by Calculated Risk on 11/06/2008 05:02:00 PM

Thursday, November 06, 2008

The Tech Slowdown

"As a result of the credit crisis and the economic uncertainty, our guidance reflects slower end- market device growth for 2009 than previously anticipated and a significant contraction in channel inventory in the first and second fiscal quarters. While we are estimating strong growth for CDMA-based devices in calendar year 2009, driven by a shift to emerging markets, this growth is meaningfully less than we would have forecast just a few weeks ago."Note: just using Qualcomm as an example (hat tip Brian)

Dr. Paul E. Jacobs, CEO of Qualcomm, Nov 6, 2008 emphasis added

From Saul Hansell at the NY Times: Cheerful Gloom From Mary Meeker:

In the first session of the Web 2.0 conference in San Francisco, Ms. Meeker terrified the audience with the prospects of the coming recession, then offered a vision of ultimate redemption. (You can see her slides here.)Investment in equipment and software has been negative for the last three quarters according to the BEA. And it appears the tech investment slump is about to get worse.

Her main point was that advertising and sales of technology products are very closely correlated to economic activity. And since both gross domestic product and consumer spending have started falling, the prospects for both don’t look good.

Click on graph for larger image in new window.

This graph shows the year over year change for residential investment vs. investment in equipment and software. Note that residential investment is shifted 3 quarters into the future because changes in residential investment usually lead changes in equipment and software by about 3 quarters. This relationship isn't perfect, but I expect equipment and software investment to decline for the next several quarters.

And a YouTube favorite ... Here Comes Another Bubble by The Richter Scales

Federal Reserve Assets Increase $105 Billion

by Calculated Risk on 11/06/2008 04:13:00 PM

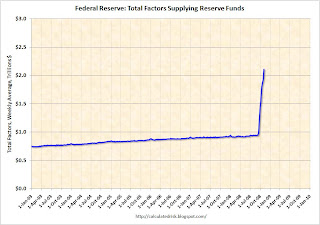

Looking a long time ahead to an economy far, far away ... I think one of the indicators of a recovery will be a shrinking Fed balance sheet. The assets on the Fed's balance sheet have doubled from under $1 trillion at the beginning of 2008 to about $2.075 trillion now.

Dallas Fed President Richard Fisher thinks there is much more to come:

"You can see the size and breadth of the Fed’s efforts to counter the collapse of the credit mechanism in our balance sheet. At the beginning of this year, the assets on the books of the Fed totaled $960 billion. Today, our assets exceed $1.9 trillion. I would not be surprised to see them aggregate to $3 trillion—roughly 20 percent of GDP—by the time we ring in the New Year."Here is the Federal Reserve report released today.

Dallas Fed President Richard W. Fisher, The Current State of the U.S. Economy and the Fed’s Response, Nov 4, 2008

Click on graph for larger image in new window.

The Federal Reserve assets increased from $105 billion this week to $2.075 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the graph shows Federal Reserve assets are still increasing rapidly. Fisher may be right - $3 trillion by the end of the year.

The good news is the Fed marked up the value of the Bear Stearns assets to $26,863 from $26,802 million two weeks ago - an increase of $61 million!

Update: For more, see Dr. Setser's post from last week: Two two-trillionaires

The Fed’s balance sheet just surpassed 2 trillion dollars. It has grown by a trillion dollars over the course of the year. Literally. ... That growth was financed by Treasury bill issuance ($560b from the supplementary financing facility) and a large rise in banks deposits at the Fed ($405b).

Schwarzenegger Calls for Tax Increases, Budget Cuts

by Calculated Risk on 11/06/2008 03:26:00 PM

As the California recession deepens, the state is facing an enormous budget deficit ...

From the LA Times: Schwarzenegger calls for sales tax hike, cuts in services

Gov. Arnold Schwarzenegger unveiled a plan today for a steep sales tax increase, new levies on alcoholic drinks and the oil industry, and deep cuts in services to wipe out a budget shortfall that is expected to swell to more than $24 billion by the middle of 2010.This proposal would push the LA sales tax rate to 10.25% - Yikes!

The linchpin of the plan is the sales tax increase of 1 1/2 cents on the dollar, which could raise $10.8 billion through fiscal 2009-10. ...

The governor also wants a number of significant spending reductions, including cuts of $2.5 billion from schools and community colleges.

Tax increases and budget cuts during a recession usually just make the recession worse. My guess is the next stimulus plan from the U.S. government will include some relief for state and local governments.

UK: Mortgage Lenders Refuse to Pass on Rate Cut as House Prices Plummet

by Calculated Risk on 11/06/2008 02:31:00 PM

Earlier the BofE announced a dramatic rate cut, The Times reports: Bank of England cuts interest rate by 1.5 points to 54-year low

But apparently most lenders are not lowering mortgage rates: Mortgage lenders refuse to pass on base rate cut

Britain's biggest mortgage lenders have ignored calls from the Government to pass on today's cut in interest rates to struggling homeowners.As house prices plummet in the UK: House prices dive 15% in record drop

...

At midday, the Bank of England announced that the cost of borrowing would fall by 1.5 points to 3 per cent in an effort to shore up the economy and stave off a deep recession. The surprise cut took the base rate to its lowest level in more than half a century.

British house prices fell by a record 15 per cent in the year to October as the country's deteriorating economy wiped £30,000 off the value of an average UK home.

On a monthly basis, house prices fell by 2.2 per cent between September and October, according to Halifax, Britain's biggest mortgage lender.

Las Vegas Sands may Default

by Calculated Risk on 11/06/2008 12:50:00 PM

When it comes to overbuilt hotel and commercial space ... and high rise condos too ... Las Vegas is the poster child of bubble credit excess!

From Bloomberg: Las Vegas Sands Plunges on Defaults, Bankruptcy Risk

Las Vegas Sands ... said in a regulatory filing today that it ... doesn't expect to meet a maximum leverage ratio covenant in the fourth quarter ... That would trigger defaults that might force the company to suspend development projects and ``raise a substantial doubt about the company's ability to continue as a going concern.''

...

Las Vegas Strip casino gambling revenue slid 6.7 percent this year through August, on track for its biggest annual decline on record, as airlines cut back capacity and consumers, battling declining home values, job losses and the worst financial crisis since the Great Depression, spent less.

Credit Crisis Indicators: More Progress

by Calculated Risk on 11/06/2008 10:16:00 AM

The U.S. economy is already in a recession, and the employment report tomorrow will probably be grim (Goldman Sachs is estimating 300 thousand in job losses in October). However, as bad as the economy currently is, without some improvement in the credit markets, the current recession will be much much worse.

Fortunately there have been some signs of a thaw in the credit markets over the last couple of weeks. Unfortunately most of the improvement has to do with the Fed intervening in rates and not due to lending between private parties. So there is still a long way to go ...

Three-month LIBOR rates for U.S. dollars fell to 2.3875% from 2.51%, well off the highs of 4.82% reached last month.The three-month LIBOR was at 2.51 yesterday. The rate peaked at 4.81875% on Oct. 10. (Better)

Click on graph for larger image in new window.

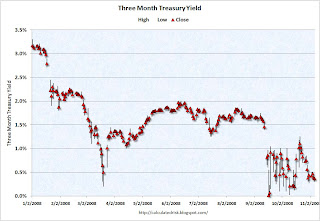

This graph shows the high, low, and the close for the three month treasury bill since the beginning of the year.

A good sign would be if the daily volatility subsides, and the yield moves up closer to the target Fed funds rate, or about 0.75%.

The yield is too low, but the daily volatility has declined.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.23% yesterday), so maybe the 3 month yield of 0.37% is somewhat in the right range. I'd also like to see the effective Fed Funds rate move closer to the target rate (1.0% currently).

This graph from Bloomberg shows the TED spread over the last year.

This graph from Bloomberg shows the TED spread over the last year.The TED spread is almost back to 2.0, but still too high. The peak was 4.63 on Oct 10th.

I'd like to see the spread move back down to 1.0 or lower.

Here is a list of SFP sales. No announcement today from the Treasury ... (no progress).

Note: Once a week I will include the Fed balance sheet assets. If this starts to decline that would be a positive sign.

Graph from the Fed.

Graph from the Fed.This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.83% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down, the TED spread is off again, the A2/P2 spread declined - so there is more progress.

Continued Unemployment Claims at Highest Since 1983

by Calculated Risk on 11/06/2008 09:01:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 1, the advance figure for seasonally adjusted initial claims was 481,000, a decrease of 4,000 from the previous week's revised figure of 485,000. The 4-week moving average was 477,000, unchanged from the previous week's revised average of 477,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 25 was 3,843,000, an increase of 122,000 from the preceding week's revised level of 3,721,000.

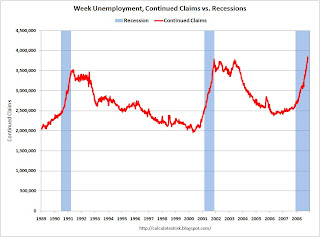

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims. The four moving average is at 477,000. This is a very high level, and indicates significant weakness in the labor market.

Continued claims are now at 3.84 million, the highest level since 1983.

The second graph shows continued claims since 1989.

The second graph shows continued claims since 1989.Note: Continued claims hit 4.7 million during the 1982 recession (not shown), although the population was much smaller then. The unemployment rate peaked at 10.8% in 1982 (compared to 6.1% last month).

This suggests a weak payroll report tomorrow.

Rate Cuts in Europe

by Calculated Risk on 11/06/2008 08:47:00 AM

From Bloomberg: Bank of England Slashes Key Lending Rate to Lowest Since 1955

The Bank of England unexpectedly cut the benchmark interest rate by 1.5 percentage points to the lowest since 1955 as U.K. policy makers tried to limit damage caused by the worst banking crisis in almost a century.That is an impressive rate cut.

The ECB cut too: ECB Cuts Interest Rate by Half Point to Counter Economic Slump

The European Central Bank lowered interest rates for the second time in less than a month to counter the euro region's worst economic slump in 15 years.The WSJ reports:

ECB policy makers meeting in Frankfurt reduced the benchmark lending rate by half a percentage point to 3.25 percent ...

Switzerland's central bank joined in, cutting its key rate target by half a percentage point to 2% in an unusual between-meeting move.

Wednesday, November 05, 2008

WSJ: Treasury and FDIC Close to Announcing Mortgage Modification Program

by Calculated Risk on 11/05/2008 11:31:00 PM

This WSJ story on possible additional options for using the TARP suggests that a mortgage modification program will be announced soon:

The report addresses the issue of trying to slow the record levels of foreclosures. "In particular, Treasury will continue efforts to ensure loan modifications are sustainable," said the report. A separate Treasury report detailing minutes of an Oct. 13 meeting of members of the Financial Stability Oversight Board suggested the Treasury is focusing on how to address ailing mortgages.Meanwhile, in California, Governor Schwarzenegger is seeking a 90 day delay on foreclosures - from Bloomberg: Schwarzenegger Seeks to Save Homeowners With Foreclosure Delay

...

[T]he Treasury, the Federal Deposit Insurance Corp. and other government agencies are said to be close to announcing a government program to address residential foreclosures at the root of the crisis.

California Governor Arnold Schwarzenegger proposed a 90-day stay on home foreclosures in California ... Schwarzenegger said he will ask lawmakers to consider delaying foreclosures when he orders them into a special session tomorrow to deal with the state's ballooning budget deficit.

GM Exec says Next 100 Days "critical"

by Calculated Risk on 11/05/2008 09:14:00 PM

From DowJones: GM Executive: Next 100 Days Critical For GM, US Auto Industry

A top General Motors Corp. (GM) executive on Wednesday said the next 100 days could represent the most crucial time in the history of the troubled company and entire U.S. auto industry.GM is expected to release results on Friday.

Troy Clarke, president of GM North America, urged auto industry executives to make the case to Washington leaders that the failure of auto companies would have devastating effects on the economy.

...

"I'd like to say we're done (with restructuring)," he said in a speech to the Original Equipment Suppliers Association. "But once again, market and economic conditions have continued to decline, primarily due to the recent global credit crisis and a steep decline in consumer confidence - both key to the auto business."