by Calculated Risk on 11/04/2008 08:57:00 AM

Tuesday, November 04, 2008

More on Auto Sales

Jim Hamilton at Econbrowser has more: Another bad month for autos.

To say that the U.S. auto sector continues to bleed may be an understatement. Maybe we should start talking about a severed artery.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from Econbrowser shows the Not Seasonally Adjusted car sales in the U.S. Look at September and October 2008 (dark blue) - sales have fallen off a cliff compared to previous years. See Hamilton's post for truck sales (and more cliff diving).

Sales are grim even for luxury car manufacturers, from Bloomberg: BMW Scraps Earnings Outlook as Quarterly Profit Falls

Bayerische Motoren Werke AG ... lowered its outlook for the second time this year after third-quarter profit plunged 63 percent as the global financial crisis sapped demand.

Vehicle sales will fall below last year's figure, the Munich-based company said ...

"The financial crisis is by no means behind us yet, particularly its impact on the real economy in 2009," Chief Executive Officer Norbert Reithofer said in the statement.

Monday, November 03, 2008

WSJ: Foreclosure Prevention Program Drags

by Calculated Risk on 11/03/2008 10:31:00 PM

From the WSJ: Homeowners Wait as Relief Plan Drags

The FDIC has been developing a proposal, which some estimate could help between two and three million homeowners, designed to encourage banks to rework troubled loans by providing a partial federal guarantee for losses on modified mortgages that meet specific criteria ... The plan would use between $40 billion and $50 billion from the government's $700 billion financial-market rescue fund ... Several officials said the plan is strongly opposed by the White House, though officials there deny killing the idea.It sounded like a plan would be announced last week, but it appears there is strong disagreement on what the plan should look like.

This is a key point:

"Even an ambitious program of mortgage modifications will not prevent a further decline in house prices," said Douglas Elmendorf, a senior fellow at the Brookings Institution and a former Clinton economic adviser. "It might prevent an overshooting of house prices on the downside. But houses still look overvalued relative to people's rents or incomes, and it's going to be very difficult to sustain house prices at their current level."Any attempt to keep house prices artificially high will just postpone the inevitable and delay the eventual recovery.

Summary of Busy Day

by Calculated Risk on 11/03/2008 07:57:00 PM

For the late readers, there were a number of news stories / posts today, so here is a summary:

Construction Spending in September: The Census Bureau reported that private non-residential construction increased slightly in September from August, but spending is still below the peak in June 2008. Residential investment decreased in September.

From MarketWatch: U.S. ISM factory index plunges again in October

Credit Crisis Indicators showed some progress, especially the LIBOR and TED spread.

Auto sales were a disaster in October. From Bloomberg: Auto Sales in U.S. Plunge; October Was the Worst Month Since 1945, GM Says. From the WSJ: Auto Makers Post Sharp Drop in U.S. Sales

U.S. auto sales in October plunged an estimated 31% to about 850,000 vehicles ... It was the first time since February 1993 that auto makers sold fewer than 900,000 cars and light trucks in a month. When adjusted for increases in the U.S. population, October was "the worst month in the post-World War II era," Michael DiGiovanni, the top sales analyst at General Motors Corp., said in an conference call. "This is clearly a severe, severe recession." ... Auto executives warned the worst may still lie ahead ...The Fed reported that lending standards tightened and loan demand declined. See post for graph for commercial real estate (CRE) lending and demand.

And finally, here is my Q3 advance MEW estimate (close to zero).

Funding the National Debt

by Calculated Risk on 11/03/2008 05:45:00 PM

It seems like just yesterday that the National Debt exceeded $10 trillion for the first time. Hard to believe that was just one month ago since the National Debt is now $10.574 trillion (yes, an increase of $574 billion in about one month).

This raises questions about funding the debt. From Bloomberg: U.S. to Borrow Record This Quarter to Finance Deficit

The U.S. Treasury more than tripled its planned debt sales for this quarter to help finance a 2009 budget deficit that bond dealers advising the department estimate may swell to almost $1 trillion.As I noted over the weekend, these huge financing needs combined with foreign governments need to stimulate their domestic economies (and maybe even selling foreign reserves) could lead to higher intermediate to long term rates in the U.S. next year - right in the middle of a recession.

Borrowing needs are expected to rise to $550 billion in the three months to Dec. 31, compared with the $142 billion predicted in July, the Treasury said in a statement in Washington. That follows a $530 billion record in the July-September quarter.

Misc: Wikinvest, Full Feed, and Zombie Ads

by Calculated Risk on 11/03/2008 05:21:00 PM

A few housekeeping notes: there is a link to related articles from Wikinvest at the bottom of most posts. Let me know what you think.

I've also enabled the full RSS feed again (I'm sure the scrapers will return). This may be temporary - sorry.

And for California readers, I've tried to disable some of the political ads, but they keep coming back ... oh well, at least the election is tomorrow and the ads should end.

Best to all.

Advance Q3 2008 MEW Estimate

by Calculated Risk on 11/03/2008 03:48:00 PM

We've been tracking mortgage equity withdrawal (MEW) to estimate when the "Home ATM" has closed. Fed economist Dr. James Kennedy's estimate of MEW is not available until after the Fed's Flow of Funds report is released each quarter. Note: the Q3 Flow of Funds report is scheduled to be released on December 11, 2008.

However it is possible to estimate MEW from supplemental data released with the GDP report. Based on the Q3 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is 1.0% of Disposable Personal Income (DPI). This would be slightly higher than the Q2 estimates, from the Fed's Dr. Kennedy, of 0.4% of Disposable Personal Income (DPI). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high, but there are differences quarter to quarter. This analysis does suggest that MEW was at about the same level in Q3 2008, as in Q2 (close to zero). We will have to wait until December to know for sure.

MEW has declined precipitously since early 2006, with a combination of tighter lending standards and falling house prices. The impact of less equity extraction on consumer spending is still being debated, but I believe a portion of the slowdown in personal consumption expenditures can be attributed to less MEW.

Fed: Lending Standards Tighten, Loan Demand Weakens in October

by Calculated Risk on 11/03/2008 02:34:00 PM

Note: some readers are being swamped with political ads - especially in California. I'm trying to block the ads ... please accept my apology.

From the Fed: The October 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the current survey, large net fractions of domestic institutions reported having continued to tighten their lending standards and terms on all major loan categories over the previous three months. The net percentages of respondents that reported tightening standards increased relative to the July survey for both C&I and commercial real estate loans, as did the fractions reporting tightening for all price and nonprice terms on C&I loans. Considerable net fractions of foreign institutions also tightened credit standards and terms on loans to businesses over the past three months. Large fractions of domestic banks reported tightening standards on loans to households over the same period. Demand for loans from both businesses and households at domestic institutions continued to weaken, on net, over the past three months.

Click on graph for larger image in new window.

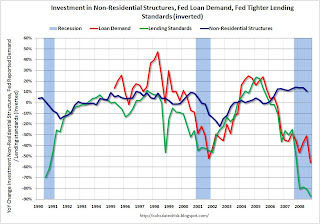

Click on graph for larger image in new window.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.

GM: "probably worst industry sales month in the post-WWII era."

by Calculated Risk on 11/03/2008 01:51:00 PM

From MarketWatch: GM U.S. October light vehicle sales fall 45.1%

General Motors said Monday that October U.S. light vehicle sales fell 45.1% to 168,719 units from 307,408 a year ago.The WSJ in a headline quoted GM executive Mark LaNeve as saying October was "probably worst industry sales month in the post-WWII era."

Ford: Auto Sales Decline 30% in October

by Calculated Risk on 11/03/2008 12:26:00 PM

From Bloomberg: Ford Motor Says October U.S. Auto Sales Declined 30 Percent (hat tip Justin)

Ford Motor Co. ... said its U.S. sales fell 30 percent in October, the 23rd decline in the past 24 months.Meanwhile, also from Bloomberg: GM, Ford, Chrysler Shut Out of Auto-Bond Market for Fifth Month

The total dropped to 132,838 cars and trucks, from 190,195 a year earlier ...

Ford Motor Co., GMAC LLC and Chrysler LLC were shut out of the market for bonds backed by auto loans for the fifth straight month ... Sales of auto bonds slumped to $500 million last month, compared with $9 billion in October 2007, according to Merrill Lynch & Co. data. ...And Ford is probably in the best shape of the U.S. automakers.

The credit market seizure is forcing automakers to cut back on loans to dealers and customers, contributing to a slowdown that may shrink U.S. auto sales this year to the lowest level since 1993.

Credit Crisis Indicators: Some More Progress

by Calculated Risk on 11/03/2008 11:12:00 AM

The London interbank offered rate, or Libor, that banks charge one another for three-month loans in U.S. currency slid 17 basis points to 2.86 percent today, a 16th day of declines, data from the British Bankers' Association showed. It hasn't been as low since the failure of Lehman Brothers Holdings Inc. on Sept. 15.The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.30% yesterday), so a 3 month yield of 0.44% is in the right range. I'd like to see the effective funds rate closer to the target rate.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. The Treasury announced another $30 billion for the Fed today ... no progress.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.97% on Friday!) - and increasing the spread between AA and A2/P2 CP. So this indicator is a little misleading right now. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is off again, so there is a little more progress.