despite the encouraging January gain, the RPI remained below 100 for the 15th consecutive month, which signifies contraction in the key industry indicators,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Same-store sales and customer traffic remained negative in January, and only one out of four operators expect to have stronger sales in six months.”

...

Restaurant operators reported negative customer traffic levels for the 17th consecutive month in January.

...

Along with soft sales and traffic levels, capital spending activity remained dampened in recent months. Thirty-four percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, matching the proportion who reported similarly last month and tied for the lowest level on record.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007. Also note the record low business investment by restaurant operators - this is happening in most industries, and is showing up as a significant decline in equipment and software investment in the GDP report (-28.8% annualized in the Q4 report!)