by Calculated Risk on 1/15/2009 10:37:00 AM

Thursday, January 15, 2009

JPM Earnings Call Notes

Here is the JPMorgan Presentation (PDF)

Notes from Brian:

Investment Bank – Allowance for losses 4.71% vs 3.85% q/q, NPLs 1.175B up $436MM q/q, VAR $327 vs 218 q/q

Dimon comment on Bear acquisition:

“It did cost us net net however you look at it several billion dollars this year.”

Leverage Lending markdowns $1.8B

Mortgage-related markdowns $1.1B (primarily CRE)

Other credit costs $0.8B

Leverage Lending commitments now marked down to 55 cents on the dollar

(Note all charge off rates for Retail Financial Services, Home Equity, Prime Mortgage and Subprime Mortgage are for Heritage JPM portfolios – the assumed WaMu portfolios excluded all the credit impaired loans and have minimal loss rates and thus are excluded from the calculations)Retail Financial Services Charge off rate 2.98% vs 2.43% q/q

Home Equity Originations $1.7B vs $9.8B y/y

Mortgage Originations $28.1B vs $37.7B q/q vs $40.0 y/y

Auto Loan Originations $2.8B vs $3.8Bq/q vs $5.6B y/yHome Equity

Charge off rate 3.24% vs 2.78% q/q, vs 1.05% y/y

Charge offs could reach $1B +/- over next few Q’s vs $770 in Q4

Max CLTVs now range from 50-70% vs 80% last quarterPrime Mortgage

Charge off rate 1.97% vs 1.79% q/q vs .22% y/y

80% of losses from CA & FL, 90% of losses from 06 and 07 vintages

Charge offs could be as high as $400MM over next few Qs vs $195MM in Q4 (or roughly 4% charge off rate!)Subprime Mortgage

Charge off rate 9.76% vs 7.65% q/q vs 2.08% y/y

Charge offs could be as high as $375-425MM per Q in 2009 vs $319MM in Q4WaMu Portfolio

At the time of the deal, home price decline assumptions ranged from 25-28% - Economy.com now is forecasting 31%

At the time of the deal, forecasted losses were in the range of $31-37B and are now estimated in the range of $32-36BCredit Cards

Charge off rate 5.29% vs 5.00% q/q vs 3.89% y/y

30 day delinquency rate 4.36% vs 3.69% q/q vs 3.48% y/y

Charge off rate expected to increase to 7% in Q1 and rise to 8% over the balance of the yearOther

Private Equity investments written down by $1.1B in the quarter

Purchase accounting adjustments (WaMu deal) added $1.1B to net income in the quarter

Mortgage servicing rights business added $900MM to net income in the quarterComments by Dimon:

“We owe you comments on the new UDAP (credit card regulations). To suffice to say here, it probably will drive profits lower and reduce the amount of credit you can make and the way you can make it available to consumers ... ”

“Commercial bank, really great results – NPL and credit loss haven't gone up that much. You cannot have an environment (like this) when you don't see a lot of stress and strain ... Expect losses to go up.”Q&A

Analyst: In terms of the outlook on consumer card balances, consumers delevering, do you expect to grow card balances in this environment?

Dimon: Very hard to tell because what we see is the consumer is spending less, card spend was down dramatic 8% in Q4, payments are way down too, balances, we don't know how the two are going to intercept.

Analyst: A lot of talk going back and forth on loan modification laws and potential principal reductions...just thoughts [from] you guys and really for the industry in general on what potential impact that could have on both acceleration of losses, but also just the state of the securitization markets.

Dimon: We are really trying to figure that out. All I'm going to say at this point is it is legislation. You know we don't know if it will get passed or not get passed. I think it could have a pretty chilling effect on consumer lending in general and drive up bankruptcy in general if people go to bankruptcy court more.

Analyst: ... you talked about the investment bank..how do you resize that business?

Dimon: ... when we added Bear Stearns we said it would add 6000 people to the IB net. The head count looking forward is more like as if you didn't add Bear Stearns at all.

RealtyTrac: Foreclosure Filings Increase 81% in 2008

by Calculated Risk on 1/15/2009 09:14:00 AM

RealtyTrac ... today released its 2008 U.S. Foreclosure Market Report(TM), which shows a total of 3,157,806 foreclosure filings -- default notices, auction sale notices and bank repossessions -- were reported on 2,330,483 U.S. properties during the year, an 81 percent increase in total properties from 2007 and a 225 percent increase in total properties from 2006. The report also shows that 1.84 percent of all U.S. housing units (one in 54) received at least one foreclosure filing during the year, up from 1.03 percent in 2007.There is no end in sight ... I expect foreclosure activity in 2009 to be higher than 2008.

Foreclosure filings were reported on 303,410 U.S. properties in December, up 17 percent from the previous month and up nearly 41 percent from December 2007. Despite the spike in December, foreclosure activity for the fourth quarter was down nearly 4 percent from the previous quarter but still up nearly 40 percent from the fourth quarter of 2007.

...

"State legislation that slowed down the onset of new foreclosure activity clearly had an effect on fourth quarter numbers overall, but that effect appears to have worn off by December," said James J. Saccacio, chief executive officer of RealtyTrac.

Weekly Unemployment Claims

by Calculated Risk on 1/15/2009 08:32:00 AM

There was some concern that the recent decline in seasonally adjusted weekly claims was because of the holidays, and also because of some glitches with state unemployment systems - and that claims would jump well above 600 thousand this week. An increase to only 524 thousand is therefore somewhat good news.

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 10, the advance figure for seasonally adjusted initial claims was 524,000, an increase of 54,000 from the previous week's revised figure of 470,000. The 4-week moving average was 518,500, a decrease of 8,000 from the previous week's revised average of 526,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 3 was 4,497,000, a decrease of 115,000 from the preceding week's revised level of 4,612,000. The 4-week moving average was 4,497,750, an increase of 27,500 from the preceding week's revised average of 4,470,250.

Click on graph for larger image in new window.

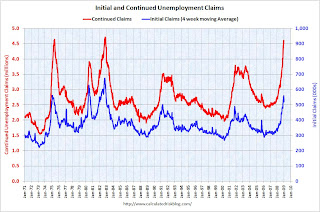

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 518,500; a decline from the recent peak of 558,750

in December.

Continued claims are now at 4.5 million, down slightly from the peak of 4.6 million.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

By these measures, the current recession is already worse than the '01 recession, and about the same as the '90/'91 recession - but far less than the severe recessions of the early '70s and early '80s.

Wednesday, January 14, 2009

Four Bad Bears Update

by Calculated Risk on 1/14/2009 08:53:00 PM

Time to check in on the Four Bad Bear markets ... Click on graph for updated image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". There is much more at the site.

Doug has added the market recoveries (light red and green) for the 1970s and early 2000s bear markets.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Another Bailout for BofA

by Calculated Risk on 1/14/2009 06:39:00 PM

Form the WSJ: U.S. Negotiating More Aid for Bank of America

The U.S. government is close to committing billions in additional aid to Bank of America Corp. as the nation's largest bank by assets tries to digest its Jan. 1 acquisition of Merrill Lynch ...Sounds like a severe case of indigestion and the earlier Countrywide acquisition can't be helping too.

... Bank of America ... told the U.S. Treasury Department it was unlikely to complete its purchase of the ailing Wall Street securities firm because of Merrill's larger-than-expected losses in the fourth quarter ...

Any possible arrangement might protect Bank of America from losses on Merrill's bad assets. There would be a cap on the amount of losses the bank would have to absorb with the federal government being on the hook for the remainder ...

Fed's Beige Book on CRE: "Grim and Depressing"

by Calculated Risk on 1/14/2009 03:04:00 PM

From the Fed's Beige Book:

Commercial real estate markets deteriorated in most Districts. Contacts in the Boston District described the commercial real estate market as grim and depressing, and market conditions continued to deteriorate in Richmond. In the Minneapolis District, a contact noted that the market remained in a downturn that has now lasted more than a year. Commercial real estate transactions in the Dallas District have reportedly ground to a halt. Leasing activity was minimal in the Boston District, continued to fall in the Philadelphia District, and was assessed as ranging from slowing to frozen in the Richmond District. Contacts in the Chicago District reported increases in sublease space. Office and industrial leasing is expected to remain steady through the first half of 2009 in the St. Louis District, but San Francisco reported that conditions in their commercial office market remained exceptionally weak. The New York District reported that Manhattan's office vacancy rate climbed to its highest level in two years. Contacts in the Chicago District noted elevated vacancy rates, and contacts in the Kansas City District expected higher vacancy rates going forward. Contacts in the Atlanta District also anticipate that more commercial space will become available.The other sections of the beige book are negative too - but CRE is being crushed.

Reports about commercial construction activity also were downbeat. In the Philadelphia District, commercial construction activity continued to fall. Cleveland reported that construction backlogs have declined for some contractors. Commercial contractors in the Atlanta and Chicago Districts reported declines in building activity and noted that more projects were cancelled or postponed. In St. Louis, contacts in commercial and industrial construction predicted a challenging environment in early 2009. San Francisco reported that commercial construction activity was very limited. Construction-related manufacturing contacts in the Dallas District reported that demand from commercial construction is shrinking rapidly.

emphasis added

More Retailer Bankruptcies

by Calculated Risk on 1/14/2009 01:46:00 PM

From Bloomberg: Gottschalks, Goody’s Seek Bankruptcy as Sales Slump

Gottschalks Inc., the owner of department stores in six western states, and Goody’s LLC, a clothing chain serving towns in the southern and central U.S., sought bankruptcy protection after sales slumped.Goody's was founded in 1953. These are long term retailers.

Gottschalks, founded in 1904 in Fresno, California, is looking for a buyer. Goody’s, based in Knoxville, Tennessee, plans to liquidate ...

Away from retail, Nortel filed bankruptcy today too.

California Foreclosure Activity Picks up Again

by Calculated Risk on 1/14/2009 11:07:00 AM

From Housing Wire: Foreclosure Activity Resumes Climb in California: Report

We’ve written for months now that extending foreclosure timelines — either via the use of legislation to lengthen notice periods, or through more direct moratoria efforts — will accomplish little more than delaying defaults, while simultaneously driving up costs and stretching servicers to a whole new level of thin. Proving that point yet again is ForeclosureRadar’s latest report on California foreclosure activity during December ...

Notices of Default, which represent the first step towards a foreclosure, rebounded sharply from an earlier stall caused by California State Senate Bill 1137, ForeclosureRadar reported. With 42,421 filings recorded in December, Notices of Default are back to the record levels reached in the second quarter of 2008, nearly doubling the 21,557 Notices of Default recorded in November alone. NOD filing levels in Dec. were 24.7 percent above year-ago totals, as well.

Notice of Trustee Sale filings were relatively flat month-over-month, but were still up 29.8 percent compared to last Dec.; such notices are filed an average 116 days after the Notice of Default, and indicate an imminent foreclosure sale, so a rebound in NTS levels in coming months seems likely.

...

“The effort by the California State Legislature to reduce foreclosures has now clearly failed,” said Sean O’Toole, founder of ForeclosureRadar. “While State Senate Bill 1137 was well intentioned, forcing lenders to talk to homeowners won’t fix this problem.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This chart shows the impact of bill 1137 - a dip in activity - but as Paul Jackson noted, this was just a delay.

Matt Padilla at the O.C. Register has local data: O.C. pre-foreclosure filings hit four-month high

Deutsche Bank Warns of $6.33 Billion Loss

by Calculated Risk on 1/14/2009 09:11:00 AM

From the WSJ: Deutsche Bank Expects to Post $6.33 Billion Fourth-Quarter Loss

Deutsche Bank AG Wednesday warned on fourth-quarter and full-year earnings, saying that exceptionally tough market conditions in sales and trading drove it to an after-tax loss of about €4.8 billion ($6.33 billion) for the fourth quarter ...Just a reminder that the confessional remains only for the banks ...

Retail Sales Collapse in December

by Calculated Risk on 1/14/2009 08:32:00 AM

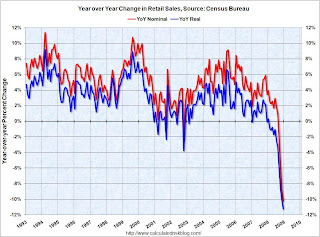

The following graph shows the year-over-year change in nominal and real retail sales since 1993.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (December PCE prices was estimated as the same as November).

Although the Census Bureau reported that nominal retail sales decreased 10.2% year-over-year (retail and food services decreased 9.8%), real retail sales declined by 11.3% (on a YoY basis). This is the largest YoY decline since the Census Bureau started keeping data.

There is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $343.2 billion, a decrease of 2.7 percent (±0.5%) from the previous month and 9.8 percent (±0.7%) below December 2007. Total sales for the 12 months of 2008 were down 0.1 percent (±0.4%)* from 2007. Total sales for the October through December 2008 period were down 7.7 percent (±0.5%) from the same period a year ago. The October to November 2008 percent change was revised from -1.8 percent (±0.5%) to -2.1 percent (±0.3%).

Retail trade sales were down 2.7 percent (±0.5%) from November 2008 and were 10.8 percent (±0.7%) below last year. Gasoline stations sales were down 35.5 percent (±1.5%) from December 2007 and motor vehicle and parts dealers sales were down 22.4 percent (±2.3%) from last year.

Retail sales are a key portion of consumer spending and real retail sales have fallen off a cliff.