by Calculated Risk on 11/26/2008 11:56:00 AM

Wednesday, November 26, 2008

More on New Home Sales

Click on graph for larger image in new window.

Click on graph for larger image in new window.

First, here is a long term graph of new home sales and inventory from the Census Bureau.

Although home builders have sharply reduced housing starts - and are now starting fewer homes than they are selling (reducing inventory) - new home sales have fallen rapidly too. It has been a race to the bottom!

Also - New home sales in October might be at the lowest level since 1982, however adjusted for owner occupied units, the current year is the worst on record.

The following graph shows both annual new home sales (from the Census Bureau) and sales through October. In 2008, sales through October (before revisions) have totaled 436 thousand. This is slightly ahead of the pace in 1991 (432 thousand sales through October).

In 2008, sales through October (before revisions) have totaled 436 thousand. This is slightly ahead of the pace in 1991 (432 thousand sales through October).

However sales have slowed in the 2nd half of 2008, and it appears that annual sales will be below the 509 thousand in 1991. This would mean sales would be the lowest since 1982 (412 thousand).

Of course the U.S. population and the number of households were much lower in 1982. In 1982 there were 54.2 million owner occupied units in the U.S., in 1991 there were 61.0 million, and there are approximately 76 million today.

If we use a ratio of owner occupied units to compare periods, the low in 1982 was 412 thousand X (76/54.2) = 578 thousand units (based on the number of owner occupied units today).

The calculation for 1991 gives 634 thousand units (to compare to today).

By this measure, 2008 is the worst year for new home sales since the Census Bureau started tracking new home sales (starting in 1963).

October New Home Sales: Lowest Since 1982

by Calculated Risk on 11/26/2008 10:00:00 AM

The Census Bureau reports, New Home Sales in October were at a seasonally adjusted annual rate of 433 thousand. This is the lowest sales rate since 1982.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for October since 1981. (NSA, 34 thousand new homes were sold in October 2008, 29 thousand were sold in October 1981).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in October 2008 were at a seasonally adjusted annual rate of 433,000, according toAnd one more long term graph - this one for New Home Months of Supply.

estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 5.3 percent below the revised September of 457,000 and is 40.1 percent below the October 2007 estimate of 723,000.

"Months of supply" is at 11.1 months.

"Months of supply" is at 11.1 months. Sales are falling quickly, but inventory is declining too, so the months of supply is slightly lower than the peak of 11.4 months in August 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

TheInventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

seasonally adjusted estimate of new houses for sale at the end of October was 381,000. This represents a supply of 11.1 months at the current sales rate.

This is a another very weak report. I'll have more later today ...

2008 Word of the Year: Bailout

by Calculated Risk on 11/26/2008 08:58:00 AM

From Boston Herald: In sign of times, ‘bailout’ is ‘word of year’ (hat tip Spatch)

The word “bailout,” which shot to prominence amid the financial meltdown, was looked up so often at Merriam-Webster’s online dictionary that the publisher says it was an easy choice for its 2008 Word of the Year.

Weekly Initial Unemployment Claims: 4-Week Moving Average at 25 Year High

by Calculated Risk on 11/26/2008 08:42:00 AM

The DOL reports:

In the week ending Nov. 22, the advance figure for seasonally adjusted initial claims was 529,000, a decrease of 14,000 from the previous week's revised figure of 543,000. The 4-week moving average was 518,000, an increase of 11,000 from the previous week's revised average of 507,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 15 was 3,962,000, a decrease of 54,000 from the preceding week's revised level of 4,016,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims. The four moving average is at 518,000 - above the highest levels of the '91 and '01 recessions, and the highest level since 1983 (not shown).

Continued claims are now at 3.962 million - a very high level. Just more evidence of a very weak job market.

Tuesday, November 25, 2008

Mortgage Rates Fall: 30 Year Fixed at 5.5%

by Calculated Risk on 11/25/2008 08:38:00 PM

From Bloomberg: U.S. Mortgage Rates Fall on $600 Billion Fed Plan

U.S. mortgage rates fell more than three-quarters of a percentage point today ... The average U.S. rate for a 30-year fixed mortgage ended the day at about 5.5 percent after falling to as low as 5.25 percent, according to Bankrate Inc. It was 6.38 percent this morning ...And refinance activity has picked up immediately, from the WSJ: Fed Aid Sets Off a Rush to Refinance

The Federal Reserve's attempt to stabilize the housing market set off a chain reaction across the U.S. on Tuesday, dropping interest rates and quickly spurring a burst of refinancing activity by borrowers eager to lower their mortgage costs.

Some brokers said it was the most activity they've seen in at least one year, although there was no way to determine to volume of refinancing.

Home Builders Accuse FDIC of Cutting off C&D Loans

by Calculated Risk on 11/25/2008 07:15:00 PM

From the WSJ: Home Builders Hammer FDIC

Home builders from Florida to Texas are railing against the Federal Deposit Insurance Corp., saying the agency is cutting off construction financing from seized banks and demanding early repayment of current loans.It takes some real digging to determine if a Construction & Development (C&D) loan is in trouble. These loans are typically made with interest reserves, and they tend to blow up when the construction project is completed (but not before since the payments are made from the interest reserve).

...

In the third quarter, 15.2% of single-family-home construction loans were delinquent, up from 12.5% in the previous quarter, according to Foresight Analytics, an Oakland, Calif., research firm. About 20.5% of condo construction loans were delinquent, up from 16.5%.

The FDIC put out a guidance on C&D loans and interest reserves in June, see: A Primer on the Use of Interest Reserves

Of particular concern is the possibility that an interest reserve could mask problems with a borrower’s willingness and ability to repay the debt consistent with the terms and conditions of the loan obligation.The FDIC is probably just following their own guidance and freezing the C&D loans until they make sure the projects are viable.

Real House Prices

by Calculated Risk on 11/25/2008 05:33:00 PM

Earlier today I posted the Case-Shiller monthly house prices, the house price-to-rent ratio, and the house price-to-income ratio.

Here is a look at real house prices using both the Case-Shiller national index and the OFHEO purchase only index.

OFHEO released their Q3 house price index today showing:

U.S. home prices fell 1.8 percent in the third quarter of 2008 from the previous quarter, according to FHFA’s seasonally-adjusted purchase-only house price index, which is based on data from repeat home sales. This decline was greater than the 1.4 percent decline in the prior quarter and the largest in the purchaseonly index’s 17-year history. Over the past year, prices fell 6.0 percent between the third quarter of 2007 and the third quarter of 2008.Note: there are a number of difference between OFHEO and Case-Shiller (See House Prices: Comparing OFHEO vs. Case-Shiller), but the main reason for the difference is OFHEO doesn't include many of the really bad loans (subprime and Alt-A) that were sold through Wall Street. OFHEO is GSE only loans.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the real house prices based on both OFHEO Purchase Only index and the Case-Shiller national index. (Q1 1999 = 100)

Both indices show prices are falling (although I think Case-Shiller more accurately reflects what I'm seeing in the market), and both indices show real prices are still significantly above prices in the '90s.

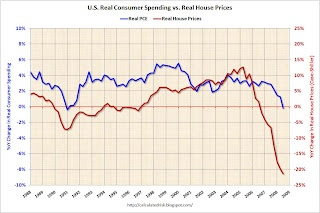

House Prices vs. PCE

by Calculated Risk on 11/25/2008 03:23:00 PM

Earlier I posted the Case-Shiller monthly house prices, the house price-to-rent ratio, and the house price-to-income ratio.

Here is a look at the real year-over-year (YoY) change in house prices vs. personal consumption expenditures (PCE):  Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph compares the YoY change in real house prices with the YoY change in real PCE.

For this limited data set (house price data is only available since 1987) the YoY changes move somewhat together, although house prices started declining before PCE during the current economic downturn. This difference in timing could be because of homeowners withdrawing equity from their homes (the Home ATM) even after prices first started falling. However recent data shows that the Home ATM is now pretty much closed - and as expected consumption has started to decline sharply.

Based on this general relationship, I wouldn't be surprised to see the YoY change in real PCE fall to -4% or so at some point next year.

House Price-to-Income Ratio

by Calculated Risk on 11/25/2008 01:03:00 PM

This morning I posted the price-to-rent ratios for the U.S and a few selected cities. Here is a look at house price to median household income:  Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price-to-income ratio and is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008).

Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 15% or so. The further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes (Note: this uses nominal incomes, and even if real incomes are stagnant or declining, nominal incomes usually are rising).

Last quarter this index was over 1.25. Now it is close to 1.2. At this pace the index will hit 1.0 in Q3 2009. However, during a recession, nominal household median incomes are usually stagnate - so it might take even longer.

FDIC: Number of Problem Banks Increased Sharply in Q3

by Calculated Risk on 11/25/2008 11:38:00 AM

A couple key points:

From the FDIC: Insured Banks and Thrifts Earned $1.7 Billion in the Third Quarter

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported net income of $1.7 billion in the third quarter of 2008, a decline of $27.0 billion (94 percent) from the $28.7 billion that the industry earned in the third quarter of 2007. With the exception of the fourth quarter of last year, the latest earnings were the lowest for the industry since the fourth quarter of 1990.And on loan losses and charge-offs:

"We've had profound problems in our financial markets that are taking a rising toll on the real economy. Today's report reflects these challenges," said FDIC Chairman Sheila C. Bair.

...

Nine FDIC-insured institutions failed in the third quarter, the most since the third quarter of 1993. The failures included Washington Mutual Bank, with assets of $307 billion. The FDIC's "problem list" grew during the quarter from 117 to 171 institutions, the largest number since the end of 1995. Total assets of problem institutions increased from $78.3 billion to $115.6 billion.

Provisions for loan losses continue to rise. Higher levels of troubled loans, in both consumer and commercial portfolios, led to increased provisions for loan losses in the quarter. Loss provisions totaled $50.5 billion, compared to $16.8 billion in the third quarter of 2007. ...

Charge-offs and noncurrent loans are still increasing. Insured institutions charged off (removed from their balance sheets because of uncollectibility) $27.9 billion in troubled loans in the third quarter. The annualized net charge-off rate of 1.42 percent was the highest quarterly average since 1991. The amount of noncurrent loans and leases (90 days or more past due or in nonaccrual status) increased by $21.4 billion (13.1 percent) during the third quarter. At the end of the quarter, 2.31 percent of all loans and leases were noncurrent, the highest level for the industry since the third quarter of 1993.