by Calculated Risk on 1/05/2009 01:10:00 PM

Monday, January 05, 2009

Ford December Sales off 32.4%

From MarketWatch: Ford U.S. December sales down 32.4% to 139,067 units

Ford Motor Co. on Monday reported a 32.4% drop in December U.S. sales to 139,067 vehicles from 205,685 in December 2007.This is about the same year-over-year decline for Ford as in November.

GM, Toyota and Chrysler report later today.

The Hotel Bust

by Calculated Risk on 1/05/2009 12:17:00 PM

From the LA Times: Hoteliers see too much room at the inn

Fortunes of the once-highflying hotel industry fell hard at the end of 2008 and the prospects for 2009 look grim as anxious Americans cut travel spending and leave plenty of room at the inn.The article also quotes well known hospitality attorney Jim Butler (someone I know and spoke with last May about the coming hotel bust):

Hotel operators have seen room reservations fall drastically as business travelers and vacationers cut down on trips. In 2009, U.S. hotels will suffer one of the greatest annual declines in occupancy and revenue in history, according to analysts.

...

Indeed, U.S. hotels have entered one of the deepest and longest recessions in the history of the country's lodging industry, according to a December report by PKF Hospitality Research. The report predicts a nearly 8% drop this year in revenue per available room, a key industry measurement of performance typically calculated by multiplying a hotel's average daily room rate by its occupancy rate.

That would be the fifth-largest drop in revenue per available room since 1930. The largest recent drop was in 2001, when the measurement slipped 10.3%.

"September was definitely a point of departure, when hotel revenues around the country began a free fall," said Los Angeles attorney Jim Butler, a hotel specialist and industry blogger. "Since Labor Day, business has been falling off a cliff."More cliff diving ...

For anyone interested, Jim writes a blog on hotel legal issues: Hotel Law Blog

Cartoon: 2009 Proclamation

by Calculated Risk on 1/05/2009 11:03:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Construction Spending Declines in November

by Calculated Risk on 1/05/2009 10:00:00 AM

From the Census Bureau: November 2008 Construction at $1,078.4 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $756.4 billion, 1.5 percent (±1.1%) below the revised October estimate of $767.7 billion. Residential construction was at a seasonally adjusted annual rate of $328.3 billion in November, 4.2 percent (±1.3%) below the revised October estimate of $342.6 billion. Nonresidential construction was at a seasonally adjusted annual rate of $428.2 billion in November, 0.7 percent (±1.1%)* above the revised October estimate of $425.1 billion.

Click on graph for larger image in new window.

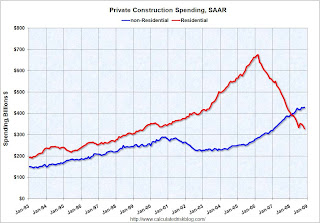

Click on graph for larger image in new window.The first graph shows private residential and nonresidential construction spending since 1993.

Nonresidential spending is still holding up as builders complete projects, but there is substantial evidence of a slowdown - less lending for new projects, less work for architects - and it appears that non-residential spending has peaked. On the graph nonresidential spending has been relatively flat for the last few months, but I expect some serious cliff diving over the next 18 months.

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative early in 2009. Residential construction spending is still declining, but the rate of decline has slowed.

Also - it now looks like investment in non-residential structures might be neutral for GDP in Q4.

CRE Crash Spreading

by Calculated Risk on 1/05/2009 12:21:00 AM

From Charles V. Bagli at the NY Times: As Vacant Office Space Grows, So Does Lenders’ Crisis

By many accounts, building owners have been caught off guard by how quickly the market has deteriorated in recent weeks.This is an excellent overview - I suggest reading the entire article. The point about regional banks is very important:

Rising vacancy rates were expected in Orange County, Calif., a center of the subprime mortgage crisis, and New York, where the now shrinking financial industry dominates office space. But vacancies are also suddenly climbing in Houston and Dallas, which had been shielded from the economic downturn until recently by skyrocketing oil prices and expanding energy businesses. In Chicago, brokers say demand has dried up just as new office towers are nearing completion.

...

Among commercial properties, the most troubled have been hotels and shopping centers, where anemic sales and bankruptcies by retailers are leading to more vacancies and where heavily leveraged mall operators, like General Growth Properties and Centro, are under intense pressure to sell assets. But analysts are increasingly worried about the office market.

Regional banks may be an even bigger concern. In the last decade, they barreled their way into commercial real estate lending after being elbowed out of the credit card and consumer mortgage business by national players. The proportion of their lending that is in commercial real estate has nearly doubled in the last six years, according to government data.Most regional banks avoided the residential real estate market (because they couldn't compete) and instead focused on CRE lending. Now with CRE imploding, the number of bank failures will probably rise rapidly in 2009.

Sunday, January 04, 2009

New Home Sales and Unemployment

by Calculated Risk on 1/04/2009 07:54:00 PM

CR does requests ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows New Home Sales vs. the Unemployment Rate.

Here are a couple of things to note:

As Dr. Yellen noted today (and Krugman and others before her) the current recession is not of the "garden-variety":

I agree with [Martin Feldstein] that the current downturn is likely to be far longer and deeper than the "garden-variety" recession in which GDP bounces back quickly. As Marty points out, a defining characteristic of this downturn is its cause. Typically, recessions occur when monetary policy is tightened to subdue the inflationary pressures that emerge during a boom. This time, the cause was the eruption of a severe financial crisis. Cross-country evidence suggests that, following such an event, GDP remains subdued for an extended period.Since the cause of the current recession is different than other post WWII recessions, the dynamics of the eventual recovery might be different too.

Fed's Yellen: Recession "longer and deeper" than "Garden-Variety"

by Calculated Risk on 1/04/2009 02:09:00 PM

From San Francisco Fed President Janet Yellen: Comments on "The Revival of Fiscal Policy"

I agree with [Martin Feldstein] that the current downturn is likely to be far longer and deeper than the "garden-variety" recession in which GDP bounces back quickly. As Marty points out, a defining characteristic of this downturn is its cause. Typically, recessions occur when monetary policy is tightened to subdue the inflationary pressures that emerge during a boom. This time, the cause was the eruption of a severe financial crisis. Cross-country evidence suggests that, following such an event, GDP remains subdued for an extended period.2 And consistent with this evidence, many forecasters expect this to be one of the longest and deepest recessions since the Great Depression. Indeed, the crisis is ongoing. Risk-aversion in financial markets remains exceptionally high; deleveraging is widespread; the markets for most private asset-backed securities are dysfunctional; financial institutions, both large and small, have failed; and the economic downturn is causing delinquencies to rise, threatening further financial distress; households and businesses face an ongoing credit crunch; and housing and financial wealth has plunged. Marty points out, and I agree, that the likely impact on consumer spending of the decline in wealth thus far—one of a number of factors weighing on this sector—is, on its own, quite substantial. And house prices are continuing to slide.And Dr. Yellen argues a fiscal stimulus package is needed:

If ever, in my professional career, there was a time for active, discretionary fiscal stimulus, it is now. Although our economy is resilient and has bounced back quickly from downturns in the past, the financial and economic firestorm we face today poses a serious risk of an extended period of stagnation—a very grim outcome. Such stagnation would intensify financial market strains, exacerbating the problems that triggered the downturn. It's worth pulling out all the stops to ensure those outcomes don't occur.

Saturday, January 03, 2009

Non-Residential Structure Investment vs.Residential Investment

by Calculated Risk on 1/03/2009 07:33:00 PM

From the AP: Commercial real estate in for tough 2009

[T]he welfare of commercial real estate trails the rest of the economy, so landlords might not get any relief for another two years.There is much more in the AP article on CRE, but I'd like to focus on the excerpt.

"If the economy recovers late this year," said Robert Bach, chief economist at Grubb and Ellis Co. "Our industry will still have a ways to go before it will recover."

Typically non-residential investment in structures trails residential investment by about 5 quarters.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the year-over-year (YoY) change in residential investment (shifted 5 quarters into the future) and the YoY change for non-residential structures.

Although a 5 quarter lag is the best fit, non-residential investment typically trails residential investment by 3 to 8 quarters.

The second graph shows the correlation coefficient for different lags (zero quarters to an 8 quarter lag).

The second graph shows the correlation coefficient for different lags (zero quarters to an 8 quarter lag).Because of this historical relationship, I expected a non-residential investment bust starting at the end of 2007 or in early 2008. Instead non-residential investment in structures is only now turning negative - a lag of over 10 quarters following residential investment.

This suggests that the recovery might be more sluggish than Robert Bach, the chief economist at Grubb and Ellis Co. expects. Instead of two years, I think the CRE slump will probably be longer.

UK: Another Round of Bailouts for Banks?

by Calculated Risk on 1/03/2009 09:09:00 AM

From The Times: Chancellor Alistair Darling on brink of second bailout for banks

Alistair Darling has been forced to consider a second bailout for banks as the lending drought worsens.Oh no, not the Paulson Plan!

The Chancellor will decide within weeks whether to pump billions more into the economy as evidence mounts that the £37 billion part-nationalisation last year has failed to keep credit flowing. Options include cash injections, offering banks cheaper state guarantees to raise money privately or buying up “toxic assets”, The Times has learnt.

...

Under one option, a “bad bank” would be created to dispose of bad debts. The Treasury would take bad loans off the hands of troubled banks, perhaps swapping them for government bonds. The toxic assets, blamed for poisoning the financial system, would be parked in a state vehicle or “bad bank” that would manage them and attempt to dispose of them while “detoxifying” the main-stream banking system.

The idea would mirror the initial proposal by Henry Paulson, the US Treasury Secretary, to underpin the American banking system by buying up toxic assets. The idea was abandoned, ironically, when Mr Paulson decided to follow Britain’s plan of injecting cash directly into troubled banks.

Mr Darling, Gordon Brown and Lord Mandelson, the Business Secretary, are expected to take the final decision on what extra help to give the banks by the end of the month.

Friday, January 02, 2009

CR's Road Trip

by Calculated Risk on 1/02/2009 06:54:00 PM

Here are some photos from my recent trip (sorry to bore anyone!)

| Click on photo for larger image in new window. CR and friends in Antelope Canyon, Arizona. Yes, it was a little cold. All Photos: Pattie A. |

| The second photo is in Carlsbad Caverns. The green tint is from the artificial lights in the Cavern. The photo shows a small part of the Big Room - a walkway is visible in the photo to provide a little scale. We also took a Ranger guided tour to the Hall of the White Giant. This involved crawling through some narrow caves, and climbing some ropes and ladders. An incredible experience! |

| The third photo is of Canyon de Chelly in Arizona. This area has been inhabited by the Navajos for hundred of years. There were ruins in the Canyon from the Anasazi "Ancient Ones" from about 800 years ago. Every turn down the path to the "White House" ruins was breathtaking. I also recommend Navajo National Monument for some ranger guided tours of ancient ruins. |  |

| The fourth photo is of Monument Valley. We drove through the valley from the south and turned around about 10 or 15 miles north of the valley (in Utah) - and this was the view! |

| And here is CR sliding down a dune at White Sands National Monument in New Mexico. It was cold at White Sands too. It was single digit cold when we left Gallup, New Mexico early in the morning! Ouch. A great trip. |  |