by Calculated Risk on 11/20/2008 07:36:00 PM

Thursday, November 20, 2008

Repeat: Four Bad Bears and Two "Experts"

A couple of images of the day ... Click on graph for larger image in new window.

Doug Short of dshort.com (financial planner) sent me this graph of "Four Bad Bears".

The current stock market decline is the worst since the Great Depression.

| Click on cartoon for larger image in new window. This cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. was inspired by Professor Duy's post last night: Fed Watch: Policy Adrift |

Treasury Capital Purchase Program (TARP)

by Calculated Risk on 11/20/2008 05:38:00 PM

Here is the site for the TARP data (hat tip Ras Stash)

Here are the details released as of Nov 17th:

CAPITAL PURCHASE PROGRAM: $158,561,409,000 Total

| $15,000,000,000 | Bank of America Corporation |

| $3,000,000,000 | Bank of New York Mellon Corporation |

| $25,000,000,000 | Citigroup Inc. |

| $10,000,000,000 | The Goldman Sachs Group, Inc. |

| $25,000,000,000 | JPMorgan Chase & Co. |

| $10,000,000,000 | Morgan Stanley |

| $2,000,000,000 | State Street Corporation |

| $25,000,000,000 | Wells Fargo & Company |

| $10,000,000,000 | Merrill Lynch & Co., Inc. |

| $17,000,000 | Bank of Commerce Holdings |

| $16,369,000 | 1st FS Corporation |

| $298,737,000 | UCBH Holdings, Inc. |

| $1,576,000,000 | Northern Trust Corporation |

| $3,500,000,000 | SunTrust Banks, Inc. |

| $9,000,000 | Broadway Financial Corporation |

| $200,000,000 | Washington Federal Inc. |

| $3,133,640,000 | BB&T Corp. |

| $151,500,000 | Provident Bancshares Corp. |

| $214,181,000 | Umpqua Holdings Corp. |

| $2,250,000,000 | Comerica Inc. |

| $3,500,000,000 | Regions Financial Corp. |

| $3,555,199,000 | Capital One Financial Corporation |

| $866,540,000 | First Horizon National Corporation |

| $1,398,071,000 | Huntington Bancshares |

| $2,500,000,000 | KeyCorp |

| $300,000,000 | Valley National Bancorp |

| $1,400,000,000 | Zions Bancorporation |

| $1,715,000,000 | Marshall & Ilsley Corporation |

| $6,599,000,000 | U.S. Bancorp |

| $361,172,000 | TCF Financial Corporation |

Fannie and Freddie to Suspend Foreclosures

by Calculated Risk on 11/20/2008 04:43:00 PM

Press Release from Fannie Mae (no link yet): Fannie Mae to Suspend Foreclosures Until January

In order to support the streamlined modification program announced on November 11, 2008, Fannie Mae (NYSE: FNM) today issued a notice to its loan servicing organizations and retained foreclosure attorneys directing them to suspend foreclosure sales on occupied single-family properties as well as the completion of evictions from occupied single-family properties scheduled to occur from November 26, 2008 until January 9, 2009.Freddie Mac also announced they are suspending foreclosures.

The temporary suspension of foreclosures is designed to allow affected borrowers facing foreclosure to retain their homes while Fannie Mae works with mortgage servicers to implement the streamlined modification program scheduled to launch December 15.

Graph: Worst Crash Since Great Depression

by Calculated Risk on 11/20/2008 04:31:00 PM

Check out Doug's site - he has added some tabs to see other crashes and recoveries ... Click on graph for larger image in new window.

Doug Short of dshort.com (financial planner) sent me this graph of "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Most Severe Market Crash Since Great Depression

by Calculated Risk on 11/20/2008 03:53:00 PM

I'll have the graph soon ...

DOW off 430

S&P500 off 53 at 11 1/2 year low (April 1997).

NASDAQ off 70

Another day of cliff diving.

LA Times: Auction of Building Equipment

by Calculated Risk on 11/20/2008 02:16:00 PM

The front page (pdf) of the LA Times has this picture of building equipment for sale in the Inland Empire. Click on photo for larger image in new window. |  |

From the LA Times: Housing slowdown spurs auction of construction equipment

Sellers said they were purging their inventories to pull in operating capital. Buyers said they were lured by cheap prices, although several expressed reluctance to spend money on equipment that could remain idle for months.Not much demand to move dirt in Southern California!

"These are the worst prices I've ever seen," said Steve Thompson, 52, who was there to make bids for Chuck Green & Associates Inc., a San Diego County company that buys, resells and rents heavy equipment.

Back in 2005, during the boom, the company sold a used hydraulic dirt excavator for $309,000. That same excavator changed hands Tuesday for just $50,000.

DataQuick: Foreclosure Resales Almost Half of Bay Area California Activity

by Calculated Risk on 11/20/2008 01:13:00 PM

From DataQuick: Bay Area median price tumbles to $375K; sales reach high for '08

Bay Area homes sold at their fastest pace in 17 months in October as buyers favored more affordable inland areas where depreciation and foreclosures have hit hardest. As a result, the median sale price continued its steep, months-long decline, falling a record 40.6 percent, or $256,000, from a year ago, a real estate information service reported.Be careful with the median price - the mix has shifted to more homes in lower priced neighborhoods with significant foreclosure resale activity - and that reduces the median price. The Case-Shiller index is a better measure of house price declines.

...

Last month's sales were the highest for any month since June 2007, when 7,964 homes sold. But sales were still the second-lowest for any October since 1995 and were 14.2 percent below the average number sold during October since 1988, when DataQuick's statistics begin.

...

Last month 44.8 percent of all existing homes sold in the Bay Area had been foreclosed on at some point in the prior 12 months, up from 41.9 percent in September and 8.2 percent a year ago.

Report: Senate Reaches Deal on Automaker Bailout

by Calculated Risk on 11/20/2008 12:41:00 PM

From the Detroit Free Press: Compromise reached on $25-billion auto bailout

Key senators reached a compromise today on a $25-billion bailout of Detroit's automakers, but questions remained as to whether there were enough votes or time to pass the bill today.It is not clear there are enough votes to pass this compromise bill - and if President Bush will sign it.

...

A draft of the compromise being worked on by Michigan Sen. Carl Levin and Sen. Christopher Bond, R-Mo., would have used the $25 billion set aside by Congress in September for retooling auto plants over the next several years and lend it to automakers immediately.

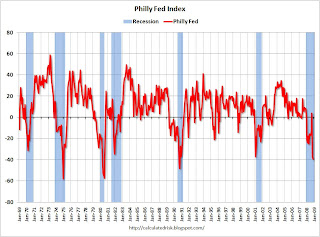

Philly Fed: Manufacturing sector index "lowest level since October 1990"

by Calculated Risk on 11/20/2008 10:41:00 AM

Until recently the manufacturing sector (except the automakers) was holding up pretty well. Not anymore ...

Here is the Philadelphia Fed Index for November activity released today: Business Outlook Survey.

Conditions in the region's manufacturing sector continued to deteriorate, according to firms polled for this month's Business Outlook Survey. Most broad indicators declined again in November, following sharp decreases in October. ... Most of the survey's indicators of future activity slid further into negative territory this month, suggesting that the region's manufacturing executives expect continued declines over the next six months.

...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from -37.5 in October to -39.3 this month. This index, which fell a dramatic 41 points last month, is now at its lowest level since October 1990.

...

The current employment index fell notably this month, declining seven points, to -25.2

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index vs. recessions for the last 40 years. The manufacturing sector is clearly in recession - although still not as bad as during earlier recessions.

Credit Crisis Indicators: Flight to Quality

by Calculated Risk on 11/20/2008 10:19:00 AM

The 10-Year Treasury Note yield is at 3.14%.

The effective Fed Funds rate was at 0.38% (yesterday). At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%) and the 3 month yield within 25 bps of the target rate.

But for now, the Fed appears engaged in quantitative easing.

The TED spread is stuck above 2.0, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5.

This graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury. The Moody's data is from the St. Louis Fed

There are periods when the spread increases because of concerns of higher default rates (like in the severe recession of the early '80s), but the recent spread is unprecedented. Worse

The Federal Reserve assets increased $139 billion last week to $2.214 trillion.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.43% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. Also the recession is creating concern for lower rated paper. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

Note:on quantitative easing, see Bernanke's paper from 2004: Conducting Monetary Policy at Very Low Short-Term Interest Rates One thing is clear - the target Fed funds rate is pretty much meaningless right now.