by Calculated Risk on 11/20/2008 09:29:00 AM

Thursday, November 20, 2008

Credit Markets: "Back in crisis mode"

From Bloomberg: Bond Risk Soars to Record as Markets Return to ‘Crisis Mode’ (hat tip Justin)

The cost of protecting corporate bonds from default surged to records around the world as the prospect of U.S. automakers filing for bankruptcy protection fueled concern of more bank losses and a deeper recession.

“Markets are back in crisis mode,” said Agnes Kitzmueller, a Munich-based credit strategist at UniCredit SpA, Italy’s biggest bank. “There is fear in the market.”

| Click on cartoon for larger image in new window. This cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. was inspired by Professor Duy's post last night: Fed Watch: Policy Adrift |

GMAC Seeks to be Bank Holding Company, Access TARP

by Calculated Risk on 11/20/2008 09:13:00 AM

From MarketWatch: GMAC moves to tap government funding

GMAC LLC, the financial arm of General Motors Corp., said Thursday that it has applied to become a bank-holding company so it can access some of the emergency cash available through the U.S. Treasury's Capital Purchase Program.

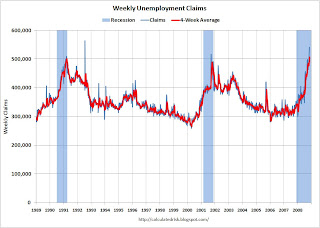

Continued Unemployment Claims Over 4 Million

by Calculated Risk on 11/20/2008 09:02:00 AM

It was just six months ago that continued claims hit 3 million; that was a big story. Now continued claims are over 4 million ...

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 15, the advance figure for seasonally adjusted initial claims was 542,000, an increase of 27,000 from the previous week's revised figure of 515,000. The 4-week moving average was 506,500, an increase of 15,750 from the previous week's revised average of 490,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 8 was 4,012,000, an increase of 109,000 from the preceding week's revised level of 3,903,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims. The four moving average is at 506,500. This is a very high level, and indicates significant weakness in the labor market.

Continued claims are now at 4.012 million, the highest level since 1982.

The second graph shows continued claims since 1989.

The second graph shows continued claims since 1989.Note: Continued claims hit 4.7 million during the 1982 recession (not shown), although the population was much smaller then. The unemployment rate peaked at 10.8% in 1982 (compared to 6.5% currently).

This suggests that November will be another very weak month for employment.

Dr. Duy: Fed Policy Adrift

by Calculated Risk on 11/20/2008 01:31:00 AM

Professor Tim Duy takes a hard look at Bernanke Fed Watch: Policy Adrift

I understand the Federal Reserve Chairman Ben Bernanke is considered something of a sacred cow, our one point of light in an uncertain world. An academic who cannot be questioned by other academics. A smart person who has mastered the Great Depression and therefore “knows” what to do, and is providing the leadership to do it.Read it all ...

I am beginning to question all of these assumptions.

... for now, I see a distinct lack of leadership from the Federal Reserve, and it suggests that Bernanke has used up his bag of tricks. And I don’t think that he knows what to do next. Indeed, Fedspeak is now littered with confusing statements that leave the true policy of the Federal Reserve in question.

Poole on Quantitative Easing

by Calculated Risk on 11/20/2008 01:18:00 AM

"The FOMC for many years has instructed the open market desk at the New York Fed to keep the actual Fed Funds rate close to the target Fed Funds rate. Clearly in recent weeks, it is not succeeding. As far as I can tell, it can't be trying."From Bloomberg: Bernanke's Cash Injections Risk Eclipse of Main Rate

William Poole, former President of Fed Bank of St. Louis

``There has been a policy shift, but the Fed is not transparently announcing what it is doing and why,'' said former St. Louis Fed President William Poole, now a senior fellow at Cato. ``Monetary policy works best when the markets understand what the central bank is doing.''

...

``It is a move to quantitative easing, to force lots and lots of reserves into the banking system with the expectation that banks will start to trade them for a higher-yielding asset,'' said Poole, a Bloomberg contributor

| Click image for video. |

Wednesday, November 19, 2008

GGP Hires BK Firm

by Calculated Risk on 11/19/2008 11:45:00 PM

General Growth Properties, the second largest mall owner in the U.S. behind Simon Property, has hired bankruptcy counsel ...

From the WSJ: Mall Owner Lines Up Bankruptcy Law Firm (hat tip crispy&cole)

Debt-laden mall giant General Growth Properties Inc. has hired the law firm Sidley Austin as bankruptcy counsel ... The move doesn't mean a Chapter 11 filing is imminent.

...

The company, which owns more than 200 U.S. malls, has struggled to repay debt it amassed during an acquisition binge near the market's peak.

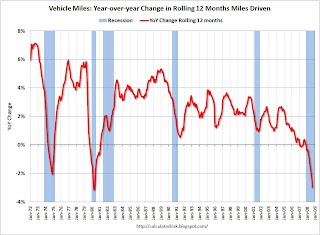

DOT: U.S. Vehicle Miles Off Sharply in September

by Calculated Risk on 11/19/2008 08:55:00 PM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -4.4% (-10.7 billion vehicle miles) for September 2008 as compared with September 2007. Travel for the month is estimated to be 232.8 billion vehicle miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.0% YoY, and the decline in miles driven is worse than during the early '70s oil crisis - and about the same as the 1979-1980 decline. As the DOT noted, miles in September 2008 were 4.4% less than September 2007, so the YoY change in the rolling average will probably get worse.

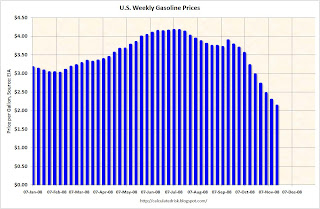

The second graph shows the weekly U.S. gasoline prices from the EIA. This shows that gasoline prices really declined in October - but prices in September were still over $3.50 per gallon. So we will have to wait for the October vehicle miles report to see the impact of sharply lower gasoline prices.

The second graph shows the weekly U.S. gasoline prices from the EIA. This shows that gasoline prices really declined in October - but prices in September were still over $3.50 per gallon. So we will have to wait for the October vehicle miles report to see the impact of sharply lower gasoline prices. Lower gasoline prices should mean more vehicle miles driven, but the weakening economy might offset the impact from lower prices.

Four Bad Bears

by Calculated Risk on 11/19/2008 06:41:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Doug Short of dshort.com (financial planner) sent me this graph of "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Interesting times ...

More Bad News for Commercial Real Estate

by Calculated Risk on 11/19/2008 05:31:00 PM

A couple of quotes from Bloomberg: Commercial mortgages seen at risk as economy weakens (hat tip Dwight)

"There is a growing concern that (commercial real estate) is going to be another tripping point in the economy."And here is a forecast of office vacancy rates increasing significantly in Chicago via the Chicago Tribune: Chicago's commercial real estate climate may soon grow colder. (hat tip Walt) A few excerpts:

William Larkin, portfolio manager with Cabot Money Management

"The mall operators are really, really in trouble. There aren't even signs on the empty stores in the malls. They've been empty for a while, barren, tumbleweeds blowing through."

Kevin Quinn, a managing director of equity trading at Stanford Group Company

With banks and investment firms occupying 12 million square feet of office space, consolidation and downsizing could push the downtown vacancy rate from 12 percent to nearly 18 percent by 2010.This story is playing out all over the country.

...

Commercial real estate faces one of its most challenging climates in nearly two decades.

...

"I think we could easily see an effective drop in rents over the next 12 months of 15 to 20 percent from where they are today." [said John Goodman, Chicago-based executive vice president with Studley, a real estate firm]

There are a couple of key points:

As example, in Chicago there are several new buildings just being finished:

Adding to the vacancies, three major developments are due for completion next year, flooding downtown Chicago with another 3.6 million square feet of office space.But the good news for landlords - and bad news for construction related businesses - is there are "no new office buildings on the horizon for 2010 and only one ... planned for 2011." This fits with the Architecture Billings Index released earlier today.

Market Crash: DOW under 8000, NASDAQ under 1,400

by Calculated Risk on 11/19/2008 04:01:00 PM

DOW at 7997

S&P 500 at 806.7

NASDAQ at 1386

Update: Overheard on the trading floor ...

"I don't want the cheese anymore... I just want out of the trap."

"This is like a half off sale at Nordstrom ... it is still overpriced!"