by Calculated Risk on 2/09/2009 06:55:00 PM

Monday, February 09, 2009

President Obama to Speak on Stimulus at 8 PM ET

The Obama news conference is scheduled for 8 PM.

Here is the CNBC feed.

And a live feed from C-SPAN.

CNBC has a comparison of the House and Senate versions of the stimulus plan. It looks like the homebuilders are going to get their gift - and other companies too - but it is the homebuilders that lobbied hard for this provision (including withholding political contributions at one time). The homebuilders made huge profits in 2004 and 2005, and they would like to offset the current losses against those profits:

MONEY LOSING COMPANIES:This is a clear gift to shareholders of the homebuilders. How does this help create jobs? This provision could be dumped - no problem. Between this and the useless $35.5 billion housing tax credit, we could cut $55 billion from the bill and maybe add back a couple of the stimulus programs that would help. Oh well ...

--House -- $15 billion to allow companies to use current losses to offset profits made in the previous five years, instead of two, making them eligible for tax refunds.

--Senate -- Allows companies to use more of their losses to offset previous profits, increasing the cost to $19.5 billion.

CNBC: 'Bad Bank' Plan Is Dropped

by Calculated Risk on 2/09/2009 05:10:00 PM

From CNBC: 'Bad Bank' Is Dropped From Financial-Rescue Package

The Obama administration’s wide-ranging plan to stabilize the financial system no longer includes creating a "bad bank" but will still contain measures to encourage private firms to buy up toxic assets from financial institutions ...The leaked details might keep changing, but I guess the time is set for the announcement.

The latest version of the plan no longer addresses any immediate aid to insurance companies with thrift units that have applied for capital injections under the existing TARP.

...

In a statement Monday, the Treasury said that senior officials from Treasury, the Federal Reserve Board and the Federal Deposit Insurance Corporation would hold a media briefing on the plan at 11:45 a.m. ET

Job Losses During Recessions

by Calculated Risk on 2/09/2009 02:44:00 PM

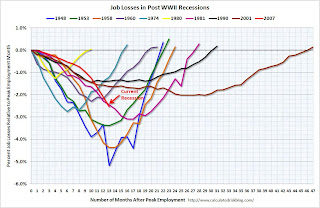

Barry Ritholtz provides us with the following chart: Job Losses in Post WWII Recessions Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows job losses during recessions from the peak month of employment until jobs recover.

The current recession has had the most job losses and the 2001 recession had the weakest job recovery.

However this graph is not normalized for increases in the work force. The second graph (that Barry asked me for) shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph (that Barry asked me for) shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession is about as bad as the 1981 recession in percentage terms at this point.

In the earlier post-war recessions, there were huge swings in manufacturing employment. Now manufacturing is a much smaller percentage of the economy, and the swings aren't as significant because of technological advances. This is the main reason that job losses were larger in those earlier recessions.

Here is Barry's updated post (with another graph). Barry asks: Are recessions taking longer to recover from? The answer appears to be yes. And I expect unemployment to be elevated for some time (even after the economy starts to recover).

CNBC: Dr. Doom & the Black Swan

by Calculated Risk on 2/09/2009 02:37:00 PM

Video from CNBC: Predicting Crisis: Dr. Doom & the Black Swan (hat tip Dwight)

Nouriel Roubini and Nassim Taleb discuss the recession.

30 Year Mortgage Rates vs. Ten Year Treasury Yield

by Calculated Risk on 2/09/2009 12:36:00 PM

On CNBC this morning, PIMCO's Bill Gross said:

"I think at some point we're going to see a 4.5 percent mortgage rate and the 10-year Treasury rate capped at some level."How far would the Ten Year yield have to fall for mortgage rates to decline to 4.5%? The ten year yield is currently at 3.045%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the relationship between the Ten Year yield (x-axis) and the 30 year mortgage rate (y-axis, monthly from Freddie Mac) since 1971. The relationship isn't perfect, but the correlation is very high.

Based on this historical data, the Fed would have to push the Ten Year yield down to around 2.3% for the 30 year conforming mortgage rate to fall to 4.5%.

The Fed could also buy more agency MBS to push down mortgage rates, but if they buy Ten Year treasuries with the goal of 4.5% mortgage rates, they might have to push Ten Year yields down significantly.

Bill Gross: Fed to Cap Ten Year Yield

by Calculated Risk on 2/09/2009 11:20:00 AM

From CNBC: Mortgage Rates Likely Headed to 4.5%: Pimco's Gross

"I think at some point we're going to see a 4.5 percent mortgage rate and the 10-year Treasury rate capped at some level," he said. "When the Fed comes in to buy Treasurys that will be a big day."CNBC has a video of the interview with Gross.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The 10-year yield is at 3.04% today, well above the record low of 2.07% set on Dec 18th.

This graph shows the 10 year yield since 1962. The smaller graph shows the ten year yield since the start of 2008. In the bigger scheme, this has been a fairly small rebound in yield.

To move the 30 year mortgage rate to 4.5%, the Fed would probably have to cap the Ten Year yield near 3.0%.

When Pier Loans go Bad

by Calculated Risk on 2/09/2009 10:00:00 AM

From Bloomberg: Lyondell Banks Caught in Bankruptcy Lose $3.7 Billion in Loans

The five banks that helped finance the takeover of Lyondell Chemical Co. have lost at least $3.7 billion, and that figure may climb to more than $8 billion, which would make the leveraged buyout the costliest in history for lenders.Back in 2007, when the liquidity crisis first started, many banks were stuck with LBO related pier loans (bridge loans that they couldn't sell). Now the banks are being forced to take write downs on these loans. Or in this case, since these are second and third lien loans, complete write-offs.

...

The financing includes $8 billion of low-ranking loans still held by the banks that may be worthless ...

Each of the five banks [Goldman Sachs Group Inc., Citigroup Inc., UBS AG, Merrill Lynch & Co. and ABN Amro Holding NV] holds $1.6 billion of so-called second- and third-lien loans, the people familiar with the situation said.

Lyondell’s losses dwarf those from the busted LBOs of the 1980s, such as Ohio Mattress Co., the $965 million takeover dubbed “the burning bed” by bond traders.

UK: Demand for Office Space Falls Sharply

by Calculated Risk on 2/09/2009 08:31:00 AM

From the Financial Times: Demand for office space falls at record pace

Demand for offices and shops has fallen at the fastest pace on record, spelling further trouble for commercial property landlords struggling to find tenants in worsening economic conditions."Demand falling at a record pace" ... Just another "record" being set, this time in CRE.

...

Most of the headline indicators of commercial property performance tracked by Rics fell to their lowest levels in the survey’s 11-year history in the fourth quarter, with particular pessimism in the retail sector where almost four-fifths of surveyors reported a fall in demand.

Mansori: Tax Credit Will Not Boost House Prices

by Calculated Risk on 2/09/2009 01:32:00 AM

Kash Mansori writes at Econbrowser: Will a Home Purchase Tax Credit Help Boost House Prices?

Check it out. Kash provides a couple of simple diagrams that suggest that the tax credit will probably not meet the stated goal of stabilizing house prices.

If my hunch is correct, then all the house purchase tax credit will do is to modestly increase the number of houses sold each month... with no noticeable impact on house prices.That is $35 billion for nothing.

That doesn't mean that the tax credit would have no impact. In particular, it may be a boon to some cash-constrained households that want to buy a house right now but can't borrow enough. And it should help to reduce inventories of unsold houses by a bit. But if you're hoping that it will make house prices rise, with all of the beneficial economic effects on home equity that such a rise might have... think again.

Sunday, February 08, 2009

NY Times on Bank Bailout Plan

by Calculated Risk on 2/08/2009 10:50:00 PM

From Floyd Norris at the NY Times: U.S. Bank Bailout to Rely in Part on Private Money

Administration officials said the plan, to be announced Tuesday, was likely to depend in part on the willingness of private investors other than banks — like hedge funds, private equity funds and perhaps even insurance companies — to buy the contaminating assets that wiped out the capital of many banks.Liz Rappaport and Jon Hilsenrath at the WSJ had a story earlier: U.S. Weighs Fed Program to Loosen Lending

... The government would guarantee a floor value, officials say, as a way to overcome investors’ reluctance to buy them. ... Details of the new plan, which were still being worked out during the weekend, are sketchy.

...

By trying to bring in private sector buyers to set prices for the distressed assets, and to take some but not all of the risk that the asset value will continue to decline, Obama officials evidently hope to restore confidence in the banking system. They will also try to avoid the politically perilous course of having the government directly buy the assets at prices that could turn out to be far higher, or lower, than their eventual value.

...

A possible model for the way the new Treasury plan could work arose in a deal last July that had no government involvement. In that case, Merrill Lynch sold $31 billion in securities for 22 cents on the dollar. The buyer, the Lone Star group of private equity funds, put down only one-quarter of the purchase price and had the right to walk away, forfeiting only the down payment, if it later turned out the securities were worth even less than it had agreed to pay.

Thus Lone Star stands to receive the upside profit if the securities prove to be more valuable, but has only a limited downside risk if they do not.

Some hedge funds, which often use borrowed money to boost returns, are lining up to get in on the Fed program, seeing a chance to make high double-digit-percentage returns with little downside using low-cost loans made on easy terms.This really depends on the details. If the model is similar to the Lone Star deal, with hedge funds (or others) putting 25% down, the the Fed loaning the other 75% at attractive rates (with no recourse), and the transaction completely transparent (as they should be), I don't think the returns for investors would be in the "high double digits" as the WSJ article suggests.

This structure would definitely increase the price investors would be willing to pay for toxic assets, as compared to current market values (while putting the taxpayers at risk). For any bank that has aggressively marked down assets to current market values, this could mean a potential markup. But I think most banks will have to take further write downs and will need additional capital.