by Calculated Risk on 11/16/2008 02:46:00 PM

Sunday, November 16, 2008

Slowing Exports and Residential Investment

From Dr. Setser: Ut-oh …. exports are starting to fall fast.

[T]he non-petrol goods deficit is now moving in the wrong direction. It increased from $29.3b in June to $35.6b in August. Non-petrol exports fell by $9.9b over the last two months, while non-petrol imports fell by “only” $3.7 billion.Although Brad Setser is concerned about the global impact of slowing U.S. exports, I think there is another interesting relationship: net exports vs. residential investment. Let me add a couple of graphs ...

...

And remember this is the September data. Since then the global outlook has deteriorated — and the dollar has strengthened substantially. That isn’t going to help US exports.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows real residential investment (from the BEA) and real net exports. These are historically countercyclical; as residential investment increases the trade deficit tends to increase, and as residential investment falls, the trade deficit declines.

The second graph shows this as a contribution to GDP (rolling 4 quarters to smooth the data).

The second graph shows this as a contribution to GDP (rolling 4 quarters to smooth the data).This shows that residential investment and net exports are countercyclical and tend to offset each other somewhat as far the impact on GDP. This is important because slowing exports could mean that there is nothing to offset a further decline in residential investment.

The good news is the trade deficit will decline sharply over the next few months (because of the decline in oil prices), and residential investment might bottom sometime in the next few quarters.

The bad news is the trade deficit might start increasing again - after the oil price adjustment - because of the stronger dollar and weak global economies. And residential investment might bottom, but any recovery will probably be anemic because of the huge overhang of surplus inventory. So it is unlikely that residential investment will offset any possible rise in the trade deficit.

Just something to add to Setser's post ...

Mortgage Mods in the U.K.

by Calculated Risk on 11/16/2008 10:56:00 AM

From the Independent: Rock makes Damascene conversion on repossessions

Northern Rock ... has been roundly criticised for keeping its mortgage rates punishingly high and repossessing a disproportionately large number of homes, is overhauling the way it approaches bad debts.Ahhh ... more jingle mail. However in the U.K. mortgages are recourse and the lenders can pursue the borrowers for six years in the event of a short fall.

...

"We are looking to work through problems with our customers on a case-by-case basis. Where appropriate, we will offer payment holidays, reduced monthly repayments and conversion to interest-only mortgages," said Jemma Rundle, a spokeswoman for Northern Rock.

In addition, Rock debt advisers will call people who are in arrears to see what extra help can be offered, rather than simply writing letters to them. ....

The Rock and four of its biggest mortgage rivals have admitted that they have seen a dramatic rise in the numbers of people voluntarily giving up their properties because they are unable to meet their mortgage repayments.

But entering voluntary repossession is no solution, said [Beccy Boden Wilks from the debt charity National Debtline]: "It can take months to sell the property and it could be at a knockdown price, so there could be a shortfall to pay. The lender can come back years later and ask for its cash."Of course some mortgages in the U.S. are recourse too, but historically U.S. lenders have rarely pursued homeowners for any losses.

Saturday, November 15, 2008

IMF Bails Out Pakistan, Iceland Still Waits

by Calculated Risk on 11/15/2008 09:59:00 PM

From CNN: Pakistan borrows $7.6B from IMF

Pakistan's government has agreed to a $7.6 billion aid deal with the International Monetary Fund (IMF), Pakistan's top finance official said.Meanwhile Iceland still waits. From Bloomberg: Icelanders Protest Government Failure to Clinch Loan

...

Pakistan expects to receive the first installment before the end of the month with further payments spread over a two-year period, according to The Associated Press.

The loan will be used to bolster Pakistan's dwindling foreign currency reserves amid concern that a run on the Pakistani rupee could force the country to default on its international debt, AP said.

Icelanders will take to the streets in their thousands tomorrow to protest the government's failure to clinch a $6 billion International Monetary Fund-led loan while countries in less dire economic straits jump the IMF queue.Here is a video of the protests in Iceland:

Weekly protests in downtown Reykjavik may swell to 20,000 soon, or 6 percent of the population, said Andres Magnusson, chief executive of the Icelandic Federation of Trade and Services. The islanders are venting their anger on politicians as prices soar, the krona collapses and the economy goes into reverse.

In Pakistan they protest receiving aid. In Iceland they protest not receiving aid. In the U.S. everyone just becomes a bank ...

NY Times: The Debt Trap

by Calculated Risk on 11/15/2008 07:01:00 PM

From the NY Times: Downturn Drags More People Into Bankruptcy

The number of personal bankruptcy filings jumped nearly 8 percent in October from September, after marching steadily upward for the last two years ... Filings totaled 108,595, surpassing 100,000 for the first time since a law that made it more difficult — and often twice as expensive — to file for bankruptcy took effect in 2005. That translated to an average of 4,936 bankruptcies filed each business day last month, up nearly 34 percent from October 2007.

“Earlier downturns followed strong booms, so families went into recessions with higher incomes and lower debt loads,” said Elizabeth Warren, a professor at Harvard Law School ... “But the fundamentals are off for families even before we hit the recession this time, so bankruptcy filings are likely to rise faster.”

Not surprisingly, filings are increasing most rapidly in states where real estate values skyrocketed and then crashed, including Nevada, California and Florida. In Nevada, bankruptcy filings in October were up 70 percent compared with last year. In California, bankruptcies jumped 80 percent in the same period, while Florida’s filings rose 62 percent.

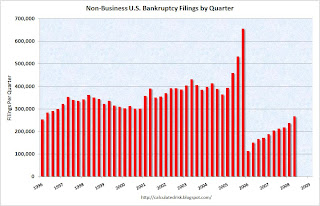

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings per quarter since the beginning of 1996 through Q2 2008 (Source: USCourts.gov). According to the NY Times article, filing were over 100 thousand in Oct 2008 and will probably be well over 300 thousand for Q4 2008 - so the graph is still trending up.

Note that there was a small surge in filings during the last recession (in 2001). As Professor Warren noted, usually household balance sheets are in pretty good shape at the end of a boom, but not this time. Instead, this time many households were struggling with too much debt even before the current recession started. So the surge in filings will probably be much larger than in 2001 (also that was a business led recession).

In addition, it is likely that some changes will be made to the bankruptcy law early next year, and it is possible we will see a record number of non-business bankruptcies in 2009 (or perhaps the 2nd highest total behind 2005 when many people rushed to beat the changes in the bankruptcy law).

San Jose to Request $14 Billion from TARP

by Calculated Risk on 11/15/2008 10:53:00 AM

From the Mercury News: San Jose mayor seeks slice of bailout pie

San Jose Mayor Chuck Reed said Friday he's working with leaders of other large California cities to make sure they're not left behind.The Bank of San Jose!

The stimulus package Congress passed last month wasn't designed to dole out money to governments, so it's far from clear whether San Jose will get a piece. But with $1.6 billion in unfunded retiree health care obligations, plus $500 million worth of local and regional road work to be done and the $750 million price tag to bring BART to the South Bay, Reed noted the city has a full slate of needs.

...

Reed created a minor furor Friday when he told an Associated Press reporter he would seek 2 percent of the bailout, or $14 billion, for San Jose — an eye-popping figure, given that the city's entire annual budget is $3.3 billion.

Jingle Mail in the UK

by Calculated Risk on 11/15/2008 09:20:00 AM

From the Financial Times: Banks see rise in voluntary repossessions

Banks are seeing an increase in the numbers of homeowners deciding voluntarily to hand back their properties because they cannot afford to keep up mortgage payments.It's not clear if these homeowners can afford the mortgage, but are "walking away" because they are underwater - or if they can no longer can afford the mortgage due to hardship or rising mortgage costs. Whichever ... it seems there are many ways to leave your lender!

Voluntary repossessions involve the bank selling the property at auction but this will not show up in official figures as a repossession because there has been no court order.

...

[A] mainstream mortgage lender ... said it had seen cases of voluntary repossessions jump from 10 a month in January and February to 55 a month in September and October....

Another big bank said it had seen a rise - from a low base - in voluntary repossessions by consumers who faced financial problems. "This is consumers acting to manage their exposure to a downturn," the lender said.

...

The Council of Mortgage Lenders, the industry body, said it had no data but there was some anecdotal evidence that voluntary repossessions were increasing.

Just slip out the back, jack

Make a new plan, stan

You dont need to be coy, roy

Just get yourself free

Hop on the bus, gus

You dont need to discuss much

Just drop off the key, lee

And get yourself free

Paul Simon, 50 ways to leave your lover

Four insurers hope to buy thrifts, access TARP

by Calculated Risk on 11/15/2008 02:39:00 AM

The AP reports: 4 insurers ask government to let them acquire thrifts so they can receive bailout funds

In addition to Hartford Financial, the AP reports that Genworth Financial Inc., Lincoln National Corp. and Aegon NV have all asked the Office of Thrift Supervision for permission to buy thrifts - and access the TARP.

The line keeps getting longer ...

Friday, November 14, 2008

Quote of the Day: Home Improvement

by Calculated Risk on 11/14/2008 08:57:00 PM

"Armageddon is here."Note: this was private and I can't reveal the source or company (I have no position in the company)

a private comment from a Senior Buyer at a home improvement retailer, Nov 13, 2008

From a previous post, here are a couple of graphs on two key components of Residential Investment (RI):

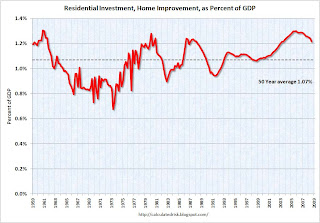

Click on graph for larger image in new window.

Click on graph for larger image in new window.As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

Currently investment in single family structures is at 1.22% of GDP, significantly below the average of the last 50 years of 2.35% - and just above the record low in 1982 of 1.20%.

But what about home improvement?

The second graph shows home improvement investment as a percent of GDP.

The second graph shows home improvement investment as a percent of GDP.Home improvement is at 1.21% of GDP, off the high of 1.3% in Q4 2005 - but still well above the average of the last 50 years of 1.07%. Maybe lenders are boosting home improvement spending fixing up all those damaged REOs!

This would seem to suggest there is significant downside risk to home improvement spending over the next couple of years.

Lowe's is scheduled to announce results on Monday and Home Depot on Tuesday.

Silicon Valley CRE Slows

by Calculated Risk on 11/14/2008 06:31:00 PM

From the Silicon Valley / San Jose Business Journal: Sobrato Development puts Santa Clara office project on hold (hat tip ShortCourage)

... For the first time in its almost 30-year history, the valley’s largest property owner decided not to finish a building under construction until the market turns around.Talk about an eyesore ...

...

“The steel seemed like a logical stopping place,” [John Michael Sobrato, chief executive officer] said at a luncheon meeting of the National Association of Industrial and Office Properties.

...

Had it been completed, the complex would have joined a growing list of new developments available and empty in the valley. Almost 32 million square feet of speculative construction from Menlo Park to Morgan Hill are in the pipeline.

“We have enough product to satisfy demand for 2009 and 2010,” [Phil Mahoney, principal and executive vice president of with Cornish & Carey Commercial/ONCOR International] said.

Hartford hopes to become S&L, access TARP

by Calculated Risk on 11/14/2008 04:24:00 PM

From the WSJ: Hartford Aims to Become S&L, Gain Access to Treasury Program

Struggling insurer Hartford Financial Services Group Inc. announced it has applied to convert to savings-and-loan status and said it will buy Federal Trust Corp. for $10 million.Can a city become a bank too? From the WSJ: TARP City

The move, which also involves Hartford applying to be part of the Treasury Department's $250 billion capital-injection effort, marks the company's biggest attempt to stem the crisis of confidence afflicting it and other life insurers.

...

Hartford estimated it would be eligible for a $1.1 billion to $3.4 billion investment from Treasury if its application is accepted.

In a letter to Treasury Secretary Henry Paulson Friday, the mayors of Philadelphia, Phoenix and Atlanta asked for the creation of a $50 billion fund to spur infrastructure investments as well as for loans to cover unfunded pension liabilities and to address cash flow crunches amidst tight credit markets.Philadelphia: a Bank?

...

The mayors envision funds to fulfill their requests coming from the government’s $700 billion Troubled Asset Relief Program.