by Calculated Risk on 1/16/2009 10:33:00 PM

Friday, January 16, 2009

Bird and Fortune: Silly Money

This is a followup to the subprime piece from a year ago ...

(Part 1: 8 min 42 sec)

(Part 2: 8 min 42 sec)

2009 Bank Failure #2: Bank of Clark County, Vancouver, WA

by Calculated Risk on 1/16/2009 09:24:00 PM

From the FDIC: Umpqua Bank Acquires the Insured Deposits of Bank of Clark County, Vancouver, WA

Bank of Clark County, Vancouver, Washington, was closed today by the Washington Department of Financial Institutions, and the Federal Deposit Insurance Corporation (FDIC) was named receiver.A Bank Failure Friday Twofer ...

...

As of January 13, 2009, Bank of Clark County had total assets of $446.5 million and total deposits of $366.5 million. At the time of closing, there were approximately $39.3 million in uninsured deposits held in approximately 138 accounts that potentially exceeded the insurance limits.

...

In addition to assuming the failed bank's insured deposits, Umpqua Bank will purchase $30.4 million of assets comprised of cash, cash equivalents, marketable securities and loans secured by deposits. The FDIC will retain the remaining assets for later disposition.

The transaction is the least costly resolution option, and the FDIC estimates the cost to its Deposit Insurance Fund will be between $120 and $145 million.

2009 Bank Failure #1: National Bank of Commerce, Berkeley, IL

by Calculated Risk on 1/16/2009 07:37:00 PM

From the FDIC: Republic Bank of Chicago Acquires All the Deposits of National Bank of Commerce, Berkeley, IL (hat tip Soylent Green Is People)

National Bank of Commerce, Berkeley, Illinois, was closed today by the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Republic Bank of Chicago, Oak Brook, Illinois, to assume all of the deposits of National Bank of Commerce.Now it feels like a Friday.

...

As of January 7, 2009, National Commerce Bank had total assets of $430.9 million and total deposits of $402.1 million. In addition to assuming all of the failed bank's deposits, Republic Bank agreed to purchase approximately $366.6 million in assets at a discount of $44.9 million. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $97.1 million.

Layoffs: I read the news today, oh boy!

by Calculated Risk on 1/16/2009 05:33:00 PM

WSJ: Circuit City to Liquidate, Meaning 30,000 Job Losses

Bloomberg: GE Capital May Cut as Many as 11,000 Jobs This Year

WSJ: Pfizer to Cut Up to 2,400 Jobs

WSJ: Google Plans 100 Layoffs of Recruiters

AP: AMD to cut 1,100 workers, 9 pct of staff

Reuters: Hertz to cut more than 4,000 jobs

Bloomberg: WellPoint Cuts 1,500 Jobs, Blames ‘State of Economy’

AP: Blue Cross Blue Shield to cut up to 1,000 jobs

Tampa Bay Business Journal: Report: Layoffs looming at Clear Channel

I'm sure I missed a few ...

California: No Tax Refund for you!

by Calculated Risk on 1/16/2009 04:24:00 PM

From the LA Times: California controller to suspend tax refunds, welfare checks (hat tips Thomas and Circle the Drain)

State Controller John Chiang announced today that his office would suspend tax refunds, welfare checks, student grants and other payments owed to Californians starting Feb. 1 ... The payments to be frozen include nearly $2 billion in tax refunds; $300 million in cash grants for needy families and the aged, blind and disabled; and $13 million in grants for college students.

CBO: $64 Billion "Subsidy Cost" for TARP

by Calculated Risk on 1/16/2009 02:35:00 PM

From the CBO: The Troubled Asset Relief Program: Report on Transactions Through December 31, 2008

This is the first of CBO’s statutory reports on the TARP’s transactions. Through December 31, 2008, those transactions totaled $247 billion. Valuing those assets using procedures similar to those specified in the Federal Credit Reform Act (FCRA), but adjusting for market risk as specified in the EESA, CBO estimates that the subsidy cost of those transactions (broadly speaking, the difference between what the Treasury paid for the investments or lent to the firms and the market value of those transactions) amounts to $64 billion.CBO calls its a "subsidy cost", others call it a "loss".

Click on table for larger image in new window.

Click on table for larger image in new window.Here is the CBO table of subsidies.

AIG and the auto companies are the big winners (in percent subsidy).

CNBC: Circuit City Will Be Liquidated

by Calculated Risk on 1/16/2009 10:53:00 AM

From CNBC: Circuit City Will Be Liquidated, Sources Say

Not good news for mall owners ...

Just a reminder, from Bloomberg last week: U.S. Shopping Mall Vacancies Reach 10-Year High as Stores Fail

Vacancies at U.S. malls and shopping centers approached 10-year highs in the fourth quarter, and are set to rise further as declining retail sales put more stores out of business, research firm Reis Inc. said.

Regional mall vacancies rose to 7.1 percent last quarter from 6.6 percent in the third quarter. It was the highest vacancy rate since Reis began tracking regional malls in 2000, as well as the largest quarter-to-quarter jump in vacancies, according to New York-based Reis.

At neighborhood and community shopping centers, the vacancy rate rose to 8.9 percent from 8.4 percent in the third quarter, the highest since Reis began publishing quarterly data in 1999.

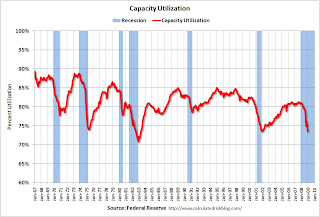

Capacity Utilization and Industrial Production Cliff Diving

by Calculated Risk on 1/16/2009 09:15:00 AM

From Greg Robb at MarketWatch: U.S. Dec. industrial production down 2%, down 11.5% in Q4

Capacity utilization ... fell to 73.6% from 75.2%. This is the lowest level since December 2001. Industrial output fell at an 11.5% rate in the fourth quarter.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This is a very sharp decline in industrial output, and industrial production is a key to the depth of the economic slowdown. Up until recently export growth had been strong, and the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

Also the significant decline in capacity utilization suggests less investment in non-residential structures for some time.

CPI declines 0.7% in December

by Calculated Risk on 1/16/2009 08:34:00 AM

From Rex Nutting at MarketWatch: Consumer prices show smallest gain in 54 years

The consumer price index fell 0.7% in December, the third decline in a row, led by an 8.3% drop in energy prices and a 0.1% drop in food prices.More later on CPI.

...

Core prices - which exclude food and energy prices - were flat in December for the second straight month ...

Consumer prices were up 0.1% in 2008, the slowest annual inflation since prices fell 0.7% in 1954. The core CPI was up 1.8% in 2008, the lowest increase since 2003.

BofA, Citi Report Losses

by Calculated Risk on 1/16/2009 08:16:00 AM

From the WSJ: Bank of America Swings to a Loss

Bank of America Corp. swung to a fourth-quarter loss as provisions for credit-losses nearly tripled, while the company showed why it needed further help from the government to support its acquisition of Merrill Lynch, whose preliminary loss was $15.31 billion.And from the WSJ: Citigroup Posts Loss, Splits Up Company

Citigroup Inc. reported an $8.29 billion net loss for the fourth quarter, putting the year's red ink at $18.72 billion, as the company announced it will reorganize into two business lines focused on banking and other financial services.