by Calculated Risk on 11/09/2008 10:49:00 AM

Sunday, November 09, 2008

WSJ: $586 Billion Stimulus Package in China

From the WSJ: China Announces $586 Billion Stimulus Package

China's government announced a two-year stimulus exceeding a half-trillion dollars to offset the impact of slowing global growth ...Professor Roubini cautioned last week about a hard landing in China (Note: Roubini argues that China's economy needs to grow at more than 6% per year to absorb the about 24 million workers joining the labor force every year): The Rising Risk of a Hard Landing in China: The Two Engines of Global Growth – U.S. and China – are Now Stalling

Just a year ago, China had adopted an unprecedented "tight" monetary policy, a step up in its three-year effort to keep the fast-growing economy from barreling out of control because it was expanding too quickly.

In conclusion the risk of a hard landing in China is sharply rising; a deceleration in the Chinese growth rate to 7% in 2009 - just a notch above a 6% hard landing – is highly likely and an even worse outcome cannot be ruled out at this point. The global economy is already headed towards a global recession as advanced economies are all in a recession and the U.S. contraction is now dramatically accelerating. The first engine of global growth – the U.S. on the consumption side – has now already shut down. The second engine of global growth – China on the production side – is also on its way to stalling. Thus, with the two main engines of global growth now in serious trouble a global hard landing is now almost a certainty. And a hard landing in China will have severe effects on growth in emerging market economies in Asia, Africa and Latin America as Chinese demand for raw materials and intermediate inputs has been a major source of economic growth for emerging markets and commodity exporters. The sharp recent fall in commodity prices and the near collapse of the Baltic Freight index are clear signals that Chinese and global demand for commodities and industrial inputs is sharply falling. Thus, global growth – at market prices – will be close to zero in Q3 of 2008, likely negative in Q4 of 2009 and well into negative territory in 2009. So brace yourself for an ugly and protracted global economic contraction in 2009.

Saturday, November 08, 2008

Some in Congress push for TARP Aid for Automakers

by Calculated Risk on 11/08/2008 08:11:00 PM

From the WSJ: Pelosi, Reid Press for TARP Aid for Auto Industry

House Speaker Nancy Pelosi and Senate Majority Leader Harry Reid sent ... a letter to Treasury Secretary Henry Paulson urging him to assist the Big Three auto makers by considering broadening the $700 billion Troubled Asset Relief Program to help the troubled industry.Everyone wants a piece of the TARP.

...

Though the administration is reluctant to widen the program to cover autos, there has been discussion among Bush officials of expanding use of the $700 billion to buy equity stakes in a range of financial-sector companies, moving beyond just banks and insurers. The focus would be on assisting companies that provide financing to the broad economy, such as bond insurers and specialty finance firms ...

Franklin Bank Failure and Commercial Real Estate

by Calculated Risk on 11/08/2008 04:27:00 PM

From Bloomberg:Ranieri Becomes Victim of Crisis as Franklin Seized

Lewis Ranieri, who helped create the mortgage-securities market in the 1980s while at Salomon Brothers Inc., became a victim of its collapse after his Houston-based bank was seized.This is a key point: Many of the bank failures will not be directly from residential, but from Construction & Development (C&D) and commercial real estate (CRE) loans.

...

``The residential side was not their problem, it was clearly the commercial side,'' said David Lykken, co-founder of Mortgage Banking Solutions, an Austin, Texas-based consulting firm. ``The reason it took a little longer is because that trailed residential,''

Restaurant Outlook Grim

by Calculated Risk on 11/08/2008 06:35:00 AM

From the National Restaurant Association: NRA research finds majority of operators report sales and traffic declines; expectations at an all-time low level. (hat tip Lyle)

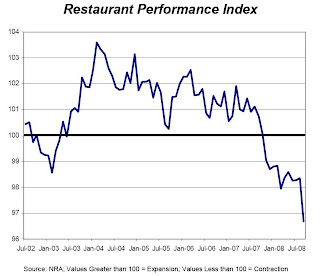

“The September decline in the Restaurant Performance Index was the result of broad-based declines across the index components, with both the Current Situation and Expectations indices falling to record lows,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Nearly two out of three restaurant operators reported negative same-store sales and traffic levels in September, while 50 percent expect their sales in six months to be lower than the same period in the previous year.”

“The rapid deterioration in economic conditions is reflected in operator sentiment, with a record 42 percent of restaurant operators saying the economy is currently the number-one challenge facing their business,” Riehle added. “Operators aren’t optimistic about the economy looking forward either, with 50 percent expecting economic conditions to worsen in six months.”

Click on graph for larger image in new window.

Any reading below 100 suggests contraction. This index doesn't have a long history, so it is not surprising that the index is at a record low.

Still the index is between below 100 for 13 consecutive months. It is typical in a recession for consumers to pull back on discretionary spending, and restaurants usually feel the pain acutely.

Note that this was for September. It appears October consumer spending was much worse.

FDIC: Two More Bank Failures Numbers 18 and 19 this year

by Calculated Risk on 11/08/2008 12:44:00 AM

Prosperity Bank Acquires All the Deposits of Franklin Bank, S.S.B., Houston, Texas

Franklin Bank, S.S.B., Houston, Texas, was closed today by the Texas Department of Savings and Mortgage Lending, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Prosperity Bank, El Campo, Texas, to assume all of the deposits, including those that exceeded the insurance limit, of Franklin Bank.Pacific Western Bank Acquires All the Deposits of Security Pacific Bank, Los Angeles, California

...

As of September 30, 2008, Franklin Bank had total assets of $5.1 billion and total deposits of $3.7 billion. Prosperity Bank agreed to assume all the deposits, including the brokered deposits, for a premium of 1.7 percent. In addition to assuming all of the failed bank's deposits, Prosperity Bank will purchase approximately $850 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost of today's transaction to its Deposit Insurance Fund will be between $1.4 billion and $1.6 billion.

Security Pacific Bank, Los Angeles, California, was closed today by the Commissioner of the California Department of Financial Institutions, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Pacific Western Bank, Las Angeles, California, to assume all of the deposits of Security Pacific.

...

As of October 17, 2008, Security Pacific had total assets of $561.1 million and total deposits of $450.1 million. Pacific Western agreed to assume all the deposits for a two percent premium. In addition to assuming all of the failed bank's deposits, Pacific Western will purchase approximately $51.8 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $210 million.

Friday, November 07, 2008

The Slowdown in China

by Calculated Risk on 11/07/2008 07:31:00 PM

This is interesting from Bloomberg: China Minister Xie Leaves Peru Early to Fix Economy

China's Finance Minister Xie Xuren was called back from an international economic conference in Peru before the meeting began, following orders from Beijing to help resolve problems at home, an organizer of the event said.From Bloomberg: China's Economic Growth May Slump as Spending Comes Too Late

...

``They told him he has to resolve an economic problem and that he's the only one who could do so,'' de Swinnen said. ``He was complaining because he had to fly 32 hours to get here and then he had to fly another 32 hours to get back.''

Gross domestic product may advance 7.5 percent or less, the weakest since 1990, according to estimates by Credit Suisse AG, UBS AG and Deutsche Bank AG. Royal Bank of Scotland Plc predicts the economy will grow 8 percent next year, while 5 percent ``can't be ruled out.''And what happens to U.S. intermediate and long rates when China tries to stimulate their own economy? That could have a serious negative impact on the U.S.

...

``The golden years have shuddered to a dramatic halt,'' said Stephen Green, head of China research at Standard Chartered Bank Plc in Shanghai. Green is reviewing his 7.9 percent forecast for next year because a ``big fiscal policy package'' hasn't arrived.

Moody's Cuts MBIA Rating

by Calculated Risk on 11/07/2008 05:57:00 PM

From Reuters: Moody's cuts MBIA Insurance to "Baa1"

Moody's Investors Service on Friday cut its ratings on MBIA insurance arm and also sent ratings on the holding company's debt into junk territory, citing diminished business prospects and a weaker financial profile.This follows a rating cut for AMBAC earlier this week.

Bloomberg Sues Fed to Force Disclosure

by Calculated Risk on 11/07/2008 04:15:00 PM

From Bloomberg: Bloomberg Sues Fed to Force Disclosure of Collateral

Bloomberg News asked a U.S. court today to force the Federal Reserve to disclose securities the central bank is accepting on behalf of American taxpayers as collateral for $1.5 trillion of loans to banks.Seems like information that should be available. The "confidential commercial information" argument seems weak.

The lawsuit is based on the U.S. Freedom of Information Act ...

``The American taxpayer is entitled to know the risks, costs and methodology associated with the unprecedented government bailout of the U.S. financial industry,'' said Matthew Winkler, the editor-in-chief of Bloomberg News ...

Construction and Retail Employment

by Calculated Risk on 11/07/2008 03:51:00 PM

A couple more graphs on employment ...

Click on graph for larger image in new window.

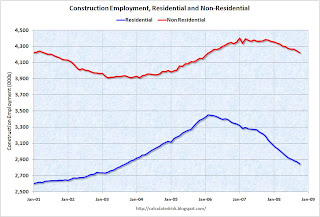

The first graph shows employment for residential and non-residential employment. Note: the y-axis doesn't start at zero to better show the change.

Residential construction is off about 600 thousand from the peak, but that doesn't include cash workers (many illegal immigrants) and some construction workers work in both residential and non-residential areas and are included in the non-residential category.

Non-residential construction employment is off 180 thousand from the peak. With the coming slump in commercial real estate (CRE), we will probably see some significant construction job losses over the next year. The second graph shows the year-over-year employment for retail. Retail employment growth has been sluggish in recent years (probably because of internet sales and more efficiency).

The second graph shows the year-over-year employment for retail. Retail employment growth has been sluggish in recent years (probably because of internet sales and more efficiency).

YoY employment is off 1.8% - close to the slump in 2001/2002. In 1991, YoY retail employment slumped by 2.5%.

A few weeks ago, the LA Times reported: Retailers cutting back on holiday hiring

A recent survey of more than 1,000 managers responsible for hiring hourly workers found that each manager planned on hiring an average of 3.7 seasonal employees this year, roughly 33% less than the 5.6 workers they hired during last year's holiday period.Retail employment could be really grim over the holiday season.

President-Elect Obama to Speak on the Economy at 2:30PM ET

by Calculated Risk on 11/07/2008 02:32:00 PM

The Obama news conference is scheduled for 2:30 PM.

Here is the CNBC feed.