by Calculated Risk on 11/08/2008 12:44:00 AM

Saturday, November 08, 2008

FDIC: Two More Bank Failures Numbers 18 and 19 this year

Prosperity Bank Acquires All the Deposits of Franklin Bank, S.S.B., Houston, Texas

Franklin Bank, S.S.B., Houston, Texas, was closed today by the Texas Department of Savings and Mortgage Lending, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Prosperity Bank, El Campo, Texas, to assume all of the deposits, including those that exceeded the insurance limit, of Franklin Bank.Pacific Western Bank Acquires All the Deposits of Security Pacific Bank, Los Angeles, California

...

As of September 30, 2008, Franklin Bank had total assets of $5.1 billion and total deposits of $3.7 billion. Prosperity Bank agreed to assume all the deposits, including the brokered deposits, for a premium of 1.7 percent. In addition to assuming all of the failed bank's deposits, Prosperity Bank will purchase approximately $850 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost of today's transaction to its Deposit Insurance Fund will be between $1.4 billion and $1.6 billion.

Security Pacific Bank, Los Angeles, California, was closed today by the Commissioner of the California Department of Financial Institutions, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Pacific Western Bank, Las Angeles, California, to assume all of the deposits of Security Pacific.

...

As of October 17, 2008, Security Pacific had total assets of $561.1 million and total deposits of $450.1 million. Pacific Western agreed to assume all the deposits for a two percent premium. In addition to assuming all of the failed bank's deposits, Pacific Western will purchase approximately $51.8 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $210 million.

Friday, November 07, 2008

The Slowdown in China

by Calculated Risk on 11/07/2008 07:31:00 PM

This is interesting from Bloomberg: China Minister Xie Leaves Peru Early to Fix Economy

China's Finance Minister Xie Xuren was called back from an international economic conference in Peru before the meeting began, following orders from Beijing to help resolve problems at home, an organizer of the event said.From Bloomberg: China's Economic Growth May Slump as Spending Comes Too Late

...

``They told him he has to resolve an economic problem and that he's the only one who could do so,'' de Swinnen said. ``He was complaining because he had to fly 32 hours to get here and then he had to fly another 32 hours to get back.''

Gross domestic product may advance 7.5 percent or less, the weakest since 1990, according to estimates by Credit Suisse AG, UBS AG and Deutsche Bank AG. Royal Bank of Scotland Plc predicts the economy will grow 8 percent next year, while 5 percent ``can't be ruled out.''And what happens to U.S. intermediate and long rates when China tries to stimulate their own economy? That could have a serious negative impact on the U.S.

...

``The golden years have shuddered to a dramatic halt,'' said Stephen Green, head of China research at Standard Chartered Bank Plc in Shanghai. Green is reviewing his 7.9 percent forecast for next year because a ``big fiscal policy package'' hasn't arrived.

Moody's Cuts MBIA Rating

by Calculated Risk on 11/07/2008 05:57:00 PM

From Reuters: Moody's cuts MBIA Insurance to "Baa1"

Moody's Investors Service on Friday cut its ratings on MBIA insurance arm and also sent ratings on the holding company's debt into junk territory, citing diminished business prospects and a weaker financial profile.This follows a rating cut for AMBAC earlier this week.

Bloomberg Sues Fed to Force Disclosure

by Calculated Risk on 11/07/2008 04:15:00 PM

From Bloomberg: Bloomberg Sues Fed to Force Disclosure of Collateral

Bloomberg News asked a U.S. court today to force the Federal Reserve to disclose securities the central bank is accepting on behalf of American taxpayers as collateral for $1.5 trillion of loans to banks.Seems like information that should be available. The "confidential commercial information" argument seems weak.

The lawsuit is based on the U.S. Freedom of Information Act ...

``The American taxpayer is entitled to know the risks, costs and methodology associated with the unprecedented government bailout of the U.S. financial industry,'' said Matthew Winkler, the editor-in-chief of Bloomberg News ...

Construction and Retail Employment

by Calculated Risk on 11/07/2008 03:51:00 PM

A couple more graphs on employment ...

Click on graph for larger image in new window.

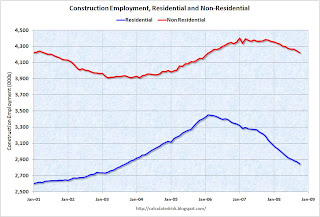

The first graph shows employment for residential and non-residential employment. Note: the y-axis doesn't start at zero to better show the change.

Residential construction is off about 600 thousand from the peak, but that doesn't include cash workers (many illegal immigrants) and some construction workers work in both residential and non-residential areas and are included in the non-residential category.

Non-residential construction employment is off 180 thousand from the peak. With the coming slump in commercial real estate (CRE), we will probably see some significant construction job losses over the next year. The second graph shows the year-over-year employment for retail. Retail employment growth has been sluggish in recent years (probably because of internet sales and more efficiency).

The second graph shows the year-over-year employment for retail. Retail employment growth has been sluggish in recent years (probably because of internet sales and more efficiency).

YoY employment is off 1.8% - close to the slump in 2001/2002. In 1991, YoY retail employment slumped by 2.5%.

A few weeks ago, the LA Times reported: Retailers cutting back on holiday hiring

A recent survey of more than 1,000 managers responsible for hiring hourly workers found that each manager planned on hiring an average of 3.7 seasonal employees this year, roughly 33% less than the 5.6 workers they hired during last year's holiday period.Retail employment could be really grim over the holiday season.

President-Elect Obama to Speak on the Economy at 2:30PM ET

by Calculated Risk on 11/07/2008 02:32:00 PM

The Obama news conference is scheduled for 2:30 PM.

Here is the CNBC feed.

Report: Commercial Vacancies for NYC to rise to 17.6%

by Calculated Risk on 11/07/2008 01:38:00 PM

From CrainsNewYorkBusiness.com: Report: Metro area vacancy rate to hit 17.6% (hat tip Brian)

In the next year, commercial vacancies for the New York metropolitan area will surge to 17.6%, up from today’s 12% rate, according to a revised forecast issued Monday by Property & Portfolio Research Inc.This forecast is for all commercial property, and not just Class-A office space.

...

“Our expectations changed, considering the events of the last few months, which are pretty much unprecedented,” said Andy Joynt, a real estate economist at the firm. “It’s a pretty severe downturn that we’re expecting.”

Just this week, Mayor Bloomberg's office projected Class-A vacancies to rise sharply:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual and projected (by the NYC OMB) rents and office vacancy rate for NYC Class A buildings.

The vacancy rate is expected to rise from about 7.5% to 13%.

All those layoffs on Wall Street are adding up.

Pending Home Sales Decline in September

by Calculated Risk on 11/07/2008 11:30:00 AM

From the NAR: Pending Home Sales Down on Tight Credit and Economic Slowdown

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in September, declined 4.6 percent to 89.2 from an upwardly revised reading of 93.5 in August, but is 1.6 percent higher than September 2007 when it stood at 87.8.Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so this suggests existing home sales will decline in November (from October).

This data shows some of the impact of the credit crunch. October Pending Home sales will probably be much worse. Also it is very possible that many of these pending sales will drop out of escrow due to tighter lending standards.

Also many of these sales are for distressed sales. Last month NAR economist Yun suggested that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales.

For some graphs comparing existing home sales to pending home sales, see: Do Existing Home Sales track Pending Home Sales? The answer is yes - they do track pretty well.

GM: Liquidity to "fall significantly short" of necessary minimum in 2009

by Calculated Risk on 11/07/2008 11:23:00 AM

Even if GM implements the planned operating actions that are substantially within its control, GM's estimated liquidity during the remainder of 2008 will approach the minimum amount necessary to operate its business. Looking into the first two quarters of 2009, even with its planned actions, the company's estimated liquidity will fall significantly short of that amount unless economic and automotive industry conditions significantly improve, it receives substantial proceeds from asset sales, takes more aggressive working capital initiatives, gains access to capital markets and other private sources of funding, receives government funding under one or more current or future programs, or some combination of the foregoing.

emphasis added

Ford Burns Through $7.7 Billion in Cash

by Calculated Risk on 11/07/2008 11:10:00 AM

From the WSJ: Ford Plans More Job Cuts as Sales Slump Erodes Cash Position

Ford Motor Co. announced wide-ranging cost cuts after burning through $7.7 billion in cash in the third quarter, as revenue plunged in a rapidly deteriorating auto market.Meanwhile GM shares are halted for pending news ...

...

"Ford's actions are based on the expectation that the global auto industry downturn will be deeper, broader and longer than was previously assumed," the company said. Ford said volume declines in 2009 are expected to be comparable with this year's steep declines, and that the company "will continue to adjust its production in line with the lower demand."