by Calculated Risk on 11/07/2008 10:34:00 AM

Friday, November 07, 2008

Credit Crisis Indicators: TED Spread Below 2.0

The London interbank offered rate, or Libor, that banks say they charge one another for loans fell 10 basis points to 2.29 percent today, the lowest level since November 2004, the British Bankers' Association said. The overnight rate held at a record low of 0.33 percent and the TED spread, a gauge of bank cash availability, dropped under 200 basis points for the first time since the day before Lehman Brothers Holdings Inc. collapsed.The three-month LIBOR was at 2.39% yesterday. The rate peaked at 4.81875% on Oct. 10. (Better)

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.23% yesterday) at 0.305%. I'd like to see the effective Fed Funds rate move closer to the target rate (1.0% currently) and the three month treasury yield increase.

The TED spread is slightly below 2.0, but still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower.

Here is a list of SFP sales. No announcement today from the Treasury ... (no progress).

Click on graph for larger image in new window.

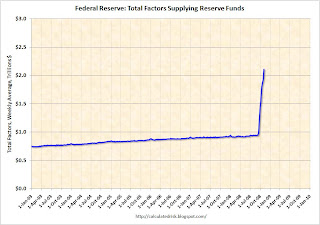

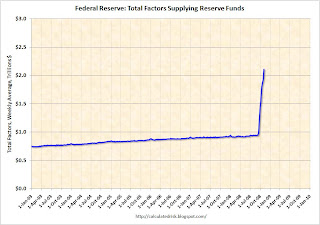

The Federal Reserve assets increased $105 billion this week to $2.075 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the Federal Reserve assets are still increasing rapidly. It will be a good sign - sometime in the future - when the Fed assets start to decline.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.82% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is off again - so there is a little more progress - however most of the progress is coming directly from Fed intervention and increases in the Fed balance sheet, so there is still a long way to go.

Unemployment Rate Jumps to 6.5%, Employment Off 240 Thousand

by Calculated Risk on 11/07/2008 08:33:00 AM

From the BLS:

Nonfarm payroll employment fell by 240,000 in October, and the unemployment rate rose from 6.1 to 6.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. October's drop in payroll employment followed declines of 127,000 in August and 284,000 in September, as revised. Employment has fallen by 1.2 million in the first 10 months of 2008; over half of the decrease has occurred in the past 3 months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 240,00 in October and September was revised down to a loss of 284,000 jobs. (Note: September was orginally announced as 159,000 in job losses, so this is a huge downward revision).

The unemployment rate rose to the highest level in 14 years at 6.5 percent.

Year over year employment is now negative (there are 1.1 million fewer Americans employed in Oct 2008 than in Oct 2007). This is another very weak employment report.

Queen Baffled by Credit Crisis

by Calculated Risk on 11/07/2008 12:08:00 AM

From the Sydney Morning Herald: Queen baffled at delay in spotting credit crunch (hat tip Martin)

The origins and effects of the crisis were explained to [the Queen] by Professor Luis Garicano, director of research at the LSE's management department ...Yeah! Hey, Hoocoodanode?!

Prof Garicano said afterwards: "The Queen asked me: 'If these things were so large, how come everyone missed them? Why did nobody notice it'?"

Thursday, November 06, 2008

Fed's Warsh: Fundamental Reassessment of Every Asset Everywhere

by Calculated Risk on 11/06/2008 07:18:00 PM

"[Policymakers] should be steady when financial market participants are fearful, and fearful when markets appear steady."Yes, the Fed was not properly fearful when markets appeared steady. As Paul Volcker said in Feb 2005:

Governor Kevin Warsh, Nov 6, 2008

"Under the placid surface, at least the way I see it, there are really disturbing trends: huge imbalances, disequilibria, risks – call them what you will. Altogether the circumstances seem to me as dangerous and intractable as any I can remember, and I can remember quite a lot."Too bad the policymakers didn't listen then.

Here are few excepts from Fed Governor Kevin Warsh's speech: The Promise and Peril of the New Financial Architecture

There are some notable signs of improvement. Short-term funding spreads are retreating from extremely elevated levels. Funding maturities are being extended beyond the very near term. Money market funds and commercial paper markets are showing signs of stabilization. And credit default swap spreads of banking institutions are narrowing significantly.And on the causes of the credit crisis, Warsh argues it is not just housing and definitely not contained:

Nonetheless, financial markets overall remain strained. Risk spreads remain quite high and lending standards appear strict. Indications of economic activity in the United States have turned decidedly negative. The economy contracted slightly in the third quarter, and the recent data on sales and production suggest that the fourth quarter will be weak.

Still, the depth and duration of this period of weak economic activity remain highly uncertain.

Many observers maintain that the boom and bust in the housing market are the root cause of the current turmoil. No doubt housing-related losses are negatively affecting household wealth and spending. Moreover, the weakness in housing markets and uncertainty about its path have caused financial institution balance sheets to deteriorate. This situation has further accelerated the deleveraging process and tightened credit conditions for businesses and households.

When liquidity pulled back dramatically in August 2007, housing suffered mightily. ...

While housing may well have been the trigger for the onset of the broader financial turmoil, I have long believed it is not the fundamental cause. Indeed, recent financial market developments strongly indicate that housing, as an asset class, does not stand alone. Indeed, the problems associated with housing finance reveal broader failings, including inadequate market discipline, excessive reliance on credit ratings, and poor credit and liquidity risk-management practices by many financial firms.

During the past several months, this domestic housing-centric diagnosis has also been subjected to a natural experiment. Among U.S. financial institutions, asset quality concerns are no longer confined to the mortgage sector. At the same time, non-U.S. financial institutions--including some with relatively modest exposures to the United States or their own domestic housing markets--appear to be suffering substantial losses. Equity prices of European banks declined more on average during 2008 year-to-date than their U.S. counterparts. Moreover, economic weakness among our advanced foreign trading partners is increasingly evident, even among economies with more modest exposures to the housing sector.

... I would advance the following: We are witnessing a fundamental reassessment of the value of virtually every asset everywhere in the world.

emphasis added

The Tech Slowdown

by Calculated Risk on 11/06/2008 05:02:00 PM

"As a result of the credit crisis and the economic uncertainty, our guidance reflects slower end- market device growth for 2009 than previously anticipated and a significant contraction in channel inventory in the first and second fiscal quarters. While we are estimating strong growth for CDMA-based devices in calendar year 2009, driven by a shift to emerging markets, this growth is meaningfully less than we would have forecast just a few weeks ago."Note: just using Qualcomm as an example (hat tip Brian)

Dr. Paul E. Jacobs, CEO of Qualcomm, Nov 6, 2008 emphasis added

From Saul Hansell at the NY Times: Cheerful Gloom From Mary Meeker:

In the first session of the Web 2.0 conference in San Francisco, Ms. Meeker terrified the audience with the prospects of the coming recession, then offered a vision of ultimate redemption. (You can see her slides here.)Investment in equipment and software has been negative for the last three quarters according to the BEA. And it appears the tech investment slump is about to get worse.

Her main point was that advertising and sales of technology products are very closely correlated to economic activity. And since both gross domestic product and consumer spending have started falling, the prospects for both don’t look good.

Click on graph for larger image in new window.

This graph shows the year over year change for residential investment vs. investment in equipment and software. Note that residential investment is shifted 3 quarters into the future because changes in residential investment usually lead changes in equipment and software by about 3 quarters. This relationship isn't perfect, but I expect equipment and software investment to decline for the next several quarters.

And a YouTube favorite ... Here Comes Another Bubble by The Richter Scales

Federal Reserve Assets Increase $105 Billion

by Calculated Risk on 11/06/2008 04:13:00 PM

Looking a long time ahead to an economy far, far away ... I think one of the indicators of a recovery will be a shrinking Fed balance sheet. The assets on the Fed's balance sheet have doubled from under $1 trillion at the beginning of 2008 to about $2.075 trillion now.

Dallas Fed President Richard Fisher thinks there is much more to come:

"You can see the size and breadth of the Fed’s efforts to counter the collapse of the credit mechanism in our balance sheet. At the beginning of this year, the assets on the books of the Fed totaled $960 billion. Today, our assets exceed $1.9 trillion. I would not be surprised to see them aggregate to $3 trillion—roughly 20 percent of GDP—by the time we ring in the New Year."Here is the Federal Reserve report released today.

Dallas Fed President Richard W. Fisher, The Current State of the U.S. Economy and the Fed’s Response, Nov 4, 2008

Click on graph for larger image in new window.

The Federal Reserve assets increased from $105 billion this week to $2.075 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the graph shows Federal Reserve assets are still increasing rapidly. Fisher may be right - $3 trillion by the end of the year.

The good news is the Fed marked up the value of the Bear Stearns assets to $26,863 from $26,802 million two weeks ago - an increase of $61 million!

Update: For more, see Dr. Setser's post from last week: Two two-trillionaires

The Fed’s balance sheet just surpassed 2 trillion dollars. It has grown by a trillion dollars over the course of the year. Literally. ... That growth was financed by Treasury bill issuance ($560b from the supplementary financing facility) and a large rise in banks deposits at the Fed ($405b).

Schwarzenegger Calls for Tax Increases, Budget Cuts

by Calculated Risk on 11/06/2008 03:26:00 PM

As the California recession deepens, the state is facing an enormous budget deficit ...

From the LA Times: Schwarzenegger calls for sales tax hike, cuts in services

Gov. Arnold Schwarzenegger unveiled a plan today for a steep sales tax increase, new levies on alcoholic drinks and the oil industry, and deep cuts in services to wipe out a budget shortfall that is expected to swell to more than $24 billion by the middle of 2010.This proposal would push the LA sales tax rate to 10.25% - Yikes!

The linchpin of the plan is the sales tax increase of 1 1/2 cents on the dollar, which could raise $10.8 billion through fiscal 2009-10. ...

The governor also wants a number of significant spending reductions, including cuts of $2.5 billion from schools and community colleges.

Tax increases and budget cuts during a recession usually just make the recession worse. My guess is the next stimulus plan from the U.S. government will include some relief for state and local governments.

UK: Mortgage Lenders Refuse to Pass on Rate Cut as House Prices Plummet

by Calculated Risk on 11/06/2008 02:31:00 PM

Earlier the BofE announced a dramatic rate cut, The Times reports: Bank of England cuts interest rate by 1.5 points to 54-year low

But apparently most lenders are not lowering mortgage rates: Mortgage lenders refuse to pass on base rate cut

Britain's biggest mortgage lenders have ignored calls from the Government to pass on today's cut in interest rates to struggling homeowners.As house prices plummet in the UK: House prices dive 15% in record drop

...

At midday, the Bank of England announced that the cost of borrowing would fall by 1.5 points to 3 per cent in an effort to shore up the economy and stave off a deep recession. The surprise cut took the base rate to its lowest level in more than half a century.

British house prices fell by a record 15 per cent in the year to October as the country's deteriorating economy wiped £30,000 off the value of an average UK home.

On a monthly basis, house prices fell by 2.2 per cent between September and October, according to Halifax, Britain's biggest mortgage lender.

Las Vegas Sands may Default

by Calculated Risk on 11/06/2008 12:50:00 PM

When it comes to overbuilt hotel and commercial space ... and high rise condos too ... Las Vegas is the poster child of bubble credit excess!

From Bloomberg: Las Vegas Sands Plunges on Defaults, Bankruptcy Risk

Las Vegas Sands ... said in a regulatory filing today that it ... doesn't expect to meet a maximum leverage ratio covenant in the fourth quarter ... That would trigger defaults that might force the company to suspend development projects and ``raise a substantial doubt about the company's ability to continue as a going concern.''

...

Las Vegas Strip casino gambling revenue slid 6.7 percent this year through August, on track for its biggest annual decline on record, as airlines cut back capacity and consumers, battling declining home values, job losses and the worst financial crisis since the Great Depression, spent less.

Credit Crisis Indicators: More Progress

by Calculated Risk on 11/06/2008 10:16:00 AM

The U.S. economy is already in a recession, and the employment report tomorrow will probably be grim (Goldman Sachs is estimating 300 thousand in job losses in October). However, as bad as the economy currently is, without some improvement in the credit markets, the current recession will be much much worse.

Fortunately there have been some signs of a thaw in the credit markets over the last couple of weeks. Unfortunately most of the improvement has to do with the Fed intervening in rates and not due to lending between private parties. So there is still a long way to go ...

Three-month LIBOR rates for U.S. dollars fell to 2.3875% from 2.51%, well off the highs of 4.82% reached last month.The three-month LIBOR was at 2.51 yesterday. The rate peaked at 4.81875% on Oct. 10. (Better)

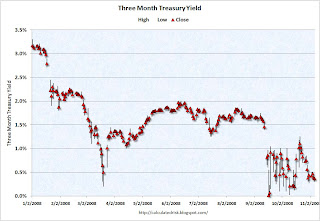

Click on graph for larger image in new window.

This graph shows the high, low, and the close for the three month treasury bill since the beginning of the year.

A good sign would be if the daily volatility subsides, and the yield moves up closer to the target Fed funds rate, or about 0.75%.

The yield is too low, but the daily volatility has declined.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.23% yesterday), so maybe the 3 month yield of 0.37% is somewhat in the right range. I'd also like to see the effective Fed Funds rate move closer to the target rate (1.0% currently).

This graph from Bloomberg shows the TED spread over the last year.

This graph from Bloomberg shows the TED spread over the last year.The TED spread is almost back to 2.0, but still too high. The peak was 4.63 on Oct 10th.

I'd like to see the spread move back down to 1.0 or lower.

Here is a list of SFP sales. No announcement today from the Treasury ... (no progress).

Note: Once a week I will include the Fed balance sheet assets. If this starts to decline that would be a positive sign.

Graph from the Fed.

Graph from the Fed.This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.83% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down, the TED spread is off again, the A2/P2 spread declined - so there is more progress.