by Calculated Risk on 1/02/2009 03:12:00 PM

Friday, January 02, 2009

FDIC Board Approves Sale of IndyMac

From the FDIC: FDIC Board Approves Letter of Intent to Sell IndyMac Federal

On Wednesday December 31, 2008 the Federal Deposit Insurance Corporation (FDIC) signed a letter of intent to sell the banking operations of IndyMac Federal Bank, FSB, Pasadena, California, to a thrift holding company controlled by IMB Management Holdings LP, a limited partnership. The FDIC's Board of Directors approved the agreement to sell IndyMac Federal to the investor group.

...

IMB Management Holdings LP and the investor group will inject a substantial amount of capital into a newly formed thrift holding company, which will own and operate IndyMac Federal. IMB Management Holdings LP, has agreed to bring in an experienced senior management team to run the day-to-day operations of the thrift.

...

The transaction is expected to close in late January or early February, at which time full details of the agreement will be provided. It is estimated that the cost to the FDIC's DIF for resolving IndyMac Bank will be between $8.5 billion and $9.4 billion, in line with previous loss estimates. Costs include prepayment fees of $341.4 million to the Federal Home Loan Bank of San Francisco, on the payoff of $6.3 billion in FHLB advances.

"It is unfortunate that many of the banks that have failed last year had a heavy reliance on Federal Home Loan Bank advances," Bovenzi said. "These secured borrowings and the associated prepayment penalties have the effect of increasing the costs to the FDIC and to uninsured depositors."

Attachment: Fact Sheet

S&P Case-Shiller House Price Graphs for October

by Calculated Risk on 1/02/2009 12:52:00 PM

Just catching up after my trip!

S&P/Case-Shiller released their monthly Home Price Indices for October earlier this week. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 25.0% from the peak.

The Composite 20 index is off 23.4% from the peak.

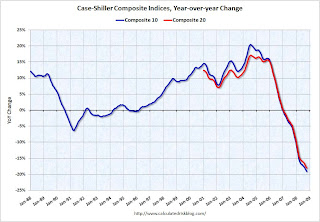

Prices are still falling, and will probably continue to fall for some time.  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 19.1% over the last year.

The Composite 20 is off 18.0% over the last year.

These are the worst year-over-year price declines for the Composite indices since the housing bubble burst.

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined more than 40% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 4% to 6% from the peak.

In Phoenix, house prices have declined more than 40% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 4% to 6% from the peak.

This shows the difference between the bubble areas (Krugman in 2005 called the "Zoned Zones") and the "Flatland" areas.

There was a bubble in Flatland too caused by the rapid migration from renting to buying - facilitated by loose lending - that pushed up Flatland prices. But those bubbles were small compared to the bubbles in the Zoned Zones.

Now that the bubble has burst, prices in the more bubbly Zoned Zones are falling much more than in Flatland.

Detroit is an exception with prices off 29% from the peak, even though Detroit never had a price bubble. The reason is Detroit has a weak economy and a declining population. Since housing is very durable, there is excess supply in Detroit, and prices for existing homes are below replacement costs.

Another exception is New York. Prices in New York are only off 11.4% even though New York is part of the Zoned Zone. New York had a price bubble, but until recently prices had held up pretty well. This probably means New York house prices will decline by a larger percentage over the next year or two than other bubble areas ...

ISM Manufacturing Index: More Cliff Diving

by Calculated Risk on 1/02/2009 11:00:00 AM

From the WSJ: U.S. Factories Slumped in December

The U.S. factory sector closed out 2008 on a decidedly sour note, marking its weakest period of activity in nearly 30 years.Another very weak report.

The Institute for Supply Management reported Friday that its manufacturing sector index came in at 32.4 during December, from 36.2 in November and 38.9 in October.

...

December's reading was the weakest since June 1980.

...

"The decline covers the full breadth of manufacturing industries, as none of the industries in the sector report growth at this time," said Norbert Ore, who leads the survey for the ISM. He added, "manufacturers are reducing inventories and shutting down capacity to offset the slower rate of activity."

...

In the report, the ISM said that the production index stood at 25.5, from 31.5. Meanwhile, the new orders index, which hints at future activity, was weak at 22.7, from 27.9. The ISM said that reading was the lowest since January 1948. Hiring contracted, with the employment index at 29.9, versus November's 34.2.

Thursday, January 01, 2009

Taxpayers to buy ... Cheese?

by Calculated Risk on 1/01/2009 08:59:00 PM

From the NY Times: As Recession Deepens, So Does Milk Surplus

[W]hile the government has price-support programs for about two dozen agricultural products, so far milk powder is the only commodity that has sunk low enough to trigger the flow of government dollars. Some expect that taxpayers will soon be buying blocks of cheese, too, given the plunging price.I'm back home and I'm catching up on my email and the news. Normal posting resumes tomorrow ... best to all.

Four Bad Bears: End of Year Update

by Calculated Risk on 1/01/2009 09:56:00 AM

Click on graph for updated image in new window. (small image HAS NOT been updated.)

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. This graph from Doug "The Mega Bear Quartet" compares the recent S&P 500 bear market with the Dow following the Crash of 1929, the post-1989 Nikkei 225, and the NASDAQ after the Tech Bubble.

Note: I'm returning home today from my vacation. Happy New Year to all.

Wednesday, December 31, 2008

Cartoon: Some Things Never Change

by Calculated Risk on 12/31/2008 02:30:00 PM

This cartoon is from 1992 ...

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Cartoon: CR on Vacation

by Calculated Risk on 12/31/2008 11:30:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

I'll be home tomorrow! Happy New Year to All!

Weekly Unemployment Claims Decline

by Calculated Risk on 12/31/2008 08:59:00 AM

From the DOL: Unemployment Insurance Weekly Claims Report

In the week ending Dec. 27, the advance figure for seasonally adjusted initial claims was 492,000, a decrease of 94,000 from the previous week's unrevised figure of 586,000. The 4-week moving average was 552,250, a decrease of 5,750 from the previous week's unrevised average of 558,000.Although the data is seasonally adjusted, I'd discount the decline because of the holidays.

The advance seasonally adjusted insured unemployment rate was 3.4 percent for the week ending Dec. 20, an increase of 0.1 percentage point from the prior week's unrevised rate of 3.3 percent.

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 20 was 4,506,000, an increase of 140,000 from the preceding week's revised level of 4,366,000.

Note that the total insured unemployment is now over 4.5 million for the first time since 1982.

Tuesday, December 30, 2008

Office Rents off as much as 25% in New York

by Calculated Risk on 12/30/2008 06:43:00 PM

From the NY Times: A Renter’s Market for Manhattan Offices

Even to industry veterans who have lived through other downturns, the precipitous decline in the Manhattan office market, especially in Midtown, has been startling.And the market will probably be flooded with sublease space in 2009.

“We have fallen further faster than any time in the last 20 years,” said Mitchell S. Steir, chief executive of Studley, a national brokerage firm that represents tenants. “There has been more damage to real estate values in the last four months than in any other four-month period. The pace with which it has occurred has been astonishing.”

...

[B]rokers say that actual rents have fallen much further than the data suggests. Studley said that the asking rents for 40 percent of the spaces included in its research are listed as “negotiable.”

“No one knows what the rents are, because there has been very little activity for the past three months,” said Ruth Colp-Haber, a partner at Wharton Property Advisors, which represents small to medium-size tenants. “No one is paying attention to the asking rents.”

...

[A]ctual rents have slipped as much as 25 percent since the summer, said Mitchell L. Konsker, a vice chairman of Cushman & Wakefield.

New Commenting System

by Calculated Risk on 12/30/2008 02:30:00 PM

A few more vacation days ... I'll be back soon.

Hopefully next week I'll be moving to the new JS-Kit commenting system. This should help with improving the quality of the comments. For those interested, check on Mish's site.

Intermittent posting continues ...

Best to all