by Calculated Risk on 11/06/2008 09:01:00 AM

Thursday, November 06, 2008

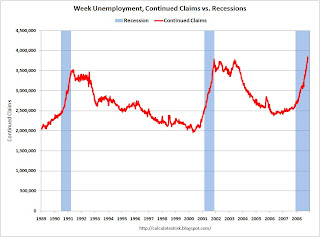

Continued Unemployment Claims at Highest Since 1983

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 1, the advance figure for seasonally adjusted initial claims was 481,000, a decrease of 4,000 from the previous week's revised figure of 485,000. The 4-week moving average was 477,000, unchanged from the previous week's revised average of 477,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 25 was 3,843,000, an increase of 122,000 from the preceding week's revised level of 3,721,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims. The four moving average is at 477,000. This is a very high level, and indicates significant weakness in the labor market.

Continued claims are now at 3.84 million, the highest level since 1983.

The second graph shows continued claims since 1989.

The second graph shows continued claims since 1989.Note: Continued claims hit 4.7 million during the 1982 recession (not shown), although the population was much smaller then. The unemployment rate peaked at 10.8% in 1982 (compared to 6.1% last month).

This suggests a weak payroll report tomorrow.

Rate Cuts in Europe

by Calculated Risk on 11/06/2008 08:47:00 AM

From Bloomberg: Bank of England Slashes Key Lending Rate to Lowest Since 1955

The Bank of England unexpectedly cut the benchmark interest rate by 1.5 percentage points to the lowest since 1955 as U.K. policy makers tried to limit damage caused by the worst banking crisis in almost a century.That is an impressive rate cut.

The ECB cut too: ECB Cuts Interest Rate by Half Point to Counter Economic Slump

The European Central Bank lowered interest rates for the second time in less than a month to counter the euro region's worst economic slump in 15 years.The WSJ reports:

ECB policy makers meeting in Frankfurt reduced the benchmark lending rate by half a percentage point to 3.25 percent ...

Switzerland's central bank joined in, cutting its key rate target by half a percentage point to 2% in an unusual between-meeting move.

Wednesday, November 05, 2008

WSJ: Treasury and FDIC Close to Announcing Mortgage Modification Program

by Calculated Risk on 11/05/2008 11:31:00 PM

This WSJ story on possible additional options for using the TARP suggests that a mortgage modification program will be announced soon:

The report addresses the issue of trying to slow the record levels of foreclosures. "In particular, Treasury will continue efforts to ensure loan modifications are sustainable," said the report. A separate Treasury report detailing minutes of an Oct. 13 meeting of members of the Financial Stability Oversight Board suggested the Treasury is focusing on how to address ailing mortgages.Meanwhile, in California, Governor Schwarzenegger is seeking a 90 day delay on foreclosures - from Bloomberg: Schwarzenegger Seeks to Save Homeowners With Foreclosure Delay

...

[T]he Treasury, the Federal Deposit Insurance Corp. and other government agencies are said to be close to announcing a government program to address residential foreclosures at the root of the crisis.

California Governor Arnold Schwarzenegger proposed a 90-day stay on home foreclosures in California ... Schwarzenegger said he will ask lawmakers to consider delaying foreclosures when he orders them into a special session tomorrow to deal with the state's ballooning budget deficit.

GM Exec says Next 100 Days "critical"

by Calculated Risk on 11/05/2008 09:14:00 PM

From DowJones: GM Executive: Next 100 Days Critical For GM, US Auto Industry

A top General Motors Corp. (GM) executive on Wednesday said the next 100 days could represent the most crucial time in the history of the troubled company and entire U.S. auto industry.GM is expected to release results on Friday.

Troy Clarke, president of GM North America, urged auto industry executives to make the case to Washington leaders that the failure of auto companies would have devastating effects on the economy.

...

"I'd like to say we're done (with restructuring)," he said in a speech to the Original Equipment Suppliers Association. "But once again, market and economic conditions have continued to decline, primarily due to the recent global credit crisis and a steep decline in consumer confidence - both key to the auto business."

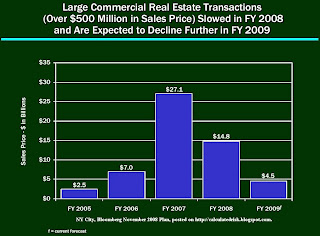

NY City Commercial Real Estate from Mayor Bloomberg Report

by Calculated Risk on 11/05/2008 08:15:00 PM

Mayor Bloomberg released a report on the NY City economy today. Here are a couple of graphs from the report on commercial real estate (CRE). There is much more in the report, especially on the impact of the financial crisis on NYC employment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the actual and projected (by the NYC OMB) rents and office vacancy rate for NYC Class A buildings.

The vacancy rate is expected to rise from about 7.5% to 13%, and rents are expect to decline by 20% or more from the peak.

This decrease in rents will make many of the recent transactions that were based on overly optimistic pro forma income projections uneconomical. These loans typically included reserves to pay interest until rents increased (like a negatively amortizing option ARM), so these deals will blow up when the interest reserve is depleted - probably in the 2009-2010 period. The second graph shows the total dollar amounts for large commercial real estate transactions in NYC. This is expected to decline sharply next year, although if a number of projects get into trouble then I wouldn't be surprised to see a few more transaction (similar to all the foreclosure sales boosting existing home sales right now).

The second graph shows the total dollar amounts for large commercial real estate transactions in NYC. This is expected to decline sharply next year, although if a number of projects get into trouble then I wouldn't be surprised to see a few more transaction (similar to all the foreclosure sales boosting existing home sales right now).

Goldman Sachs expects one of weakest Employment Reports in 20 years

by Calculated Risk on 11/05/2008 05:46:00 PM

In a research note today, Goldman Sachs changed their forecast (no link):

We have deepened our forecast of the change in payroll employment for October to -300,000 from -250,000. ... The drop in payrolls we are now forecasting would be one of the worst month-over-month declines in the past twenty years. ... Unfortunately, there is no guarantee that the October decline in payroll employment will be the worst of this cycle. Real activity appears to have contracted sharply in October and ... could well bleed into November and cause another large drop in payroll employment ...It sounds like the numbers to be released this Friday will be grim.

Moody's cuts Ambac Rating

by Calculated Risk on 11/05/2008 04:51:00 PM

Ambac and MBIA are back in the news ...

From Bloomberg: MBIA, Ambac Losses Widen on Higher Claims Forecast

MBIA Inc. and Ambac Financial Group Inc., the bond insurers crippled by credit-rating downgrades, posted wider losses than analysts anticipated ...And right on cue from MarketWatch: Moody's cuts Ambac to 'Baa1'; outlook developing

MBIA ... reported a $806.5 million net loss after setting $961 million aside for guarantees on home-equity loan bonds. Ambac fell 41 percent as it recorded a $2.43 billion net loss after reserving $3.1 billion.

"The big issue for bond insurers is their ratings," said Jim Ryan, an analyst with Morningstar Inc. in Chicago. "If the rating agencies pile on, that could create more problems."

Paul Jackson at HousingWire adds: Ambac Posts $2.4 Billion Q3 Loss on “False” MBS Recovery

In an investor presentation, Ambac said that second quarter RMBS trending among private-party transactions it had insured — which had initially turned upward earlier this year — has since proven to be the latest example of a “false positive” in battered mortgage securities markets.I think it is absurd to hope that the TARP will "establish a floor for housing market fundamentals". Hope is not a plan.

...

Ambac expressed hope that the Treasury’s TARP program and capital purchase program would “establish a floor for housing market fundamentals,” according to its investor presentation. The insurer has asked Treasury to consider guaranteeing a portion of its structured securities portfolio, as well.

Note: just to be clear "Hope is not a plan" is a phrase I've used for at least 30 years ... and was not intended as a swipe at President-elect Obama.

Shiller: "Worst Times Ahead"

by Calculated Risk on 11/05/2008 03:24:00 PM

Robert Shiller on forecasting and the economy ...

"This is not a run of the mill recession that we are in. This is a crisis of confidence that we haven't seen since the Great Depression.And many other interesting comments ... "no one really knows what to do", "we are getting into Ben's nightmare scenario" ... "and then we try some other heterodox monetary policies":

...

Ultimately I think economic forecasting is more guess work than people realize. In times when you don't have a fundamental change, you can exrapolate curves, and people do that pretty well. But right now I don't trust extrapolation. It also - forecasting - depends on how the new government, how the new president, what he does, how he shapes confidence - and those are also unknowns at this point."

Credit Crisis Indicators: More Progress

by Calculated Risk on 11/05/2008 12:01:00 PM

The London interbank offered rate, or Libor, for three- month loans fell to 2.51 percent today, from 4.82 percent on Oct. 10.The three-month LIBOR was at 2.71 yesterday. The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.23% yesterday), so maybe the 3 month yield of 0.44% is somewhat in the right range.

It is nice to be back near 2.0, and I'd like to see the spread move back down to 1.0 or lower.

Here is a list of SFP sales. No announcement today from the Treasury ... no progress.

Note: Once a week I will include the Fed balance sheet assets. If this starts to decline that would be a positive sign.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.97% on Friday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down, the TED spread is off again, the A2/P2 spread declined - so there is more progress.

The Treasury Secretary Speculation

by Calculated Risk on 11/05/2008 10:36:00 AM

There is plenty of speculation this morning about possible nominees for Treasury Secretary. Bloomberg mentions former Clinton Treasury Secretary Lawrence Summers and NY Fed President Tim Geithner:

Summers, 53, is favored to return to the Treasury post that he held under President Bill Clinton because Obama values his experience and familiarity with markets and global leaders ... Still, people close to the president-elect stress no final decision has been reached and that Timothy Geithner, president of the New York Federal Reserve, is also a strong contender.Another person frequently mentioned is JPMorgan Chase CEO Jamie Dimon.

Goldman Sachs conference call this morning on impact of election (my notes):

President-elect Obama will face a significantly deteriorating economy. The risks are to the downside of Goldman forecast of -2.0% GDP in Q4 and -1.0% in Q1 2009, and upside risk to Goldman unemployment forecast (peak of 8.0%).

Currently expect $200 billion in stimulus. Now, with Democratic control of government, expect to see a larger economic stimulus package of at least $300 billion, maybe as high as $500 billion. It's possible there will be a smaller stimulus package this fall, and then a 2nd bill early next year (late January or February).

Also expect to see more emphasis on mortgage modifications. Expect something similar to the FDIC proposal - also might see 90 day foreclosure moratorium.

Healthcare reform and tax policy discussions will probably be pushed out for a year or two - unless some of the tax proposals are part of the stimulus package.

Expect significantly larger budget deficits over the next two years.

Other issues will probably be pushed out (healthcare reform, energy and environmental policies).

Q&A: Hatzius says the probability of depression is 'very low' unless we see phenomenal mistakes from Fed and Government - and he doesn't expect those mistakes.