by Calculated Risk on 11/19/2008 02:15:00 PM

Wednesday, November 19, 2008

Comparing Stock Market Crashes

Architecture Billings Index Drops to All Time Low

by Calculated Risk on 11/19/2008 01:19:00 PM

The American Institute of Architects reports: Architecture Billings Index Drops to All Time Low Click on graph for larger image in new window.

Click on graph for larger image in new window.

On the heels of a six-point drop in September, the Architecture Billings Index (ABI) plummeted to its lowest level since the survey began in 1995. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI rating was 36.2, down significantly from the 41.4 mark in September (any score above 50 indicates an increase in billings). The inquiries for new projects score was 39.9, also a historic low point.This is the 2nd leg down for the index this year. There is "an approximate nine to twelve month lag time between architecture billings and construction spending", so we should expect the first decline in architecture billing to impact non-residential structure investment in Q4 2008, and a further downturn in non-residential construction activity next summer.

“Until recently, the institutional sector had been somewhat insulated from the deteriorating conditions affecting the commercial and residential markets,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Now we are seeing that governments and nonprofit agencies are having difficulties getting bonds approved to finance large scale education and healthcare facilities, furthering the weak conditions across the construction industry.”

emphasis added

Credit Crisis Indicators: No Progress

by Calculated Risk on 11/19/2008 10:55:00 AM

It seems these indicators are stuck ...

With the effective Fed Funds rate at 0.37% (as of yesterday), this is probably somewhat in the right range. At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%) and the 3 month yield within 25 bps of the target rate.

But for now, the Fed is engaged in quantitative easing.

The TED spread is stuck above 2.0, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5.

The Federal Reserve assets increased $139 billion last week to $2.214 trillion.

Click on graph for larger image in new window.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.45% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. Also the recession is creating concern for lower rated paper. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

Note:on quantitative easing, see Bernanke's paper from 2004: Conducting Monetary Policy at Very Low Short-Term Interest Rates One thing is clear - the target Fed funds rate is pretty much meaningless right now.

Another day with no improvement ...

WSJ: CMBS Market Shows Fissures

by Calculated Risk on 11/19/2008 08:53:00 AM

From the WSJ: CMBS Market Begins to Show Fissures

The market for debt used to finance hotels, offices and shopping malls tumbled Tuesday on worries that the long-feared rise in defaults for commercial mortgage-backed securities had begun, possibly ushering in the next phase of the financial crisis.This article discusses the Westin Portfolio and The Promenade Shops loans (see here for more).

...

The news comes as defaults on commercial mortgages are starting to rise. According to a Citigroup Inc. report, the overall number of commercial mortgages packaged into securities that are 30 days or more past due rose to 0.64% in October from 0.39% at the end of last year, with most of the increase coming in October. The latest figure, though low by historic standards, marked the highest delinquency rate in two years.

Sure enough - all of the CMBX indices are setting new record lows again.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a graph from Markit of the CMBX-NA-AAA 4 mentioned in the WSJ.

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down.

Housing Starts at Record Low

by Calculated Risk on 11/19/2008 08:29:00 AM

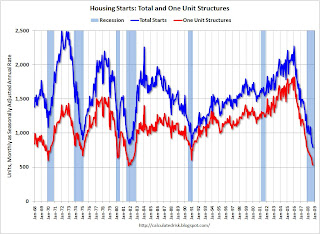

Total housing starts were at 791 thousand (SAAR) in October, the lowest level since the Census Bureau began tracking housing starts in 1959.

Single-family starts were at 531 thousand in October; the lowest level since October 1981. Single-family permits were at 460 thousand in October, suggesting single family starts will fall even further next month.

Here is the Census Bureau reports on housing Permits, Starts and Completions.

Building permits decreased:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 708,000. This is 12.0 percent below the revised September rate of 805,000 and is 40.1 percent below the revised October 2007 estimate of 1,182,000.On housing starts:

Single-family authorizations in October were at a rate of 460,000; this is 14.5 percent below the September figure of 538,000.

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 791,000. This is 4.5 percent below the revised September estimate of 828,000 and is 38.0 percent below the revised October 2007 rate of 1,275,000.And on completions:

Single-family housing starts in October were at a rate of 531,000; this is 3.3 percent below the September figure of 549,000.

Privately-owned housing completions in October were at a seasonally adjusted annual rate of 1,043,000. This is 10.2 percent below the revised September estimate of 1,161,000 and is 25.6 percent below the revised October 2007 rate of 1,401,000.Notice that single-family completions are significantly higher than single-family starts. This is important because residential construction employment tends to follow completions, and completions will decline sharply soon.

Single-family housing completions in October were at a rate of 760,000; this is 7.7 percent below the September figure of 823,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at an annual pace of 791 thousand units in October, the lowest rate on record.

Starts for single family structures (531 thousand) were the lowest since Oct 1981. The Census Bureau has been tracking starts since Jan 1959, and the lowest month for single family structures was Oct 1981 (523 thousand units SAAR) - so it is possible that a new record low will be set in November 2008.

FDIC Leases Office Space in Orange County

by Calculated Risk on 11/19/2008 12:09:00 AM

From the LA Times: FDIC to open temporary office in Irvine (hat tip jb)

The Federal Deposit Insurance Corp. has leased 200,000 square feet of space in Irvine for a temporary office that will manage receiverships and liquidate assets from failed financial institutions in the western United States.

...

In choosing Irvine, the agency is benefiting from Orange County's depressed office market, which has been hurt by the collapse in recent years of New Century Financial Corp., Ameriquest Mortgage Co. and other financial companies.

The office vacancy rate in Orange County soared to 17.4% in the third quarter from 12.1% a year earlier, while rents fell 4.4%, according to Cushman & Wakefield.

Tuesday, November 18, 2008

Condo Projects Postponed in Vancouver

by Calculated Risk on 11/18/2008 07:15:00 PM

A couple of major holes in the ground in Vancouver, BC, Canada.

From the Province: Bank pulls funding on luxury condo project

A splashy jewel of a downtown condo development ... has been put on hold after a bank pulled funding, the latest in a growing list of failed residential projects.

...

At the site, a crane sat idle and there was no activity in the partially completed seven-storey-deep hole at the $180-million project that was scheduled to be finished by spring 2010.

Ritz Carlton Vancouver Condo Project Postponed

Report: Two Major Commercial Mortgages Near Default

by Calculated Risk on 11/18/2008 05:07:00 PM

From Bloomberg: Westin, Promenade Commercial Mortgages Near Default (hat tip Ted)

The $209 million Westin Portfolio loan and the $125 million loan for Promenade Shops at Dos Lagos ... of loans bundled into bonds are about to default on their debt, according to Credit Suisse Group AG.Not really a surprise - possible defaults on mortgages for a shopping center near ground zero of the housing bust, and for hotels with the rapidly declining occupancy rates.

...

The Westin loan is backed by two hotels located in Tucson, Arizona, and Hilton Head, South Carolina. ... The Promenade Shops are located in Corona, California, one of the regions hardest hit by the worst housing crisis since the Great Depression.

UPDATE: Deutsche Bank analysts Richard Parkus and Jing An commented on these two deals today in a research note (hat tip Marc):

"The delinquencies of the two large loans have caught many by surprise. ... Delinquencies in loans of such limited seasoning are extremely unusual, particularly for very large loans."The analysts note that these were "pro forma" loans, and were based on significantly higher operating income in the future. Pro forma loans were the "stated income" loans for commercial properties!

"Pro forma underwriting was a common phenomenon from late 2006 through 2007 and these two loans validate our concerns regarding the practice."With falling office rents, rising vacancies rates for offices and malls - falling occupancy rates for hotels - these pro forma deals will collapse once the borrowers run through the interest rate reserves.

Fed: Delinquency Rates Rise in Q3

by Calculated Risk on 11/18/2008 03:34:00 PM

The Federal Reserve reports that delinquency rates rose in Q3 in almost all categories. The one exception was consumer credit cards (declined slightly), although charge-offs for credit cards rose in Q3. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the delinquency rates at the commercial banks for residential real estate and commercial real estate.

Commercial real estate delinquencies are rising rapidly, and are at the highest rate since Q3 '94 (as delinquency rates declined following the S&L crisis).

Residential real estate delinquencies are at the highest level since the Fed started tracking the data (since Q1 '91).

Although there is credit deterioration everywhere, the rise in CRE delinquencies is especially significant. The Fed defines commercial as "construction and land development loans, loans secured by multifamily residences, and loans secured by nonfarm, nonresidential real estate", and many of the problems are probably in the C&D loans.